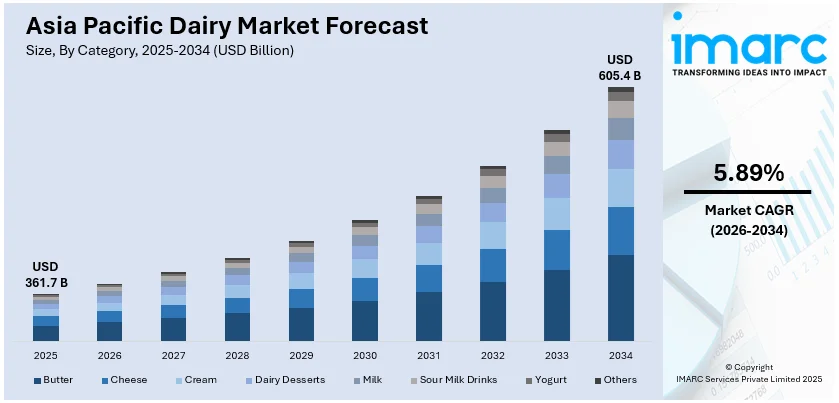

Asia Pacific Dairy Market Size, Share, Trends and Forecast by Category, and Distribution Channel, and Region, 2026-2034

Asia Pacific Dairy Market Size and Share:

The Asia Pacific dairy market size was valued at USD 361.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 605.4 Billion by 2034, exhibiting a CAGR of 5.89% from 2026-2034. The growth of the Asia Pacific dairy market is driven by rising disposable incomes, urbanization, and shifting dietary habits, particularly the adoption of Western-style diets. Increased health awareness, demand for functional dairy products, and the rise of plant-based alternatives are further fueling market expansion in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 361.7 Billion |

| Market Forecast in 2034 | USD 605.4 Billion |

| Market Growth Rate (2026-2034) | 5.89% |

The Asia Pacific dairy market is booming because of growing disposable incomes, urbanization, and a shift in diet patterns. More people are being classified as the middle class in China and India, which are accelerating the tendency to take to the Western-style diets with higher contents of dairy products such as milk, cheese, and yogurt. Amplified demand for convenience and value-added dairy products that are observed to be healthy and nutritious complements this diet transition. For instance, in August 2024, Fonterra launched new dairy products in Australia and New Zealand, including Mainland Special Reserve Chilli and Garlic Brie, Anchor Double Cream, and Mainland Sweet Cinnamon Spreadable, catering to evolving consumer tastes. Additionally, foodservice and retail sectors within the region have experienced growth in access to more varied dairy products. Heightened health knowledge about the need for dairy calcium for healthy bones and dairy protein for the growth of muscles have also spurred its consumption. Moreover, the escalating demand for plant-based and alternative dairy products has driven the innovation of lactose-free, dairy-free, or plant-based offerings toward meeting the diverse dietary preferences of the population.

To get more information on this market Request Sample

The Asia Pacific dairy market continues to grow spurred by the healthy and sustainable approach of consumers into food choices. Consumers are accelerating their demand to consume healthier forms of dairy by seeking probiotic, fortified nutritional, and minimal sugar content to name a few. For example, in October 2024, Jom Cha, Malaysia’s popular boba brand under Farm Fresh Berhad, launched its innovative "Farm-to-Cup Signature Soft Serve Yoghurt." The product combines farm-fresh yogurt with soft serve for a refreshing, healthy treat. Furthermore, this allows dairy producers a motivate to think innovatively into products that accommodate health trends in the market. Moreover, consumers' intensifying focus on sustainable production practices is prompting companies to practice environmentally friendly agricultural methods and, in turn, reduce their carbon footprint. Consumers demand higher levels of responsibility and accountability from brands, businesses that are environmentally conscious and take sustainability and fair sourcing seriously emerge as leaders. The hiking organic and hormone-free dairy products being available in the market are further catering to the health-conscious, eco-aware segment of consumers who are driving more growth in this market.

