Asia Pacific Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing and End User, and Region, 2026-2034

Asia Pacific Footwear Market Size and Share:

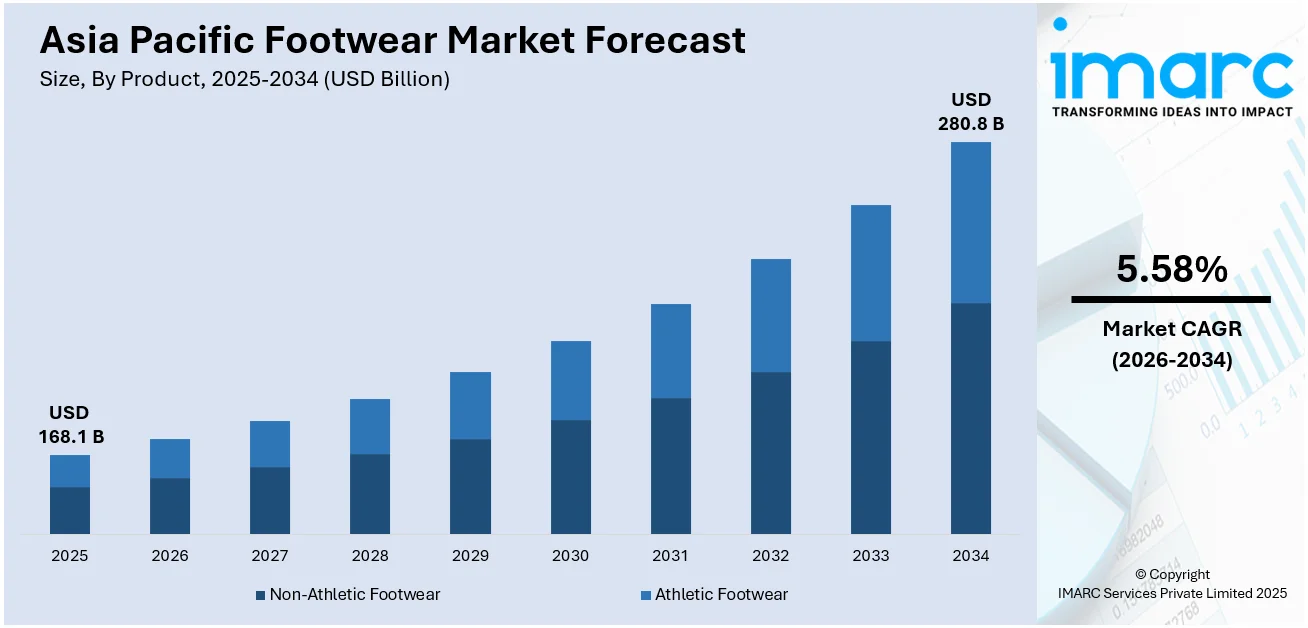

The Asia Pacific footwear market size was valued at USD 168.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 280.8 Billion by 2034, exhibiting a CAGR of 5.58% from 2026-2034. The Asia Pacific footwear market is growing rapidly as demand in the sports and fitness category, especially for sustainable and eco-friendly products, is surging further. In addition, online retail platforms are gaining popularity due to greater convenience, variety, and accessibility to a wide range of footwear options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 168.1 Billion |

|

Market Forecast in 2034

|

USD 280.8 Billion |

| Market Growth Rate (2026-2034) | 5.58% |

Growth in the Asia Pacific footwear market industry is influenced by a variety of key drivers, including rapid urbanization, increased disposable income, and changing lifestyles of consumers. The higher demand for both functional and fashionable footwear arises due to boost in the population living in urban areas. For instance, in September 2024, FILA India unveiled a new sneaker collection inspired by Italian Couture, blending retro designs and modern athleticism. The collection features bold aesthetics and functionality, targeting fashion-forward consumers. Moreover, retail infrastructure is expanding in urban centers in China, India, and Japan. Consumers are finding it easier to get access to a large diversity of footwear products-the global as well as local brands. As a result, the growing middle-class population is providing higher disposable income for the consumers and, subsequently, amplifies their purchasing power, mainly for premium or branded footwear. With changing fashion norms, comfort with style has become the latest requirement, further leading to boosting demand. Online retailing also facilitates consumers with access to thousands of products, which are booming in numbers and use toward convenience for the overall market growth in the region.

To get more information on this market Request Sample

Rising interest in sports and fitness activities has been one of the other significant drivers for the growth of the Asia Pacific footwear market. Escalating demand for athletic footwear has been associated with this aspect, as more consumers are becoming health and fitness conscious. China and India, for instance, have gained immense growth in sporting participation with active participation by their respective governments. Moreover, due to boosted sport events and focus on well-being, there has been an upsurge in demand for sports shoes and activewear in these regions that contributed to the escalated demand in footwear market. Innovations in the shoe technology, from lightweight materials and comfort to the performance-driven design, are getting more consumers towards the sports and outdoor footwear categories. Additionally, the trend in sustainable purchasing among consumers also has led companies to create an eco-friendly range of products for the Asia Pacific shoe market.

