Asia Pacific Plastic Caps and Closure Market Size, Share, Trends and Forecast by Product Type, Raw Material, Container Type, Technology, End Use, and Country, 2026-2034

Asia Pacific Plastic Caps and Closure Market Size and Share:

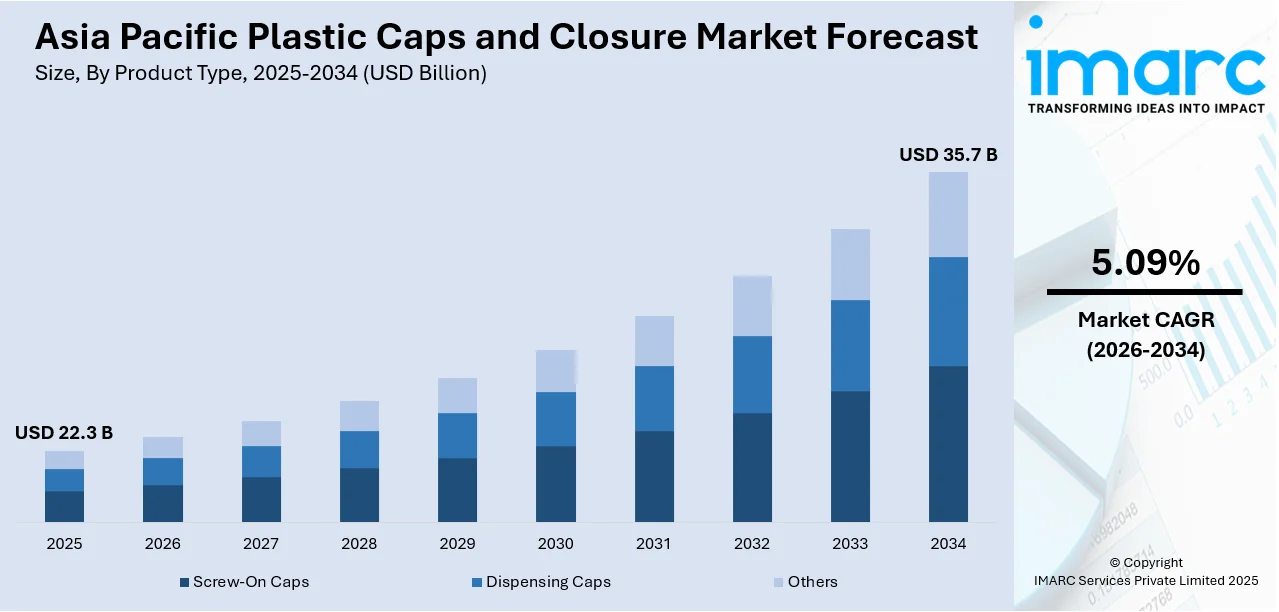

The Asia Pacific plastic caps and closure market size was valued at USD 22.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 35.7 Billion by 2034, exhibiting a CAGR of 5.09% from 2026-2034. The market is witnessing steady expansion, majorly influenced by elevating need for packaged goods, notable urbanization, and sustainability projects. Crucial sectors like food, personal care, and beverages, boost demand, while innovations in recyclable or lightweight materials and advanced designs further improve market outlook.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 22.3 Billion |

|

Market Forecast in 2034

|

USD 35.7 Billion |

| Market Growth Rate (2026-2034) |

5.09%

|

The Asia Pacific plastic caps and closures industry is majorly impacted by the escalating need for packaged goods, bolstered by a proliferating middle-class population and intense increase in urbanization. For instance, according to the UN-Habitat, Asia Pacific’s urban population is anticipated to grow by 50% by the year 2050. Moreover, augmenting critical sectors, such as personal care, beverage, and food, heavily depend on plastic closures for convenient and safe packaging. Beside this, the notable inclination on-the-go lifestyles and elevating disposable incomes in nations like India or China have magnified the utilization of packaged foods as well as bottled beverages. In addition to this, the heightening preference for e-commerce platforms further fuels requirement for tamper-proof and durable closures, guaranteeing product safety during transportation, thereby expanding the Asia Pacific plastic caps and closure market share.