Asia Pacific Dairy Market Trends:

Health and Wellness Focus

The demand for the dairy products within the Asia Pacific dairy market that offer more than basic nutrition to health-conscious consumers is on an increase. Heightened knowledge of the value of a healthy diet has translated into a trend towards functional dairy products with supplementary health benefits from probiotics, vitamins, and minerals. This enhances digestive health, immunity, and general wellbeing. In addition, reduced sugar dairy products as well as low-fat and low-calorie dairy products are in huge demand, where consumers prefer low-fat milk, yogurt, and cheese. In the plant-based dairy alternative market, it is observed that demand is boosting since the consumers are looking for products as per their dietary preferences: vegan or lactose-free. Notable among these new consumers are young, urban shoppers who value their health and have the willingness to pay a price premium for nutritionally and ethically acceptable products.

Sustainability and Ethical Sourcing

Sustainability has become a pivotal factor in determining consumer behavior within the Asia Pacific dairy market due to growing concern over environmentally friendly practices. With climate change concerns on the rise, consumers are now looking toward dairy products that make little impact on the environment. This includes sustainable farming techniques, reduced carbon footprints, and solutions in terms of eco-friendly packaging. For instance, In March 2024, Ashgrove launched the world’s first commercially available low-emission milk, Ashgrove Eco-Milk, in collaboration with Sea Forest, utilizing methane-reducing feed technology to cut emissions by up to 90%. Further, this also includes organic and hormone-free sources with hiked demand, as consumers high awareness about how the food they purchase is produced along with the good treatment of the animals. Response by dairy firms is through strategies like regenerative agriculture, like restored soil health while promoting products, including recyclable packaging to mitigate waste. Governments and industry standards are also promoting sustainable practices, which is driving the adoption of green initiatives. As consumer values shift toward environmental responsibility, these factors are shaping the future of the dairy market.

Technological Innovations in Dairy Production

Recent trends in dairy production technologies are also changing the shape of the Asia Pacific dairy market. Modern farming techniques like high-tech milking systems and very efficient pasteurization have added efficiency to general dairy farming by maintaining product homogeneity and consistency. Advances in fermentation and the processing of milk have created the availability of far more dairy product lines, along with flavors and textures, enhanced by nutritional advantages. Precision fermentation and biotechnology further open up options for the generation of dairy products, including milk and cheese-based products, designed to meet surging dietary choices. Packaging advances, including vacuum-sealed materials and bioplastics, provide extended shelf lives and better preservations, contributing to lessened waste. These technological advances fulfill the rising demand of high-quality, diverse dairy products among consumers and further support the region to become sustainable and efficient in the production of dairy products.

Asia Pacific Dairy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific dairy market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on category and distribution channel.

Analysis by Category:

- Butter

- Cultured

- Uncultured

- Cheese

- Natural

- Processed

- Cream

- Double Cream

- Single Cream

- Whipping Cream

- Others

- Dairy Desserts

- Cheesecakes

- Frozen Desserts

- Ice Cream

- Mousse

- Others

- Milk

- Condensed Milk

- Flavored Milk

- Fresh Milk

- Powdered Milk

- UHT Milk

- Sour Milk Drinks

- Yogurt

- Flavored

- Unflavored

- Others

The Asia Pacific dairy markets butter consumption is fueled by its flexibility in cooking and baking and the accelerating demand for premium, grass-fed types. Health-conscious consumers are looking for alternatives such as low-fat or plant-based butters, which supports the growth of the segment as they seek healthier options.

The trend for cheese is moving up due to the rapid integration of Western dietary habits within regions, such as China and India. As more people find their way to urban platforms, consumers intensely demand for processed cheese, mozzarella, and specialty cheese varieties. Cheese alternatives with innovation in plant-based options also find their place here as part of the changing tastes and diet preferences of the region.

Cream remains on a strong demand curve based on its applications in cooking, desserts, and beverages. In addition, consumer interest in high-value, organic, and low-fat versions boosts market demand. Interest in whipped and flavored cream varieties is driving foodservice and retail category growth within the region.

