Asia Pacific Handicrafts Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End Use, and Country, 2025-2033

Asia Pacific handicrafts Market Size and Share:

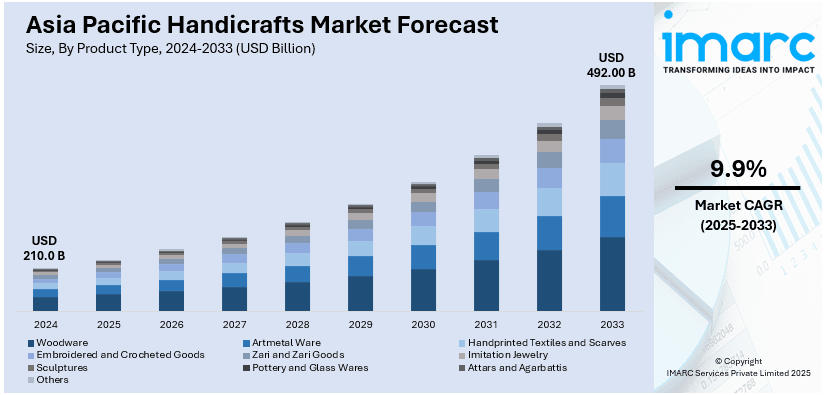

The Asia Pacific handicrafts market size was valued at USD 210.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 492.00 Billion by 2033, exhibiting a CAGR of 9.9% from 2025-2033. The rising tourism, growing global demand for sustainable products, increasing government support, rapid e-commerce expansion, heightened appreciation for cultural goods, escalating middle-class spending, and robust export growth, are major factors boosting the Asia Pacific handicraft market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 210.0 Billion |

| Market Forecast in 2033 | USD 492.00 Billion |

| Market Growth Rate (2025-2033) | 9.9% |

Tourism has been a significant booster for the handicrafts market in Asia Pacific. Visitors often seek unique souvenirs that reflect the region's culture, heritage, and artistry. Countries like Thailand, China, Indonesia, India, and Vietnam are major hubs where handcrafted items such as textiles, pottery, jewelry, and wooden artifacts attract global tourists. International arrivals in China were estimated to exceed 35.5 million in 2023, representing a 41% increase compared to the previous year. This increase in visitors has boosted the demand for local handicrafts that intrigue international travelers. Moreover, online platforms now enable tourists to purchase handcrafted goods even after returning home, further fueling the Asia Pacific handicraft market demand.

To get more information on this market, Request Sample

Handicrafts often utilize natural, sustainable, and recycled materials, aligning with the global push for eco-conscious consumption. As per a survey, it has been found that more than four-fifths or 80 percent of consumers are willing to pay more for sustainable produced or sourced goods. Some customers are prepared to pay approximately 9.7% extra for products that comply with certain environmental standards. This push as consumers worldwide are turning to products that minimize environmental impact is boosting the Asia Pacific handicraft market growth. In this region, artisans use materials like bamboo, jute, coconut shells, and natural dyes to create products that appeal to this growing demographic. The region’s ability to offer aesthetically pleasing and sustainable alternatives gives it a competitive edge.

Asia Pacific Handicrafts Market Trends:

Growing Government Support and Initiatives

As per the Asia Pacific handicraft market trends, governments across Asia Pacific are actively promoting the handicrafts sector to preserve cultural heritage and boost employment in rural areas. Subsidies, training programs, and market access initiatives help artisans gain visibility and access new markets. The Government of India (GOI) plans to invest USD 120 million in the handloom and handicraft sector over the next four to five years. The initiative aims to enhance awareness across the handicrafts industry about emerging design trends and color patterns, ultimately increasing India’s exports by promoting innovative, design-led products. Along with this, campaigns such as "Make in India," "One Village One Product" in Japan, and "Thai OTOP" focus on improving the quality and marketing of handicrafts. These efforts are not just creating awareness but also increasing global exports.

