Asia Pacific Duty-Free Retailing Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Country, 2025-2033

Asia Pacific Duty-Free Retailing Market Size and Share:

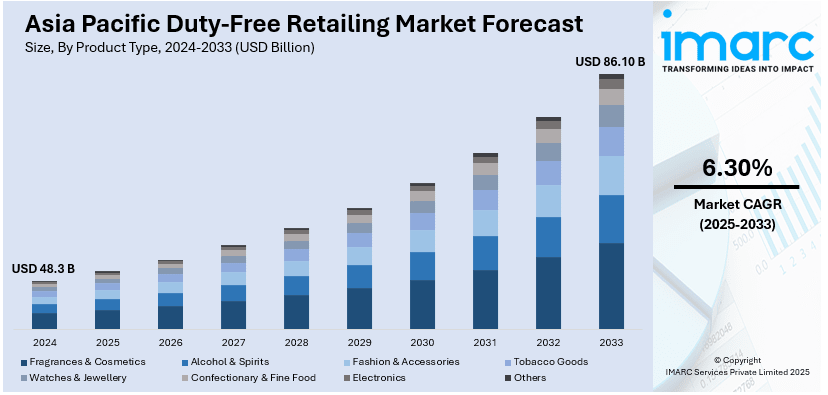

The Asia Pacific duty-free retailing market size was valued at USD 48.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 86.10 Billion by 2033, exhibiting a CAGR of 6.30% from 2025-2033. The market is witnessing substantial expansion, propelled by augmenting airport infrastructure, elevating tourism, and magnifying disposable incomes. Requirement for digital incorporation and luxury goods further fortifies the industry, with retailers utilizing omnichannel tactics and exclusive offerings to address the transforming customer preferences across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 48.3 Billion |

|

Market Forecast in 2033

|

USD 86.10 Billion |

| Market Growth Rate (2025-2033) | 6.30% |

The Asia Pacific duty-free retailing market share is mainly expanded by magnifying domestic as well as international tourism, with nations such as Thailand, Singapore, and South Korea rising as preferred travel destinations. Expanding middle-class populations with higher disposable incomes drive demand for premium products, particularly in cosmetics, luxury goods, and alcohol categories. For instance, as per industry reports, by the year 2034, China will host around half of emerging market middle-class households, while India's middle class is poised to more than double within five years. Moreover, governments’ initiatives to boost tourism through relaxed visa regulations and improved infrastructure further amplify market growth. In addition to this, the surge in leisure travel has significantly increased footfall at airports and other travel hubs, creating a robust environment for retailers across duty-free segment to expand their portfolios and capture rising consumer spending.

To get more information on this market, Request Sample

The rapid development of airport and transportation infrastructure across Asia Pacific significantly supports the growth of duty-free retailing. For instance, industry reports for 2024-2025 reveal 575 airport projects globally, valued at USD 488 Billion. Asia Pacific accounts for 170 existing airport investments worth USD 217 Billion and dominates new airport projects, representing 60% globally, with the remaining 40% spread across other regions. Moreover, modernized airports with larger retail spaces enhance product visibility and offer diverse shopping experiences to travelers. In addition, the integration of digital technologies, including mobile apps, online pre-order services, and contactless payments, aligns with evolving consumer preferences for convenience. Retailers leverage omnichannel strategies to engage travelers before, during, and after their journeys. Furthermore, these advancements not only improve consumer satisfaction but also enhance operational efficacy, strengthening the market's expansion across the region.

Asia Pacific Duty-Free Retailing Market Trends:

Growing Demand for Luxury Products

Luxury products are a dominant trend in the Asia Pacific duty-free retailing market, driven by increasing disposable incomes and aspirational consumer behavior. Travelers seek premium brands for cosmetics, fragrances, fashion, and accessories, boosting sales across airports and border outlets. Retailers are responding by offering exclusive collections and collaborations with luxury labels to attract high-spending customers. In addition to this, the expanding presence of high-end brands in duty-free outlets strengthens the market's appeal, particularly in travel hubs within countries like China, Japan, and South Korea. This trend underscores the region's status as a major destination for luxury retail. For instance, as per industry reports, duty-free sales in Japan reached USD 450.7 Million during May 2024, with around 566,000 individuals purchasing duty-free products, which mainly encompassed high-priced items like luxury jewelry and bags.

