Asia Pacific Healthcare Big Data Analytics Market Size, Share, Trends and Forecast by Component, Analytics Type, Delivery Model, Application, End Use, and Region, 2025-2033

Asia Pacific Healthcare Big Data Analytics Market Size and Share:

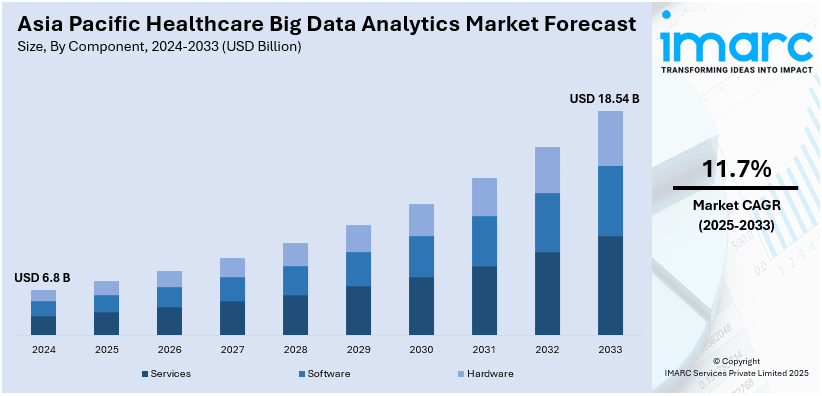

The Asia Pacific healthcare big data analytics market size was valued at USD 6.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.54 Billion by 2033, exhibiting a CAGR of 11.7% from 2025-2033. The Asia Pacific healthcare big data analytics market size is expanding significantly due to the widespread adoption of electronic health records (EHRs), advancements in AI and ML technologies, government investments in digital healthcare infrastructure, rising demand for personalized medicine, and the expansion of telemedicine and wearable health devices, fostering data-driven decision-making.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.8 Billion |

|

Market Forecast in 2033

|

USD 18.54 Billion |

| Market Growth Rate (2025-2033) | 11.7% |

The market in Asia Pacific is majorly driven by the widespread adoption of electronic health records (EHRs) and the digitization of healthcare systems. Additionally, an enhanced emphasis on health IT infrastructure development by governments and private sectors to streamline data storage and management, is propelling the market further. For instance, On October 3, 2024, the HIMSS24 APAC conference convened leaders to discuss the future of healthcare across the APAC region. The event, themed "Creating Tomorrow’s Health," addressed topics such as artificial intelligence, cybersecurity, 5G connectivity, electronic medical records, and strategies to enhance healthcare access. Speakers emphasized the necessity of transforming data into actionable insights and fostering a mindset geared toward continuous digital transformation. In addition to this, rising demand for personalized medicine, supported by predictive analytics, is further fostering market growth. Apart from this, the region's growing aging population, coupled with an increasing incidences of chronic diseases, is necessitating efficient data-driven decision-making in healthcare delivery.

To get more information on this market, Request Sample

Another significant driver is the expansion of telemedicine and wearable health devices, generating vast amounts of real-time data requiring advanced analytics. For instance, on September 24, 2024, WHOOP announced its official entry in the Indian market, introducing advanced wearable fitness and health technology designed for high-performance athletes as well as individuals who are wellness-conscious. This device offers features like real-time insights into recovery, strain, stress, and sleep. This collaboration aims to make premium, data-driven health solutions accessible to a broader Indian audience. Furthermore, growing investments in artificial intelligence (AI) and machine learning (ML) technologies are fueling the development of sophisticated data analytics tools. Besides, government favorable initiatives promoting data interoperability and integration across healthcare systems are improving market potential. Also, increasing awareness of cost optimization and operational efficiency through analytics further bolsters the adoption of big data solutions in the Asia Pacific healthcare sector.

Asia Pacific Healthcare Big Data Analytics Market Trends:

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The Asia Pacific healthcare big data analytics market is witnessing increasing integration of AI and ML technologies. For instance, On September 18, 2024, SAP released a study indicating that 92% of midmarket businesses in Asia Pacific and Japan consider adopting generative artificial intelligence (Gen AI) a top priority. The research, encompassing 12,003 companies with 250 to 1,500 employees, revealed that 94% of high-growth firms prioritize Gen AI adoption, compared to 86% of lower-growth counterparts. Key areas where AI is expected to drive transformation include data security and privacy (52%), accurate decision-making (50%), and the creation of new business models (48%). These tools enable advanced predictive analytics, early disease detection, along with personalized treatment plans. Moreover, AI-driven solutions also streamline administrative processes, improving operational efficiency. The development of intelligent algorithms for analyzing unstructured healthcare data, including clinical notes as well as imaging, is gaining traction. This trend is supported by significant investments in AI research and growing partnerships between technology providers and healthcare institutions.