Asia Pacific Footwear Market Trends:

Increasing Popularity of Sports and Fitness Footwear

The Asia Pacific footwear market is one of the highly growing markets and is currently at a peak since people have focused more on healthy living. Because of this, heightening numbers of participation in fitness exercises, such as running, gym works, and outside sports lead the demand for sport-specific performance-oriented shoes. These sports shoe manufacturers are working for comfort, durable, and modern designs for fitness-conscious consumers. For instance, in February 2024, ASICS unveiled the METASPEED™ SKY PARIS and EDGE PARIS, featuring lighter designs, improved cushioning, and revamped carbon plates tailored for STRIDE and CADENCE running styles, boosting performance. Moreover, this awareness of health issues and growing disposable incomes in countries, such as China and India have led many more consumers to invest in high-quality, functional footwear. The growing popularity of professional and amateur sports leagues along with fitness centers and events in general is continuing to energize this trend. Thus, sports and fitness footwear are currently booming and expanding across the region, increasing the growth rate of footwear in the region.

Shift Towards Sustainable and Eco-Friendly Footwear

Sustainability is taking the center stage in the Asia Pacific footwear market due to accelerating demands of ecofriendly products by consumers. Concerns are intensifying regarding degradation of the environment and climate change, which encourages consumers to go for those brands of footwear using eco-friendly material and adopting practices. To address this growing demand, the companies are resorting to recyclable materials, plant-based alternatives, and organic cotton for making footwear. Another trend is the amplifying investment in efficient manufacturing processes by companies that reduce carbon emissions and waste. There is a rising environmental consciousness among younger consumers that has shaped purchasing behavior and led brands to make sustainability commitments. The accelerating consumer demand for sustainable products is paired with growing regulatory pressure on companies to adopt environmentally responsible practices. As consumers grow more aware of the environmental effects of their purchasing decisions, the demand for eco-friendly footwear will only continue to grow and fuel innovation within the market.

Growth of Online Retail and E-Commerce Platforms

With online retail and e-commerce platforms driving the Asia Pacific footwear market forward, consumer shopping patterns are revolutionizing in the ways in which shoes are bought. With boosting penetration of internet and smartphones, digital shopping is transforming the purchase avenues of brands and opening the marketplace to channels other than the physical store. E-commerce sites have been giving the advantage to consumers of surfing various kinds of footwear products, price comparisons, and shopping from the comfort of their home. For instance, in October 2024, Bata launched a revamped website across key markets like Malaysia, Thailand, and India, emphasizing speed, intuitive navigation, fashion-forward design, and comprehensive product insights to enhance online shopping experiences. Additionally, virtual dressing rooms, augmented reality (AR), and artificial intelligence (AI)-powered suggestions have helped online shopping get even better as customers find it easier to discover their ideal fit. In addition, social media marketing and collaborations with influencers have made the brand reach younger and tech-savvy audiences more effectively. Moreover, this shift in purchasing behavior has been significant due to the convenience, variety, and accessibility that online shopping offers. The consumers in the region are highly buying footwear online, accelerating the growth of the market.

Asia Pacific Footwear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific footwear market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, material, distribution channel, pricing, and end user.

Analysis by Product:

- Non-Athletic Footwear

- Athletic Footwear

The non-athletic footwear segment dominates the Asia-Pacific market as a result of evolving fashion trends and growing adoption of casual and formal footwear for diverse purposes. Consumers are increasingly showing preferences for stylish yet comfortable designs, which fuels the demand for loafers, sandals, boots, and flats. The fast-fashion brands, that offer affordable but trendy options, are also an essential growth factor. Also, the reach of e-commerce platforms amplifies accessibility to a greater variety of products and facilitates market growth. Premium non-athletic footwear, with high quality material, is picking up within middle and high-income groups. The innovation in non-athletic footwear related to sustainability and going green attracted eco-conscious customers. Growth in this segment is also aided by regional events and reasons for styles, resulting in consistent demand in all groups.

Analysis by Material:

- Rubber

- Leather

- Plastic

- Fabric

- Others

The Asia-Pacific region continues to thrive in leather footwear due to its durability, premium appeal, and timeless aesthetic. Leather provides comfort, breathability, and a long life, the demand for high-quality leather among middle- and high-income groups continues to rise rapidly due to heightening urbanization. With enhanced leather processing technologies and the embracing of eco-friendly tanning processes, the market responds to the increasingly sustainability-conscious customers. Premium leathers are a prime resource among strong brands for novel designs that create an appeal in the fashion-inclined markets. Customization and handmade footwear out of leather boost this market also. Export opportunities for leather from India and Vietnam are significant to regional growth, positioning leather as a financially viable material in the Asia-Pacific footwear market.