Integration of Digital Technologies

Digital transformation is reshaping the Asia Pacific duty-free retailing market, with retailers adopting e-commerce platforms, mobile apps, and digital payment solutions to enhance customer convenience. Omnichannel strategies allow travelers to browse, reserve, and purchase products online before picking them up at duty-free outlets. Furthermore, artificial intelligence and data analytics are increasingly utilized to deliver personalized shopping experiences, boosting customer engagement. For instance, in January 2025, Lotty Duty Free announced the deployment of robot bartender at its Gimpo International Airport's duty-free store. This innovative robot provides customers tailored liquor recommendations by leveraging AI analysis. In addition, the use of QR codes and contactless payments, particularly post-pandemic, further streamlines transactions. This technological integration, in turn, strengthens customer loyalty and expands the market's reach beyond physical retail spaces.

Rising Influence of Regional Tourism

Regional tourism plays a significant role in driving the Asia Pacific duty-free retailing market. Popular travel destinations such as Thailand, China, and Japan attract large volumes of international and domestic tourists, creating substantial retail opportunities. For instance, as per industry reports, Japan ranked as the top global destination, seeing a 0.9% rise with 3,081,600 international visitors during March 2024, its highest yet, ahead of peak season. Outbound tourism from the Chinese Mainland recovered to 80.3% of 2019 levels. Furthermore, in 2024, APAC (excluding ANZ) travelers extended trips by two days, averaging 7.4 days. Moreover, governments actively promote tourism through visa relaxation policies and infrastructure development, increasing the influx of travelers. In addition to this, duty-free outlets in airports, seaports, and border locations are capitalizing on this growth by tailoring their offerings to the preferences of diverse tourist demographics. The emphasis on cultural and local product assortments further enhances the appeal of regional travel retail.

Asia Pacific Duty-Free Retailing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific duty-free retailing market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Fragrances & Cosmetics

- Alcohol & Spirits

- Fashion & Accessories

- Tobacco Goods

- Watches & Jewellery

- Confectionary & Fine Food

- Electronics

- Others

The fragrances and cosmetics segment holds a substantial share of the Asia Pacific duty-free retailing market, driven by increasing consumer demand for premium beauty products and luxury skincare. International travelers, particularly from China, South Korea, and Japan, contribute significantly to sales, seeking high-end perfumes, skincare solutions, and makeup brands at competitive prices. The region's rising disposable income, coupled with a growing preference for exclusive, duty-free-only product lines, further supports market expansion. Major brands continuously innovate with travel-exclusive offerings and digital engagement strategies, enhancing customer experience and boosting sales. Additionally, the increasing influence of K-beauty and J-beauty trends stimulates demand, particularly in airport and downtown duty-free outlets. The segment benefits from cross-border tourism growth, reinforcing its strong positioning within the duty-free sector.

The alcohol and spirits category remains a key revenue generator in Asia Pacific’s duty-free retail sector, driven by the strong demand for premium whiskies, cognacs, and fine wines among international travelers. Business and leisure tourists capitalize on tax-free pricing to purchase high-end and collectible spirits, particularly in major hubs like Singapore, Hong Kong, and South Korea. The growing culture of gifting luxury spirits and the increasing popularity of exclusive duty-free bottlings further enhance sales. Additionally, global brands collaborate with travel retailers to introduce limited-edition releases and immersive in-store experiences, strengthening consumer engagement. The rise of digital pre-order platforms and omnichannel retail strategies supports segment growth by offering convenience and personalized shopping experiences. Despite regulatory challenges, the category maintains its strong competitive positioning within regional duty-free retailing.

The fashion and accessories segment captures a notable share of the Asia Pacific duty-free retailing market, fueled by the demand for luxury handbags, watches, eyewear, and apparel. High-net-worth travelers and fashion-conscious consumers seek exclusive collections and tax-free pricing from renowned international brands. Airports in Hong Kong, Singapore, and Seoul serve as major shopping destinations, housing flagship duty-free boutiques that showcase the latest trends. The segment benefits from brand collaborations, limited-edition product launches, and digital innovations, enhancing customer engagement. Additionally, the integration of VIP shopping experiences and personalized concierge services attracts affluent buyers. With the increasing adoption of e-commerce and omnichannel strategies, duty-free retailers strengthen consumer loyalty, ensuring the continued expansion of fashion and accessories within the regional duty-free sector.

