Asia Pacific Aluminium Cans Market Size, Share, Trends and Forecast by Application, and Country, 2025-2033

Asia Pacific Aluminium Cans Market Size and Share:

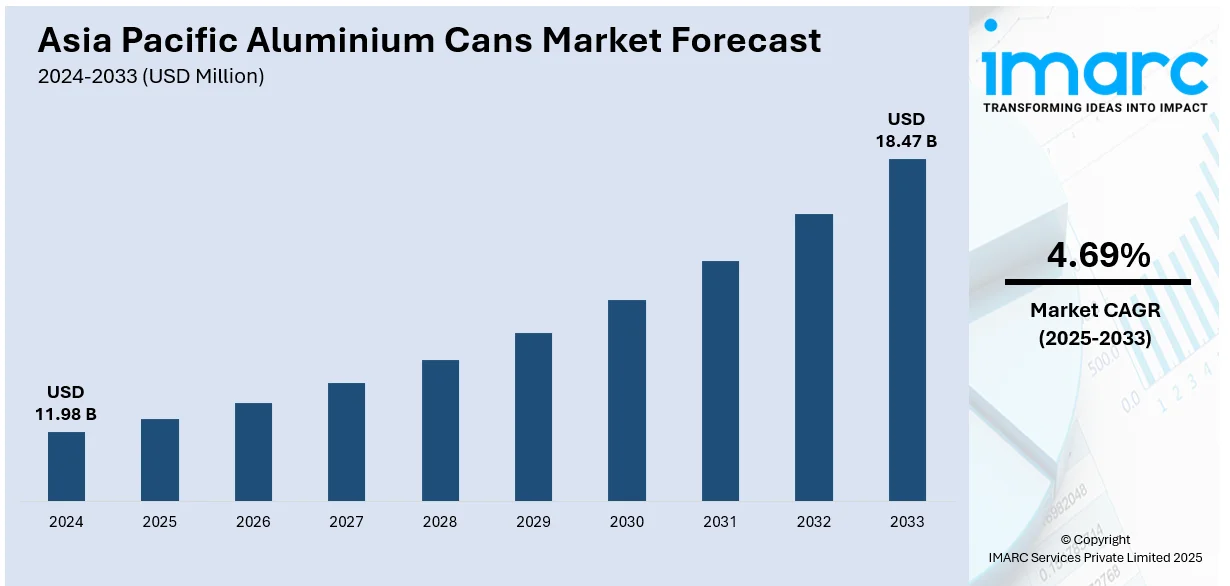

The Asia Pacific aluminium cans market size was valued at USD 11.98 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.47 Billion by 2033, exhibiting a CAGR of 4.69% from 2025-2033. China currently dominates the market. The increasing demand for sustainable packaging solutions is majorly driving the market. Additionally, considerable growth of the beverage industry, particularly ready-to-drink and carbonated beverages, is a significant factor. Government initiatives promote environmental sustainability and stricter regulations on plastic waste further support the Asia Pacific aluminium cans market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.98 Billion |

|

Market Forecast in 2033

|

USD 18.47 Billion |

| Market Growth Rate (2025-2033) | 4.69% |

The Asia Pacific aluminium cans market is witnessing significant growth, driven by increased demand from both the beverage and food industries. Moreover, the widespread popularity of ready-to-drink beverages and carbonated drinks is fueling the market expansion. Aluminum cans are preferred as they are lightweight, recyclable, and cost-effective. Thus, the use of aluminum cans is gaining momentum in China, India, and Japan, where consumers are becoming more conscious of their environmentally friendly packaging choices. Aluminum cans have emerged as an effective solution to the increasing demand for plastic-free packaging in the region. According to UNEP, of all plastics ever made, 36% of them are used in packaging, and within single-use items, 85% of food and beverage containers come out as waste or end up in landfills. The recent Greenpeace International survey shows significant public support for reduced plastic production. More than 80% of consumers are of the view that plastic production must be cut so as to control pollution, while 90% want governments and corporations to take action in phasing out single-use plastics.

