Asia Pacific Chitosan Market Size, Share, Trends and Forecast by Grade, Source, Application, and Country, 2025-2033

Asia Pacific Chitosan Market Size and Share:

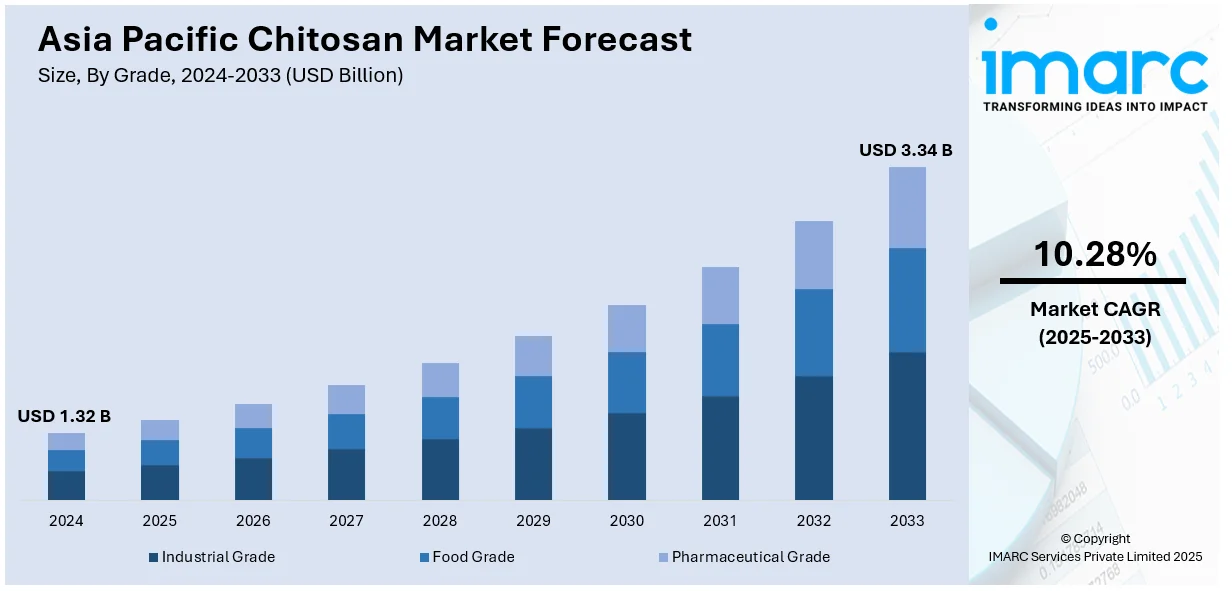

The Asia Pacific chitosan market size was valued at USD 1.32 Billion in 2024. The market is projected to reach USD 3.34 Billion by 2033, exhibiting a CAGR of 10.28% during 2025-2033. Market growth is driven by the availability of seafood processing byproducts, demand for eco-friendly water treatment solutions, expanding pharmaceutical and cosmetic applications, and supportive government sustainability initiatives.

Market Insights:

- Country-wise, China leads the Asia Pacific chitosan market.

- Based on grade, industrial-grade chitosan holds the largest share in the market.

- Based on source, shrimp is the leading segment in the market.

