Asia Pacific IT Training Market Size, Share, Trends and Forecast by Application, End User, and Country, 2025-2033

Asia Pacific IT Training Market Size and Share:

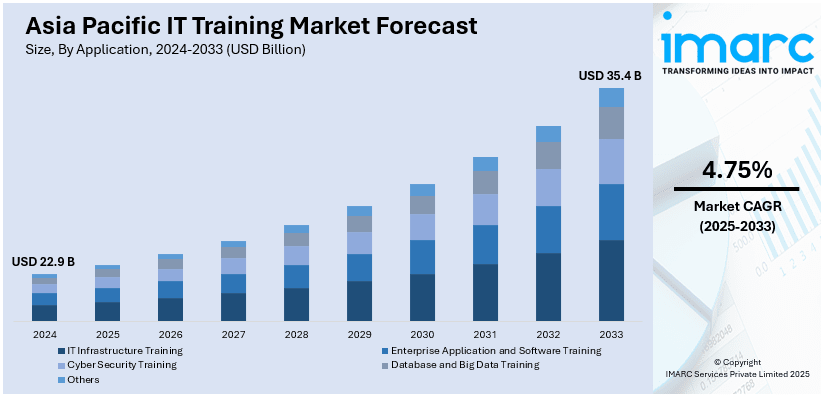

The Asia Pacific IT training market size was valued at USD 22.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.4 Billion by 2033, exhibiting a CAGR of 4.75% from 2025-2033. China currently dominates the market in 2024. The market across the region is propelled by rapid advancements in artificial intelligence (AI) and machine learning (ML) technologies, growing reliance on data analytics and big data tools across industries, increased adoption of automation and robotics in manufacturing sectors, rising demand for certification programs in specialized IT fields, and expanding collaboration between educational institutions and IT training providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 22.9 Billion |

|

Market Forecast in 2033

|

USD 35.4 Billion |

| Market Growth Rate (2025-2033) | 4.75% |

The Asia Pacific IT training market is driven by the rapid digital transformation and increasing adoption of advanced technologies in the region. Businesses across industries are integrating solutions such as cloud computing, cybersecurity, and artificial intelligence, creating a high demand for skilled professionals. According to the IMARC Group, the Asia Pacific artificial intelligence market size is projected to reach USD 163.8 Billion by 2032, exhibiting a CAGR of 21.1% during 2024-2032. In addition, investment is being made in upskilling employees to gain a competitive edge and adapt to the constantly shifting technological landscape. Besides this, the booming IT outsourcing and software services market in the region is increasing the need for skill enhancement.

To get more information on this market, Request Sample

Other key drivers include the growing interest in automation and data-driven decision-making. Manufacturing, healthcare, and retail industries are now using data analytics, IoT, and machine learning (ML), which require training programs that are specialized in these areas. The increasing prevalence of remote work and e-learning platforms has also increased access to flexible IT training for working professionals and students. As per a report published by the IMARC Group, the Asia Pacific e-learning market size is forecasted to reach USD 211.6 Billion by 2032, exhibiting a CAGR of 11.9% during 2024-2032. Certification programs in trending fields such as blockchain, robotics, and software development are also in high demand among the learners, further facilitating industry expansion.

Asia Pacific IT Training Market Trends:

Rapid digital transformation across industries

The rapid digital transformation happening in almost every industry is propelling the Asia Pacific IT training market. Businesses are adopting advanced technologies that include cloud computing, artificial intelligence (AI), machine learning (ML), and big data analytics to enhance their ability to operate efficiently and remain competitively viable. This has led to a substantial demand for IT professionals with relevant skills to manage, develop, and optimize these newer technologies. Companies are also investing heavily in IT training programs to have better-skilled workforces so that they can efficiently use modern digital tools. The emphasis on knowledge-based economies, supported by government initiatives, further supports digital literacy and technical education, propelling the demand for IT training services.