To get more information on this market Request Sample

Environmental sustainability efforts and innovations in technology serve as key factors propelling growth in the plastic caps and closures market across the Asia Pacific region. Manufacturers are increasingly utilizing sustainable materials and lightweight packaging solutions to comply with environmental standards and cater to consumers' growing preference for eco-conscious options. Advancements like resealable and tamper-proof closures are improving both product security and user convenience, thereby accelerating market expansion.Government policies promoting sustainable practices in major economies like Japan and Australia have encouraged the development of bio-based plastics and advanced manufacturing processes, ensuring the market's alignment with global sustainability goals. For instance, as per industry reports, bioplastics account for 1% of the plastic utilized across Australia, offering a substantial opportunity to develop commercial prospects while lowering adverse influence on the environment.

Asia Pacific Plastic Caps and Closure Market Trends:

Growing Demand for Sustainable Packaging

Sustainability is a key trend shaping the Asia Pacific plastic caps and closures market. Producers are progressively shifting toward eco-friendly and recyclable plastics to meet evolving consumer demands and adhere to environmental compliance standards. Lightweight caps, designed to reduce material usage, are gaining popularity in industries like beverages and personal care. Furthermore, nations, mainly encompassing China and India, are elevating the gravitation towards eco-friendly solutions due to heightened awareness of plastic pollution. For instance, as per industry reports, India is emerging as one of the leading plastic pollution contributors, accounting for around 20% of total plastic waste worldwide. In line with this, almost 9.3 million tons of plastic waste in India is generated per year. This trend is further supported by advancements in material technology and increased investment in recycling infrastructure, making sustainable packaging a priority for the region's industries.

Advancements in Closure Technology

Technological innovations in plastic closures are transforming the Asia Pacific market. Tamper-evident, child-resistant, and resealable closures are witnessing high demand across sectors such as food, beverages, and pharmaceuticals. Smart closures with features like QR codes and NFC technology are also emerging, enhancing product traceability and consumer engagement. For instance, in August 2024, Domino Printing Sciences, a global firm with numerous manufacturing plants in India and China, launched a new series of high-speed product printing as well as handling solutions targeted at aiding beverage manufacturers phase out from bottle labels, boosted by both regulatory and environmental factors. The Bottle Closure Printing Stations are developed to print both machine-readable codes and variable data, encompassing QR codes, directly onto HDPE caps and closures. Furthermore, injection molding advancements allow for intricate designs and improved functionality. These innovations cater to consumer expectations for safety, convenience, and sustainability while driving differentiation in highly competitive industries. As technology evolves, closures are becoming smarter and more efficient, supporting the market's growth.

Increased Adoption of Lightweight Closures

Lightweight closures are a growing trend in the Asia Pacific plastic caps and closures market, driven by cost efficiency and sustainability goals. Reducing the weight of caps without compromising functionality helps manufacturers save on raw materials and transportation costs. The beverage industry is a major adopter, incorporating lightweight closures for bottled water, soft drinks, and juices. In addition to this, regulatory pressures to minimize plastic usage and carbon emissions further accelerate this trend. For instance, as per industry reports, China launched a five-year action plan (2021 to 2025) to enhance plastic pollution chain management by eradicating single-use plastics, incentivizing recycling and endorsing plastic substitutes. Moreover, with continued advancements in polymer technology, lightweight closures are expected to remain a focus for manufacturers seeking competitive and environmentally friendly solutions.

Asia Pacific Plastic Caps and Closure Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific plastic caps and closure market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on product type, raw material, container type, technology, and end use.

Analysis by Product Type:

- Screw-On Caps

- Dispensing Caps

- Others

Asia Pacific plastic caps and closure market report indicates that screw-on caps dominate the product type segment mainly due to their versatility, ease of use, and secure sealing capabilities. Widely used across industries such as beverages, food, and personal care, these caps ensure product freshness and prevent spillage during transportation. Their compatibility with various container types, including bottles and jars, further enhances their market demand substantially. In addition to this, manufacturers increasingly focus on improving designs for tamper-evidence and child safety, driven by regulatory and consumer expectations. Furthermore, with the rise in e-commerce and on-the-go consumption trends, screw-on caps remain a preferred choice for packaging solutions across the region.

