Arteriovenous Fistula Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

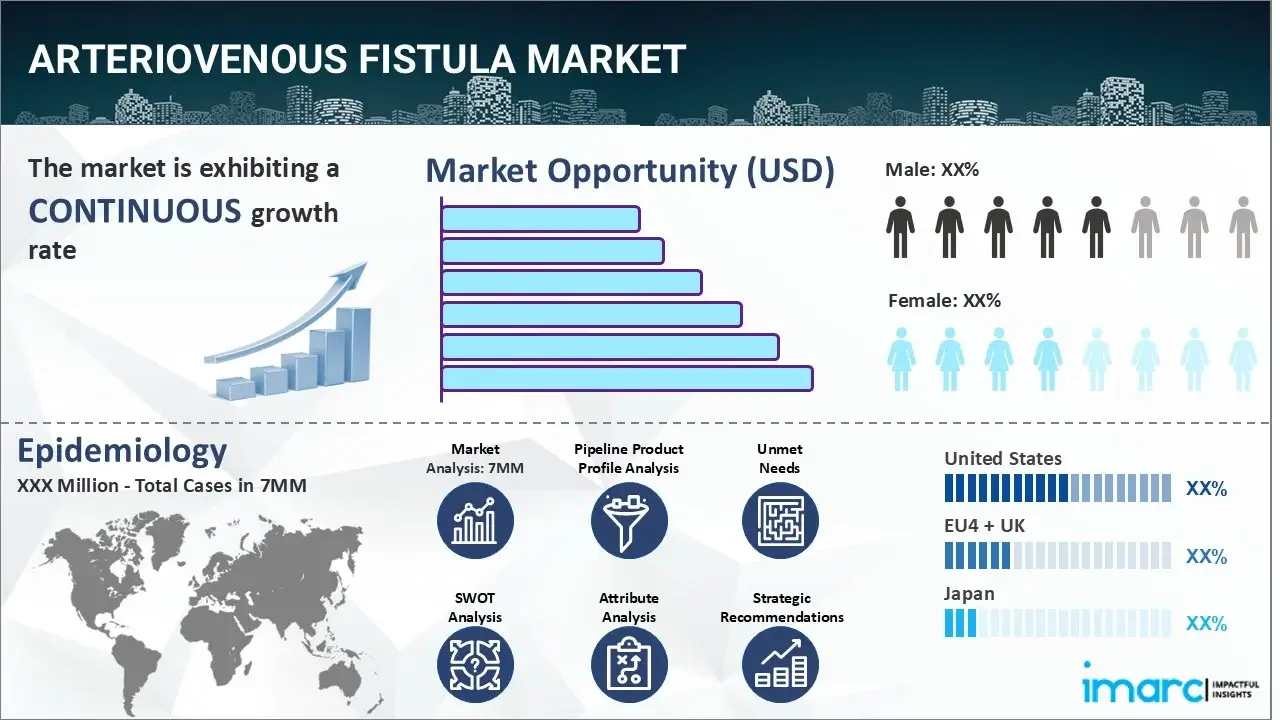

The arteriovenous fistula market reached a value of USD 264.9 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 425.3 Million by 2035, exhibiting a growth rate (CAGR) of 4.39% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 264.9 Million |

|

Market Forecast in 2035

|

USD 425.3 Million |

|

Market Growth Rate 2025-2035

|

4.39% |

The arteriovenous fistula market has been comprehensively analyzed in IMARC's new report titled "Arteriovenous Fistula Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Arteriovenous fistula is a medical condition that occurs due to an abnormal connection between a vein and an artery, disrupting the natural blood flow pattern within the circulatory system. This direct link causes arterial blood to flow directly into a vein without first passing through the capillaries, leading to a range of signs and symptoms. The indications of an arteriovenous fistula can vary depending on its location and size. Common signs include localized swelling, a pulsating mass, and a prominent blue or purplish appearance of the affected area. Additionally, patients might experience pain, throbbing sensations, and high risk of bleeding due to the increased pressure of arterial blood in the venous system. Diagnosing an arteriovenous fistula typically involves a combination of physical examination, medical history review, and imaging techniques. Doppler ultrasound, magnetic resonance angiography (MRA), and computed tomography angiography (CTA) are commonly used to visualize the abnormal connection and assess its size and impact on blood circulation.

To get more information on this market, Request Sample

The rising incidences of trauma or injuries that can cause a direct connection between an artery and a nearby vein, bypassing the normal capillary network, are primarily driving the arteriovenous fistula market. In addition to this, the inflating utilization of surgical and endovascular methods, since they ensure the optimal flow of blood between arteries and veins, thereby preserving the quality and viability of capillaries in individuals suffering from the illness, is also creating a positive outlook for the market. Moreover, the widespread adoption of comprehensive medical care and therapeutic approaches, encompassing rehabilitative measures and patient education, is further bolstering the market growth. These procedures focus on boosting physical and mental well-being, optimizing functional abilities, and enhancing the overall quality of life. Apart from this, the rising usage of effective medical techniques, including percutaneous transluminal angioplasty, on account of their numerous benefits, like shorter recovery times, immediate improvement in blood flow, and reduced risk of complications as compared to traditional open surgeries, is acting as another significant growth-inducing factor. Additionally, the emerging popularity of regenerative medicine and tissue engineering strategies, which focus on developing biological substitutes to rejuvenate or replace damaged tissues, is expected to drive the arteriovenous fistula market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the arteriovenous fistula market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for arteriovenous fistula and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the arteriovenous fistula market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the arteriovenous fistula market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the arteriovenous fistula market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current arteriovenous fistula marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Key Questions Answered in this Report:

Market Insights

- How has the arteriovenous fistula market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the arteriovenous fistula across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the arteriovenous fistula across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of arteriovenous fistula across the seven major markets?

- What is the number of prevalent cases (2019-2035) of arteriovenous fistula by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of arteriovenous fistula by gender across the seven major markets?

- How many patients are diagnosed (2019-2035) with arteriovenous fistula across the seven major markets?

- What is the size of the arteriovenous fistula patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend of arteriovenous fistula?

- What will be the growth rate of patients across the seven major markets?

Arteriovenous Fistula: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for arteriovenous fistula drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the arteriovenous fistula market?

- What are the key regulatory events related to the arteriovenous fistula market?

- What is the structure of clinical trial landscape by status related to the arteriovenous fistula market?

- What is the structure of clinical trial landscape by phase related to the arteriovenous fistula market?

- What is the structure of clinical trial landscape by route of administration related to the arteriovenous fistula market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)