Asia Pacific Cable Accessories Market Size, Share, Trends and Forecast by Voltage, Installation, End Use, and Country, 2025-2033

Asia Pacific Cable Accessories Market Size and Share:

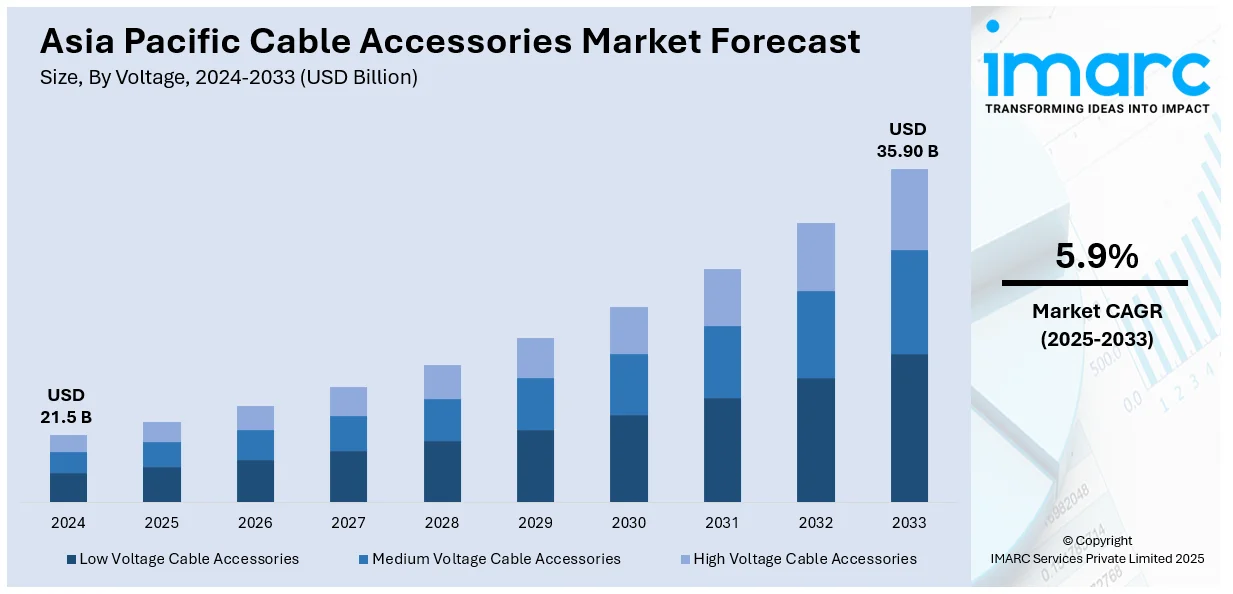

The Asia Pacific cable accessories market size was valued at USD 21.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.90 Billion by 2033, exhibiting a CAGR of 5.9% from 2025-2033. The ongoing technological advancements in cable accessories, rising infrastructure projects, increased demand for renewable energy, and government initiatives to upgrade grid systems are positively impacting the Asia Pacific cable accessories market share, ensuring the growth of power distribution networks and energy-efficient solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 21.5 Billion |

|

Market Forecast in 2033

|

USD 35.90 Billion |

| Market Growth Rate (2025-2033) | 5.9% |

The global market is primarily driven by the expansion of advanced power infrastructure due to rapid urbanization and industrialization. For instance, on July 28, 2024, The Five-Year Action Plan for Deeply Implementing the People-oriented New Urbanization Strategy was published by the Chinese State Council in 2024, aiming to increase the urbanization rate to nearly 70 percent by 2025, up from 66.16 percent in 2023. The plan emphasizes restructuring the household registration (hukou) system, improving housing and welfare for migrant workers, and enhancing urban infrastructure and public services to support the increasing urban population. Each 1 percentage point increase in urbanization is projected to generate over RMB 200 billion (USD 28 Billion) in new consumer demand annually, highlighting the plan's economic significance. Moreover, substantial investments by government bodies, particularly in emerging economies, in renewable energy projects and grid modernization, are creating lucrative market opportunities for advanced cable accessories. Additionally, growing urban population along with the rising electricity consumption are further creating a need for efficient transmission and distribution systems, thereby fostering the Asia Pacific cable accessories market growth. Also, the increasing usage of smart grid technologies and underground cabling projects to avoid more losses in power and ensure the safety of power supply further supporting the market.