Analysis by Raw Material:

- PET

- PP

- HDPE

- LDPE

- Others

Polypropylene (PP) is the leading raw material used in the Asia Pacific plastic caps and closures market, owing to its lightweight, cost-efficiency, and superior durability. PP's chemical resistance and versatility make it ideal for packaging applications in beverages, pharmaceuticals, and personal care products. In addition to this, its recyclability aligns with growing environmental concerns, driving its adoption among manufacturers. Besides, rapid advancements in PP grades have significantly improved its performance in sealing and barrier properties, making it suitable for high-performance caps. Moreover, the increasing preference for sustainable materials and innovations in polymer technology continue to bolster the use of PP in the region’s plastic caps and closures industry.

Analysis by Container Type:

- Plastic

- Glass

- Others

Plastic containers command a notable portion of the Asia Pacific plastic caps and closures market, attributed to their light weight, affordability, and robust durability. Plastic containers paired with plastic closures are widely used in the crucial industries such as beverage, food, and pharmaceutical typically because of their compatibility and functionality. Innovations in plastic materials, such as bio-based plastics, have further driven their demand in sustainable packaging. In addition, their exceptional ability to be molded into various shapes and sizes makes them adaptable to diverse packaging needs. Moreover, as urbanization and disposable incomes rise, the demand for packaged goods in plastic containers continues to grow across the region.

Analysis by Technology:

- Injection Molding

- Compression Molding

- Post-Mold Tamper-Evident Band

Injection molding is the most prevalent technology used in the Asia Pacific plastic caps and closures market, valued for its precision, efficiency, and scalability. This method enables the production of complex designs and high-quality caps at competitive costs, making it ideal for large-scale manufacturing. Furthermore, key industries such as beverages, pharmaceuticals, and personal care rely on injection molding for caps with superior sealing properties and custom designs. Besides this, the technology's adaptability to various materials, including PP and HDPE, ensures its continued relevance. Additionally, as automation and innovations in molding machinery advance, injection molding remains a cornerstone of the region’s plastic closure manufacturing.

