Asia Pacific Heat Exchanger Market Size, Share, Trends and Forecast by Type, Material, End Use Industry, and Country, 2025-2033

Market Overview:

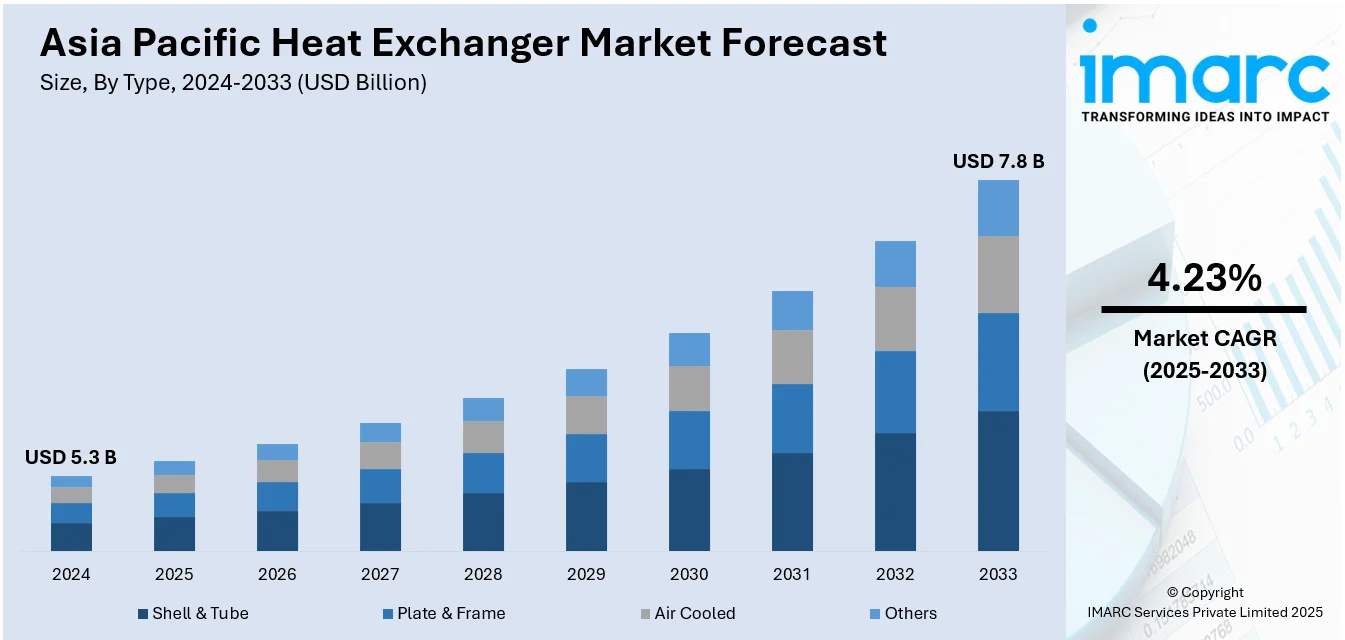

The Asia Pacific heat exchanger market size reached USD 5.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.23% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.3 Billion |

|

Market Forecast in 2033

|

USD 7.8 Billion |

| Market Growth Rate 2025-2033 | 4.23% |

Heat exchangers are designed to transfer heat from one liquid to another and control the temperature of a system. These devices help to heat or cool buildings and enable the efficient performance of engines and machines. As compared to the conventional methods of cooling, heat exchangers use less energy and produce less pollution. Therefore, they find extensive application in sewage treatment, boilers, refrigerators, furnaces and air conditioning systems across the Asia Pacific region.

To get more information on this market, Request Sample

The rising population and rapid urbanization are positively fueling the need for power consumption. This represents one of the primary factors strengthening the heat exchangers market growth in the Asia Pacific. In addition to this, the installation of new power units has resulted in the increasing adoption of heat exchangers across the region. Moreover, the key market players are investing in research and development (R&D) projects to introduce an efficient upgrade for conventional heat exchangers. However, the coronavirus disease (COVID-19) outbreak and lockdown restrictions imposed by governments of several countries have led to temporary closures of manufacturing units across the Asia Pacific. This has severely affected the market growth, but it will witness growth once lockdown restrictions are uplifted.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific heat exchanger market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on type, material and end use industry.