To get more information on this market, Request Sample

The market is further driven by the rise of demand for uninterrupted and reliable power supply in various residential, commercial, and industrial establishments. Apart from this, growth in the construction sector, especially in smart cities and industrial corridors, has significantly increased the demand for superior quality cable accessories. For instance, on June 21, 2024, MEED reported that China's construction industry is projected to grow by 4% in real terms in 2024, driven by substantial investments in infrastructure and energy projects. The Chinese government's 2024 budget, announced in March, allocates CNY28.6 Trillion (USD 4 Trillion), marking a 3.8% increase from the previous year, with CNY1.2 Trillion (USD 173 Billion) dedicated to transport infrastructure projects. Additionally, stringent government regulations aimed at improving energy efficiency and safety standards are encouraging the adoption of innovative cable solutions. The region's increasing focus on renewable energy sources such as solar and wind power is also fostering the demand for specialized accessories tailored for these applications.

Asia Pacific Cable Accessories Market Trends:

Growing Adoption of Renewable Energy Projects

The market is expanding significantly due to the increasing focus on renewable energy projects such as solar and wind farms. For instance, on November 13, 2024, The nation's entire renewable energy was announced by the Ministry of New and Renewable Energy has surpassed 200 gigawatts (GW), reaching 203.18 GW as of October 2024. This achievement aligns with India's goal of attaining 500 GW from non-fossil sources by 2030. Renewable energy now constitutes over 46.3% of India's total installed electricity generation capacity, which stands at 452.69 GW. The increase includes a 13.5% growth from October 2023, when the renewable capacity was 178.98 GW. Governments in the region are setting ambitious targets for clean energy adoption, driving the need for specialized cables and accessories that can handle high voltage and extreme conditions. Innovations in cable technology for renewable energy transmission are further creating a positive Asia Pacific cable accessories market outlook, ensuring efficient and sustainable power distribution across diverse applications.

Expansion of Smart Grids and Underground Cabling

The development of smart grid infrastructure and underground cabling projects is a significant trend shaping the Asia Pacific cable accessories market. Smart grids demand advanced cable systems for real-time monitoring, data transmission, and improved energy efficiency. Underground cabling projects, aimed at reducing power losses and improving safety in densely populated urban areas, are gaining traction. For instance, on December 17, 2024, Bengaluru announced a ₹200 crore initiative to relocate 12,800 kilometers of overhead cables underground. This "Brand Bengaluru" project aims to enhance urban safety and aesthetics by establishing an extensive underground utility corridor for optical fiber and power lines. The plan includes utilizing approximately 15,000 kilometers of existing ducts, with around 3,400 kilometers allocated to electricity utilities and Smart City projects. These initiatives are more visible in countries such as Japan, China, and India, where modernization of aging power infrastructure is a priority, which in turn is positively influencing the overall Asia Pacific cable accessories market demand.

Growth in Urbanization and Construction Activities

Rapid urbanization in the Asia Pacific region, and the expanding construction sector is fostering the demand for cable accessories. Smart city initiatives and industrial development projects require robust power transmission systems, thus catalyzing the market's growth. Countries such as India, China, and Indonesia have seen a growing number of high-rise buildings, commercial spaces, and infrastructure development, all requiring strong electrical systems. For instance, on July 11, 2024, Business Standard reported a significant increase in demand for luxury homes in Delhi-NCR, with such properties constituting 41% of all residential sales in the first half of 2024. This trend is attributed to homebuyers prioritizing opulence and quality living, leading to the development of towering skyscrapers and premium residential projects in areas such as Gurugram and Noida. This development underscores Indonesia's commitment to urban growth and architectural advancement. This is one of the major Asia Pacific cable accessories market trends that are resulting in innovations in the manufacturing of cable accessories to meet diverse and evolving energy needs.

Asia Pacific Cable Accessories Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific cable accessories market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on voltage, installation, and end user.