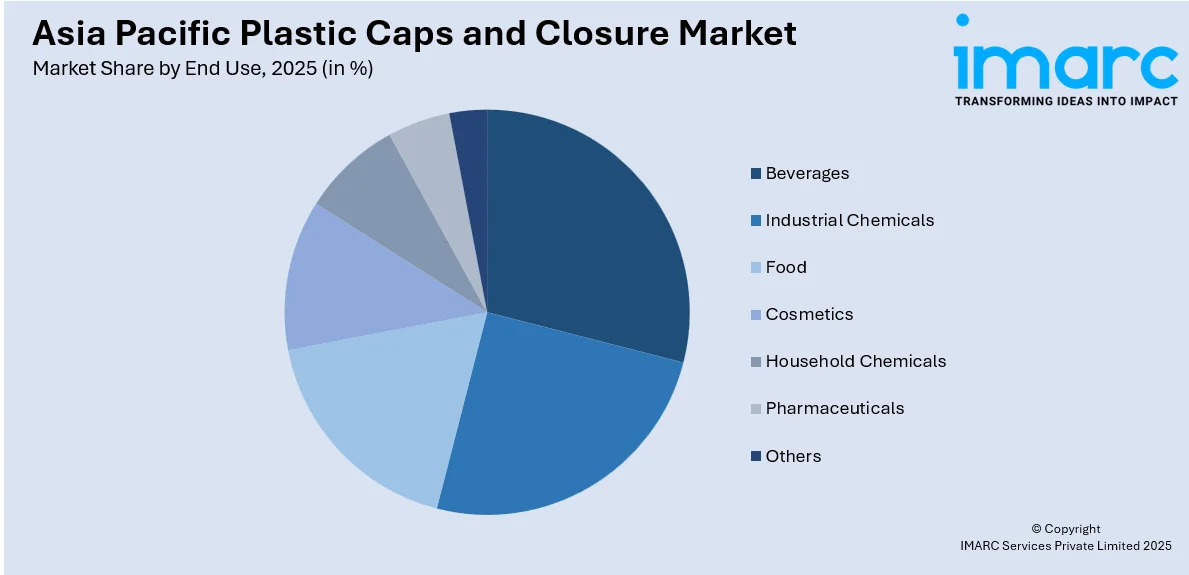

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Beverages

- Industrial Chemicals

- Food

- Cosmetics

- Household Chemicals

- Pharmaceuticals

- Others

In the Asia Pacific region, the beverage sector represents the primary end-user of plastic caps and closures, fueled by increasing demand for bottled water, soft drinks, and fruit juices. Screw-on and flip-top caps dominate this sector due to their convenience and secure sealing capabilities. In addition to this, the demand for tamper-evident and resealable closures has grown significantly, catering to health-conscious and on-the-go consumers. Furthermore, innovations in lightweight and recyclable materials have strengthened the use of plastic closures in sustainable beverage packaging. With the expanding middle-class population and urban lifestyles, the beverage sector continues to drive the demand for plastic caps and closures.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China leads the Asia Pacific plastic caps and closures market, driven by its massive population, rapid urbanization, and robust manufacturing capabilities. For instance, as per industry reports, urbanization rate in China is anticipated to reach around 70% by the year 2029. Additionally, the nation’s expanding beverage and personal care industries are major contributors to market growth, fueled by increasing disposable incomes and changing consumer lifestyles. China is also a hub for the production of plastic caps and closures, benefiting from cost-effective raw materials and advanced manufacturing infrastructure. Government initiatives promoting sustainable packaging have further driven innovations in recyclable and lightweight closures. As the demand for packaged goods grows, China remains a pivotal player in the regional plastic caps and closures market.

Competitive Landscape:

The market exhibits heavy competitive dynamics, with several regional as well as global players actively striving for major market share. Leading firms generally compete by providing sustainable, advanced, and lightweight solutions. In addition to this, regional producers are currently focusing on customized designs and cost-efficient manufacturing to cater to the varied sector demands. Furthermore, innovations in both technologies and materials, such as recyclable or tamper-evident closures, are significantly boosting competition. Moreover, tactical mergers, partnerships, and heavy investments in research and development projects are intensely common as several firms strive to fortify their positions. Besides, dominant players are currently participating in recycling initiatives to address the wastage concerns, which, in turn, magnifies the competitive dynamics. For instance, in May 2024, Dow and SCG Chemicals signed an MoU to boost their circularity alliance across Asia Pacific. This collaboration aims to reform 200KTA of plastic waste into circular products by the year 2030.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific plastic caps and closure market with detailed profiles of all major companies.

Latest News and Developments:

- In June 2024, Berry Global Group, Inc., a leading company with global footprint across various regions including Asia Pacific, introduced its customizable Domino bottle composed with 100% post-consumer recycled plastic for the personal care, beauty, and home segments. The neck is suitable for a wide range of caps and closure.

- In May 2024, Origin Materials, a global company that has established its footprints in Asia through several tactical partnerships, introduced its new, sustainable terephthalate (PET) cap for soft drink bottles. This new cap is highly compatible with the PCO 1881 neck finish and is exceptionally lightweighted.

- In April 2024, Amcor, a packaging solutions company with well-established packaging plants in China, launched its new 1-liter PET bottle for soft drinks. This bottle is composed of 100% recycled content.

Asia Pacific Plastic Caps and Closure Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Screw-On Caps, Dispensing Caps, Others |

| Raw Materials Covered | PET, PP, HDPE, LDPE, Others |

| Container Types Covered | Plastic, Glass, Others |

| Technologies Covered | Injection Molding, Compression Molding, Post-Mold Tamper-Evident Band |

| End Uses Covered | Beverages, Industrial Chemicals, Food, Cosmetics, Household Chemicals, Pharmaceuticals, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific plastic caps and closure market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific plastic caps and closure market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific plastic caps and closure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific plastic caps and closure market was valued at USD 22.3 Billion in 2025.

The market is boosted by magnifying need in the beverage and food segments, accelerated urbanization, and increase in customer need for sustainable, convenient, and lightweight packaging. Technological innovations and proliferating personal care as well as pharmaceutical industries further boost market expansion.

IMARC estimates the market to reach USD 35.7 Billion by 2034, exhibiting a CAGR of 5.09% from 2026-2034.

China accounted for the largest country market share due to its vast population, rapid urbanization, and expanding consumer goods industry. The growing demand for packaged beverages, food products, and personal care items drives the need for reliable and cost-effective sealing solutions. Additionally, China's strong manufacturing capabilities, competitive production costs, and extensive distribution networks contribute to its dominance in this market segment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)