Asia Pacific Payment Gateways Market Size, Share, Trends and Forecast by Application, Mode of Interaction, and Country, 2025-2033

Asia Pacific Payment Gateways Market Size and Share:

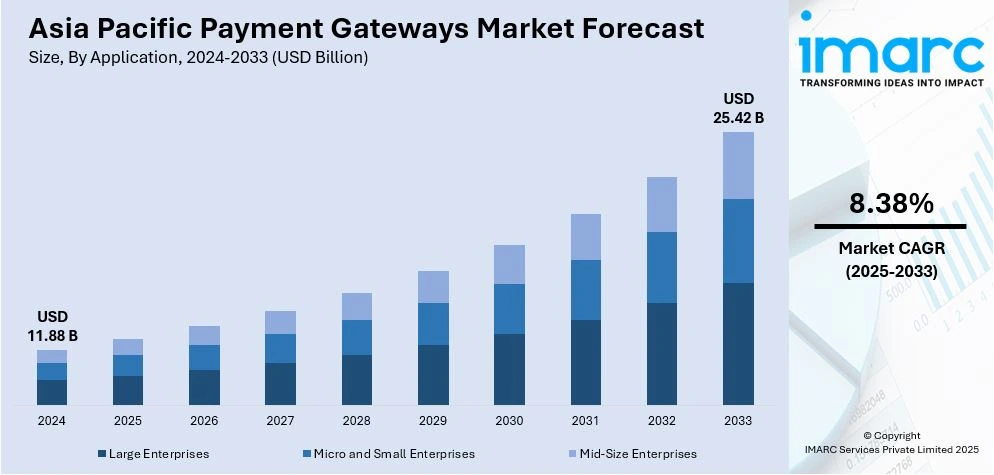

The Asia Pacific payment gateways market size was valued at USD 11.88 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.42 Billion by 2033, exhibiting a CAGR of 8.38% from 2025-2033. The Asia Pacific payment gateways market share is expanding, driven by improvements in technology to enhance the user experience and assist companies in optimizing operations, along with the rising popularity of e-commerce platforms that rely on payment gateways to provide people with a seamless and effortless checkout option.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.88 Billion |

|

Market Forecast in 2033

|

USD 25.42 Billion |

| Market Growth Rate (2025-2033) | 8.38% |

The rising security concerns, with businesses and users prioritizing safe and reliable digital payment solutions, are impelling the market growth in the Asia-Pacific region. The excessive number of online transactions impacts the risk of fraud, data breaches, and cyberattacks. To address these challenges, payment gateway providers invest heavily in advanced security features like encryption, tokenization, and multi-factor authentication. These technologies ensure the protection of sensitive customer data, build trust, and encourage more people to adopt digital payments. Businesses prefer secure payment gateways to ensure regulatory standards compliance. This is vital for protecting the payment information. As users become more aware about online risks, they choose platforms with robust security measures, thereby fueling the Asia Pacific payment gateways market growth.

To get more information on this market, Request Sample

Government initiatives are promoting cashless transactions and financial inclusion. Many countries in the region, like India and China, introduce policies and programs to encourage digital payments, reducing reliance on cash. Initiatives like India’s Digital India campaign and the launch of Unified Payments Interface (UPI) make digital transactions accessible to millions, driving the demand for secure and efficient payment gateways. Government agencies also support fintech innovations by providing regulatory frameworks and funding for digital payment systems. Additionally, subsidies and incentives for employing digital payment methods motivate businesses and users to shift online. These initiatives assist in expanding the digital payment ecosystem.

Asia Pacific Payment Gateways Market Trends:

Advancements in technology

Technological advancements have made digital transactions faster, safer, and more user-friendly. Innovations like artificial intelligence (AI), blockchain, and machine learning (ML) enhance security with real-time fraud detection and encryption, building trust among businesses and people. Application programming interface (API) integrations make payment gateways seamless to use with e-commerce platforms and apps while mobile optimization ensures smooth transactions on smartphones. Blockchain technology also reduces transaction costs and improves transparency, which is especially useful for cross-border payments. Additionally, biometric authentication such as fingerprint or facial recognition combines another layer of security and convenience for users. These innovations not only improve the customer experience but also help companies to streamline functions. Additionally, government agencies in China actively wager on AI and fintech innovations, ensuring the digital payment ecosystem remains competitive and future ready. In October 2024, China Investment Corporation invested $1.3tn in AI to leverage the growth potential of this technology, as China aims to secure an advantage in the face of increasing global competition.

