Asia Pacific Low-Grade Silica Sand Market Size, Share, Trends and Forecast by Grade, End Use, and Country, 2025-2033

Market Overview:

The Asia Pacific low-grade silica sand market size reached 54.9 Million Metric Tons in 2024. Looking forward, IMARC Group expects the market to reach 71.4 Million Metric Tons by 2033, exhibiting a growth rate (CAGR) of 2.82% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 54.9 Million Metric Tons |

| Market Forecast in 2033 | 71.4 Million Metric Tons |

| Market Growth Rate (2025-2033) | 2.82% |

Low-grade silica sand, also called ordinary silica sand, is primarily composed of quartz and other materials, such as feldspars, carbonates, clay minerals, iron oxides, etc. It contains less than 99% of SiO2 and more than 0.01% of iron oxide. Low-grade silica sand finds diverse applications in glassmaking, water filtration, industrial casting, sandblasting, hydraulic fracturing, etc. This can be accredited to its numerous benefits pertaining to high granularity, better resistance against heat and chemical reactions, improved strength, enhanced durability, etc.

.webp)

To get more information on this market, Request Sample

Asia Pacific Low-Grade Silica Sand Market Trends:

Asia Pacific is amongst the largest consumers of low-grade silica sand based on its rising utilization in the glass and foundry industries. Furthermore, the increasing demand for low-grade silica sand in water filtration, along with the growing establishment of sewage treatment plants and installation of water purification systems, is also augmenting the market growth in the region. Additionally, a significant rise in infrastructural development and the escalating usage of low-grade silica sand in manufacturing various construction materials, such as ceramics, stained glass, paints and coatings, etc., are further propelling the regional market. Apart from this, the expanding renewable energy sector has led to the increasing utilization of low-grade silica sand in glass-based photovoltaic modules, which is also catalyzing the product demand. Moreover, extensive R&D activities for the utilization of low-grade silica sand in lightweight glazing glass, nanotechnology in flat glass, solar control glazing for building glass, etc., are positively influencing the market growth. Additionally, the expanding applications of low-grade silica sand in numerous shale gas exploration activities are expected to bolster the Asia Pacific silica sand market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific low-grade silica sand market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on grade and end use.

Breakup by Grade:

- Below 200 ppm Fe

- 201-400 ppm Fe

- 401-600 ppm Fe

- Above 600 ppm Fe

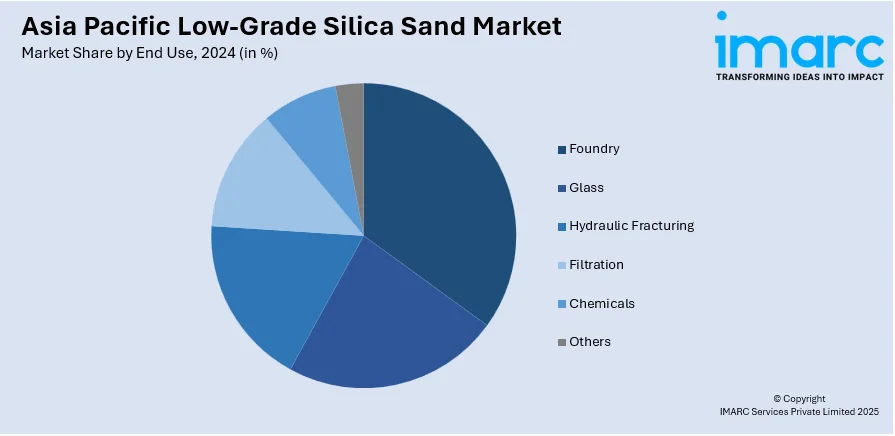

Breakup by End Use:

- Foundry

- Glass

- Hydraulic Fracturing

- Filtration

- Chemicals

- Others

Breakup by Country:

- China

- India

- Malaysia

- South Korea

- Japan

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Hisagoya Co. Ltd., JFE MINERAL & Alloy Co. LTD., Mangal Minerals, PUM Group, Raghav Productivity Enhancers Limited, Rock Energy International, Tochu Corporation and Toyoura Keiseki Kogyo Co. Ltd.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Metric Tons |

| Segment Coverage | Grade, End Use, Country |

| Countries Covered | China, India, Malaysia, South Korea, Japan |

| Companies Covered | Hisagoya Co. Ltd., JFE MINERAL & Alloy Co. LTD., Mangal Minerals, PUM Group, Raghav Productivity Enhancers Limited, Rock Energy International, Tochu Corporation and Toyoura Keiseki Kogyo Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Asia Pacific low-grade silica sand market reached a volume of 54.9 Million Metric Tons in 2024.

We expect the Asia Pacific low-grade silica sand market to exhibit a CAGR of 2.82% during 2025-2033.

The growing adoption of low-grade silica sand in glassmaking, water filtration, industrial casting, etc., owing to its various benefits, such as high granularity, optimal resistance against heat and chemical reactions, improved strength, enhanced durability, etc., is primarily driving the Asia Pacific low-grade silica sand market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Asia Pacific nations, resulting in the temporary halt in numerous construction activities, thereby negatively impacting the Asia Pacific market for low-grade silica sand.

Based on the grade, the Asia Pacific low-grade silica sand market has been segregated into below 200 ppm Fe, 201-400 ppm Fe, 401-600 ppm Fe, and above 600 ppm Fe. Among these, 401-600 ppm Fe currently holds the largest market share.

Based on the end use, the Asia Pacific low-grade silica sand market can be bifurcated into foundry, glass, hydraulic fracturing, filtration, chemicals, and others. Currently, foundry exhibits a clear dominance in the market.

On a regional level, the market has been classified into China, India, Malaysia, South Korea, Japan, and others, where China currently dominates the Asia Pacific low-grade silica sand market.

Some of the major players in the Asia Pacific low-grade silica sand market include Hisagoya Co. Ltd., JFE MINERAL & Alloy Co. LTD., Mangal Minerals, PUM Group, Raghav Productivity Enhancers Limited, Rock Energy International, Tochu Corporation, and Toyoura Keiseki Kogyo Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)