Asia Pacific Crane Market Size, Share, Trends and Forecast by, Product Type, Application, and Country, 2025-2033

Asia Pacific Crane Market Size and Share:

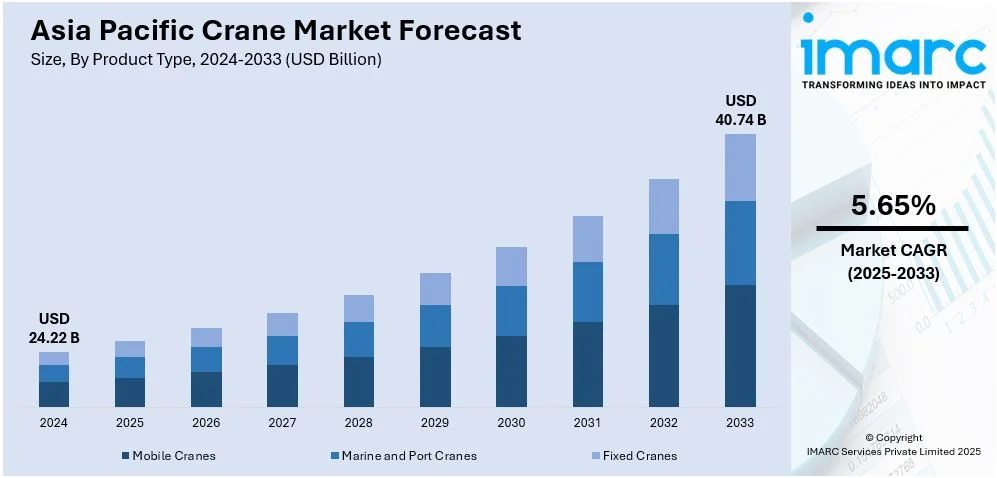

The Asia Pacific crane market size was valued at USD 24.22 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40.74 Billion by 2033, exhibiting a CAGR of 5.65% from 2025-2033. The growth of the market is driven by increasing infrastructure investments, government-backed megaprojects, and rising demand for advanced construction machinery. Expanding renewable energy projects, such as wind farms, and the adoption of smart construction technologies are also driving the demand for cranes to enhance efficiency and meet stringent project timelines across the Asia Pacific region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.22 Billion |

|

Market Forecast in 2033

|

USD 40.74 Billion |

| Market Growth Rate (2025-2033) | 5.65% |

The Asia Pacific region is experiencing massive investments in infrastructure development, including highways, railways, bridges, and airports. Governing bodies are prioritizing connectivity and modernizing transportation networks, which require advanced lifting equipment to ensure efficient construction processes. These large-scale projects are driving the demand for cranes capable of handling heavy loads and complex operations, reinforcing their pivotal role in infrastructure development. Besides this, the growing focus on renewable energy projects, like wind and solar farms, is offering a favorable Asia Pacific crane market outlook. Specialized cranes with high lifting capacities and precision controls are essential for installing turbines, solar panels, and other heavy equipment. The increasing focus on green energy solutions, supported by governmental incentives and policies, is further catalyzing the demand for these advanced machines across the region.

To get more information on this market, Request Sample

In addition, rapid advancements in crane technologies, such as the integration of internet of things (IoT), automation, and telematics, are improving operational efficiency and safety. These innovations allow real-time monitoring, improved precision, and reduced downtime, making cranes more attractive to industries focused on productivity and cost management. Moreover, the adoption of modular and prefabricated construction techniques is driving the demand for cranes that can handle precise and efficient placement of pre-assembled structures, reducing overall project timelines. Besides this, the expansion of ports and increased trade activities are driving the Asia Pacific crane market demand, especially in the logistics and shipping sectors. Port cranes and heavy-duty equipment are vital for cargo handling and container transportation.