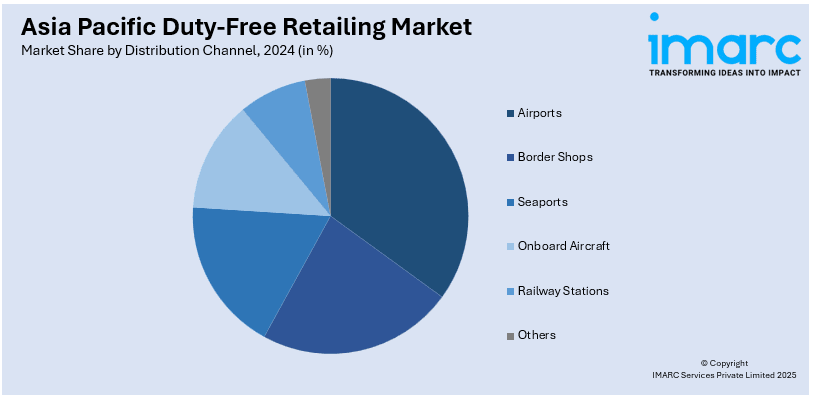

Analysis by Distribution Channel:

- Airports

- Border Shops

- Seaports

- Onboard Aircraft

- Railway Stations

- Others

Airports are crucial channel in the duty-free retailing industry across the Asia Pacific region, benefiting from high passenger traffic and premium retail infrastructure. The segment is driven by rising international travel, especially from business and leisure travelers seeking luxury goods at competitive prices. Duty-free stores at major hubs such as Changi, Incheon, and Hong Kong International Airport offer a diverse range of products, including cosmetics, liquor, electronics, and fashion. Retailers leverage digital integration, personalized promotions, and loyalty programs to enhance the shopping experience. Additionally, the expansion of low-cost carriers and increasing disposable incomes in emerging economies further fuel growth. With airports continuously investing in commercial spaces, partnerships with global brands, and omnichannel strategies, the segment is expected to maintain its stronghold in the Asia Pacific duty-free sector.

Border shops play a crucial role in the Asia Pacific duty-free retailing market, catering to travelers crossing land borders in key locations such as China-Hong Kong, Thailand-Malaysia, and India-Nepal. These outlets benefit from high foot traffic due to tourism, cross-border trade, and commuting shoppers seeking tax-exempt products. Competitive pricing and strategic positioning near customs checkpoints drive sales of alcohol, tobacco, beauty products, and confectionery. Additionally, evolving trade agreements and relaxed border regulations boost duty-free retail activity. Retailers enhance engagement through targeted promotions, multilingual staff, and digital payment options. Despite challenges such as regulatory shifts and geopolitical uncertainties, border shops remain a significant distribution channel, particularly in areas with strong economic ties and high consumer demand for affordable luxury and everyday essentials.

Seaports contribute steadily to the Asia Pacific duty-free retailing industry, serving cruise passengers, ferry travelers, and maritime workers. This segment benefits from the expansion of luxury cruise tourism, particularly in destinations like Singapore, Japan, and Australia. Duty-free stores at major ports capitalize on extended dwell times, offering high-end liquor, perfumes, and designer goods at tax-free prices. The rise in inter-island travel and ferry services further drives demand, particularly in regions with strong maritime connectivity, such as Southeast Asia. Retailers focus on exclusive product offerings, onboard shopping experiences, and seamless duty-free pickup services to enhance convenience. While the segment faces competition from airports and border shops, continued investments in port infrastructure and the growing appeal of cruise tourism ensure its relevance in the regional duty-free landscape.

Country Analysis:

- China (including Hong Kong)

- South Korea

- Japan

- India

- Singapore

- Thailand

- Australia

- Indonesia

- Taiwan

- Others

China is one of the major nations in the Asia-Pacific duty-free retailing market due to its vast consumer base and strong spending power. Major international airports and duty-free zones, particularly in Hainan, attract domestic and international travelers. Government policies supporting duty-free shopping and a recovering tourism sector post-pandemic further bolster market expansion. Luxury goods, cosmetics, and premium liquor remain key product categories driving sales, with Chinese travelers significantly influencing regional duty-free trends.

South Korea is a key player in the duty-free retailing market, largely driven by its thriving tourism sector and strong domestic demand. Seoul’s Incheon International Airport is among the world’s busiest duty-free hubs, supported by favorable government regulations. Leading Korean conglomerates, including Lotte and Shilla, dominate the market, leveraging strong brand partnerships. High demand for luxury cosmetics, fashion, and electronics continues to sustain market growth.

Japan’s duty-free retail market benefits from a robust influx of international tourists, particularly from China and South Korea. Tokyo and Osaka serve as major retail hubs, with airports and downtown duty-free stores catering to high-end shoppers. Japan’s strong reputation for premium cosmetics, electronics, and specialty food products drives sales. Government initiatives to promote inbound tourism and tax-free shopping further strengthen market performance.

