Argon Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Argon Market Size and Share:

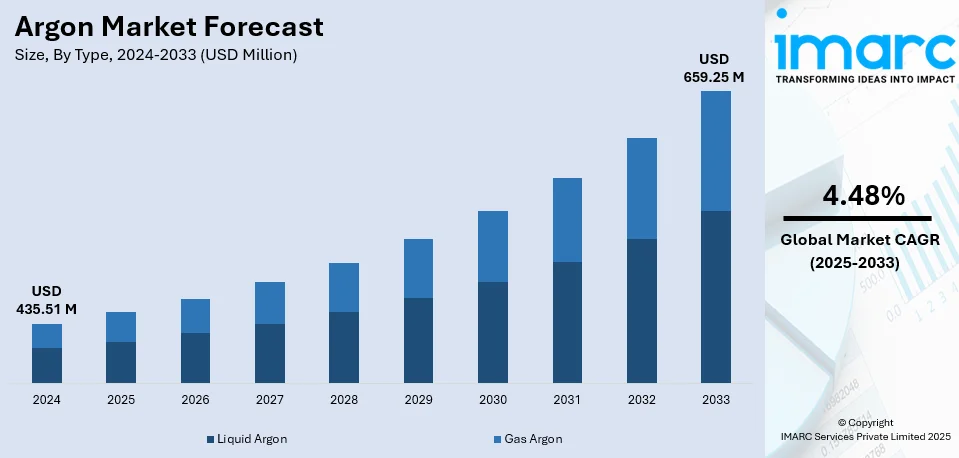

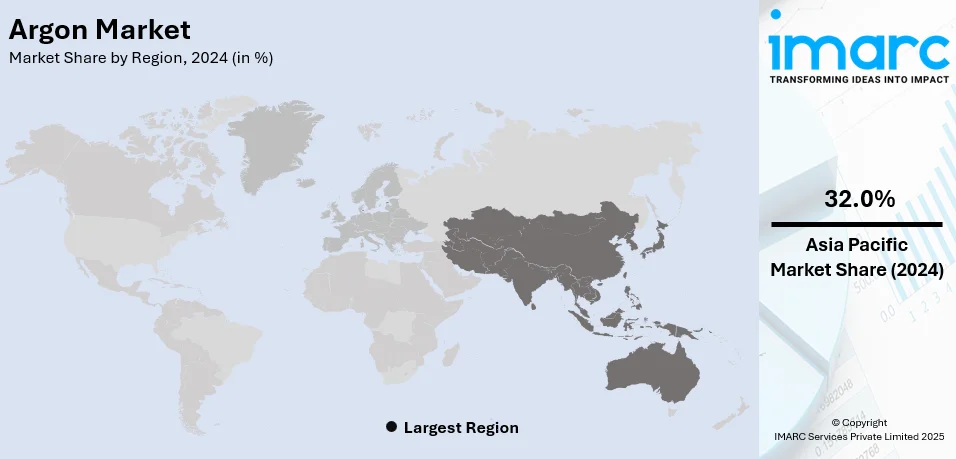

The global argon market size was valued at USD 435.51 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 659.25 Million by 2033, exhibiting a CAGR of 4.48% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 32.0% in 2024. The increasing demand for the gas in electronics and lighting industries, rapid industrialization and manufacturing activities, growing investments in the healthcare sector, continual advancements in argon-production technologies, popularity in additive manufacturing, and an enhanced focus on renewable energy projects are some of the factors positively impacting the argon market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 435.51 Million |

|

Market Forecast in 2033

|

USD 659.25 Million |

| Market Growth Rate (2025-2033) | 4.48% |

The market is significantly influenced by the increasing demand in industries such as manufacturing, healthcare, and electronics. Additionally, the paradigm shift toward cleaner and more sustainable manufacturing methods, such as laser cutting and 3D printing, is providing an impetus to the market. Moreover, extensive research and development (R&D) activities on energy-efficient technologies and developments related to argon are expected to continue fueling argon market demand. For example, on January 21, 2025, ASDevices unveiled a cost-effective method for high-sensitivity trace analysis using argon as both the carrier and discharge gas in gas chromatography. This approach serves as an alternative to helium, offering reduced costs and efficient impurity analysis at ppm and ppb levels. The development of Enhanced Plasma Discharge (Epd) Technology enables this innovation, enhancing the performance of various detectors without relying on helium's high cost and limited availability.