Growing Adoption of Cloud-Based Analytics

Cloud-based solutions are emerging as a dominant trend in the Asia Pacific healthcare analytics market. For instance, Singtel and Hitachi Ltd. signed a Memorandum of Understanding on August 26, 2024, to collaborate on next-generation data centers as well as GPU Cloud services in Japan and potentially the wider APAC region. This strategic partnership aims to combine Singtel's data center and connectivity expertise along with the end-to-end data center integration capabilities of Hitachi, including green cooling systems, storage infrastructure, power solutions, and data management. These platforms offer scalability, cost-effectiveness, and seamless data accessibility, making them highly attractive for healthcare providers, thereby positively impacting the Asia Pacific healthcare big data analytics market share. Cloud adoption supports real-time data processing and facilitates integration across healthcare ecosystems. The increasing focus on interoperability and the need for secure, centralized data storage are further driving this trend. Cloud-based analytics also enable smaller healthcare facilities to access sophisticated tools without significant upfront investments.

Expansion of Telehealth and Remote Monitoring Analytics

The expansion of telehealth services as well as remote monitoring technologies is shaping the Asia Pacific healthcare analytics market. Wearable devices and mobile health applications are generating vast datasets, requiring robust analytics for actionable insights. This trend is driven by rising demand for remote patient care, particularly in rural and underserved areas. Analytics is being used to monitor patient outcomes, optimize resource allocation, and predict healthcare needs. For instance, on February 13, 2024, Biofourmis announced four new agreements with top pharmaceutical companies, leveraging its expertise in digital biomarker development and comprehensive, device-agnostic clinical trial solutions. These collaborations include oncology therapies, which helps expand Biofourmis' diverse therapeutic portfolio, by including pain, cardiovascular, and metabolic diseases. The partnerships aim to enhance the efficiency and effectiveness of clinical trials through advanced digital health technologies. Governments and private players are heavily investing in telehealth infrastructure, accelerating this transformation.

Asia Pacific Healthcare Big Data Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific healthcare big data analytics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, analytics type, delivery model, application, and end use.

Analysis by Component:

- Services

- Software

- Electronic Health Record Software

- Practice Management

- Workforce Management

- Hardware

- Data Storage

- Routers

- Firewalls

- Virtual Private Networks

- E-Mail Servers

- Others

Services lead the market share in 2024. This dominance is due to its importance in implementing, integrating, and maintaining analytics solutions. Moreover, consulting, training, and support services help healthcare providers leverage analytics tools and optimize their operations. The demand for outsourcing analytics management to specialized service providers further supports this trend, which is turn is fostering market growth. With widespread adoption of advanced solutions like AI and ML, services help address complexities associated with system upgrades and data security, particularly in resource-constrained settings, making them indispensable for market growth.

Analysis by Analytics Type:

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Cognitive Analytics

Descriptive Analytics lead the market share leader in 2024. This dominance is due to their foundational role in decision-making in healthcare. Moreover, by summarizing historical data, they provide insights into operational efficiency, patient outcomes, resource utilization, etc. Apart from this, they have become a necessity for healthcare providers due to the widespread application of descriptive analytics in identifying trends and monitoring performance metrics. Additionally, In the Asia Pacific, where many organizations are at the early stages of analytics adoption, descriptive analytics serve as an entry point, offering immediate value. Besides, their ease of implementation, with the power to generate actionable insights, gives them prominence in the region.

Analysis by Delivery Model:

- On-Premise Delivery Model

- On-Demand Delivery Model

On-Demand Delivery Model holds the largest market share in 2024. This dominance is due to its flexibility, scalability, and cost-effectiveness. This model allows health care providers to use advanced analytics solutions without making large upfront investments, thereby fueling the Asia Pacific market. Additionally, cloud-based platforms that support this model allow for real-time processing and integration of data from various systems. The pay-as-you-go structure supports budget constraints for small and medium-sized providers while allowing for seamless scalability. The more reliance on telehealth and mobile healthcare applications furthers the demand for on-demand analytics solutions.

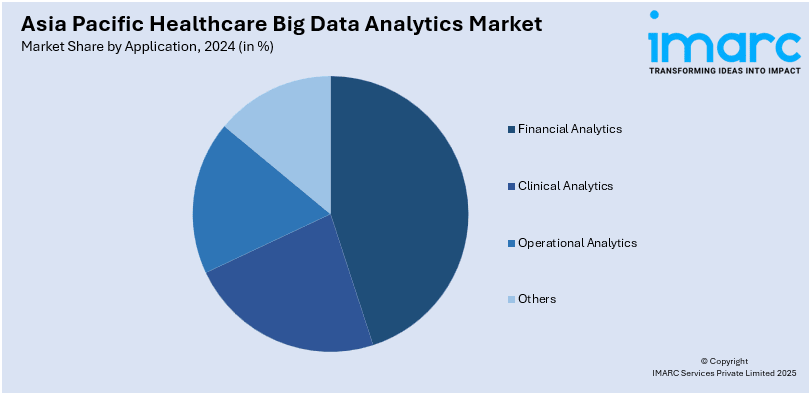

Analysis by Application:

- Financial Analytics

- Clinical Analytics

- Operational Analytics

- Others

Clinical Analytics lead the market share in 2024. This dominance is driven by the improved patient outcomes and improving care delivery. These tools make it easier to work with evidence-based decision-making through predictive modeling and in-time monitoring. The increasing incidence of chronic diseases in the Asia Pacific region has increased the need for clinical analytics to enhance treatment plans and minimize costs. In addition, integration with EHRs and telehealth platforms allows for the analysis of patient data in a holistic manner, thus enhancing the accuracy of diagnosis. Clinical analytics is preferred by healthcare providers because it helps them align care delivery with patient-centric and value-based healthcare models.