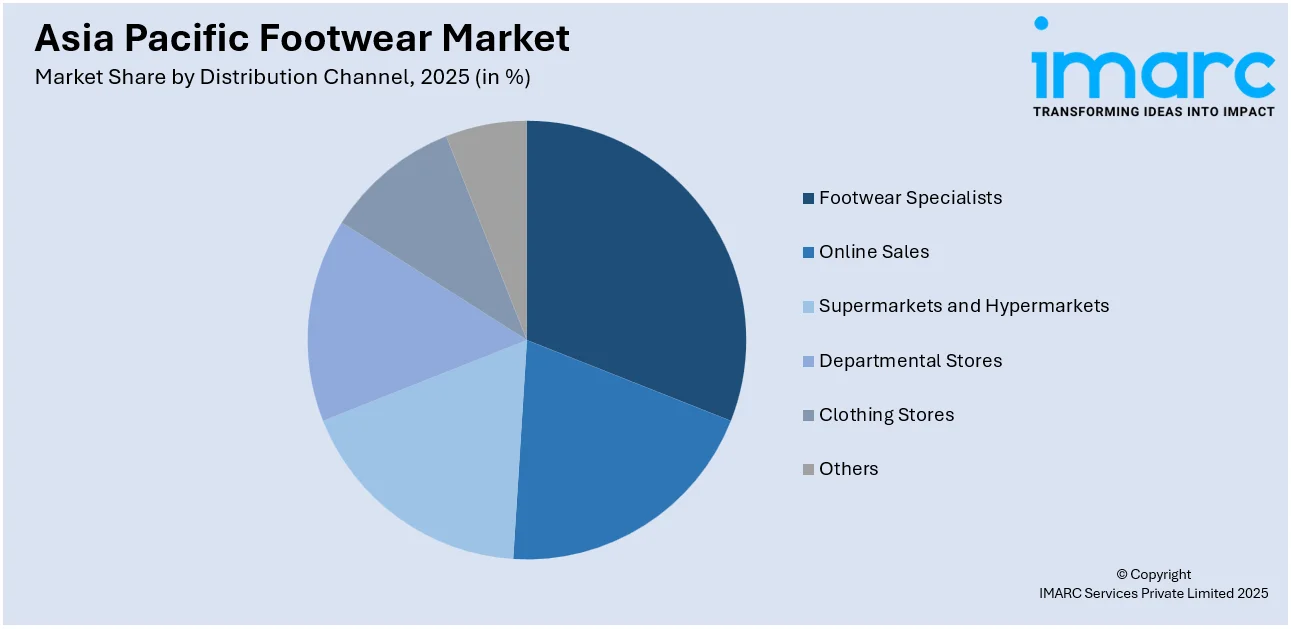

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

Specialists in footwear cater to niche markets through professional advice, individualized service, and the finest brands and styles. The stores are preferred for quality assurance, precise fitting, and premium footwear. Exclusive collaborations and limited-edition releases are added advantages, which help create customer loyalty and brand recognition.

In many ways, with the convenience it offers, low prices, and wide variety in products, sales are increasing over the internet. E-commerce provides easy shopping services with user-friendly interfaces, online try-ons, and flexible returns. Brands further use digital marketing, influencer collaborations, and AI-driven recommendations to increase the engagement of their consumers, with higher sales figures and market penetrations.

Supermarkets and hypermarkets offer competitive prices, ready access, and bulk purchasing alternatives, making the chain appealing for price-sensitive buyers. They own a large logistics network, always keeping products readily available in both towns and suburbs. Promotional pricing, seasonal and special offers and private labeling help to lure a wide target audience and render them competitive at the shoe rack.

Multidepartment stores stock the market with a mix of branded and private label footwear, according to the consumer's preferences. Middle- and high-income shoppers are attracted to their structured layout and premium shopping environments. In-store promotions and strategic brand partnerships enhance customer experiences, hence a critical retail destination for fashion-conscious consumers.

Clothing stores add footwear lines to complement clothing sales, improving cross-selling possibilities. Customers prefer to buy coordinating outfits in a single store. Fashion retailers continue to update their footwear lines to keep up with seasonal trends and customer demand, which further cements their position among style-sensitive customers looking for flexible and trendy products.

Factory outlets, direct-to-consumer brand stores and multi-brand retailers fall under other distribution channels. Such formats provide consumers with differing types of shopping experiences ranging from discounted factory pricing to high-end immersive brand interactions. The expansion into emerging retail formats, like pop-up shops and mobile commerce, further diversifies the sales channels that make access easier for consumers.