Improvements in e-commerce platforms

The increasing number of e-commerce platforms is offering a favorable Asia Pacific payment gateways market outlook. With more individuals shopping online, especially in countries like China, India, and Southeast Asia, the requirement for safe and efficient payment gateways rises rapidly. In November 2024, Chinese e-commerce leaders Alibaba and JD.com announced robust sales during the 2024 "Double 11" shopping event. Taobao and Tmall, operated by Alibaba Group, announced a notable rise in sales, as 589 brands surpassed 100 million yuan in revenue, marking a 46.5 percent growth compared to the previous year. In line with this, e-commerce platforms depend on payment gateways to offer customers a smooth and hassle-free checkout experience, which is crucial for boosting sales and user loyalty. As these platforms expand across urban and rural areas, they need payment solutions that support multiple payment methods, including credit cards, digital wallets, and local payment options. The broadening of cross-border e-commerce services further drives the demand for gateways that handle multi-currency transactions. Additionally, the increasing competition among e-commerce companies enables them to adopt advanced payment technologies, ensuring speed and security.

Rising proliferation of the Internet and smartphones

The increasing proliferation of the Internet and smartphones is supporting the market growth. With more people gaining access to affordable smartphones and reliable internet, especially in developing countries like India, Indonesia, and Vietnam, digital payments are becoming more accessible to a wider audience. As per the data provided on the official website of the Indian Brand Equity Foundation, Counterpoint Research reported that in the third quarter of 2024, India's smartphone market ranked as the second largest in the world by unit volume and the third largest by value. In terms of market value, India held about 12.3%, a small rise from 12.1% in the corresponding quarter last year. In Q3 2024, smartphone deliveries in India rose by 3% compared to the previous year, while the value surged by 12%, setting a new quarterly record. Smartphones make it easy for users to shop online, pay bills, and transfer money, all of which require secure and efficient payment gateways. Mobile apps and digital wallets are popular due to smartphone adoption, creating the need for gateways that integrate with these platforms. Moreover, with the increase in speed and affordability of mobile internet, a growing number of individuals favor cashless payments due to their convenience. The increasing digital connectivity stimulates the need for sophisticated payment gateways that serve the area's tech-oriented and mobile-centric demographics.

Asia Pacific Payment Gateways Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific payment gateways market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and mode of interaction.

Analysis by Application:

- Large Enterprises

- Micro and Small Enterprises

- Mid-Size Enterprises

Large enterprises represent the largest segment since they handle high transaction volumes and require robust, secure, and scalable payment solutions. These companies often operate across multiple countries, which means they need payment gateways that support multi-currency transactions and seamless cross-border payments. With their extensive user base, large enterprises prioritize gateways with advanced security features, like encryption and fraud detection, to protect sensitive customer data. E-commerce companies, big retailers, and travel platforms heavily depend on payment gateways to provide a smooth checkout experience, which is critical for user satisfaction and retention. Additionally, large enterprises often have the resources to spend on customized payment gateway solutions that integrate with their systems and offer advanced analytics for better decision-making. As online sales and digital payments continue to grow in the region, large enterprises remain at the forefront, driving the demand for efficient, reliable, and innovative payment gateways to meet the needs of their diverse operations and users.

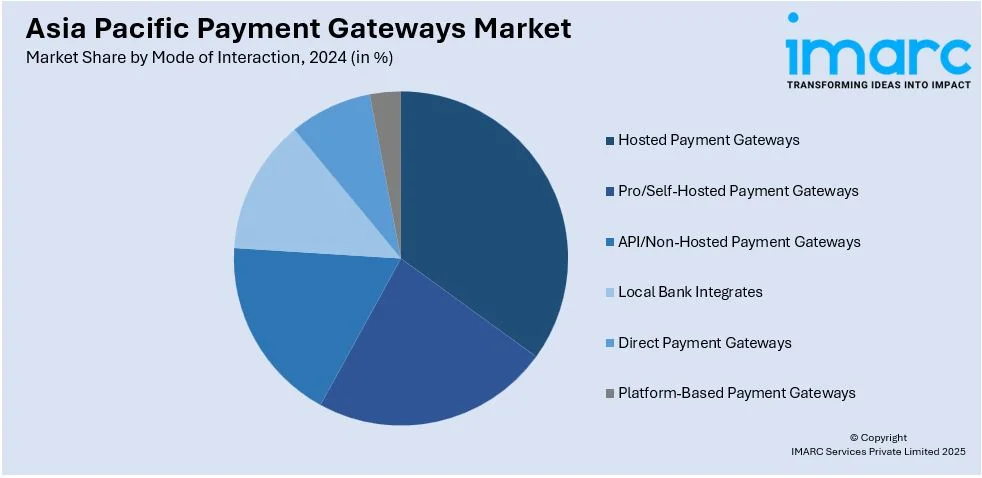

Analysis by Mode of Interaction:

- Hosted Payment Gateways

- Pro/Self-Hosted Payment Gateways

- API/Non-Hosted Payment Gateways

- Local Bank Integrates

- Direct Payment Gateways

- Platform-Based Payment Gateways

Hosted payment gateways dominate the market as they are straightforward, secure, and easy to use for businesses of all sizes. These gateways handle the entire payment process on their own platform, so businesses do not have to worry about managing sensitive customer payment data. This setup reduces the risk of fraud and ensures compliance with security standards, which is a big advantage for companies. For small and medium-sized businesses, hosted gateways are especially appealing since they are easy to integrate and do not require significant technical expertise. People are redirected to the gateway’s secure page to complete their transactions, providing a smooth and trustworthy experience. With the rapid expansion of e-commerce and digital payments in Asia-Pacific, hosted payment gateways are in high demand for their ability to handle high transaction volumes while ensuring safety.