To get more information on this market, Request Sample

In addition to the rising demand for beverages, the food sector in the Asia Pacific is increasingly adopting aluminium cans for packaging, thus contributing to the market growth. The ability of aluminium to preserve the freshness of food products while maintaining convenience is driving its popularity among manufacturers and consumers. Moreover, governments across the region are implementing policies that promote sustainable packaging practices, further bolstering the Asia Pacific aluminium cans market demand. According to a research by The Energy and Resources Institute, aluminium cans are the most environmentally friendly beverage packaging as they have a global recycling rate of 69% and an Indian recycling rate of 85%, with the lowest Global Warming Potential. The research compared aluminium cans, PET bottles, glass bottles, and multi-layer packaging in 18 different environmental impact categories. This includes the recyclability of aluminium, low weight, and high recycled content, putting it at the forefront of India's beverage industry in terms of a circular economy. The market is also growing with key players investing in advanced production technologies and expanding their operations to meet the growing regional demand for eco-friendly packaging solutions.

Asia Pacific Aluminium Cans Market Trends:

Increasing Adoption of Sustainable Packaging Solutions

Sustainability is significantly supporting the market across the region. As environmental concerns escalate, governments and consumers are encouraging greener packaging alternatives. Aluminium is increasingly favored on account of its recyclability, durability, and relatively lower environmental impact as compared to plastic. Many countries in the region are introducing regulations that mandate or encourage the use of recyclable materials, creating a favorable Asia Pacific aluminium cans market outlook. On 22nd August 2024, the Government of India announced that from the 2027-28 financial year, all new products manufactured from non-ferrous metals, such as aluminium, copper, and zinc, will contain at least 5% recycled content. It will increase over time, and aluminium will have 10% recycled content by FY31, while copper and zinc will be at 20% and 25%, respectively. This initiative aims to minimize the dependency on primary resources and the negative impact of mining on the environment. Consumers, especially, have become more aware of their ecological impact, and are thus opting for products made of sustainable materials. This is encouraging beverage and food companies to use aluminum cans in their green strategies, opening up new avenues in the market. Manufacturers are still investing in product improvements, specifically in making them more recyclable, which is creating aluminium cans as a resource that is more acceptable to the environment.

Growth of the Ready-to-Drink (RTD) Beverage Segment

The rise in demand for ready-to-drink (RTD) beverages, including energy drinks, soft drinks, and alcoholic beverages, is significantly influencing the market in Asia Pacific. This shift towards convenience and on-the-go consumption aligns well with the benefits of aluminium cans, which offer portability, preservation, and ease of use. In July 2024, PepsiCo collaborated with Indorama to set up a PET recycling plant in India and is targeting the recycling of one-fourth of beverage PET bottle demand by 2025. Coca-Cola India rolled out 1-litre and smaller rPET bottles in 2023 and began a PET collection pilot with Reliance Retail in 36 stores in Mumbai and Delhi, which aims to collect 500,000 bottles by 2024, with scaling up to 200 stores by 2025. In addition, aluminium cans also maintain the carbonation and freshness of beverages, making them a preferrable option for producers and consumers. The growing middle class, particularly in emerging markets including India and China, is driving the demand for RTD beverages, further augmenting the Asia Pacific aluminium cans market growth. With increasing disposable incomes and changing lifestyles, this segment is expanding rapidly, creating more opportunities for aluminium can manufacturers in the region.

Technological Advancements in Production and Design

Technological innovation is another significant trend in the market. Manufacturers are increasingly focusing on advanced production techniques to enhance the efficiency, quality, and sustainability of aluminium can production. On 23rd April 2024, Kazakhstan's first beverage can plant, QazAlPack (QAP) in Shymkent, announced to double its production capacity to 1 billion aluminum cans per annum by the end of 2024. Currently, the facility, the only one in Central Asia, produces 500 million cans per year and recently upgraded the production line to increase speed from 1,600 cans/minute to 2,500 cans per minute. The upgrades include lightweighting the cans and making them more efficient with the advanced machinery. In addition, these innovations include lightweight can design, improved print capabilities, and increasing use of environment-friendly coatings. These help with reducing production costs and improving the aluminium can's overall environmental performance. Moreover, modern digital printing techniques are allowing brand owners to involve more personal style designs in product designs, which presents more flexibility toward the brands by packaging the same. Manufacturers of this region of the Asia Pacific invest heavily in researching and developing skills to maintain a competitive pace in compliance with shifting demand from the consumers as well as along with sustainability vision. This drive is according to the search for meeting market needs along with environmental demands.