The United States stands out as a key regional market, which is majorly driven by the increasing utilization in the manufacturaing industries. According to BEA data, manufacturing contributed $2.3 trillion to the US economy in 2023, or 10.2% of the country's total GDP in chained 2017 dollars. As these sectors continue to prioritize precision manufacturing and welding, the demand for argon as an inert gas in these processes is on the rise. Besides this, the rapid growth of the electronics and semiconductor industries, where argon is essential for creating controlled atmospheres during production, has contributed significantly to market expansion. Furthermore, the growing demand for electronic and renewable energy technologies, along with increasing industrial activity, are expected to sustain the positive trajectory of the US argon market.

Argon Market Trends:

Technological Advancements in Argon Extraction

The development of extraction technologies enables the production of argon more efficiently, which supports the argon market growth. For example, on August 2, 2024, researchers in Brazil claimed a discovery of liquid argon purification for neutrino experiments. They found that a commercially available material could cut nitrogen contamination dramatically, which improves the detection of neutrino interactions. Argon produced through this method could significantly enhance the precision of particle measurements in the Deep Underground Neutrino Experiment (DUNE), thereby improving the accuracy of neutrino detection and advancing fundamental research in particle physics. These improvements further make the possibility of cheaper and easier production, which benefits various industries. As ASU technologies become more energy-efficient, the production of argon becomes less resource-intensive, contributing to its broader application across various sectors. These developments are helping to meet the rising global demand for the gas as industries seek more cost-effective and sustainable ways to obtain the gas, leading to further market expansion.

The rising popularity of cryosurgery and cryopreservation techniques

The market is experiencing significant growth due to the rising popularity of cryosurgery and cryopreservation techniques. Healthcare facilities specializing in cryopreservation rely on argon to maintain tissues and living cells in a metabolically and structurally preserved state at extremely low temperatures. Also, the increasing incidence of cancer and skin disorders is driving the demand for cryosurgery, valued for its non-invasive nature and minimal hospitalization requirements, thus propelling the argon market growth. The WHO estimates that there will be over 35 Million new cases of cancer in 2050, a 77% rise over the 20 Million cases that are expected in 2022. The advancement of regenerative and personalized medicine, along with long-term bioresearch, is further propelling the demand for gas in the cryopreservation field. The considerable rise in funding for medical research and the creation of new biobanks are also adding to the growing need for cryopreservation options. Additionally, the improvement of state-of-the-art cryosurgical tools and methods is anticipated to boost the effectiveness and efficiency of these procedures, which will, in turn, strengthen the dependence on gas in medical practices.

Strategic Collaborations in the Argon Market

One of the significant argon market trends is the increase in strategic collaborations between argon producers and end-user industries. These partnerships allow for the development of more specialized and efficient applications tailored to meet the needs of sectors like electronics, healthcare, and manufacturing. Also, gas producers are working closely with semiconductor manufacturers to ensure a consistent and high-purity supply of argon for advanced production processes. Additionally, collaborations with a focus on sustainability goals in optimizing argon are enhancing the market. For example, on February 6, 2025, BIG and Aapico Hitech announced a partnership to implement low-carbon argon technology in Thailand's automotive manufacturing. This collaboration aims to promote sustainable production processes, aligning with global climate goals. The partnership underscores a commitment to reducing carbon emissions in the automotive sector, with a focus on energy-efficient manufacturing practices. These alliances enable both innovation and operational efficiencies, contributing to the growth of the argon market.