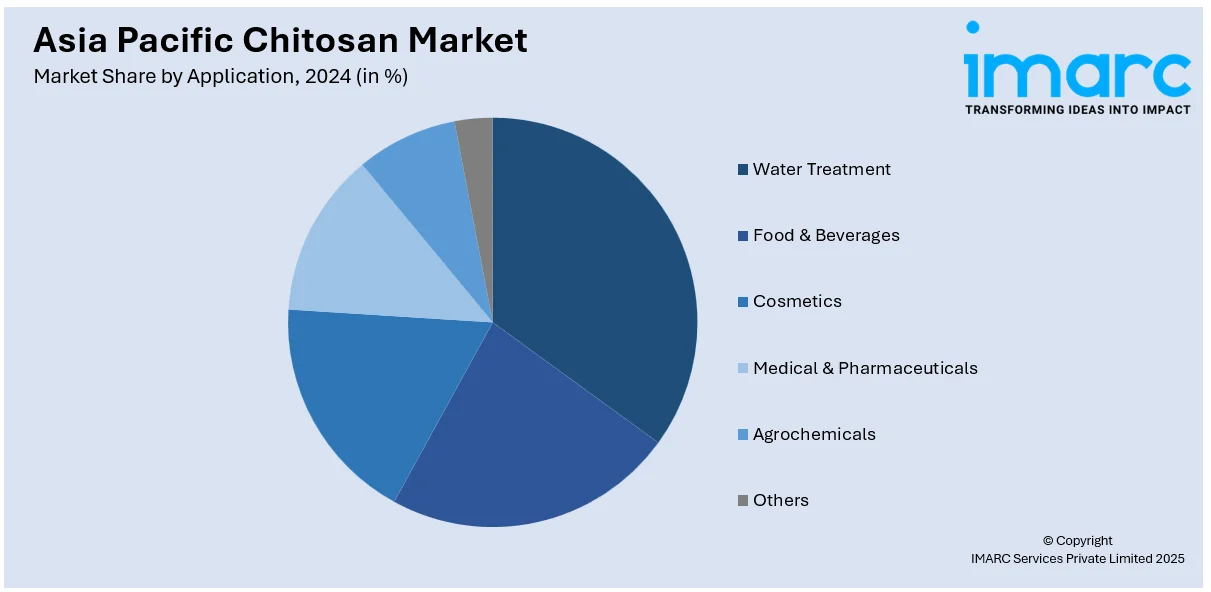

- Based on application, water treatment dominates the market.

Market Size and Forecast:

- 2024 Market Size: USD 1.32 Billion

- 2033 Projected Market Size: USD 3.34 Billion

- CAGR (2025–2033): 10.28%

- Largest Market in 2024: China

The Asia-Pacific chitosan market is experiencing significant growth, influenced by various factors across multiple industries. The availability of raw materials, particularly from the region’s thriving seafood industry, provides a steady supply of chitin, the precursor to chitosan. Countries like Japan, China, and India have extensive aquaculture industries, making them key players in the production of chitosan. For instance, the India aquaculture market size reached 13.4 Million Tons in 2023. Looking forward, IMARC Group expects the market to reach 26.4 Million Tons by 2032, exhibiting a growth rate (CAGR) of 7.97% during 2024-2032. Moreover, the food and beverage sector also leverages chitosan for its ability to extend shelf life and act as a natural preservative. Similarly, the cosmetics industry benefits from chitosan’s hydrating and anti-aging properties.

To get more information of this market, Request Sample

Rising demand for eco-friendly solutions is a significant driver for the Asia Pacific chitosan market growth. The biodegradable and non-toxic nature of chitosan has made it widely used in water treatment to remove heavy metals and pollutants. With rising environmental concerns and strict regulations on wastewater management, industries are embracing chitosan-based solutions. Government initiatives for R&D in biotechnology and sustainable materials also help boost the chitosan market. Increasing consumer and industrial awareness of eco-friendly and sustainable alternatives ensures continued demand for chitosan in the Asia-Pacific region. For example, in August 2024, ICAR-Central Institute of Fisheries Technology collaborated with Ecogenie Biotech, a Bengaluru-based biotechnology start-up to create innovative, sustainable solutions to produce chitin and chitosan from silkworm pupae, using ICAR-CIFT's technology and industry knowledge.

