Asia Pacific Courier, Express and Parcel Market Size, Share, Trends and Forecast by Service Type, Destination Type, End Use Sector, and Region, 2025-2033

Asia Pacific Courier, Express and Parcel Market Size and Share:

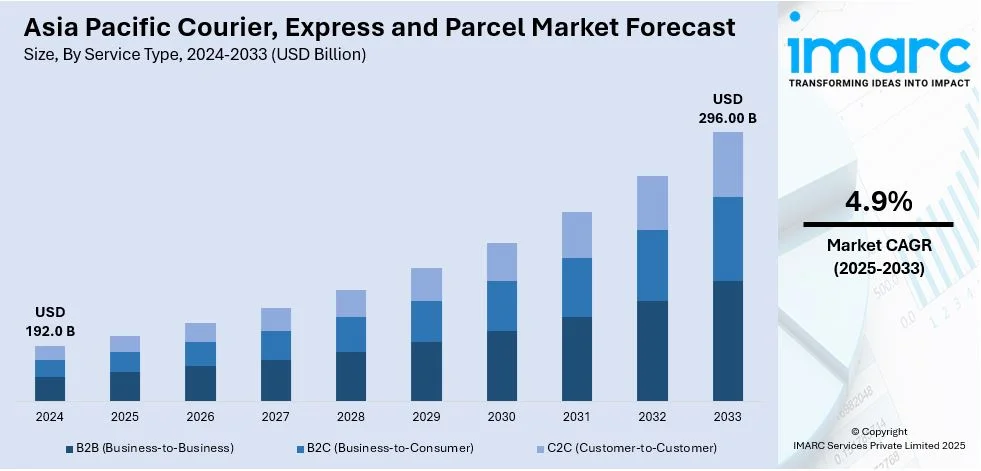

The Asia Pacific courier, express and parcel market size was valued at USD 192.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 296.00 Billion by 2033, exhibiting a CAGR of 4.9% from 2025-2033. The market is expanding due to e-commerce growth, urbanization and cross-border trade. An increasing demand for last-mile solutions and drone deliveries enhances market competitiveness supporting continuous growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 192.0 Billion |

|

Market Forecast in 2033

|

USD 296.00 Billion |

| Market Growth Rate (2025-2033) | 4.9% |

Expansion of e-commerce in Asia Pacific is the primary driver of the CEP market while increasing internet penetration and digital payments are fueling demand for faster and more reliable deliveries. According to the data published by the India Brand Equity Foundation (IBEF), India's ecommerce sector is expected to rise from US$ 123 billion in 2024 to US$ 325 billion by 2030 with online grocery sales reaching US$ 26.93 billion by 2027. The market demonstrated resilience with a 26.2% increase in order volumes in FY23 driven by a surge in tier-1 cities. Parcel volumes are on the rise in cross-border trade especially in China, India, and Southeast Asia. Retailers and logistics providers are investing in automated sorting hubs, AI-driven route optimization and last-mile delivery solutions that include drones and autonomous vehicles. Competition is becoming more acute in the demand for same-day and next-day delivery services leading logistics firms to increase efficiencies and regional networks, which also represents one of the key Asia Pacific courier, express, and parcel market trends.

To get more information on this market, Request Sample

Urbanization and economic growth in the Asia Pacific are accelerating logistics infrastructure investment. For instance, in July 2024, China's state council announced that the urbanization rate of its permanent population is expected to reach nearly 70% within five years. As of the end of 2023 66.16% of residents lived in urban areas. The council released a five-year plan aimed at harnessing domestic demand from urbanization. Governments are investing into smart logistics hubs, customs procedures, roads, rail and air cargo networks to support increased parcel volumes. Sustainability initiatives such as electric delivery fleets and carbon-neutral logistics are emerging. Improving customer transparencies and real-time tracking are driving investments in solutions like digital supply chains using blockchain and IoT-enabled monitoring.

Asia Pacific Courier, Express and Parcel Market Trends:

Cross Border Trade Expansion

Asia Pacific cross-border trade is expanding as regional trade agreements, such as RCEP, reduce tariffs and simplify customs processes. The increasing cross-border e-commerce, especially from China to Southeast Asia, increases demand for efficient international shipping solutions. For instance, in June 2024, China announced the issuance of draft rules to enhance cross-border e-commerce vital for foreign trade. The commerce ministry aims to improve data management and supervision while facilitating financing for companies like Shein and Alibaba. President emphasizes fostering a competitive environment for tech innovations targeting economic growth amid a slowdown. Logistics companies are investing in multimodal transport networks, bonded warehouses, and digital customs clearance systems to speed up cross-border deliveries. Global express delivery services are also gaining further reliance because of the growth in DTC brands and international marketplace sellers. Enhanced trade connectivity supported by infrastructure projects such as China's Belt and Road Initiative is improving the efficiency of cross-border logistics for this region.

