Asia Pacific Microinsurance Market Size, Share, Trends and Forecast by Product Type, Provider, Model Type, and Country, 2025-2033

Market Overview:

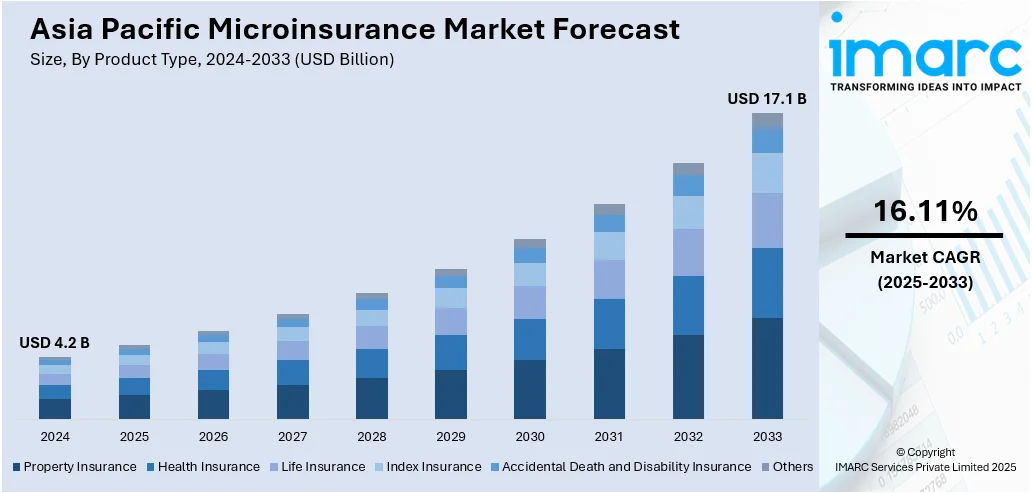

The Asia Pacific microinsurance market size reached USD 4.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.1 Billion by 2033, exhibiting a growth rate (CAGR) of 16.11% during 2025-2033. The flourishing growth of the insurance sector, the increasing consumer awareness about the numerous benefits of microinsurance, favorable government initiatives, and ongoing technological advancement and innovation are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.2 Billion |

|

Market Forecast in 2033

|

USD 17.1 Billion |

| Market Growth Rate (2025-2033) | 16.11% |

Microinsurance is a form of financial protection specifically designed for low-income households with limited income access and low-valued assets. Its primary objective is to provide coverage to the vulnerable segments of society, offering compensation for incidents such as illness, injury, disabilities, and death. By consolidating multiple small financial units into a larger structure, microinsurance acts as a safeguard against unforeseen losses and the exorbitant interest rates imposed by unorganized money lenders. This insurance coverage extends to various risks, encompassing life, property, health, and liability. It also offers the benefits of financial security, improved access to healthcare, elevated living standards, enhanced economic growth, and the promotion of community development.

To get more information on this market, Request Sample

The Asia Pacific microinsurance market is primarily fueled by the bolstering growth of the insurance sector. In addition to this, ongoing technological advancements and innovations, including mobile banking and telemedicine, have facilitated the delivery of microinsurance to low-income individuals and households, thus presenting remunerative growth opportunities for the market. Moreover, the implementation of numerous government initiatives to develop reimbursement policies and consumer-friendly insurance models, like peer-to-peer models, coupled with increasing awareness among consumers, are propelling the market growth in the region. Furthermore, major companies are leveraging multichannel interaction platforms and virtual networks to enhance customer experience and establish sustainable value chains for microinsurance businesses, creating a positive outlook for market expansion. Concurrent with this, the launch of various education and awareness campaigns to inform low-income households about the numerous benefits of insurance, including risk management, is acting as another significant growth-inducing factor.

Asia Pacific Microinsurance Market Trends/Drivers:

Expanding insurance sector

The Asia Pacific microinsurance market is primarily driven by the expanding insurance sector in the region. The escalating awareness and recognition of the importance of insurance coverage have led to increased demand for microinsurance products among low-income individuals and households. As economies in the Asia Pacific continue to develop and income levels rise, there is a greater need for financial protection against risks such as illness, injury, and natural disasters. This increasing demand for insurance services has created a conducive environment for the growth of microinsurance. Concurrent with this, the introduction of innovative insurance products and services is presenting lucrative growth opportunities for the market, attracting new customers and retaining existing ones. These products may include specialized coverage for emerging risks, customizable policies, and value-added services that provide additional benefits to policyholders.