Analysis by End Use:

- Hospitals and Clinics

- Finance and Insurance Agencies

- Research Organizations

Hospitals and clinics hold the highest market share in 2024. Primary end-users for this market are mostly hospitals and clinics as they generate and process a massive amount of data. Such institutions require analytics to make operations and patients' data more efficient, or else enhance the quality of medical outcomes. Analytics implementation in hospitals and clinics is gaining momentum due to increased usage of EHRs, telehealth, and precision medicine in the Asia Pacific region. Furthermore, analytics is crucial to help optimize resources and reduce costs. Large patient volumes and government support for digital transformation further reinforce their leading position.

Regional Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China leads the market share in 2024. China dominates the Asia Pacific healthcare big data analytics market due to its rapid digital transformation and healthcare reforms. The country’s significant investments in health IT infrastructure and AI-driven analytics bolster its leadership. High adoption of EHRs, wearables, and telemedicine generate abundant data, making the need for analytics greater. Moreover, government schemes such as Healthy China 2030 focus on using data-based improvements for healthcare. High patients' population along with the rising incidence of chronic diseases emphasizes high demand. China would be a leading market due to strong technological innovation and collaboration with the world's leading technology firms.

Competitive Landscape:

The market in Asia Pacific is highly competitive, majorly driven by rapid technological advancements and increasing investments in innovative solutions. Market participants are focusing on developing AI-driven and cloud-based analytics platforms to improve efficiency and scalability. Collaboration between technology providers and healthcare institutions is intensifying to address regional challenges, such as interoperability and data security. The presence of diverse players, from startups to established firms, fosters innovation. Additionally, government initiatives promoting digital health adoption and data standardization are encouraging competition, driving continuous product improvement and service expansion.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific healthcare big data analytics market with detailed profiles of all major companies.

Latest News and Developments:

- On October 18, 2024, South Korea's Ministry of Health and Welfare and the Korea Health Industry Development Institute announced 7 new projects under the the Korean ARPA-H initiative that were planned through demand surveys, big data analysis, and expert consultations. The initiative will allocate KRW 1.1628 trillion over nine years (2024-2032) to address five imperative missions, including health security, unconquered diseases, and cutting-edge biohealth technologies, with project investments ranging from KRW 13 billion to KRW 23 billion. Recent projects include early cancer screening technologies, space medicine advancements, and an AI-enabled emergency patient classification system, demonstrating a commitment to transformative healthcare solutions.

- On August 09, 2024, South Korea announced expanded access to its large cancer data repository, supporting advanced medical research and personalized healthcare. The initiative includes utilizing big data analytics to improve cancer treatment outcomes and streamline research processes. This development signifies South Korea's commitment to leveraging data-driven solutions for enhanced healthcare innovation.

- On June 27, 2024, SoftBank Group announced the establishment of a joint venture, SB TEMPUS Corp., with Tempus AI, a leader in artificial intelligence and precision medicine. Each company invested USD 102 Million, totaling USD 205 Million, to develop AI-driven medical data analysis and treatment recommendation services in Japan. This collaboration aims to enhance healthcare outcomes by leveraging advanced AI technologies.

- On June 12, 2024, IQVIA introduced "One Home for Sites™," a unified technology platform designed to streamline clinical research operations. This platform consolidates multiple clinical trial systems into a single sign-on and dashboard, aiming to reduce the administrative burden on clinical research sites. By integrating various software applications, it enhances efficiency and simplifies daily tasks for research personnel.

Asia Pacific Healthcare Big Data Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Analytics Types Covered | Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Cognitive Analytics |

| Delivery Models Covered | On-Premises Delivery Model, On-Demand Delivery Model |

| Applications Covered | Financial Analytics, Clinical Analytics, Operational Analytics, Others |

| End Uses Covered | Hospitals and Clinics, Finance and Insurance Agencies, Research Organizations |

| Regions Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific healthcare big data analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific healthcare big data analytics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific healthcare big data analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific healthcare big data analytics market was valued at USD 6.8 Billion in 2024.

The market is primarily driven by the adoption of electronic health records (EHRs), digitization of healthcare systems, investments in AI and ML technologies, rising demand for personalized medicine, expansion of telemedicine, and wearable health devices. Governments and private sectors are also emphasizing healthcare IT infrastructure development, enhancing data storage and management capabilities.

Asia Pacific healthcare big data analytics market to is projected to exhibit a CAGR of 11.7% during 2025-2033, reaching a value of USD 18.54 Billion by 2033.

In 2024, the descriptive analytics segment held the largest market share in the Asia Pacific healthcare big data analytics analytics type market driven by its foundational role in decision-making, summarizing historical data, and identifying trends in healthcare operations and outcomes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)