Asia Pacific Chitosan Market Trends:

Expansion of Pharmaceutical and Biomedical Applications

Chitosan’s versatile biological properties, including biocompatibility, antimicrobial activity, and wound-healing potential, are driving its demand in the pharmaceutical and biomedical sectors. In Asia-Pacific, the growing healthcare industry and increased investment in drug delivery systems, tissue engineering, and medical devices fuel this trend. Chitosan is also used in dietary supplements and as a drug carrier, supporting the region’s demand for advanced healthcare solutions. With aging populations in countries like Japan and China, there is rising interest in products that promote health and longevity, contributing to the expansion of chitosan applications. For instance, in September 2022, Hansoh Pharmaceutical Group Company Limited, a notable biopharmaceutical company in Asia, and KiOmed Pharma, a Belgian biotechnology company focused on the production, development, and distribution of effective and safe medical devices based on a medical-grade, highly pure natural chitosan-derivative, proclaimed a license contract for the commercialization and development of KiOmedinevsOne, a carboxymethyl chitosan injection originally introduced in Europe for the treatment of osteoarthritis in the knee. The agreement encompasses China's mainland, Macau, and Taiwan (the territory).

Growing Need for Effective Water Treatment Solutions

The Asia-Pacific region has extreme water pollution and scarcity challenges that require efficient solutions for effective treatment of water. Industry reports say that groundwater pollutant contamination of India had a significant impact on more than 2 Million people in 2024. Meanwhile, even though heavy metals and nitrates have emerged as the leading causes of pollution, arsenic and fluoride contamination also increased. About 60% of the 38.3 billion liters of daily wastewater produced in mega cities are treated. Chitosan, with exceptional adsorption properties on heavy metals and organic pollutants, has been widely used in wastewater treatment. China and India are investing heavily on water quality improvements to open up a solid market for chitosan-based technologies. In addition, the low cost, non-toxicity, and impurity-removing properties make it a pick for industrial and water treatment applications, thereby addressing environmental and regulatory concerns in the region.

Increasing Adoption in Agriculture

Chitosan's application in agriculture is gaining momentum as a bio-based alternative to chemical fertilizers and pesticides. Its role as a plant growth enhancer and natural biostimulant aligns with the rising focus on sustainable farming practices in Asia-Pacific. It helps improve crop yield, enhances disease resistance, and boosts soil health without harming the environment. As per the Asia Pacific chitosan market forecast, countries with extensive agricultural activities, such as India, China, and Vietnam, are adopting chitosan to meet food production demands while minimizing ecological impact. Government initiatives stimulating organic farming and lowering reliance on synthetic chemicals support the Asia Pacific chitosan market growth. For instance, in January 2025, The Institute of Bast Fiber Crops, Chinese Academy of Agricultural Sciences (IBFC, CAAS) Green Low-Carbon Production Technology Innovation Team announced that it has proposed a novel technique for enhancing industrial hemp's phytomanagement effectiveness by employing chitosan oligosaccharide. Hemp is a good choice for phytoremediation because of its many uses, high economic value, resistance to cadmium, and high biomass. Nevertheless, hemp's remediation effectiveness is inadequate and needs to be increased. This assessed the effects of two application doses (45 and 90 μL m-2 of 500 mg L-1 mother solution) of several chitosan oligosaccharides (COS, NACOS, and HTCOS) on hemp growth and phytoremediation effectiveness.

Growth Drivers of the Asia Pacific Chitosan Market

The chitosan market in Asia Pacific is largely driven by an increasing demand for sustainable and eco-friendly solutions. As environmental concerns rise, industries are turning to chitosan due to its biodegradable, non-toxic, and versatile nature. Its application in water treatment to remove contaminants such as heavy metals is a significant contributor, especially in regions dealing with extreme water pollution. Furthermore, chitosan’s growing role in pharmaceuticals and biotechnology, especially in drug delivery systems and wound healing, is fueling market expansion. Another key driver is the rising adoption of chitosan in the agricultural sector, where it is being used as a natural pesticide and growth enhancer, aligning with the global shift towards organic farming. The ongoing research into chitosan’s applications, coupled with increasing awareness among industries and consumers about its benefits, further propels its market growth in the region.