Continuous technological advancements

Ongoing technological advancements play a significant role in driving the Asia Pacific microinsurance market. The advent of mobile banking, telecommunication networks, and digital platforms has revolutionized the way microinsurance products are delivered to low-income individuals and households, further positively impacting the market growth. These technological innovations have made it easier for insurance providers to reach underserved populations, especially in remote areas where traditional distribution channels may be limited, aiding in market expansion. In addition to this, mobile applications and online platforms enable convenient access to microinsurance policies, premium payments, and claims processing, fueling its adoption across the region. Furthermore, telemedicine services have emerged as a vital component of microinsurance, providing affordable and accessible healthcare services to policyholders. The integration of technology in microinsurance operations has not only improved efficiency but also expanded the market reach, making it more inclusive and sustainable.

Government initiatives and awareness campaigns

Government initiatives and awareness campaigns are one of the major factors driving the Asia Pacific microinsurance market. Numerous governments across the region have recognized the importance of financial inclusion and have taken steps to promote and support microinsurance initiatives. This includes developing reimbursement policies, providing regulatory frameworks, and incentivizing insurance providers to cater to low-income populations. Government support helps create a favorable ecosystem for microinsurance, fostering market growth and encouraging participation from providers and consumers. In addition to this, the launch of various awareness campaigns by microinsurance providers aimed to educate low-income households about the benefits of insurance and the various microinsurance products available are contributing to the market growth.

Asia Pacific Microinsurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific microinsurance market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on product type, provider, and model type.

Breakup by Product Type:

- Property Insurance

- Health Insurance

- Life Insurance

- Index Insurance

- Accidental Death and Disability Insurance

- Others

Life insurance is dominating the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes property insurance, health insurance, life insurance, index insurance, accidental death and disability insurance, and others. According to the report, life insurance represented the largest segment.

The region's economic growth and the rising middle-class population have resulted in increased disposable income and a greater emphasis on securing financial stability for the future. This, in turn, is strengthening the market growth. In addition to this, the growing awareness of the importance of life insurance as a means of mitigating risks and ensuring the financial well-being of dependents is creating a favorable outlook for market expansion. Furthermore, insurance companies in the region are increasingly offering innovative life insurance products tailored to specific customer segments, such as customizable coverage, investment-linked policies, and riders for critical illness or disability. These offerings cater to the evolving needs and preferences of customers, further driving the demand for life insurance.

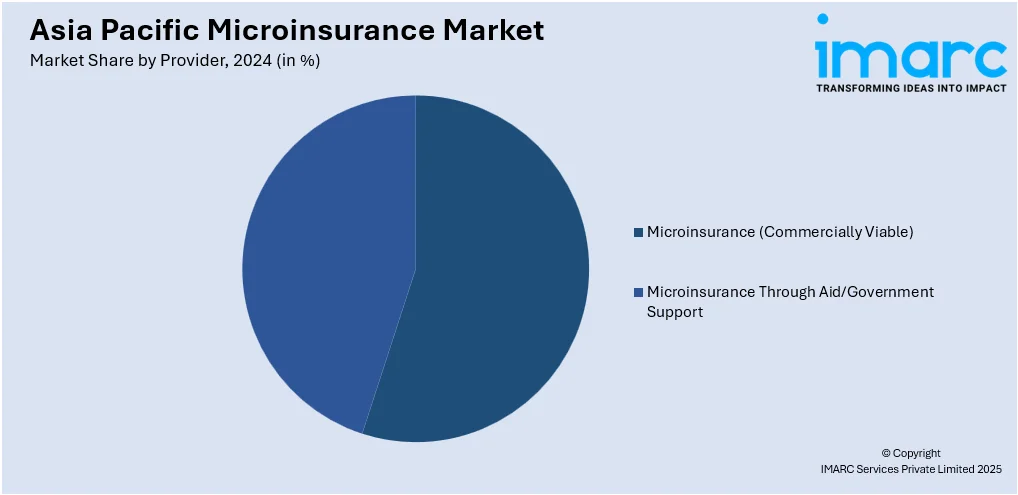

Breakup by Provider:

- Microinsurance (Commercially Viable)

- Microinsurance Through Aid/Government Support

Microinsurance (commercially viable) holds a larger share in the market

A detailed breakup and analysis of the market based on the provider has also been provided in the report. This includes microinsurance (commercially viable) and microinsurance through aid/government support. According to the report, microinsurance (commercially viable) accounted for the largest market share.