Breakup by Type:

- Shell & Tube

- Plate & Frame

- Air Cooled

- Others

Breakup by Material:

- Carbon Steel

- Stainless Steel

- Nickel

- Others

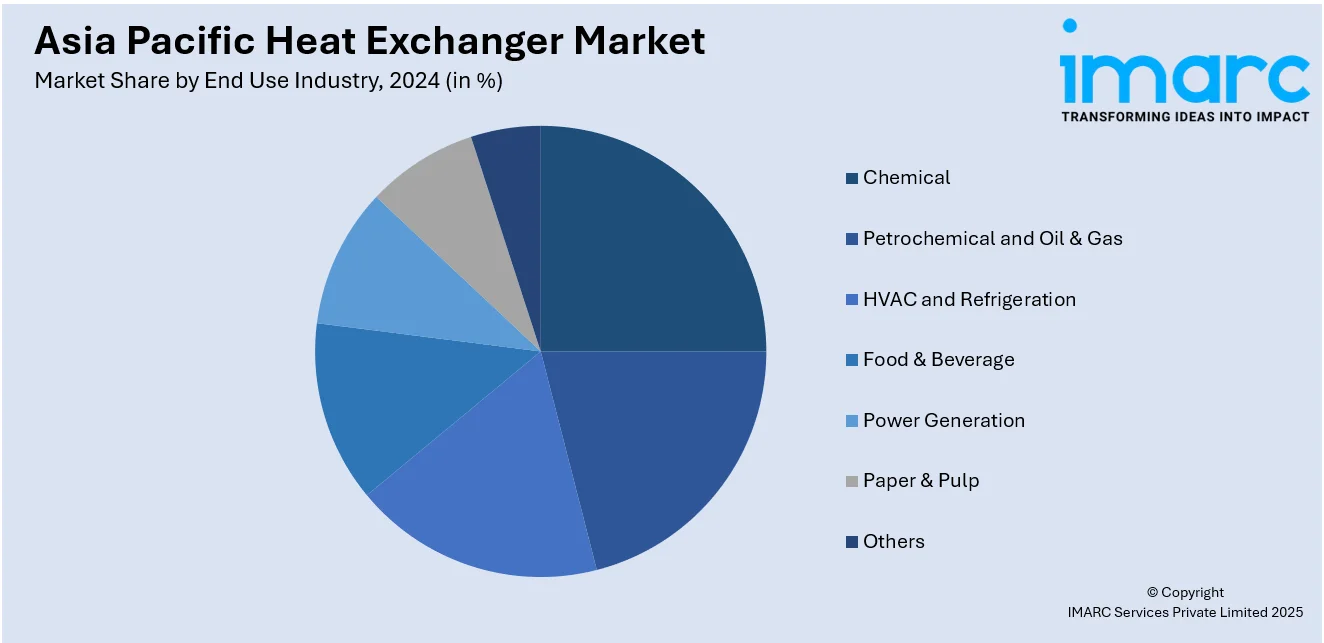

Breakup by End Use Industry:

- Chemical

- Petrochemical and Oil & Gas

- HVAC and Refrigeration

- Food & Beverage

- Power Generation

- Paper & Pulp

- Others

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Material, End Use Industry, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Asia Pacific heat exchanger market was valued at USD 5.3 Billion in 2024.

We expect the Asia Pacific heat exchanger market to exhibit a CAGR of 4.23% during 2025-2033.

The extensive utilization of heat exchangers in boilers, furnaces, refrigerators, automotive radiators, sewage treatment, etc., is currently driving the Asia Pacific heat exchanger market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Asia Pacific nations resulting in temporary closure of numerous manufacturing units for heat exchanger.

Based on the type, the Asia Pacific heat exchanger market can be divided into shell & tube, plate & frame, air cooled, and others. Currently, shell & tube exhibits a clear dominance in the market.

Based on the material, the Asia Pacific heat exchanger market has been bifurcated into carbon steel, stainless steel, nickel, and others. Among these, stainless steel currently holds the majority of the total market share.

Based on the end use industry, the Asia Pacific heat exchanger market can be segmented into

chemical, petrochemical and oil & gas, HVAC and refrigeration, food & beverage, power generation, paper & pulp, and others. Currently, the chemical industry represents the largest market share.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where China currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)