Asia Pacific Aluminium Cans Industry Segmentation:

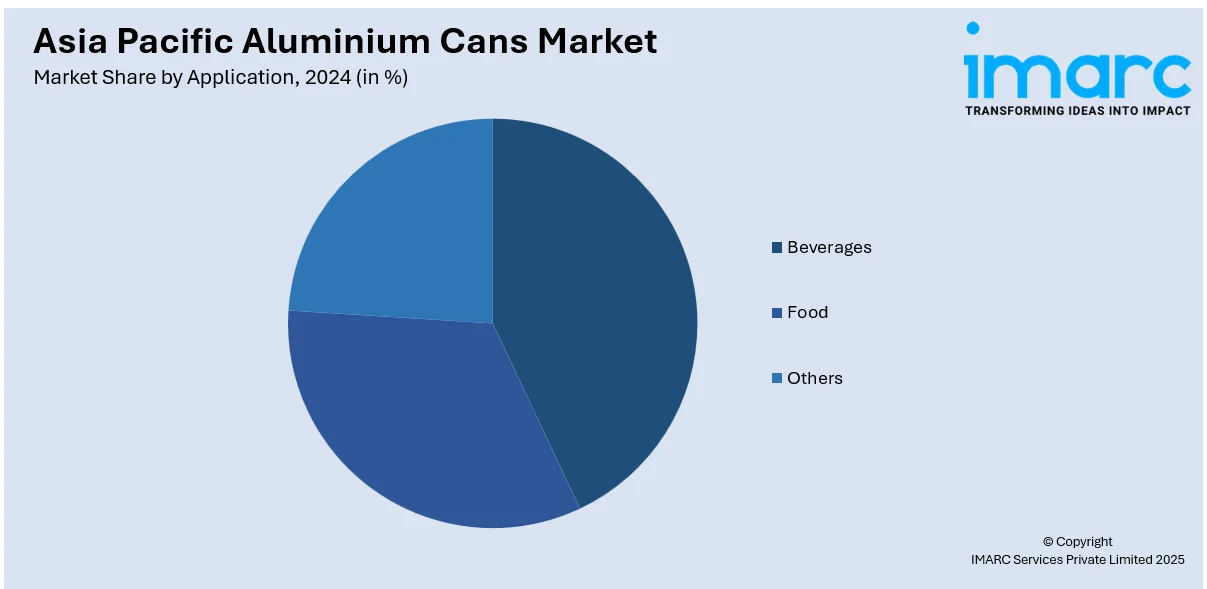

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific aluminium cans market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Beverages

- Food

- Others

Beverages represent the largest application segment in the market, driven by the growing consumption of carbonated soft drinks, energy drinks, and alcoholic beverages. Aluminum cans are highly preferred in the beverage sector since they preserve freshness, carbonation, and flavor of the drinks while being much lighter and convenient. As consumer preferences are shifting towards convenience and on-the-go products, the demand for aluminium cans is gaining momentum, particularly in fast-growing markets such as China and India. In addition, ready-to-drink (RTD) beverages, along with increased disposable incomes and changing lifestyles, are contributing to the growth of the segment. As concerns about sustainability increase, the recyclability of aluminium makes it the most preferred option for beverage manufacturers who want to cater to consumer demands for environmentally friendly packaging.

