Argentina Retail Market Report by Product (Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others), and Region 2026-2034

Argentina Retail Market Overview:

The Argentina retail market size reached USD 168.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 312.1 Billion by 2034, exhibiting a growth rate (CAGR) of 7.13% during 2026-2034. The growing number of internet users, expansion of e-commerce platforms and digital transformation, rapid urbanization and population growth, and investments in retail infrastructure are some key aspects driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 168.0 Billion |

| Market Forecast in 2034 | USD 312.1 Billion |

| Market Growth Rate (2026-2034) | 7.13% |

Access the full market insights report Request Sample

Argentina Retail Market Trends:

Growing Number of Internet Users

An article published in 2023 on the website of the International Trade Administration (ITA) shows that Argentina has over 37 million internet users. Increasing internet penetration means more people have access to online shopping platforms. This is leading to a rise in e-commerce activities, allowing retailers to reach a broader audience beyond traditional brick-and-mortar stores. Moreover, as more people gain access to the internet, there is a corresponding increase in digital payment methods, which facilitates smoother transactions for online purchases, boosting confidence of people and encouraging more frequent online shopping. The use of the internet as a way of shopping also boosts the synchronization between online and offline shopping modes. Retailers can use an omnichannel technique where people can browse merchandise online and make purchases either on-line or in-shop, improving convenience and versatility.

Besides this, internet access enables people, especially those in remote areas, to select from a wider range of products and services. This democratizes retail access and opens the arena where small or medium scale industries or retailers can compete nationally or even internationally.

Rapid Urbanization

According to the Central Intelligence Agency (CIA), the urban population in Argentina was 92.5% of total population in 2023. Urbanization necessitates the development of retail infrastructure, which include malls, buying complexes, and retail chains, for catering to the growing urban population. This infrastructure expansion not only meets individual demand but also creates employment opportunities and contributes to monetary boom. In addition, retail outlets in urban areas benefit from better accessibility through public transportation networks and proximity to residential areas. This convenience factor encourages frequent shopping trips and impulse purchases, thereby driving retail sales.

In line with this, urban residents often prioritize convenience in their shopping habits due to busy lifestyles and limited time. Retailers respond by offering easily accessible stores, online shopping options, and services like click-and-collect same-day delivery, meeting the demand for convenience-driven shopping experiences. Major cities and urban centers in Argentina attract tourists and serve as commercial hubs. This influx of visitors boosts retail activity, particularly in areas with high tourist footfall like shopping districts and entertainment zones.

Argentina Retail Market News:

- July 21, 2023: Inditex, the parent company of clothing chain Zara, entered into an agreement to transfer its store operations in Argentina and Uruguay to Regency Group.

- February 10, 2023: Carrefour Argentina collaborated with Go2Future to open its first autonomous store in the country. Products that customers choose via an app are automatically loaded into a virtual cart and payment is made upon leaving without the need to use a traditional checkout.

Argentina Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

To get detailed segment analysis of this market Request Sample

- Food and Beverages

- Personal and Household Care

- Apparel, Footwear and Accessories

- Furniture, Toys and Hobby

- Electronic and Household Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes food and beverages, personal and household care, apparel, footwear and accessories, furniture, toys and hobby, electronic and household appliances, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

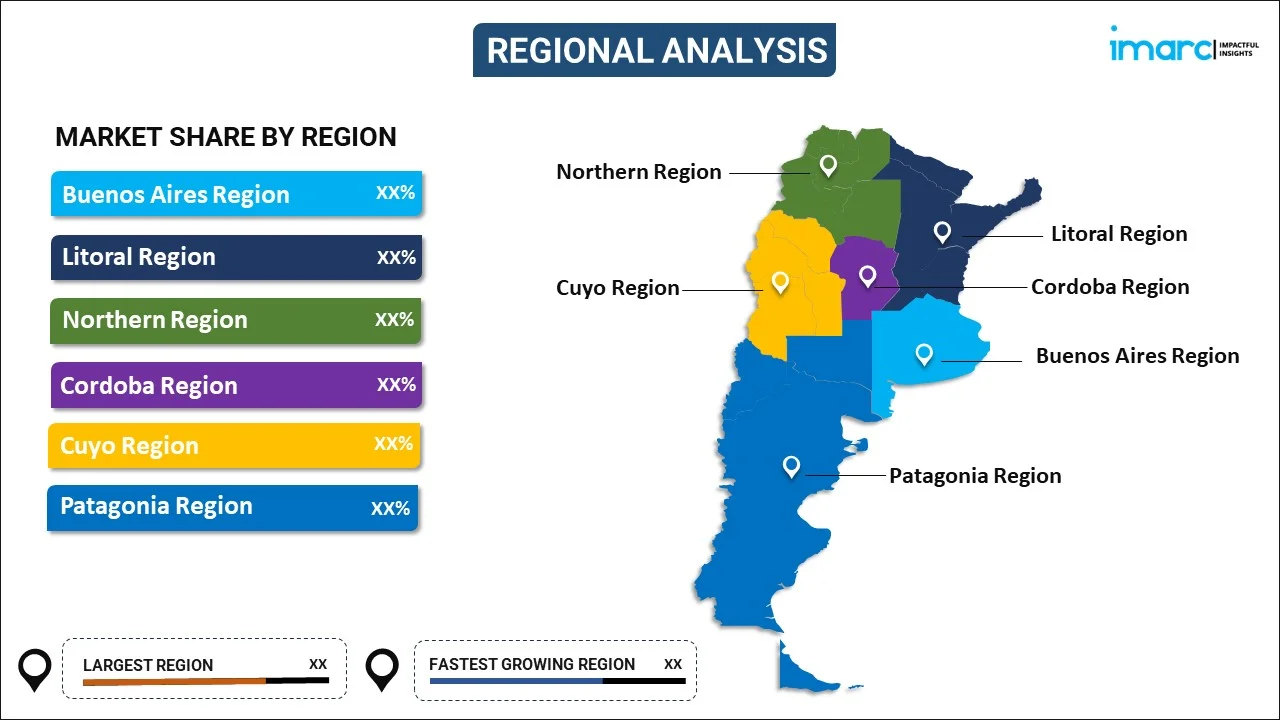

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Buenos Aires Region

- Litoral Region

- Northern Region

- Cordoba Region

- Cuyo Region

- Patagonia Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, and Patagonia Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Argentina Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, Patagonia Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the argentina retail market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the argentina retail market?

- What is the breakup of the argentina retail market on the basis of product?

- What is the breakup of the argentina retail market on the basis of distribution channel?

- What are the various stages in the value chain of the argentina retail market?

- What are the key driving factors and challenges in the argentina retail?

- What is the structure of the argentina retail market and who are the key players?

- What is the degree of competition in the argentina retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the argentina retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the argentina retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the argentina retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)