Analysis by Voltage:

- Low Voltage Cable Accessories

- Medium Voltage Cable Accessories

- High Voltage Cable Accessories

Low voltage cable accessories lead the market share in 2024. The dominance is due to their wide usage in various residential, commercial, and small-scale industrial applications. Connectors, terminations, and joints of those accessories are very critical for the power transmission in low-voltage networks in an efficient and safe manner. Moreover, rapid urbanization, widespread adoption of electrical appliances in housing, and commercial spaces are fostering the demand for low voltage cable accessories. Furthermore, advancements in low-voltage cable technologies, such as fire-resistant and eco-friendly materials, enhance the reliability and appeal of these accessories. This makes them a key component in the growing Asia Pacific cable accessories market.

Analysis by Installation:

- Overhead Cable Accessories

- Underground Accessories

Overhead cable accessories are leading the market share in 2024, mainly due to their cost-effective and efficient use in long-distance electricity transmission. Connectors, insulators, and spacers provide stability and safety to overhead power lines, thereby increasing the demand for these accessories in the market. Additionally, large rural areas in India and Indonesia depend mainly on overhead power distribution, hence the demand for these accessories is higher. Additionally, improvements in weather-resistant materials and designs have enhanced their durability and performance under harsh environmental conditions, making them even more appealing for long-term use in the region.

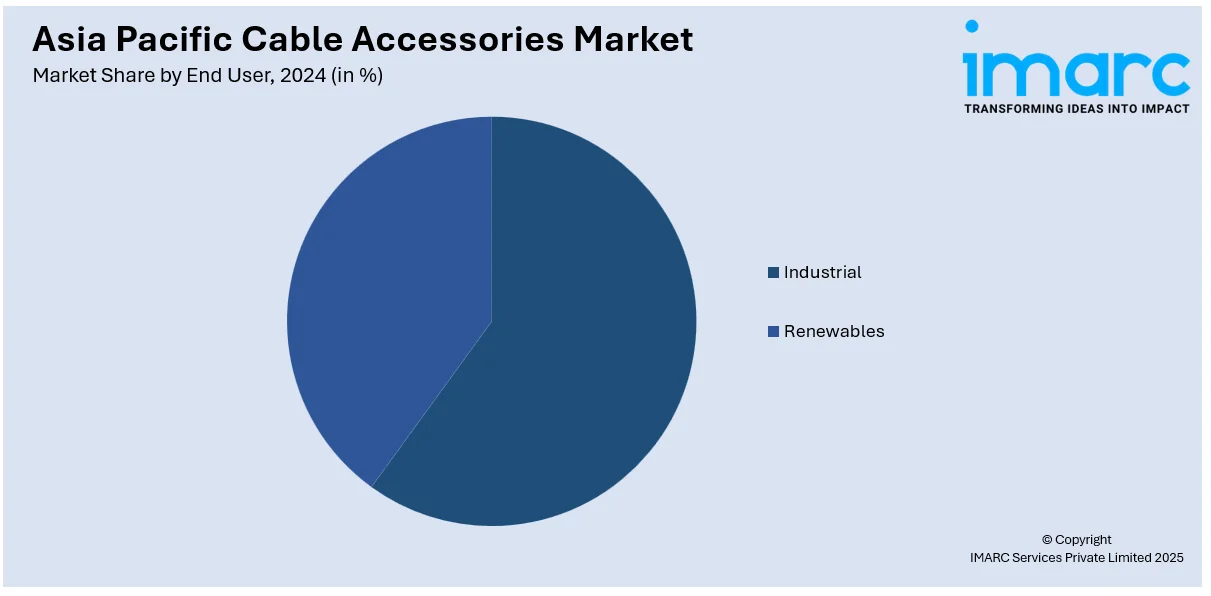

Analysis by End User:

- Industrial

- Renewables

The industrial sector leads the Asia Pacific cable accessories market in 2024. This dominance is due to the rapid industrialization and rising manufacturing hubs in the region. For high-performance cable systems and efficient power distribution, durable cable systems are required by industries like automotive, petrochemical, and electronics. The demand for high-performance cable accessories increases with the expansion of industrial corridors in China, India, and Southeast Asia. These solutions support uninterrupted power supply, compliance with safety standards, and scalability, which are critical factors for industrial growth and productivity. This demand reinforces the strong position of the industrial sector in the regional market.