Dairy desserts, including ice creams, puddings, and custards, are growing in popularity in the Asia Pacific region due to rising disposable incomes and changing consumption patterns. The growing trend of indulgent yet functional desserts, such as low-calorie or probiotic-rich options, has spurred innovation. Additionally, demand for premium dessert varieties is driving growth in this category.

Milk remains the most consumed product in the Asia Pacific, with amplified consumer demand for fresh, fortified milk. Plant-based milk alternatives such as almond, soy, and oat milk are also growing strong because consumers want milk-free alternatives for health or ethical motives. This has given the need for more product lines to be launched, including lactose-free and organic milk.

Another probiotic-enhanced drink that is picked up in the Asia Pacific market is sour milk drinks, which include kefir and lassi. Rising health awareness among the consumer lead people to consume those fermented drinks due to their beneficial influence on their digestive health. The stimulating trend of functional and fermented foods has boosted the sales in this category.

Yogurt is also showing steady growth in the Asia Pacific region, as the product offers numerous health benefits to consumers, including those associated with gut health and digestion. Innovative products in the yogurt line include probiotic, plant-based, and low-sugar variants that meet different consumer requirements. Escalating popular formats for snacking and on-the-go are another reason why yogurt sales continue to increase.

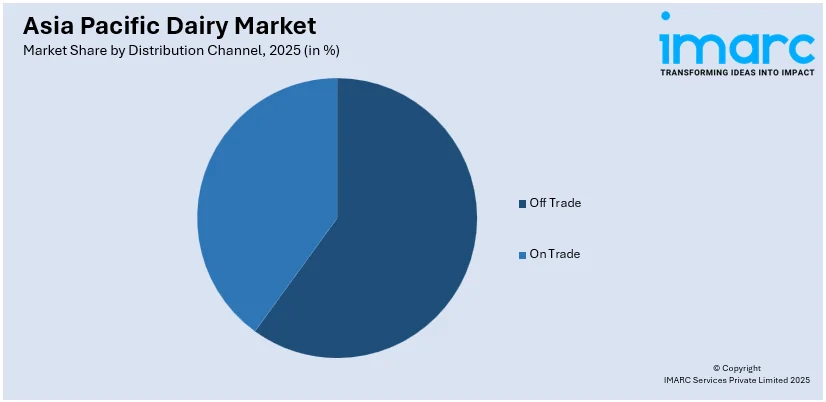

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Off Trade

- Convenience Stores

- Online Retails

- Specialists Retailers

- Supermarkets and Hypermarkets

- Others

- On Trade

Off-trade distribution encompasses supermarkets, hypermarkets, and online retail in the Asia Pacific dairy market, driven by growth in urbanization and a surging modern retail format. There is consumer convenience in purchasing large quantities of dairy products and increasingly online retail with improved access and delivery.

The other area of distribution, on-trade, which would include foodservice channels such as restaurants, cafes, and hotels, is growing as well with the high popularity of dairy-based beverages and desserts. Premium dining and the rapidly growing café culture in urban environments are driving this growth in the on-trade dairy segment among countries with solid foodservice sectors.

Regional Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

In the Asia Pacific region China is stimulated by dietary changes toward the 'West,' an increase in urbanization, and rising income levels. This amplifies dairy consumption in the form of milk, cheese, and yogurt as the gradually changing preferences of the growing middle class and health-conscious consumers expand.

Japan has a developed dairy market with huge demand in yogurt, milk, and functional dairy. Probiotics and health-oriented offerings continue to fuel the growth trend for this market. Plus, the latest advances in dairy alternatives meet the growing demand for lactose-free and plant-based options.

India’s dairy market is expanding due to the country’s deep-rooted dairy consumption culture and increased urbanization. The demand for milk, yogurt, and traditional dairy products like paneer is rising, alongside innovations in flavored and functional dairy. The middle-class population’s growing disposable income and changing dietary habits are further driving market growth.