Competitive Landscape:

The competitive landscape is typically steered by established global players and regional operators striving to capture growing consumer demand. Companies focus on premium product offerings, exclusive deals, and personalized services to enhance customer experiences. Strategic partnerships with luxury brands and airport authorities strengthen their market position. For instance, in May 2024, Noida International Airport, India, announced strategic partnership with BWC Forwarders Pvt Ltd. and Heinemann Asia Pacific under with BWC and Heinemann will act as its duty-free and retail partners. As per the agreement, Heinemann will operate the duty-free concession and the airport outlet with provide a broad range of premium brands. The adoption of digital technologies, including mobile payment solutions and e-commerce platforms, further intensifies competition. Moreover, operators are also expanding their presence across key travel hubs to capitalize on increasing international and domestic tourism within the region.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific duty-free retailing market with detailed profiles of all major companies, including:

- China Duty Free (Group) Co. Ltd.

- DFS Group Ltd. (LVMH)

- Dufry AG

- Ever Rich D.F.S. Corporation

- Japan Airport Terminal Co. Ltd.

- King Power International Company Limited

- Lagardère Travel Retail Pacific (Lagardère Group)

- Lotte Duty Free (Lotte Corporation)

- Shinsegae DF Inc. (Shinsegae Inc.)

- The Shilla Duty Free Shop (Hotel Shilla Co., Ltd.)

Latest News and Developments:

- In December 2024, Lagardère AWPL announced the opening of its travel retail and duty-free store at Wellington Airport, New Zealand, in the beginning of 2025. This development is a part of USD 12 million upgrade, encompassing extended partnerships and new stores.

- In November 2024, Travel Blue launched its custom shop-in-shop at Shinsegae Duty Free and The Shilla Duty Free in Incheon Airport's Terminal 2, fortifying its foothold in Korea's travel retail sector and improving its global expansion strategies.

- In June 2024, Ospree Duty Free introduced its no-cost EMI Scheme for its store in Mumbai. This strategic move will offer an enhanced customer experience and a user-friendly shopping dynamic.

- In April 2024, Avolta announced plans to expand in Asia Pacific with a new duty-free contract at Indonesia's Kualanamu Airport. Starting July 2024, it will open a 350sqm temporary departures store and a 300sqm arrivals store near security and immigration.

Asia Pacific Duty-Free Retailing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fragrances & Cosmetics, Alcohol & Spirits, Fashion & Accessories, Tobacco Goods, Watches & Jewellery, Confectionary & Fine Food, Electronics, Others |

| Distribution Channels Covered | Airports, Border Shops, Seaports, Onboard Aircraft, Railway Stations, Others |

| Countries Covered | China (including Hong Kong), South Korea, Japan, India, Singapore, Thailand, Australia, Indonesia, Taiwan, Others |

| Companies Covered | China Duty Free (Group) Co. Ltd., DFS Group Ltd. (LVMH), Dufry AG, Ever Rich D.F.S. Corporation, Japan Airport Terminal Co. Ltd., King Power International Company Limited, Lagardère Travel Retail Pacific (Lagardère Group), Lotte Duty Free (Lotte Corporation), Shinsegae DF Inc. (Shinsegae Inc.) The Shilla Duty Free Shop (Hotel Shilla Co., Ltd.) etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific duty-free retailing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific duty-free retailing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific duty-free retailing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific duty-free retailing market was valued at USD 48.3 Billion in 2024.

The market is influenced by escalating international tourism, rapid increase in disposable incomes, proliferation of airport infrastructure, and amplifying need or luxury goods. Beneficial government regulations aiding travel retail and the preference of regional travel destinations further bolster market expansion.

IMARC estimates the Asia Pacific duty-free retailing market to reach USD 86.10 Billion by 2033, exhibiting a CAGR of 6.30% from 2025-2033.

Major players in the Asia Pacific duty-free retailing market include China Duty Free (Group) Co. Ltd., DFS Group Ltd. (LVMH), Dufry AG, Ever Rich D.F.S. Corporation, Japan Airport Terminal Co. Ltd., King Power International Company Limited, Lagardère Travel Retail Pacific (Lagardère Group), Lotte Duty Free (Lotte Corporation), Shinsegae DF Inc. (Shinsegae Inc.), and The Shilla Duty Free Shop (Hotel Shilla Co., Ltd.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)