Rising Disposable Income Among Middle-Class Consumers

Based on the Asia Pacific handicraft market outlook, the increasing purchasing power of the middle-class population in countries like China, India, and Indonesia is another driver. In FY24, India's per capita disposable income increased by 8%, following a 13.3% growth in FY23. Meanwhile, China's per capita disposable income reached USD 5,511, marking a 5.4% nominal rise from the previous year. This increased has boosted the purchasing of handicrafts as consumers are willing to spend on decorative and functional items for their homes, offices, and personal use. Handcrafted products are often perceived as premium and luxurious, attracting consumers who prioritize quality and exclusivity over mass-produced goods.

Increasing Focus on Export Markets

According to the Asia Pacific handicraft market forecast, exporting handicrafts has become a vital growth strategy for many countries in Asia Pacific. With the global demand for unique and handmade goods on the rise, artisans and exporters are finding lucrative opportunities in international markets. For instance, as per industry estimates, during April-July 2024, the total exports of handicrafts from India were valued at USD 1.18 billion. Trade agreements, collaborations with global brands, and participation in international fairs and exhibitions have also opened new avenues. Countries like India, Vietnam, and Indonesia are among the largest exporters of handicrafts, meeting demand in regions like North America and Europe. In line with this, Vietnamese handicraft products are now present in 163 countries and territories and its exports reached around $3.5 billion in 2023.

Asia Pacific Handicrafts Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific handicrafts market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, distribution channel, and end use.

Analysis by Product Type:

- Woodware

- Artmetal Ware

- Handprinted Textiles and Scarves

- Embroidered and Crocheted Goods

- Zari and Zari Goods

- Imitation Jewelry

- Sculptures

- Pottery and Glass Wares

- Attars and Agarbattis

- Others

Woodware holds the largest market share in the Asia Pacific handicrafts industry due to its aesthetic worth and cultural aspect, and varied range of products which includes furniture, kitchenware, decorative items, or even traditional carvings. These products can be manually prepared from sustainable material such as teak, bamboo, or rosewood. This segment enjoys high demand in the domestic market and export markets of various regions, mainly North America and Europe. The consumers with high interest in woodware are looking for skilled-handed products and those that contain eco-friendly outcomes.

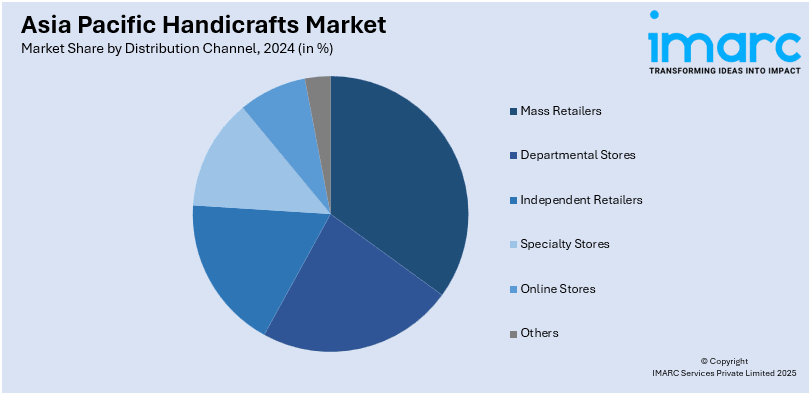

Analysis by Distribution Channel:

- Mass Retailers

- Departmental Stores

- Independent Retailers

- Specialty Stores

- Online Stores

- Others

Mass retailers serve as the largest distribution channel in the Asia-Pacific handicrafts market. They are known to offer wide accessibility and affordability. These include supermarket chains, hypermarkets, and large-scale departmental stores. They sell nearly all categories of handicrafts, ranging from home decor to fashion accessories, thereby catering to budget-conscious consumers and the mass markets. Having widespread networks and agreements with suppliers ensures customers of consistent product availability, while in-store promotions and discount campaigns account for huge volume sales, particularly for urban and suburban locations.