Argon Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global argon market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Liquid Argon

- Gas Argon

Gas argon leads the market with around 55.8% of market share in 2024. As an inert gas, it is very necessary in environments that require stability. Gas argon is used as a shielding gas to prevent oxidation in welding. Its use in electronics manufacturing, especially in semiconductor and flat panel display manufacturing, further throws light on its importance. The medical applications include cryosurgery and imaging, among others. In preserving foodstuffs and beverages, gas argon is widely applied. In chromatography, a sample separation technique, its role has been immense. Such uses lead to the production of highly pure grades of argon and result in increased investments in more efficient production technologies. As industries continue to evolve, the demand for gas argon is expected to grow, reinforcing its importance as a key player in the market.

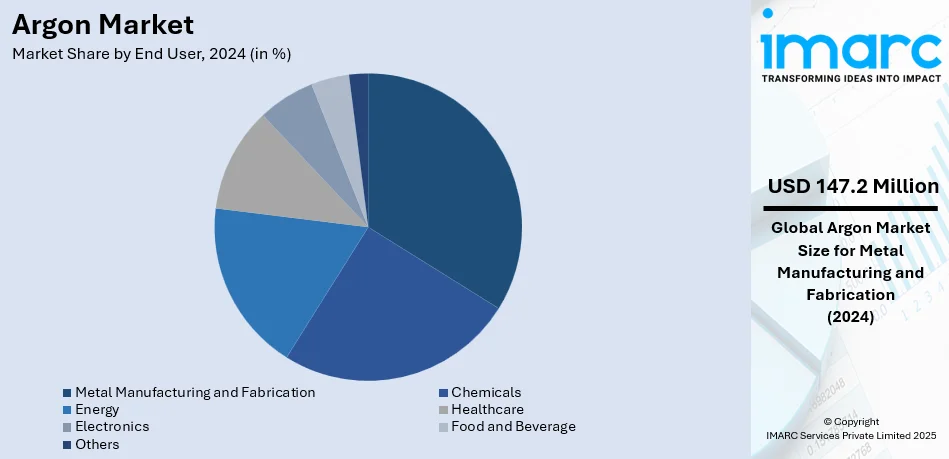

Analysis by End User:

- Metal Manufacturing and Fabrication

- Chemicals

- Energy

- Healthcare

- Electronics

- Food and Beverage

- Others

Metal manufacturing and fabrication leads the market with around 33.8% of market share in 2024. The primary role of argon in this industry is as a shielding gas for welding and cutting processes, where it prevents oxidation and ensures high-quality welds. Its inert properties also make it necessary for creating controlled atmospheres during metal heat treatment, preventing undesirable reactions with the metal surface. In addition to welding, argon is used in the processes of refining metal, which itself can produce metals as pure as titanium and stainless steel. The growing requirement for strength precision-engineered metal applications in sectors such as automotive, aerospace, and construction increases the demand for argon. As the metal manufacturing and fabrication sector continues to grow and evolve, the role of argon remains critical for achieving optimal results and enhancing production efficiency.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 32.0%. Due to its strong industrial base and increased investment in industrial gas infrastructure, the Asia Pacific region is becoming a larger consumer of the product. The region has a huge presence of industries such as automotive, electronics, and metal manufacturing. With constant advancements in modern manufacturing technology, the region is remaining at the forefront. Asia Pacific is also well-known for its high-quality and precise manufacturing processes, which necessitate excellent equipment and goods. Industries like metal fabrication and welding are required to maintain product integrity, thereby creating a positive argon market outlook. It also has a large capacity of factories in the region, making it an important base for the supply and distribution of argon gas.

Key Regional Takeaways:

United States Argon Market Analysis

The argon market in the United States is expanding due to increasing demand across manufacturing, electronics, healthcare, and aerospace industries. The metal fabrication sector, particularly in welding applications, is driving significant consumption, supported by growth in automotive and infrastructure projects. Argon’s role as an inert shielding gas in welding stainless steel and aluminum components makes it essential for industries requiring precision manufacturing. Healthcare applications, particularly in cryosurgery and gas chromatography, are also contributing to market growth. Besides this, the aerospace sector, driven by increased aircraft production and space exploration activities, further augments the product demand. In line with this, the rising use of argon in food packaging for extending shelf life is creating new opportunities. It is also utilized in wine and beverage bottling to prevent oxidation and maintain freshness by creating a protective layer over liquids. According to industry reports, it is estimated that a total consumption of 17,800 Million liters and a per capita consumption of 4.5 liters. Apart from this, supply chain improvements and technological advancements in argon extraction are enhancing availability and cost efficiency.