Opportunities in the Asia Pacific Chitosan Market

The Asia Pacific chitosan market outlook is brimming with opportunities due to the region's diverse and fast-growing sectors. In agriculture, chitosan presents an opportunity to revolutionize farming by replacing harmful chemical pesticides with natural alternatives. With the global shift toward sustainable farming practices and organic agriculture, chitosan-based biostimulants and fertilizers are becoming increasingly popular. Additionally, the potential of these products in the pharmaceutical and biomedical sectors offers substantial growth prospects, particularly for the development of drug delivery systems, tissue engineering, and wound care products. According to the Asia Pacific chitosan market analysis, emerging startups and collaborations are also resulting in the exploration of innovative methods to produce chitosan more sustainably, creating new market avenues . Additionally, chitosan's use in environmental remediation and water treatment in densely populated countries like India and China offers an expanding market as industries seek solutions to address water pollution and scarcity.

Challenges in the Asia Pacific Chitosan Market

Despite the promising growth, the Asia Pacific chitosan market faces several challenges. One significant barrier is the high production cost, particularly related to the extraction of chitosan from shellfish and other natural sources, as per the Asia Pacific chitosan market research report. This can limit its widespread adoption, especially in developing economies where cost efficiency is a priority. Additionally, while the demand for chitosan-based solutions is increasing, the lack of standardization in the quality of chitosan products can result in inconsistent performance, particularly in applications like water treatment and pharmaceuticals. Another challenge is the relatively low consumer awareness of chitosan's benefits, particularly in rural and remote areas where it could have a substantial impact in agriculture and health. Furthermore, limited infrastructure for large-scale production and distribution of chitosan in certain regions may hinder the market's full potential, requiring significant investments in manufacturing and logistics to meet growing demand.

Asia Pacific Chitosan Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific chitosan market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on grade, source, and application.

Analysis by Grade:

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

Industrial-grade chitosan holds the largest market share because of its wide-ranging applications and cost-effectiveness. It is extensively used in water treatment for its ability to eliminate heavy metals, dyes, and oils, addressing the region’s rising industrial pollution. Additionally, industrial-grade chitosan finds applications in agriculture as a biopesticide and seed treatment agent, driven by the growing demand for sustainable farming practices. Its use in the textile and paper industries for coating and dye removal further boosts the Asia Pacific chitosan market demand. The region’s strong industrial growth, coupled with cost-sensitive markets, makes industrial-grade chitosan a preferred choice across various sectors.

Analysis by Source:

- Shrimp

- Crab

- Squid

- Krill

- Others

Shrimp holds the largest share in the Asia Pacific chitosan market due to its abundance as a primary source of chitosan. The region is a major producer of shrimp, with large-scale aquaculture industries in countries like China, India, and Thailand. The chitosan extracted from shrimp shells is highly valued for its bioactive properties, making it a popular choice in pharmaceuticals, cosmetics, and health supplements. The rising need for sustainable and natural products in these industries has further contributed to shrimp-derived chitosan’s dominance. Additionally, the growing focus on waste utilization in the seafood industry supports the use of shrimp shells for chitosan production.

Analysis by Application:

- Water Treatment

- Food & Beverages

- Cosmetics

- Medical & Pharmaceuticals

- Agrochemicals

- Others

Water treatment represents the highest Asia Pacific chitosan market share because of the rising demand for efficient, eco-friendly solutions to manage industrial pollution. Chitosan from shrimp and similar sea creatures remove heavy metals, oil, and colorants from treated water. Water pollution issues from industrial growth make chitosan-based water purification methods more valuable across the Asia Pacific region. It provides an environmentally friendly solution as it breaks down naturally and is harmless to health. Stricter environmental rules and growing industry interest in green technology push chitosan toward more water treatment uses.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

The Asia Pacific chitosan market in China is influenced by several key factors. China’s strong aquaculture industry, particularly in shrimp farming, provides a steady supply of chitosan. The rising environmental concerns and stricter regulations on water pollution have boosted the demand for chitosan in water treatment applications. Additionally, the increasing focus on sustainable, eco-friendly alternatives drives its use in agriculture, pharmaceuticals, and cosmetics. China’s expanding health-conscious population further influences the need for chitosan-based dietary supplements. Government initiatives promoting green technologies and waste management also play a significant role in accelerating the chitosan market's growth in the country.