Analysis by End Use:

- Residential

- Commercial

The residential sector is the largest end-use category in the Asia Pacific handicrafts market, as consumers increasingly show interest in customized and culturally inspired home décor. Handcrafted furniture, decorative items, and utility products like lamps and tableware are sought for their unique designs and artisanal quality. The rising disposable incomes, urbanization, and preference for eco-friendly, aesthetically appealing interiors further boost demand in this segment, especially among middle- and upper-class households.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China dominates the Asia-Pacific handicrafts market, fueled by its rich cultural heritage, advanced production capacity, and expansive export network. The country is a global hub for handcrafted goods, including ceramics, textiles, and traditional artwork, leveraging its skilled artisan base and cost-efficient manufacturing. Domestically, rising disposable incomes and consumer interest in traditional and modern home décor further drive demand, while robust international exports, particularly to North America and Europe, cement China’s dominance in the Asia Pacific handicraft market share.

Competitive Landscape:

Leading market players are prioritizing innovation, digital transformation, and global expansion to enhance their competitive position. Companies and artisans' cooperatives are connecting with global audiences using e-commerce platforms and regional marketplaces. Most of them are adopting sustainable and environmentally friendly operations and production by using natural dyes, recycled materials, and sustainable wood in their designs. Their exportation business sites have further translated into strategic partnerships with international retailers as well as trade fares and exhibitions around the world, giving them increased visibility and connectedness to premium markets in North America and Europe. More recently, brands are focusing on storytelling, where the cultural value and crafted aspects of their brands build an emotional value for the consumer. Investments in artisan training programs, quality control, and certifications are also prominent, ensuring competitiveness in premium segments. Government-backed initiatives further support market players by offering subsidies and infrastructure to scale their operations and meet growing demand.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific handicrafts market with detailed profiles of all major companies.

Latest News and Developments:

- In August 2024, NR Group, the makers of Cycle Pure Agarbathi, received the 'Top Excellence Export Award' for Agarbathi for the fourth consecutive year and the 'Hat-Trick Award' at EPCH's 24th Handicrafts Export Awards.

- In February 2024, Aarsun Woods Private Limited launched its first physical store in Mysuru, Karnataka. Known for handcrafted wooden furniture and a global presence in over 55 countries, Aarsun has earned accolades for promoting handicrafts and supporting local artisans. With plans to exceed 40 stores, Aarsun aims to meet rising demand for high-quality designer furniture in India and abroad.

- In May 2023, IKEA launched a 20-piece collection which is developed with seven social good businesses across Asia. It supports traditional artisans and promotes sustainable craftsmanship. This range features handwoven baskets, upcycled denim, vibrant decor, and unique items like a handmade genealogy chart from Thailand.

Asia Pacific Handicrafts Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Woodware, Artmetal Ware, Handprinted Textiles and Scarves, Embroidered and Crocheted Goods, Zari and Zari Goods, Imitation Jewelry, Sculptures, Pottery and Glass Wares, Attars and Agarbattis, Others |

| Distribution Channels Covered | Mass Retailers, Departmental Stores, Independent Retailers, Specialty Stores, Online Stores, Others |

| End Uses Covered | Residential, Commercial |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific handicrafts market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific handicrafts market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific handicrafts industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific handicrafts market was valued at USD 210.0 Billion in 2024.

The Asia Pacific handicrafts market is growing due to the rising tourism, increasing demand for sustainable products, growing government initiatives supporting artisans, expanding e-commerce, escalating disposable incomes, and significant export opportunities to markets like North America and Europe.

IMARC Group estimates the market to reach USD 492.00 Billion by 2033, exhibiting a CAGR of 9.9% from 2025-2033.

Woodware represents the largest market share by product type driven by its durability, versatility, and cultural value. Products like furniture, kitchenware, and decorative items made from sustainable materials such as teak, bamboo, and rosewood enjoy high demand in domestic and export markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)