E-Commerce Expansion

According to the Asia Pacific courier, express and parcel market analysis, e-commerce in the Asia Pacific is growing at an unprecedented rate due to increased digital adoption and growing disposable incomes. Parcel volumes are rising exponentially with major online marketplaces like Alibaba, Shopee and Tokopedia driving demand for faster and more efficient deliveries. For instance, China's parcel deliveries reached a record 120 billion items in 2023 averaging nearly 100 parcels per person reflecting growth in ecommerce despite economic challenges. The country’s major platforms including PDD, Alibaba, and JD.com saw revenue increases marking a positive shift in online shopping after pandemic disruptions. To cater to the rising expectations of consumers logistics providers are now enhancing last-mile delivery through AI-driven route optimization, smart lockers and crowd-sourced delivery models. The same-day and next-day delivery services expansion is putting pressure on investments in urban micro-fulfillment centers and automated sorting hubs. Retailers are integrating omnichannel strategies using store-based fulfillment and real-time tracking to upgrade delivery speed and transparency driving market growth even faster.

Same-Day and Next-Day Delivery

Rising consumer demand for rapid fulfillment is pushing logistics firms to optimize networks through strategic warehousing, advanced routing and real-time tracking, which is intensifying the Asia Pacific courier, express and parcel market demand. Urban micro-fulfillment centers reduce transit distances enabling same-day and next-day deliveries. AI-driven route optimization minimizes delays while automated sorting hubs improve parcel processing speed. Retailers and logistics providers collaborate to integrate fulfillment within stores using hybrid models like ship-from-store. Autonomous delivery solutions including drones and robots improve last-mile efficiency. For instance, in April 2024, Alibaba announced its partnership with Epoch Space to launch a rocket-based delivery system aimed at achieving one-hour global deliveries. This innovative approach enhances its logistics capabilities amidst fierce ecommerce competition. Utilizing the Yuanxingzhe 1 rocket the initiative promises swift parcel transport from China to various international destinations. Crowdsourced delivery networks along with gig economy couriers increase capacity during peak demand. Companies invest in predictive analytics to predict peaks in demand thereby optimizing stock distribution and delivery operations.

Asia Pacific Courier, Express and Parcel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific courier, express and parcel market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on service type, destination, type, and end use sector.

Analysis by Service Type:

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- C2C (Customer-to-Customer)

B2B leads the CEP market due to bulk shipments, high-value consignments and long-term contracts with enterprises. Manufacturers, wholesalers and retailers rely on efficient logistics for just-in-time inventory reducing warehousing costs. Healthcare, electronics and automotive require specialized logistics including temperature-controlled and high-security deliveries. Businesses emphasize reliability leading to investments in real-time tracking, automated fulfillment and dedicated fleet management. Cross-border trade expansion further strengthens the B2B demand whereby companies seek more streamlined international shipping and customs-clear express deliveries to speed up their supply chain.

Analysis by Destination:

- Domestic

- International

The Asia Pacific courier, express and parcel market growth is driven by domestic shipments fueled by ecommerce growth, urbanization and rising consumer expectations for faster deliveries. Expanding digital retail ecosystems in China, India and Southeast Asia boost parcel volumes with companies investing in regional fulfillment centers and last-mile innovations. Government investments in logistics infrastructure, smart warehouses and express delivery hubs enhance domestic network efficiency. Same-day and next-day delivery demand accelerates prompting courier firms to deploy AI-driven route optimization, electric delivery fleets and automated sorting facilities.

Analysis by Type:

- Air

- Ship

- Subway

- Road

Road transport holds the majority of the Asia Pacific courier, express and parcel market share due to its cost-effectiveness, extensive connectivity and flexibility in handling diverse parcel volumes. Expanding highway networks, government-led infrastructure projects and cross-border road freight agreements enhance efficiency. Ecommerce growth drives demand for last-mile delivery prompting investments in AI-powered route optimization and EV fleets. Logistics firms deploy automated parcel hubs and real-time tracking for seamless road-based shipments. Urban and rural connectivity improvements support same-day and next-day delivery services reinforcing road transport's market leadership.

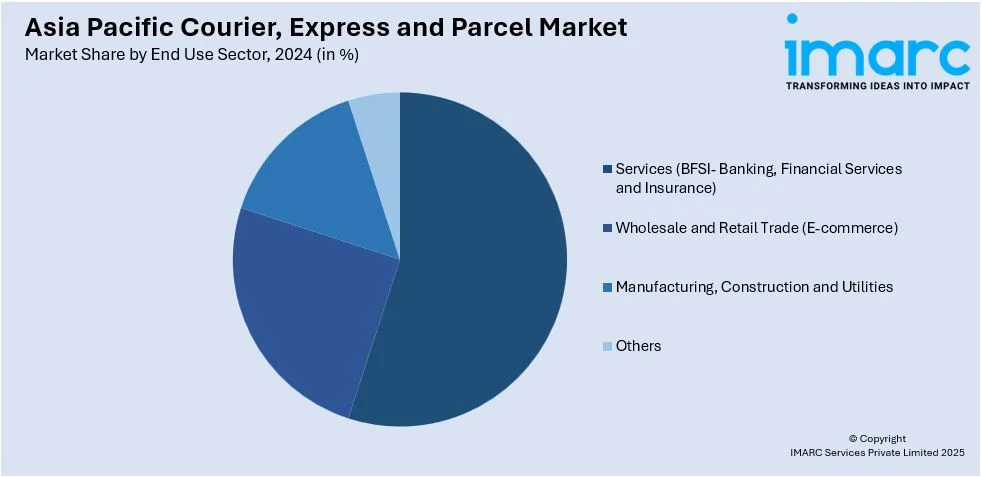

Analysis by End Use Sector:

- Services (BFSI- Banking, Financial Services and Insurance)

- Wholesale and Retail Trade (E-commerce)

- Manufacturing, Construction and Utilities

- Others

The BFSI sector propels the Asia Pacific CEP market with secure and time-sensitive delivery of financial documents, debit and credit cards, legal contracts and confidential records. Banks and insurance firms depend on courier services for compliance-driven document handling, identity verification and express dispatch of critical paperwork. Increasing digital banking fuels the need for last-mile document authentication and secure parcel logistics. Companies invest in real-time tracking, tamper-proof packaging and dedicated express services to ensure regulatory compliance and customer trust in financial deliveries.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China dominates the Asia Pacific CEP market due to its massive ecommerce ecosystem, advanced logistics infrastructure and high parcel volumes. Demand from the top platforms like Alibaba and JD.com drives innovation in automation, AI-driven route optimization and last-mile solutions. Government investments in smart logistics hubs, high-speed rail freight and cross-border e-commerce further strengthen market leadership. With rapid expansion of electric delivery fleets, drone deliveries and autonomous vehicles it enhances efficiency. China has remained the most developed and competitive CEP market in the region.

Competitive Landscape:

The Asia Pacific CEP market is highly competitive with established logistics providers, e-commerce-driven delivery networks and regional couriers expanding their presence. Companies focus on network optimization, automation, and real-time tracking to enhance operational efficiency. Urban logistics innovation, including micro-fulfillment centers and last-mile delivery solutions, intensifies competition. Cross-border e-commerce growth fuels strategic partnerships for seamless international shipping. Sustainability efforts, such as electric fleets and carbon-neutral logistics, are gaining traction. Pricing pressures and service differentiation drive investment in AI, IoT, and blockchain-enabled supply chain solutions. Government policies supporting infrastructure development and regulatory compliance influence market dynamics. The demand for specialized services, including temperature-sensitive shipments and secure financial deliveries, creates new competitive opportunities for logistics firms.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific courier, express and parcel market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, DHL Express reported a 6% increase in shipments between Asia Pacific and other continents in 2024. Enhancements include upgraded facilities in Singapore and Kuala Lumpur a new Hong Kong service center and strengthened partnerships with Japan Airlines aimed at meeting growing trade demand and improving transit times across the region.

- In November 2024, FedEx introduced a new flight route from Guangzhou, China, to Bangalore India and onward to Europe operating five times a week. This enhancement aims to reduce transit times by one day ensuring next-day delivery to South India particularly benefiting the high-tech and automotive sectors during the holiday season.

- In October 2024, UPS announced its plans to enhance its air network in Asia Pacific, reducing delivery times by up to two business days to over 35 countries, including Nigeria and South Africa. The company is adding over 200 flights to support peak season demand and improve logistics for customers across the region.

- In August 2024, FedEx announced the launch of FedEx Surround® an AI-powered solution for real-time shipment monitoring in Asia Pacific starting in Singapore and Hong Kong. It offers advanced tracking, predictive analytics and 24/7 support enhancing control and visibility for critical shipments across various industries while using advanced sensor technology for proactive interventions.

- In May 2024, Singapore Post (SingPost) and Kazakhstan's Qazpost announced their strategic partnership to enhance eCommerce and logistics between the two nations. The agreement includes technology collaboration, efficient logistics routes and best practice sharing aiming to modernize operations and improve customer experience benefiting businesses and consumers in both countries.

Asia Pacific Courier, Express and Parcel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | B2B (Business-to-Business), B2C (Business-to-Consumer), C2C (Customer-to-Customer) |

| Destinations Covered | Domestic, International |

| Types Covered | Air, Ship, Subway, Road |

| End Use Sectors Covered | Services (BFSI - Banking, Financial Services and Insurance), Wholesale and Retail Trade (E-commerce), Manufacturing, Construction and Utilities, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific courier, express and parcel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific courier, express and parcel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific courier, express and parcel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The courier, express and parcel market was valued at USD 192.0 Billion in 2024.

Market growth is driven by e-commerce expansion, urbanization, cross-border trade, last-mile delivery innovations, digital payment adoption, AI-driven logistics, and government investments in smart logistics infrastructure. The rise of same-day and next-day delivery services, automation, and sustainability initiatives further accelerates market demand, creating a positive Asia Pacific courier, express and parcel market outlook.

IMARC Group estimates the Asia Pacific CEP market to reach USD 296.00 Billion by 2033, exhibiting a CAGR of 4.9% from 2025-2033.

B2B (Business-to-Business) shipments dominate the market due to bulk shipments, long-term contracts, and demand for efficient supply chain logistics in industries such as manufacturing, healthcare, electronics, and automotive.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)