Analysis by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

In 2024, China is the leading country in the Asia Pacific cable accessories market. This dominance is due to due to significant investments in infrastructure and renewable energy. The country's focus on urbanization and industrial development has increased the power transmission and distribution projects. China's goal of achieving carbon neutrality by 2060 is driving the demand for advanced cable accessories. Furthermore, the adoption of smart grid technology and underground cabling systems further strengthens China's position in the market. All these and ongoing investments ensure China plays a principal role in this growth of regional cable accessories.

Competitive Landscape:

The market in Asia Pacific is highly competitive, majorly driven by key players focusing on technological advancements to meet diverse regional needs. Market players also focus on offering advanced solutions such as weather-resistant and energy-efficient cable accessories to cater to varying climatic and operational demands. The rise in renewable energy projects and smart grid development has intensified competition, with companies vying to provide specialized products to the consumers. In addition to this, high investments in R&D, strategic partnerships, and forays into emerging markets represent some of the competitive strategies that shape this dynamic industry.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific cable accessories market with detailed profiles of all major companies.

Latest News and Developments:

- On January 14, 2025, OKI Electric Cable announced the development of a coaxial cable with a FAKRA connector, designed for machine vision systems in robotics and industrial factory automation equipment. The cable achieves high-speed data transmission of approximately 5 Gbps and features a slim outer diameter of about 3 mm, facilitating installation in confined spaces. Samples will be available starting January 2025, with mass production and shipping slated for March 2025.

- 3rd- On November 4, 2024, Sterlite Power reported that in the second quarter of 2025, Sterlite Power reported that it has secured new orders of INR 1,200 Crores throughout its Global Products and Services (GPS) sector. With this accomplishment, the company's overall order wins for the first half of FY25 amounts to INR 2,700 Crores, solidifying its position as the market leader both domestically and internationally. Notably, a top state utility ordered the company's first 144-fiber count Optical Ground Wire (OPGW) cable in India, demonstrating its dedication to cutting-edge and environmentally friendly power transmission solutions.

- On June 6, 2024, Sumitomo Electric Industries, Ltd. stated that it has strategically acquired a controlling stake in Südkabel, a well-known German manufacturer of high-voltage cables. In order to boost Germany's net-zero efforts, this action intends to locally construct 525 kV high-voltage direct current (HVDC) cables at Südkabel's Mannheim site. Notably, Sumitomo Electric was awarded two significant HVDC cable projects by German transmission system operator Amprion, Korridor B V49 and a portion of the Rhein-Main-Link, totaling more than EURO 3 billion.

- On May 17, 2024, ABB stated that it will acquire Siemens' Wiring Accessories division in China in order to increase its market share in smart building solutions. Smart home systems, smart door locks, and wiring accessories are all part of this acquisition's product line, which will be licensed under the Siemens name.

- On December 14, 2023, Taihan Cable & Solution Co. announced plans to raise USD 406 Million through a rights issue to expand its production facilities due to the augmenting demand for submarine cable products. The company intends to issue 62 million common shares at 8,480 won per share, with the proceeds allocated as follows: 470 Billion Won for constructing a second domestic submarine cable plant by 2026, and about 50 billion Won for building or acquiring an underground cable plant in the United States, Europe, or the Middle East.

Asia Pacific Cable Accessories Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Voltages Covered | Low Voltage Cable Accessories, Medium Voltage Cable Accessories, High Voltage Cable Accessories |

| Installations Covered | Overhead Cable Accessories, Underground Cable Accessories |

| End Users Covered | Industrial, Renewables |

| Countries Covered | China, Japan, India,South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific cable accessories market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific cable accessories market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific cable accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific cable accessories market was valued at USD 21.5 Billion in 2024.

Increasing industrialization, rapid urbanization, rising electricity consumption, government investments in infrastructure, and a focus on renewable energy sources are driving the growth of the Asia Pacific cable accessories market, improving the demand for efficient power transmission and distribution solutions.

The Asia Pacific cable accessories market is projected to exhibit a CAGR of 5.9% during 2025-2033, reaching a value of USD 35.90 Billion by 2033.

According to the report, low voltage cable represented the largest segment by voltage, driven by widespread demand in residential, commercial, and industrial sectors.

According to the report, overhead cable accessories represented the largest segment by component, driven by cost-effectiveness, ease of installation, and widespread use.

According to the report, the industrial sector represented the largest segment by component, driven by the increasing manufacturing, automation, infrastructure development, and energy projects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)