Asia Pacific Crane Market Trends:

Increasing Construction and Infrastructure Development

The rising number of large-scale construction and infrastructure projects across the Asia Pacific region is a crucial factor bolstering the market growth. Countries in the region are focusing on urbanization, expanding transportation networks, and improving energy and industrial infrastructure. Government-backed initiatives and various smart city projects are fueling the demand for cranes. The region’s construction boom is further amplified by the need for cranes capable of handling heavy lifting and complex maneuvers, particularly in confined urban spaces. The development of airports, bridges, highways, and high-rise buildings is contributing to the increased need for specialized crane equipment. Additionally, the rise in real estate investments across key markets is driving the need for advanced cranes to support large and intricate construction tasks. In 2024, Manitowoc introduced the Potain MCT 2205, its largest topless tower crane, during Bauma China 2024. Featuring an 80m jib and a capacity of 80 tons, it merges heavy lifting power with convenient transport and assembly, making it perfect for large-scale infrastructure projects. The crane incorporates cutting-edge technology, ergonomic design, and efficient systems to improve functionality on crowded job sites.

Growing Focus on Sustainability in Construction

The push toward sustainable and green construction practices is influencing crane demand across Asia Pacific. As environmental mandates become more strict and construction firms aim to meet sustainability goals, there is a higher preference for eco-friendly cranes. This includes cranes with lower emissions, energy-efficient engines, and electric or hybrid power options that reduce the carbon footprint of construction operations. Moreover, cranes used for the construction of sustainable buildings and infrastructure, such as energy-efficient housing, green-certified buildings, and eco-friendly commercial projects, are in higher demand. This shift towards sustainability is helping drive innovation in crane technology, with manufacturers focusing on providing more eco-conscious solutions to meet the needs of a changing market. In 2024, Japan's Kobe-Osaka International Port inaugurated the globe's first hydrogen-powered Rubber-Tired Gantry (RTG) crane at the Kobe International Container Terminal. The initiative, designed to change the port's activities to carbon-neutral, involves collaboration with several partners, including Mitsui Engineering & Shipbuilding and Iwatani Corporation. The transformation of cranes is an essential element of Japan’s plan to electrify cargo handling equipment and encourage decarbonized port operations by 2025.

Increasing Renewable Energy Projects

The rising focus on renewable energy infrastructure is another factor propelling the Asia Pacific crane market growth. Governments and private entities are investing in solar, wind, and hydroelectric power projects, which require large-scale construction and installation of specialized equipment. The construction of wind farms, in particular, demands heavy lifting cranes capable of assembling large turbines in remote or challenging environments. Additionally, the expansion of solar power plants and the development of energy storage facilities require efficient and versatile cranes for both the installation and maintenance phases. This shift toward sustainability and cleaner energy sources is encouraging the creation of novel cranes suitable for such projects. In 2024, XCMG introduced the XCA4000, an 11-axle telescopic crane with a capacity of 4,000 tons, defining it as the largest in the world. The crane is engineered for placing turbines exceeding 10MW and features a lifting capability of 230 tons to elevations of 170 meters. Its initial task included hoisting large wind turbine parts at a wind farm in Jing County, China, employing a superlift system and 300 tons of counterbalance.

Asia Pacific Crane Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific crane market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, and application.

Analysis by Product Type:

- Mobile Cranes

- Marine and Port Cranes

- Fixed Cranes

Mobile cranes exhibit a clear dominance in the market due to their adaptability, mobility convenience, and broad applicability across different sectors. Their capability to be moved and set up rapidly at various locations makes them extremely appealing for projects that necessitate adaptability and effectiveness. Mobile cranes offer significant benefits in difficult landscapes or tight urban areas where fixed cranes encounter restrictions. Technological advancements have improved their lifting abilities, operational accuracy, and safety features, thereby increasing their attractiveness. Sectors like construction, energy, logistics, and mining gain a lot from mobile cranes because of their flexibility in various tasks, such as heavy lifting, material handling, and equipment setup. The increasing need for updating infrastructure and the rise of renewable energy projects, including wind and solar power plants, are further aiding in their prevalence. Moreover, cost-efficiency, decreased installation time, and alignment with modern control systems guarantee that mobile cranes continue to be a favored option in the market.