Competitive Landscape:

The Asia Pacific chitosan market is substantially competitive, with numerous local and international players. Leading companies focus on innovative production techniques, sustainable sourcing, and expanding application areas. Key players include manufacturers like Golden Shell Pharmaceutical Co., Ltd., Primex EHF, and Qingdao Yunzhou Biochemistry Co., Ltd. These companies are expanding their product portfolios, especially in water treatment, agriculture, and health supplements. The market also sees increasing collaborations between suppliers and research institutions to enhance chitosan’s performance and application. Competitive strategies emphasize cost-effectiveness, product quality, and meeting the rising demand for eco-friendly, bio-based solutions across industries.

Latest News and Developments:

- In January 2025, the Institute of Bast Fiber Crops at the Chinese Academy of Agricultural Sciences announced a breakthrough using chitosan oligosaccharide to enhance hemp’s phytoremediation capabilities. The foliar application significantly increased hemp's biomass and its ability to extract cadmium from contaminated soils. The innovation supports greener farming and more efficient soil remediation in China.

- In August 2024, the ICAR-Central Institute of Fisheries Technology (ICAR-CIFT) signed a Memorandum of Agreement with Bengaluru-based Ecogenie Biotech to develop innovative, sustainable solutions for the production of chitin and chitosan from silkworm pupae. The initiative is led by a scientific team from ICAR-CIFT and is recognized as a pioneering step for eco-friendly biopolymer sourcing in India.

- In August 2024, Dyson, a company well-known for its hair care appliance technology, announced the introduction of its line of Dyson Chitosan formulas. With this new range, the company is taking a big step forward and exploring ingredient science in addition to devices.

- In March 2024, The Directorate General of Foreign Trade (DGFT) implemented strict policy requirements to export chitin and chitosan derivatives to improve compliance and enable seamless trade operations. These steps are designed to guarantee regulatory compliance, especially for exports going to the EU market, which will improve Indian exporters' standing internationally.

- In May 2022, UPL revealed that its company purchased OptiCHOS, a naturally derived fungicide, for its Natural Plant Protection (NPP) business unit. The NPP portfolio includes agricultural inputs and technologies that are organically and biologically derived. With minimal effects on the environment and people, OptiCHOS provides farmers with a novel, low-risk, residue-free, biodegradable broad-spectrum disease management solution. BioCHOS, a spin-off of the Norwegian University of Life Sciences, created the active components of OptiCHOS from the chitin-rich shellfish industry by-products.

Asia Pacific Chitosan Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Industrial Grade, Food Grade, Pharmaceutical Grade |

| Sources Covered | Shrimp, Crab, Squid, Krill, Others |

| Applications Covered | Water Treatment, Food & Beverages, Cosmetics, Medical & Pharmaceuticals, Agrochemicals, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific chitosan market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific chitosan market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific chitosan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chitosan market in the Asia Pacific was valued at USD 1.32 Billion in 2024.

The Asia-Pacific chitosan market trends represent the rising demand in water treatment, agriculture, and biomedical applications. Factors include abundant raw materials (seafood industry byproducts), growing awareness of eco-friendly solutions, expanding healthcare sectors, and government support for sustainable technologies. Key industries include pharmaceuticals, cosmetics, food preservation, and environmental management.

The Asia Pacific chitosan market is projected to exhibit a CAGR of 10.28% during 2025-2033, reaching a value of USD 3.34 Billion by 2033.

Industrial-grade chitosan dominates the Asia Pacific market due to its affordability, versatility, and widespread applications in water treatment and agriculture.

Shrimp dominates the Asia Pacific chitosan market due to its abundance, cost-effectiveness, and high bioactive properties for various applications.

According to the Asia Pacific chitosan market outlook, water treatment dominates the market due to its effective, eco-friendly properties in removing pollutants from wastewater.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)