The demand for commercially viable microinsurance in the Asia Pacific region is driven by the expanding middle-class population, rising income levels, and increased awareness of the importance of financial protection among low-income individuals and households. As more people strive to improve their quality of life and safeguard their assets, there is a growing demand for microinsurance that offers affordable coverage for risks such as health, property, and livelihoods. In addition to this, significant technological advancements and the increasing penetration of mobile and internet connectivity have facilitated the distribution and delivery of microinsurance products, creating a favorable outlook for market expansion. Furthermore, the growing recognition of the social and economic benefits of microinsurance by governments, regulatory bodies, and development organizations are creating a supportive environment for market expansion.

Breakup by Model Type:

- Partner Agent Model

- Full-Service Model

- Provider Driven Model

- Community-Based/Mutual Model

- Others

Partner agent model is dominating the market

The report has provided a detailed breakup and analysis of the market based on the model type. This includes partner agent, full-service, provider driven, community-based/mutual, and other models. According to the report, partner agent model represented the largest segment.

The rising demand for the partner agent model microinsurance to leverage the extensive reach and trusted relationships of local agents or intermediaries who have deep knowledge of the communities they serve is positively impacting the market growth. Besides this, the widespread product utilization to facilitate effective communication, build trust, and enhance customer engagement is aiding in market expansion. Moreover, the partner agent model offers a personalized approach to microinsurance distribution. Local agents have a better understanding of the unique needs, preferences, and cultural nuances of their communities. They can provide tailored advice, assist in policy enrollment, and offer ongoing support to policyholders. This personalized touch resonates with customers, increasing the demand for microinsurance products delivered through the partner agent model.

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

India exhibits a clear dominance in the market, accounting for the largest Asia Pacific microinsurance market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes China, Japan, India, South Korea, Australia, Indonesia, and others. According to the report, India accounted for the largest market share.

India has a large population, with a significant portion being low-income individuals and households. Microinsurance caters specifically to this segment, providing affordable and accessible insurance coverage, thereby addressing the unique needs of the financially vulnerable population. The demand is further fueled by the increasing awareness about the importance of insurance and risk mitigation among individuals and communities. Moreover, various initiatives taken by the Government of India (GoI) to promote financial inclusion and expand insurance coverage in the country, such as Pradhan Mantri Jan Dhan Yojana (PMJDY) and the Pradhan Mantri Suraksha Bima Yojana (PMSBY), are strengthening the market growth. Furthermore, the widespread penetration of mobile phones and internet connectivity in the country has made it easier for insurance providers to reach remote areas and underserved populations through digital platforms and mobile applications.

Competitive Landscape:

The competitive landscape of the Asia Pacific microinsurance market is characterized by a mix of established insurance companies, microinsurance specialists, and emerging players. The established insurance companies in the region recognize the potential of the microinsurance market and are actively expanding their offerings to include microinsurance products. Moreover, specialized microinsurance providers focus exclusively on serving the low-income population and have developed expertise in tailoring products to meet their unique needs. These providers often collaborate with local partners, such as microfinance institutions and NGOs, to reach underserved communities. Besides this, the emergence of insurtech startups and digital platforms has brought innovation to the microinsurance market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Asia Pacific Microinsurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Property Insurance, Health Insurance, Life Insurance, Index Insurance, Accidental Death and Disability Insurance, Others |

| Providers Covered | Microinsurance (Commercially Viable), Microinsurance Through Aid/Government Support |

| Model Types Covered | Partner Agent Model, Full-Service Model, Provider Driven Model, Community-Based/Mutual Model, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific microinsurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific microinsurance market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific microinsurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific microinsurance market was valued at USD 4.2 Billion in 2024.

We expect the Asia Pacific microinsurance market to exhibit a CAGR of 16.11% during 2025-2033.

The growing adoption of microinsurance, as it helps individuals belonging to the financially weaker section of society by formulating a tailored plan with low premiums and provides compensation for illness, injury, disabilities, death, etc., is primarily driving the Asia Pacific microinsurance market.

The sudden outbreak of the COVID-19 pandemic has led to the rising utilization of microinsurance by organizations across several Asia Pacific nations to provide cover for medical expenses incurred during the treatment of the coronavirus infection.

Based on the product type, the Asia Pacific microinsurance market can be categorized into property insurance, health insurance, life insurance, index insurance, accidental death and disability insurance, and others. Among these, life insurance accounts for the majority of the total market share.

Based on the provider, the Asia Pacific microinsurance market has been segregated into microinsurance (commercially viable) and microinsurance through aid/government support, where microinsurance (commercially viable) currently exhibits a clear dominance in the market.

Based on the model type, the Asia Pacific microinsurance market can be bifurcated into partner agent model, full-service model, provider driven model, community-based/mutual model, and others. Currently, partner agent model holds the largest market share.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where India currently dominates the Asia Pacific microinsurance market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)