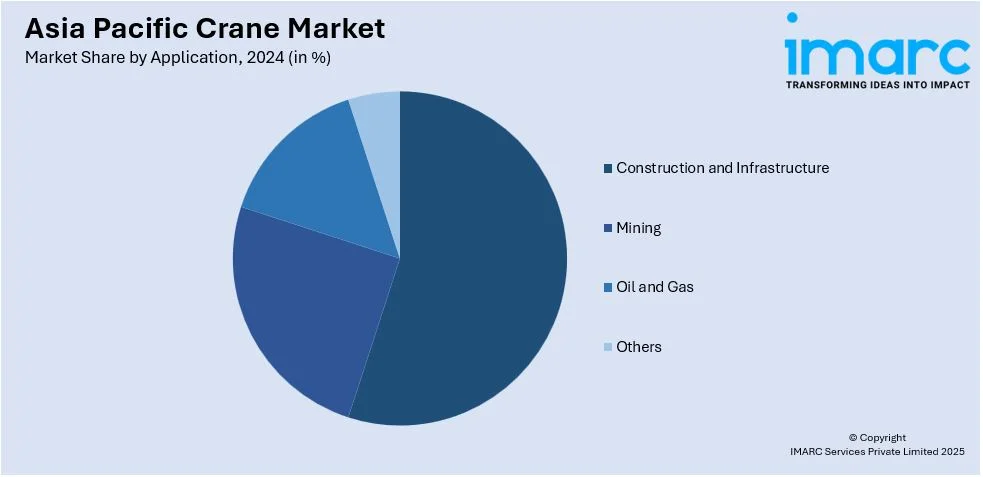

Analysis by Application:

- Construction and Infrastructure

- Mining

- Oil and Gas

- Others

Construction and infrastructure represent the largest segment attributed to the rise in government-backed projects and private investments aimed at improving transportation networks, housing, and energy facilities. The expansion of highways, bridges, railways, and airports is driving the demand for cranes to handle heavy lifting and ensure project efficiency. Additionally, the growing focus on renewable energy infrastructure, like wind farms and solar power plants, requires specialized cranes for installation and maintenance. The sector’s demand is also driven by the need for high-rise buildings and advanced construction methods, including prefabrication, which rely heavily on crane operations. The increasing adoption of advanced lifting technologies and precision-engineered cranes enables the construction sector to achieve faster project completion rates, reduced labor costs, and enhanced safety. These factors, combined with a rising number of public-private partnerships (PPP) in infrastructure development, continue to position construction and infrastructure as the leading application segment in the market.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China holds the biggest Asia Pacific market share due to its robust infrastructure development initiatives, extensive manufacturing capabilities, and strong government support for large-scale projects. The nation has established itself as a leader in crane production, benefiting from cost-effective manufacturing processes and access to raw materials. The government's emphasis on renewable energy, such as wind and hydropower, is driving the need for specialized lifting equipment. Additionally, China’s well-developed supply chain network and focus on technological advancements, such as automation and smart construction, enhance its competitive edge. Leading manufacturers in the country leverage economies of scale, allowing them to provide high-quality products at competitive prices. In 2024, The China Construction Eighth Engineering Division unveiled its self-developed new generation of unmanned remote tower cranes in Qingdao, Shandong Province. Demonstrated at a construction site, these cranes feature advanced remote operation for enhanced efficiency and safety. The launch highlights China's progress in automating construction technology.

