Asia Pacific Electronic Toll Collection Market Size, Share, Trends and Forecast by Technology, System, Subsystem, Offering, Toll Charging, Application, and Country, 2025-2033

Market Overview:

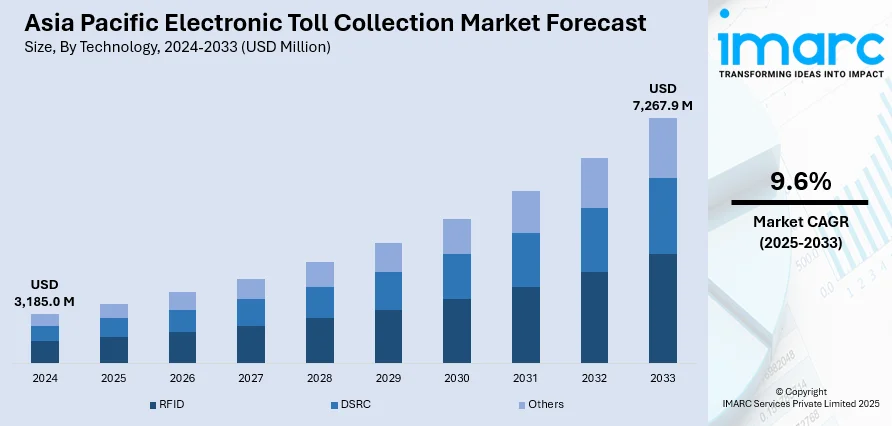

The Asia Pacific electronic toll collection market size reached USD 3,185.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,267.9 Million by 2033, exhibiting a growth rate (CAGR) of 9.6% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,185.0 Million |

|

Market Forecast in 2033

|

USD 7,267.9 Million |

| Market Growth Rate 2025-2033 | 9.6% |

Electronic toll collection (ETC) relies on transaction processing, automated vehicle identification (AVI), automated vehicle classification (AVC) and violation enforcement system (VES) to automatically perform monetary transactions at toll booths. It functions using transponders, antennas, sensors and wireless communication devices to offer a cashless facility, increase data quality and enhance transaction speed. It also minimizes fuel consumption on toll bridges, reduces air pollution, saves travel time and minimizes road congestion. Consequently, ETC is gaining traction in different parts of the Asia Pacific region.

To get more information on this market, Request Sample

The development of transportation and logistics infrastructure, along with the increasing traffic congestion in urban cities, is impelling the growth of the ETC market in the Asia Pacific region. Apart from this, governments of various countries in the region are focusing on developing smart cities, which is positively influencing the demand for smart toll collection systems. Moreover, ETC systems track defaulters and users violating traffic laws and enhance the transparency of toll collection processes, which is further stimulating the market growth. Furthermore, the increasing utilization of advanced solutions, such as video analytics, Dedicated Short-Range Communications (DSRC), Global Positioning System (GPS) and Global Navigation Satellite System (GNSS), in these systems is anticipated to bolster the market growth in the coming years.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific electronic toll collection market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on technology, system, subsystem, offering, toll charging and application.

Breakup by Technology:

- RFID

- DSRC

- Others

Breakup by System:

- Transponder - or Tag-Based Toll Collection Systems

- Other Toll Collection Systems

Breakup by Subsystem:

- Automated Vehicle Identification

- Automated Vehicle Classification

- Violation Enforcement System

- Transaction Processing

Breakup by Offering:

- Hardware

- Back Office and Other Services

Breakup by Toll Charging:

- Distance Based

- Point Based

- Time Based

- Perimeter Based

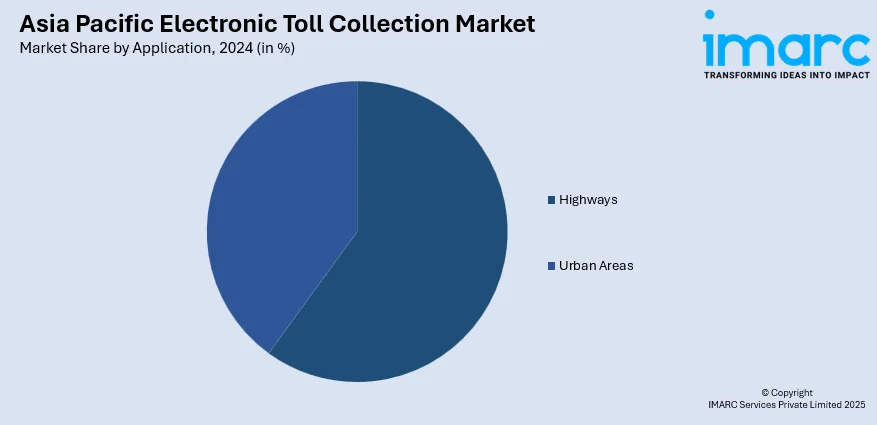

Breakup by Application:

- Highways

- Urban Areas

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Technology, System, Subsystem, Offering, Toll Charging, Application, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the Asia Pacific electronic toll collection market to exhibit a CAGR of 9.6% during 2025-2033.

The growing prominence of electronic toll collection systems in urban cities, owing to their ability to enhance the transparency of toll collection processes and minimize road congestion, is currently driving the Asia Pacific electronic toll collection market.

The sudden outbreak of the COVID-19 pandemic has led to the rising inclination towards automated transaction solutions, such as electronic toll collection system, as it offers cashless transaction facility resulting in combating the risk of the coronavirus infection upon manual transaction.

Based on the technology, the Asia Pacific electronic toll collection market has been segregated into RFID, DSRC, and others. Among these, RFID technology accounts for the largest market share.

Based on the system, the Asia Pacific electronic toll collection market can be divided into transponder - or tag-based toll collection systems and other toll collection systems. Currently, transponder - or tag-based toll collection systems exhibit a clear dominance in the market.

Based on the subsystem, the Asia Pacific electronic toll collection market has been categorized into automated vehicle identification, automated vehicle classification, violation enforcement system, and transaction processing. Among these, automated vehicle classification subsystem holds the majority of the total market share.

Based on the offering, the Asia Pacific electronic toll collection market can be segmented into hardware and back office and other services. Currently, hardware exhibits a clear dominance in the market.

Based on the toll charging, the Asia Pacific electronic toll collection market has been divided into distance based, point based, time based, and perimeter based. Among these, distance based toll charging accounts for the largest market share.

Based on the application, the Asia Pacific electronic toll collection market can be bifurcated into highways and urban areas. Currently, highways hold the majority of the total market share.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where China currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)