Asia Pacific Positive Displacement Pumps Market Size, Share, Trends and Forecast by Product Type, Capacity, Pump Characteristics, Raw Material, End Use Industry, and Country, 2025-2033

Market Overview:

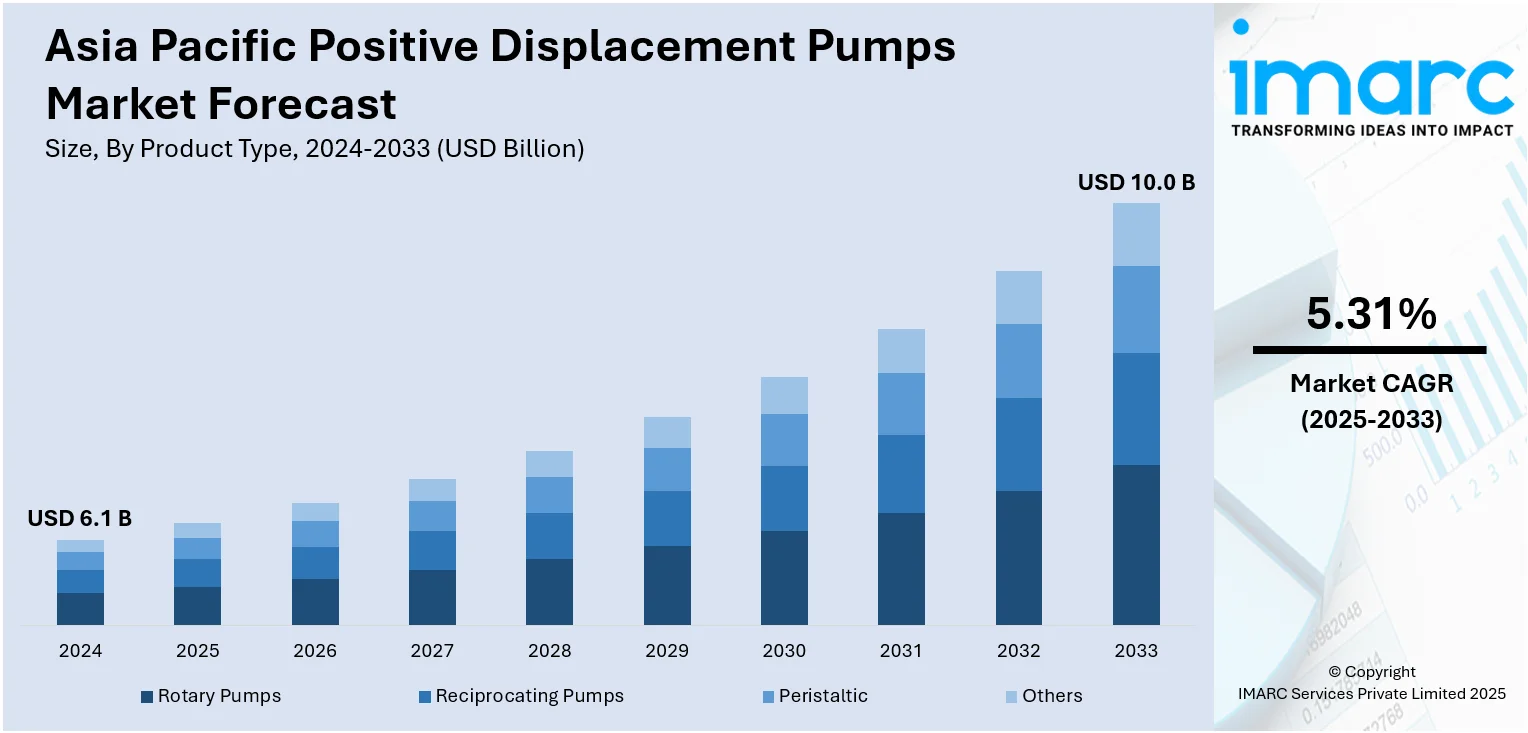

The Asia Pacific positive displacement pumps market size reached USD 6.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.31% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.1 Billion |

|

Market Forecast in 2033

|

USD 10.0 Billion |

| Market Growth Rate 2025-2033 | 5.31% |

Positive displacement pumps (PDP), also known as constant flow machines, are used to transfer fluids, in either liquid, gas, or slurry form, through mechanical action. In this type of pump, the moving liquid is first captured in a cavity and then discharged, carried by a plunger or a piston. PDPs are equipped with a mounting cavity at the suction side and a shrinking cavity on the discharge side.

To get more information on this market, Request Sample

Asia Pacific represents one of the leading markets for positive displacement pumps. The primary factor driving the growth of the market is the extensive use of PDPs in water and wastewater treatment facilities. These pumps are compact in size, offer high viscosity performance and manage high differential pressure. Besides this, the upgradation and the renovation of oil and gas exploration facilities in the region are also expected to create a positive outlook for the market. Moreover, the rising concerns for limited water resources have prompted governments of several countries in the region, including China and India, to promote wastewater treatment and recycling. Furthermore, PDPs offer simpler installation with enhanced and effective outcomes while significantly reducing the carbon footprints, which, in turn, is further bolstering the market growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific positive displacement pumps market report, along with forecasts at the regional and country from 2025-2033. Our report has categorized the market based on product type, capacity, pump characteristics, raw material and end use industry.

