Asia Pacific Gluten-Free Oats Market Size, Share, Trends and Forecast by Product Type, Application, End Use, Distribution Channel, and Country, 2026-2034

Market Overview:

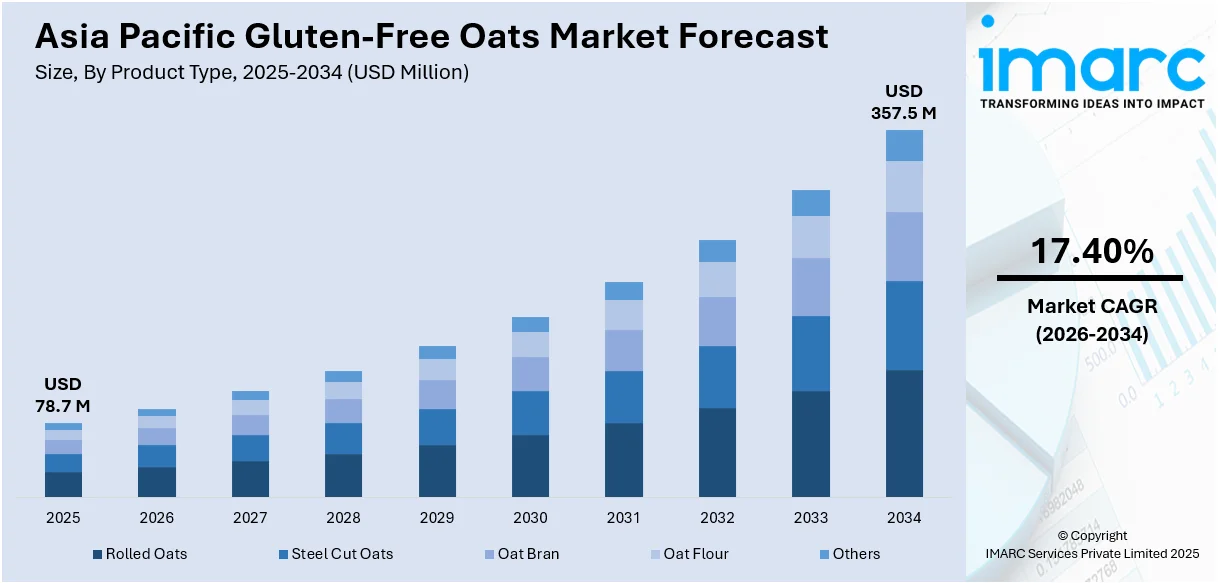

The Asia Pacific gluten-free oats market size reached USD 78.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 357.5 Million by 2034, exhibiting a growth rate (CAGR) of 17.40% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 78.7 Million |

|

Market Forecast in 2034

|

USD 357.5 Million |

| Market Growth Rate 2026-2034 | 17.40% |

Gluten-free oats are cereals grown in temperate areas and are suitable for consumption by people who have celiac disease or gluten intolerance. Oats are rich in essential vitamins, fiber, minerals, and antioxidant plant compounds. They are added in various breakfast cereals, snacks and bakery goods, such as cakes, cookies, and bread. They are also used for moisture retention characteristics and to provide a unique flavor and increase the nutritional value of the dish.

To get more information on this market Request Sample

The Asia Pacific gluten-free oats market is primarily driven by the increasing number of people affected by celiac disease and gluten intolerance. Besides this, with the rising health awareness and growing preference for healthy and high-quality food, people are voluntarily opting for gluten-free foods to avoid any future complications related to gluten intake. Gluten-free oats are also incorporated in a healthy diet due to their low-calorie value and glycemic index, which is effective in weight management. Furthermore, due to the hectic lifestyles, consumers nowadays prefer convenient and healthy breakfast options, such as gluten-free oats, which is significantly contributing to the growth of the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific gluten-free oats market report, along with forecasts at the regional and country level from 2026-2034. Our report has categorized the market based on product type, application, end use and distribution channel.

Breakup by Product Type:

- Rolled Oats

- Steel Cut Oats

- Oat Bran

- Oat Flour

- Others

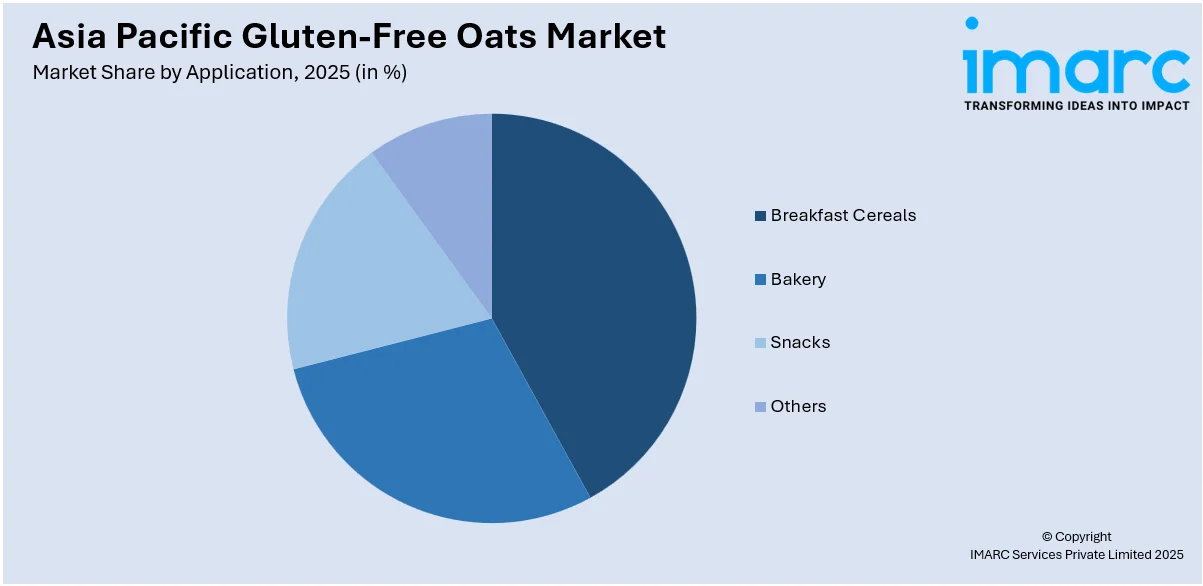

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Breakfast Cereals

- Bakery

- Snacks

- Others

Breakup by End Use:

- HORECA

- Retail

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Product Type, Application, End Use, Distribution Channel, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the Asia Pacific gluten-free oats market to exhibit a CAGR of 17.40% during 2026-2034.

The growing prevalence of celiac disease, along with the rising adoption of gluten free oats as a healthy breakfast option, owing to their high nutritional content, is currently driving the Asia Pacific gluten-free oats market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of gluten-free oats.

Based on the product type, the Asia Pacific gluten-free oats market has been divided into rolled oats, steel cut oats, oat bran, oat flour, and others. Currently, rolled oats exhibit a clear dominance in the market.

Based on the application, the Asia Pacific gluten-free oats market can be categorized into breakfast cereals, bakery, snacks, and others. Among these, breakfast cereals currently hold the majority of the total market share.

Based on the end use, the Asia Pacific gluten-free oats market has been segmented into HORECA and retail. Currently, the retail sector represents the largest market share.

Based on the distribution channel, the Asia Pacific gluten-free oats market can be bifurcated into supermarkets and hypermarkets, convenience stores, online, and others. Among these, supermarkets and hypermarkets currently account for the majority of the total market share.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where China currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)