Rise of e-learning platforms

Another driving force for the Asia Pacific IT training market growth is the rising use of e-learning platforms and virtual training solutions. Due to increasing internet connectivity, usage of smartphones and other digital devices has also grown. With growing online activity, individuals can increasingly find time for courses by means of access to platforms that offer convenience and flexibility in the course acquisition process. Moreover, the pandemic has revolutionized IT training delivery with the availability of cost-efficient e-learning solutions and personal learning experiences powered by AI. Remote learning adoption also increased during the pandemic, continuing to drive online IT training programs across the region.

Expanding IT sector and demand for skilled workforce

The rapid expansion of the IT sector in the Asia Pacific countries, that is, India, China, Singapore, and others, is propelling the demand for a skilled workforce. These nations have become global hubs for IT service provision, software development, and technology innovation. Accordingly, enterprises and educational establishments are focusing on providing IT training relevant to the industrial world. This demand is also due to multinational companies that are establishing their bases in the region, thus investing in workforce development in line with global standards. Start-ups and SMEs are rising and increasing this demand since they require professionals to implement and manage the IT infrastructure. The sustained growth of the Asia Pacific IT training market share is consequently being led by increased emphasis on skill enhancement.

Asia Pacific IT Training Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific IT training market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and end user.

Analysis by Application:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

IT infrastructure training helps individuals acquire skills in hardware and network management and maintenance along with data centers. The segment is important for most businesses adopting cloud computing, virtualization, and enterprise networks. With digital technology adoption on the rise, the demand for IT infrastructure training increases as organizations place greater emphasis on system reliability, scalability, and operational efficiency.

Enterprise application and software training focuses on teaching users to optimize and exploit business-critical software systems, including ERP, CRM, and HR management tools. As enterprises embrace digital transformation strategies, this segment finds its way to the forefront. It enables employees to make effective use of complex tools and integrate departments seamlessly for effective decision-making and workflow management.

Cybersecurity training fulfills the requirement to secure digital assets from cyber threats and attacks. This segment provides information on threat detection, strategies to prevent them, and compliance with data protection regulations. Growing concerns over data breaches and the rising sophistication of cyberattacks are making cybersecurity expertise a highly sought demand, making this a key area in the IT training market.

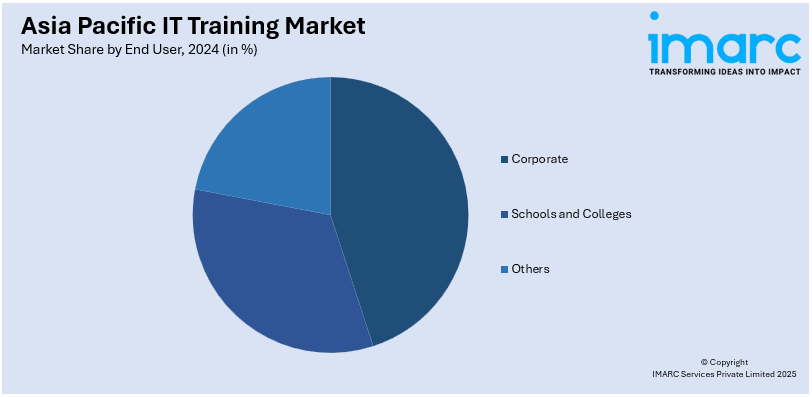

Analysis by End User:

- Corporate

- Schools and Colleges

- Others

Corporate is a leading segment in the Asia Pacific IT training market, with organizations spending money on upskilling their employees to adapt to changing technologies. Businesses are focused on training programs in cloud computing, cybersecurity, and AI to improve productivity and stay competitive. Customized solutions and partnerships with IT training providers are being offered by industry-specific companies to develop their workforce and enhance operational efficiency.

Schools and colleges are another prominent segment, offering IT courses that prepare students for technology-oriented careers. These institutions include foundational skills in programming, networking, and cybersecurity among their priorities. Collaborative efforts with training providers, combined with government initiatives to promote interest in STEM education, further boost the availability of structured IT training for the younger generation.