Growing health awareness is one factor that South Korea's dairy market is being driven by: This mainly focuses on functional and low-fat dairy products. Yogurt has experienced immense growth, probiotic, fortified, as well as flavored yogurt flavors, gained favor among consumers. Other beverages, such as milk based, and coffee creamers contribute to the growth of the market.

Australia's dairy market is also strong, with a focus both on domestic consumption and exports. Organic, lactose-free, and plant-based dairy alternatives have come into the fray, creating great opportunities for innovation. Of late, health-conscious consumers have emerged in large numbers, making an innovative play on premium dairy products, especially yogurt and cheese, in the café culture in urban areas.

Indonesia is witnessing a growth in demand for dairy products, particularly milk and yogurt, driven by urbanization and the trend towards Western diets. Disposable incomes are boosting, and consumers are becoming more aware of the nutritional benefits of dairy. Dairy-based snacks and beverages are on the rise as well.

Other regional countries like Thailand, Malaysia, and the Philippines benefit from higher urbanization rates, growth of middle-class populations, and adoption of healthier eating patterns. This is helping boost the consumption of dairy in these markets, which are expected to grow further as consumers are becoming highly keen on healthier, functional, and more convenient dairy product forms.

Competitive Landscape:

The competitive landscape of the Asia Pacific dairy market is characterized by both established and emerging players competing to meet diverse consumer demands. Companies are investing in research and development to introduce innovative, health-focused products such as probiotic-rich, fortified, and lactose-free options, which align with rising health consciousness. In parallel, local producers are focusing on traditional dairy offerings while modernizing production methods to stay competitive. Additionally, consumers intensely opt for plant-based options; hence new oat, almond, and soymilk products gain market popularity among the consumer demand for dairy-free options. Consumers have started looking towards sustainable lifestyles; companies adapt eco-friendly strategies like biodegradable packaging, sourcing of renewable sources to sell products that consumers look at being green-friendly. As the market continues to evolve, players are focused on balancing tradition with innovation to meet the changing dietary preferences of a diverse and rapidly growing consumer base across the region.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific dairy market with detailed profiles of all major companies, including.

Latest News and Developments:

- In November 2024, Karnataka Milk Federation launched its Nandini brand dairy products in the Delhi-NCR market, offering competitive pricing to challenge key players like Mother Dairy and Amul. The range includes cow milk variants, curd, and buttermilk, with prices set lower to establish a foothold in the region.

- In October 2024, Meiji Holdings Co., Ltd. launched the nationwide distribution of its "Meiji Whole Oats Oat Milk." Enriched with beta-glucan from whole grain flour, the product targets various health concerns.

- In September 2024, Purabi, Northeast India’s leading dairy cooperative, launched its new flavoured milk range, including Mango, Strawberry, and Kesar variants. Manufactured at a state-of-the-art facility in Assam, the long shelf-life products aim to expand Purabi’s market reach.

- In May 2024, the Brooklyn Creamery has launched two new specialized milk products: High Protein Milk and Lactose-Free, Fat-Free Milk. The High Protein Milk offers 12 grams of protein per serving, while the Lactose-Free Milk caters to lactose-intolerant consumers. These products cater to the evolving dietary needs of health-conscious consumers across India.

- In January 2024, Mother Dairy launched its Pure Buffalo Milk variant. The new product, featuring 6.5% fat and 9% SNF, offers a creamy texture and is enriched with A2 protein. Available in 500ml and 1L sizes, it will be distributed through the company’s full distribution network, including e-commerce and modern trade channels.

Asia Pacific Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Distribution Channels Covered |

|

| Regions Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific dairy market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific dairy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific dairy market was valued at USD 361.7 Billion in 2025.

The growth of the Asia Pacific dairy market is driven by heightening health consciousness, rising disposable incomes, urbanization, and a shift towards Western diets rich in dairy products. Additionally, there is growing demand for functional, low-fat, and plant-based dairy options, as well as sustainable and ethically sourced products.

The Asia Pacific dairy market is projected to exhibit a CAGR of 5.89% during 2026-2034, reaching a value of USD 605.4 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)