Asia Pacific Argon Market Analysis

The Asia Pacific argon market is witnessing rapid expansion due to the region’s strong industrial base, particularly in metal fabrication, electronics, and chemical processing. China, India, Japan, and South Korea are key contributors, with growing manufacturing sectors driving substantial argon consumption. In line with this, the thriving healthcare sector in the region is bolstering market growth. As per the India Brand Equity Foundation (IBEF), in 2023, the Indian healthcare sector continued to expand steadily and was valued at USD 372 Billion. The number of surgical procedures has increased, which require argon for cryogenic applications. It is used in laser surgeries to enhance precision and reduce tissue damage. Additionally, argon plasma coagulation (APC) is a common technique in gastroenterology for cauterizing tissues and controlling bleeding. Apart from this, the steel industry, a major consumer of argon for degassing and refining, continues to be a dominant driver, particularly in China and India. Furthermore, increasing investments in industrial gases, technological advancements in air separation units, and expanding industrial automation are further supporting the growth of the argon market in the region.

Europe Argon Market Analysis

The European argon market is advancing due to strong demand from the automotive, aerospace, and electronics industries. The semiconductor and electronics industry relies on argon for plasma etching, ion implantation, and the production of microchips and display panels. According to the IMARC report, the size of the European semiconductor industry is projected to increase at a CAGR of 6.4% from 2024 to 2032. This reflects the increased requirement for argon in the semiconductor industry. It provides an inert atmosphere in manufacturing environments, preventing contamination in processes involving silicon wafers, LED production, and fiber optics. Germany, France, the UK, and Italy are leading markets due to their well-established industrial sectors. Moreover, the rapid growth of the electric vehicle industry, requiring the gas for component fabrication and battery manufacturing, is creating new demand. The healthcare sector, particularly in medical imaging, cryotherapy, and laboratory research, is another significant driver. Additionally, the rising adoption of additive manufacturing (3D printing) in aerospace and medical applications is driving argon demand for metal powder processing. The European Union’s push for reducing industrial emissions is encouraging advancements in gas recycling technologies, further shaping market growth.

Latin America Argon Market Analysis

Brazil, Mexico, and Argentina are key players, with increasing demand for argon in metal fabrication and welding applications. Infrastructure development projects, supported by public and private investments, are leading to higher consumption in construction-related welding Furthermore, the energy sector uses argon in the production of photovoltaic solar panels, where it aids in silicon crystal growth and plasma-based etching processes. According to the IMARC Group, Brazil's solar energy market size is projected to exhibit a CAGR of 21.38% during 2024-2032. The growth reflects the growing need for argon in solar panel manufacturing. In addition, the healthcare industry is also contributing, as the use of argon in medical procedures and laboratory research is expanding. Besides this, the steel and metal industries in countries like Brazil rely on argon for refining processes, supporting market stability.

Middle East and Africa Argon Market Analysis

The Middle East and Africa argon market is expanding due to rising industrialization, infrastructure development, and growing healthcare needs. In the Middle East, demand is increasing in the oil and gas sector, where argon is used in refining processes and metal welding. The healthcare industry is also seeing rising demand due to improving medical infrastructure and increasing surgical procedures requiring argon. In Africa, growing investments in manufacturing and mining industries are supporting argon usage in metal processing and welding. As per reports, in 2023, the mining industry made up over 12% of all real fixed investment in South Africa. Besides this, technological advancements in air separation plants and increased investments in industrial gas production are improving argon supply and affordability, contributing to overall market growth.