The others category encompasses users in the form of people, government departments, and nonprofit bodies requiring IT training to increase their skills and digital competency. This category focuses on freelancers, job seekers, and community programs trying to fill the gap between people who have access to computers and those who do not. Online learning platforms and certification services increase access, which would provide diverse groups with easier ways of acquiring IT training.

Analysis by Country:

- China

- India

- South Korea

- Indonesia

- Japan

- Malaysia

- Thailand

- Others

China leads the Asia Pacific IT training market in its pursuit of rapid technological progress and significant digital transformation. Innovation, with a focus on smart manufacturing, drives government policy. This has fueled a massive demand for IT skills related to AI, cloud computing, and robotics. Partnerships between global technology firms and local providers are also improving access to sophisticated programs and developing the workforce within their respective industries.

The IT training market in India flourishes from its strong position as a global hub for IT outsourcing and software services. A large demand in areas such as data analytics, cybersecurity, and software development keep growing. Digital India and Skill India programs initiated by the government, along with the expansion of e-learning platforms, ensure that a large student and professional community gets to avail of IT training.

The South Korea IT training market benefits from its strong focus on technological innovation and digital infrastructure. Advanced industries such as electronics and automotive create demand for specialized IT skills. Government-backed programs and collaborations with global IT companies promote training in emerging fields such as IoT, blockchain, and AI, further strengthening the IT workforce in South Korea.

Competitive Landscape:

The key players in the Asia Pacific IT training market are driving growth through strategic partnerships, technological innovation, and tailored training programs. Various partnerships between companies and educational/academic or corporate institutions in offering industrialized courses and specialized fields specific to industry needs have been designed. They offer flexible opportunities for e-learning through a network of digital channels, particularly targeting remote learners and other working professionals. The integration of advanced tools such as virtual labs, AI-driven assessments, and gamification enhances engagement and effectiveness. Expanding their course portfolios to include trending technologies such as cloud computing, cybersecurity, and AI ensures relevance. Moreover, investments in localized content and multilingual support are broadening their reach, making IT training accessible to diverse populations across the region.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific IT training market with detailed profiles of all major companies.

Latest News and Developments:

- 6 June 2024: IBM, a leading technology firm based in New York, has empowered 650,000 women in the Asia-Pacific region with digital skills. This education initiative is part of IBM’s commitment to the Indo-Pacific Economic Framework for Prosperity Upskilling Initiative, led by the US Secretary of Commerce. As part of this partnership, the program aims to provide digital skills education and training to women and girls throughout the Asia-Pacific region.

- 30 April 2024: Microsoft has announced a training initiative that plans to provide AI skills to 2.5 million people across Malaysia, Thailand, Indonesia, Vietnam, and the Philippines by 2025. As part of this initiative, Microsoft aims to collaborate with governments, businesses, nonprofit organizations, and various communities to effectively implement the training program in these countries.

Asia Pacific IT Training Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End Users Covered | Corporate, Schools and Colleges, Others |

| Countries Covered | China, India, South Korea, Indonesia, Japan, Malaysia, Thailand, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific IT training market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific IT training market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

IT training involves structured programs designed to enhance knowledge and skills in information technology. It covers areas such as software development, cybersecurity, networking, and data analytics. IT training is essential for professionals to stay updated with evolving technologies and for organizations to improve efficiency. It supports career growth, workforce development, and the effective use of technological solutions.

The Asia Pacific IT training market was valued at USD 22.9 Billion in 2024.

IMARC estimates the Asia Pacific IT training market to exhibit a CAGR of 4.75% during 2025-2033.

The rapid digital transformation across industries, increasing adoption of advanced technologies, rising demand for skilled IT professionals to address skill gaps, government initiatives supporting digital education and workforce development, and growth of e-learning platforms and virtual training solutions are the primary factors driving the Asia Pacific IT training market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)