Competitive Landscape:

Major participants in the market are prioritizing innovation, strategic collaborations, and geographical growth to enhance their competitive standing. They are putting resources into cutting-edge technologies such as IoT and automation to enhance crane efficiency, safety, and accuracy. Businesses are also expanding their product ranges by launching sustainable and energy-efficient options to comply with changing environmental regulations. Working with local distributors and service providers enhances customer accessibility and assistance. Furthermore, they are focusing on research and development to design adaptable cranes suitable for various applications in different sectors. In 2024, at the Bauma Conexpo 2024 event, Action Construction Equipment Ltd. (ACE) displayed its advanced cranes, featuring the 75 Ton Rough Terrain Crane and the 100 Ton Crawler Crane. The rough terrain crane is engineered for intricate tasks such as mining and energy setups, providing outstanding maneuverability and resilience in off-road environments. Simultaneously, the crawler crane stands out in major projects due to its strong lifting ability, long reach, and fuel-efficient, environmentally friendly design, highlighting ACE's dedication to sustainable, high-performance solutions.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific crane market with detailed profiles of all major companies.

Latest News and Developments:

- December 2024: Adani Gangavaram Port in Visakhapatnam launched the first Economic Grab Ship Cranes in India. These advanced electric cranes boost multi-functional cargo management processes, increasing both efficiency and sustainability. The inauguration highlights the port's dedication to implementing cutting-edge technologies and enhancing India's trade framework.

- December 2024: Konecranes announced it would supply eight CXT overhead cranes to PT Beka Wire Indonesia's new production facility in Subang. The cranes, ordered in October 2024, will support various stages of manufacturing, including galvanizing, warehousing, and pickling, with deliveries set for March 2025. These cranes will feature specialized durability coatings for long-term performance.

- June 2024: INTERGIS Co. Ltd ordered a Konecranes Gottwald ESP.5 Mobile Harbor Crane for the Port of Busan in South Korea to enhance cargo and bulk handling capacity. This Generation 6 crane, scheduled for delivery in early 2025, will lower emissions and enhance efficiency, supporting the port's environment-friendly objectives. The crane is part of Konecranes' Ecolifting™ project, which aims to minimize carbon emissions and enhance material handling methods.

- March 2024: Huisman announced a contract to supply two subsea cranes for Toyo Construction's hybrid power cable lay and construction vessel, built by Norway’s VARD. The cranes include a 250mt hybrid boom crane with advanced heave compensation and a 100mt knuckle boom crane for subsea and cargo operations. Both will support Japan’s offshore wind industry and meet ClassNK certification standards.

- March 2024: Manitowoc launched the Potain MCR 625, a 32-tonne luffing jib tower crane designed for urban construction in Asia, Australasia, the Middle East, and Latin America. Featuring a moving counterweight and compact K850 mast, the crane offers high performance in tight spaces. It has a maximum boom length of 65 meters and a freestanding height of 72.4 meters, with transport logistics optimized for efficient deployment.

- February 2024: Zoomlion revealed its first hydraulic luffing jib tower crane, the RL165-10, at a customer event in Changde, China. This 10-ton capacity crane operates in both luffing and flat-top modes, featuring a hydraulic cylinder for jib movement without an A-frame structure in flat-top mode. The design enhances versatility and efficiency for construction projects.

Asia Pacific Crane Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mobile Cranes, Marine and Port Cranes, Fixed Cranes |

| Applications Covered | Construction and Infrastructure, Mining, Oil and Gas, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific crane market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific crane market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crane market in the Asia Pacific was valued at USD 24.22 Billion in 2024.

The growth of the Asia Pacific crane market is driven by increasing infrastructure investments, government-backed megaprojects, and rising demand for advanced construction machinery. Expanding renewable energy projects, such as wind farms, and the adoption of smart construction technologies are also fueling demand for cranes to enhance efficiency and meet stringent project timelines across the region.

IMARC estimates the Asia Pacific crane market to exhibit a CAGR of 5.65% during 2025-2033.

In 2024, mobile cranes exhibit a clear dominance in the market because of their versatility, ease of mobility, and wide range of applications across various industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)