Competitive Landscape:

The argon market is highly competitive, with the increasing demand for industrial gases in manufacturing, healthcare, electronics, and metallurgy. It has a mix of large multinational corporations and regional players competing through product innovation, cost leadership, and regional supply chain optimization. The main market players usually compete based on production capacity, pricing strategy, and ability to provide reliable and efficient distribution networks. The key differentiator also lies in technological advancements, including the development of more energy-efficient production processes. Strategic mergers, acquisitions, and partnerships facilitate the key player as companies strive to enhance their market positions. Furthermore, changing raw material costs, regulation policies, and sustainability drive the business landscape and critically determine the competition among the players.

The report provides a comprehensive analysis of the competitive landscape in the argon market with detailed profiles of all major companies, including:

- Air Liquide India

- Air Products and Chemicals Inc.

- Amcs Corporation

- BASF SE

- Buzwair Industrial Gases Factories

- Iwatani Corporation

- Linde plc

- Messer SE & Co

- KGaA

- Wesfarmers Company

Latest News and Developments:

- November 2024: In order to investigate the hydrogen-argon power cycle for net-zero power generation, Wärtsilä joined a new cooperation. The goal of the study is to increase the efficiency of balancing engines by employing argon, a non-toxic ideal gas present in the atmosphere. The Integrated Hydrogen-Argon Power Cycle (iHAPC) consortium, led by the University of Vaasa, oversees the co-innovation initiative in coordination with Business Finland and a wide range of partners.

- September 2024: As part of a long-term agreement with Wanhua Chemical Group (Wanhua), a world-renowned provider of chemically innovative goods, Air Liquide intended to invest around USD 62.59 Million to acquire and run an Air Separation Unit (ASU) in the Chinese city of Yantai. In order to serve the industrial merchant markets in Yantai and the larger Shandong province, Air Liquide will also construct, own, and run a new liquid argon production facility on this ASU. This unit will be built by Air Liquide Engineering & Construction.

- July 2024: With an investment of USD 40.50 Million, Air Liquide India established a manufacturing facility in Mathura, Uttar Pradesh, with the goal of growing its business. The industrial merchant and healthcare industries in Kosi, Mathura, are the focus of this air separation unit. It can produce about 300 tons of medical oxygen and liquid oxygen daily, as well as roughly 45 tons of liquid nitrogen and 12 tons of liquid argon.

- July 2023: Airgas is an Air Liquide company and a prominent supplier of medical, industrial gases, and welding materials in the United States. In order to strengthen the argon supply chain for its clients who leverage argon in multiple applications, the company strategically installed two argon storage nodes.

Argon Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquid Argon, Gas Argon |

| End Users Covered | Metal Manufacturing and Fabrication, Chemicals, Energy, Healthcare, Electronics, Food and Beverage, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Liquide India, Air Products and Chemicals Inc., Amcs Corporation, BASF SE, Buzwair Industrial Gases Factories, Iwatani Corporation, Linde plc, Messer SE & Co. KGaA, Wesfarmers Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the argon market from 2019-2033.

- The argon market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the argon industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The argon market was valued at USD 435.51 Million in 2024.

The argon market is projected to exhibit a CAGR of 4.48% during 2025-2033, reaching a value of USD 659.25 Million by 2033.

The market is driven by the increasing demand in industries such as metals, electronics, and healthcare. The rise in the use of argon for welding, as well as its role in manufacturing semiconductors and providing inert atmospheres for various applications, contributes to the market expansion. Additionally, the growing trend in the production of clean energy technologies and its usage in the food and beverage industry also supports market growth.

Asia Pacific currently dominates the argon market, accounting for a share of 32.0% in 2024. The dominance is fueled by rapid industrialization, increasing manufacturing activities, and rising demand for argon in sectors like metallurgy, electronics, and chemicals across countries like China and India.

Some of the major players in the argon market include Air Liquide India, Air Products and Chemicals Inc., Amcs Corporation, BASF SE, Buzwair Industrial Gases Factories, Iwatani Corporation, Linde plc, Messer SE & Co. KGaA, and Wesfarmers Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)