Analysis by Pricing:

- Premium

- Mass

Premium footwear is mostly related to superior materials, great craftsmanship, and luxurious brands. They are expensive because of their excellent design, durability, and technological superiority used in the making process. It is comfortable, stylish, and exclusive for customers who can pay a premium price for something durable and long-lasting.

Mass footwear is designed to be affordable and more available. Cost-effective material with cost-effective methods of manufacture often results in a lower price for the product. Mass footwear generally aims at a wider range of consumers, targeting those who want a functional and comfortable shoe that looks good for a relatively low price. Such footwear caters to consumers who are budget-conscious but are unwilling to sacrifice on basic quality or style.

Analysis by End User:

- Men

- Women

- Kids

Rapidly growing with boosted influence from the fashion sector, rising disposable income, and change in roles among women within the workforce, women's footwear market in Asia-Pacific is vast. This covers various products including heels, flats, boots, and sneakers with varied functional as well as aesthetic demand. A new taste for comfortable yet fashionable designs has made brands invest in ergonomic and innovative technology, including cushioned soles and adaptive fit. The conscious eco-friendly woman is leading the way in driving the demand for sustainable footwear produced from biodegradable materials. Online retail platforms have further augmented sales through personalized recommendations and collections. Further, cultural diversity in the region allows brands to create specific products for preferences, thus adding more strength to the women's footwear market.

Analysis by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China remains at the top, other than Asian nations, with high population sizes and an extended class of consumers going into its class, further expanded by amplified capabilities in manufacture. Urbanization as well as growth in incomes improved demand in that region for premium fashionable foot ware. To boot, recently the Chinese buyers put much spotlight onto sustainable goods calling for more environment-friendly technological packages in manufacturing. E-commerce platforms bring in significant growth through the sales of a comprehensive range of footwears within competitive prices while providing hassle-free purchase experiences. More importantly, with such great supply chain infrastructure and a developed workforce, it is the number one footwear production country in the world. Since the country does not stop innovating-the smart and ergonomic footwear are prime examples-it maintains its growth curve for the future. More collaborative efforts from the global and local brands are giving way to the diversification of products to accommodate evolving consumer needs.

Competitive Landscape:

The Asia Pacific footwear market is also dynamic in competition, with large numbers of participants vying for market shares through innovation and product differentiation with strategic expansion. Companies are making efforts to enhance the portfolios of products by incorporating materials that are innovative, such as eco-friendly fabrics and sustainable components, to suit the growing demand of environmentally conscious footwear. With the emergence of online retail platforms, competition has become more prominent as brands have had to show a digital footprint and ensure effortless shopping for consumers. In terms of technology, consumer engagement and satisfaction are becoming prominent with tools such as virtual fitting and AI-driven personalization. Finally, partnerships and collaborations between footwear brands and sports, lifestyle, or entertainment sector entities have become the norm to allow companies to reach a wider audience. The continuing focus on athletic, performance-based shoes because of fitness trends and demands from fashionable yet functional designs make the competition in the market more intense.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific footwear market with detailed profiles of all major companies, including:

Latest News and Developments:

- In December 2024, Liberty Shoes launched its ‘Forever Sneakers’ collection to captivate Gen Z and Millennials. The campaign blends style and comfort, featuring CGI videos and influencer collaborations. With a focus on innovation and quality, Liberty aims to redefine its brand, making the sneakers a trendy, must-have wardrobe staple.

- In November 2024, Paragon Footwear entered the quick commerce market by partnering with Swiggy Instamart and Zepto. This collaboration offers fast, on-demand footwear delivery to major metropolitan areas, expanding its reach to style-conscious consumers.

- In July 2024, ASICS, in collaboration with Dassault Systèmes, launched the ASICS Personalization Studio in Paris. This studio offers on-demand insoles personalized to individual foot shapes using advanced 3D printing and modeling technology. The service aims to enhance performance and recovery, with plans to expand to Japan in 2025.

- In March 2024, Perfitt launched its AI-based size recommendation solution, PerfittSize, on ABC Mart’s e-commerce platform. This innovation enhances online shoe shopping by reducing size-related returns, improving customer satisfaction, and streamlining the purchasing process with precise AI-driven recommendations.

Asia Pacific Footwear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End Users Covered | Men, Women, Kids |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific footwear market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific footwear market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific footwear market was valued at USD 168.1 Billion in 2025.

The growth of the Asia Pacific footwear market is driven by rising disposable incomes, increasing urbanization, and a growing middle class. Consumer demand for fashionable, sustainable, and eco-friendly footwear is on the rise. E-commerce platforms are expanding, offering wider product ranges, convenient shopping experiences, and competitive pricing. Additionally, the popularity of sports and fitness footwear is boosting market growth.

IMARC Group estimates the market to reach USD 280.8 Billion by 2034, exhibiting a CAGR of 5.58% from 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)