Breakup by Product Type:

- Rotary Pumps

- Vane

- Screw

- Lobe

- Gear

- Progressing Cavity (PC)

- Others

- Reciprocating Pumps

- Piston

- Diaphragm

- Plunger

- Others

- Peristaltic

- Others

Breakup by Capacity:

- Low Capacity Pumps

- Medium Capacity Pumps

- High Capacity Pumps

Breakup by Pump Characteristics:

- Standard Pumps

- Engineered Pumps

- Special Purpose Pumps

Breakup by Raw Material:

- Bronze

- Cast Iron

- Polycarbonate

- Stainless Steel

- Others

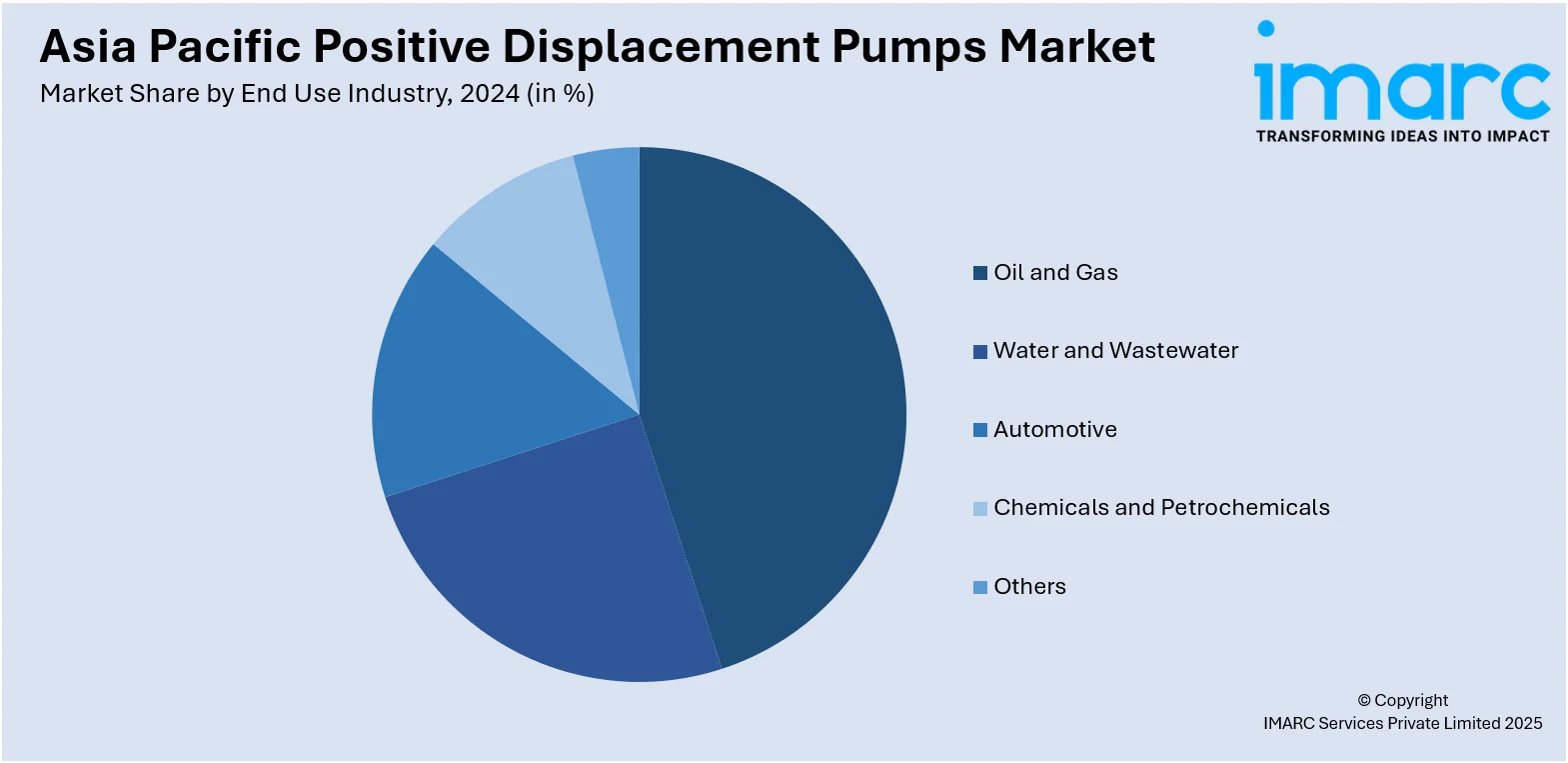

Breakup by End Use Industry:

- Oil and Gas

- Water and Wastewater

- Automotive

- Chemicals and Petrochemicals

- Others

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Capacities Covered | Low Capacity Pumps, Medium Capacity Pumps, High Capacity Pumps |

| Pump Characteristics Covered | Standard Pumps, Engineered Pumps, Special Purpose Pumps |

| Raw Materials Covered | Bronze, Cast Iron, Polycarbonate, Stainless Steel, Others |

| End Use Industries Covered | Oil and Gas, Water and Wastewater, Automotive, Chemicals and Petrochemicals, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Asia Pacific positive displacement pumps market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Asia Pacific positive displacement pumps market?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the capacity?

- What is the breakup of the market based on the pump characteristics?

- What is the breakup of the market based on the raw material?

- What is the breakup of the market based on the end use industry?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Asia Pacific positive displacement pumps market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)