Analysis by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China is the leading country in the Asia Pacific aluminium cans market, driven by its massive population, rapid urbanization, and growing middle class. Along with this, the growth in demand for packaged beverages such as soft drinks, energy drinks, and alcoholic beverages is a significant growth factor for the market. The demand is higher for aluminum cans as they are light in weight, easy to carry, convenient, recyclable, and consumer-friendly. China's emphasis on environmental sustainability and efforts toward becoming an eco-friendly nation has also supported the utilization of aluminium cans. As a world leader in manufacturing and consumption, the market dynamics in China play a strong role in determining the general trends of the Asia Pacific region, hence being a key player in the aluminum cans industry.

Competitive Landscape:

Investments in technology and sustainability are key factors driving the competitive market. The main producers are enhancing the efficiency of their production by applying automation and innovation, thus making use of new manufacturing techniques with reduced costs and higher-quality cans. Sustainability has become a focus for most companies, with measures such as the use of lighter-weight cans, better recyclability, and the development of alternative materials that can minimize the environmental impact of cans. Moreover, companies are designing more extensive lines of products that include customized packaging solutions to meet the increased demand for specialty designs in the beverage industry. Also, with the shifting preference towards eco-friendly packaging, companies are collaborating with beverage producers to develop more sustainable, low-cost solutions for both the environment and the marketplace.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific aluminium cans market with detailed profiles of all major companies.

Latest News and Developments:

- December 12, 2024: Dabur India launched Réal Bites juice in 185 ml aluminium cans through Ball Corporation. The new series comes with a fruit chunk experience, which ranges from peach and pineapple to green apple, offering a longer shelf life - up to one year. Sustainable packaging supports recycling. Energy consumption stands at 95% less than compared to conventional methods.

- September 27, 2024: Coca-Cola's Georgia coffee brand became the first company to mass-produce a 190 ml SOT can using Compression Bottom Reform (CBR) technology from Toyo Seikan's lightest aluminium can weighing 185g. The new design will reduce the can's weight by 13% and decrease aluminium content from 7g to 6.1g. For this, both companies won the 'Appropriate Packaging Award' at the Japan Packaging Contest 2024.

- July 24, 2024: Co-op introduced a 94-store trial that includes new BWS chillers carrying single-serve beverages in recyclable aluminium cans, such as pre-mixed cocktails, craft beers, ciders, and wines. The new trial is focused on the 'on-the-go' drink segment and includes leading brands such as Sipsmith and Jack Daniels. The move supports Co-op's sustainability commitment and the widespread trend for utilizing recycled aluminium in packaging.

- July 22, 2024: Ball Corporation's beverage unit announced a Rs 700 crore plant in the state of Telangana, India to manufacture premium slender aluminium cans for beverages.

- April 04, 2024: Lion Brewery released a nitrogen-infused stout in 440ml aluminium cans in an effort to challenge the Singapore beer market. The new stout is smooth and velvety, with a plastic-widget-free application available at bars, online retailers, and soon at supermarkets. It's targeting a growing desire for premium beers to be consumed easily at home.

Asia Pacific Aluminium Cans Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Beverages, Food, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific aluminium cans market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific aluminium cans market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific aluminium cans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific aluminium cans market was valued at USD 11.98 Billion in 2024.

The growth of the Asia Pacific aluminium cans market is primarily driven by the increasing demand for sustainable packaging solutions, the rise in the beverage industry, and the growing popularity of ready-to-drink and carbonated beverages. Additionally, government initiatives promoting environmental sustainability and stricter regulations on plastic waste are further supporting market growth. Consumer preference for eco-friendly packaging solutions and aluminium's recyclability are significant market drivers.

The Asia Pacific aluminium cans market is projected to exhibit a CAGR of 4.69% during 2025-2033, reaching a value of USD 18.47 Billion by 2033.

The beverages segment accounted for the largest share of the Asia Pacific aluminium cans market, driven by the growing consumption of carbonated soft drinks, energy drinks, and alcoholic beverages. Aluminium cans are highly favored in this sector due to their ability to preserve beverage freshness, carbonation, and flavor while offering lightweight, convenient packaging.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)