Analysis by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China enjoys the leading position in the market due to several reasons. It has one of the largest populations in the world, with a humongous number of internet and smartphone users. The China Internet Network Information Center (CNNIC) report indicated that internet penetration in China hit 78.6 percent in 2024, three decades after the nation became fully integrated into the worldwide internet. This creates a massive need for online payments. Additionally, digital wallets are widely employed, making cashless transactions a daily habit for millions of people. The high number of e-commerce platforms also drives the Asia Pacific payment gateways market demand to support online shopping. China’s tech-savvy users and widespread adoption of QR codes for payments further fuel the market growth. Government policies to promote digital transformation and financial inclusion also encourage the use of payment gateways. Moreover, the establishment of cross-border e-commerce services in China promotes the employment of gateways that support international transactions.

Competitive Landscape:

Key players in the market are working on developing innovative solutions that make digital payments faster, safer, and more convenient. They wager on advanced technologies, such as AI, blockchain, and encryption to enhance security and prevent fraud, which builds trust among users. Big companies are also offering seamless integrations for businesses, enabling them to accept payments across multiple platforms, including mobile apps and e-commerce websites. With the high popularity of digital wallets and mobile payments in the region, key players actively partner with local banks, fintech firms, and retailers to expand their reach. They also tailor their services to meet the diverse needs of users, including cross-border transactions and multiple currency support, making digital payments accessible to a broader audience. For instance, in April 2024, Transaction Media Networks, Inc., a gateway services provider, declared that it initiated the support for the commercial launch of Square K.K's new product, Square Register, within the Japanese domestic market. The company started offering e-cash payment gateway services for Square Register.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific payment gateways market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Klasha, a leading technology company, introduced its newest offering, Pay to China, aimed at enabling instant money transfers from Africa to China. Utilizing the Pay to China feature, both companies and individuals in Africa can promptly send CNY payments to Chinese bank accounts, Alipay wallets, WeChat wallets, and bank cards.

- November 2024: Cashfree Payments, a prominent payments and API banking company, teamed up with Indian firms like Swiggy and Nykaa to facilitate international customers in making payments in India. This payment gateway serves merchants involved in both importing and exporting. The company's international payments license enables users to carry out smooth transactions.

- August 2024: PhonePe Payment Gateway unveiled PhonePe PG Bolt, an innovative solution that enables merchants to provide customers with the quickest in-app payment experience, boasting a 99% success rate. It provides a 1-second transaction duration with the broadest access for registered PhonePe merchants and users who can seamlessly integrate their payments across different applications without the need for multiple onboarding processes.

- March 2024: Cashfree Payments introduced a payment gateway risk management solution designed to decrease fraudulent activities by 40 percent. It allows customers to set restrictions on how often and how much an individual customer can pay over a specific time frame.

- February 2024: Razorpay, a well-known payment gateway firm, declared that it reached an annualized Total Payment Volume (TPV) of USD 150 Billion, during the 5th edition of its main event. The company introduced a new benchmark for payments in India, Payment Gateway 3.0, establishing it as the sole Payment Gateway (PG) in the country that addresses the entire buyer journey. Driven by its exclusive AI engine, AI Nucleus, this revamped checkout will enable companies to anticipate over 30% increased conversions, leading to greater revenues.

Asia Pacific Payment Gateways Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Large Enterprises, Micro and Small Enterprises, Mid-Size Enterprises |

| Mode of Interactions Covered | Hosted Payment Gateways, Pro/Self-Hosted Payment Gateways, API/Non-Hosted Payment Gateways, Local Bank Integrates, Direct Payment Gateways, Platform-Based Payment Gateways |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific payment gateways market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific payment gateways market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific payment gateways industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific payment gateways market in the region was valued at USD 11.88 Billion in 2024.

The increasing smartphone penetration is enabling more people to access digital payments, encouraging the adoption of payment gateways. Besides this, the rise of cross-border e-commerce services are promoting businesses to employ gateways that support multiple currencies and international transactions. Moreover, innovations like blockchain and AI are improving gateway efficiency and reliability, further fueling the market growth.

IMARC estimates the Asia Pacific payment gateways market to exhibit a CAGR of 8.38% during 2025-2033, reaching a value of USD 25.42 Billion by 2033.

Large enterprises accounted the largest Asia Pacific payment gateways application market share.

Hosted payment gateways represented the largest Asia Pacific payment gateways mode of interaction market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)