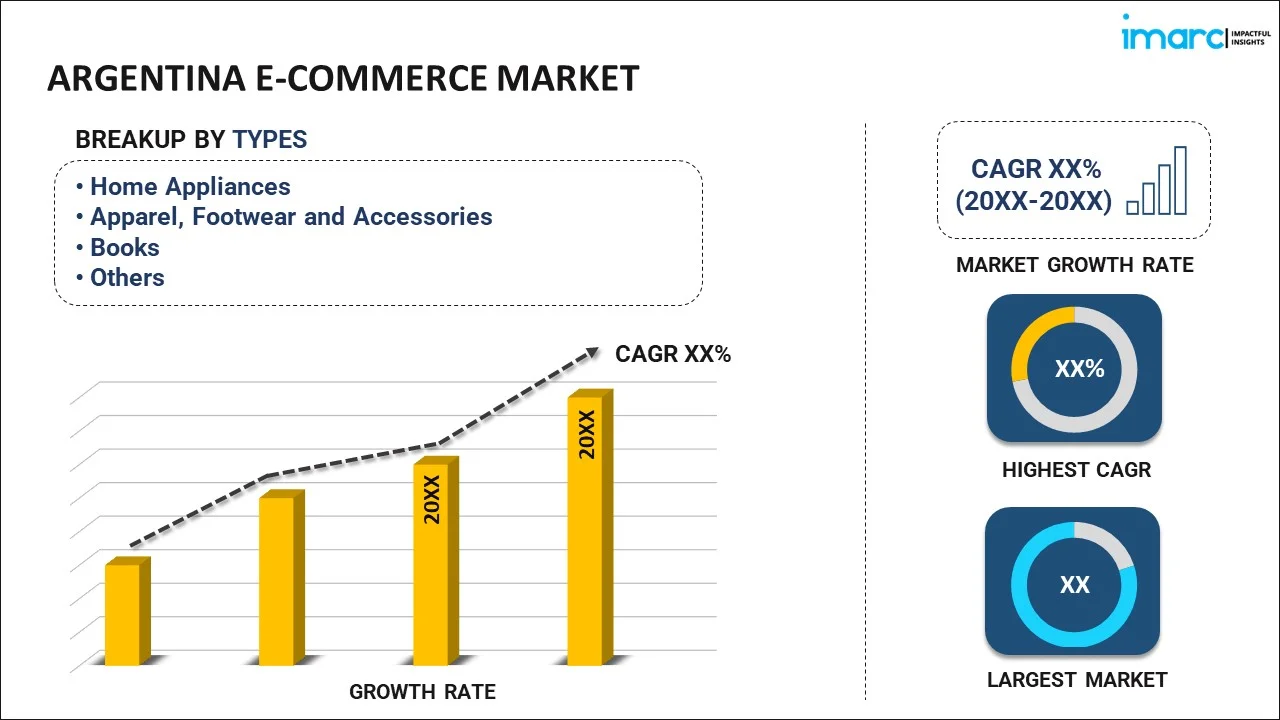

Argentina E-commerce Market Report by Type (Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, and Others), Transaction (Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, and Others), and Region 2026-2034

Argentina E-commerce Market:

The Argentina e-commerce market size reached USD 165.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 774.3 Million by 2034, exhibiting a growth rate (CAGR) of 18.68% during 2026-2034. There are numerous factors that are driving the market, which include the rising number of internet users, increasing utilization of social media platforms, and changing preferences and behavior of individuals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 165.8 Million |

|

Market Forecast in 2034

|

USD 774.3 Million |

| Market Growth Rate 2026-2034 | 18.68% |

Access the full market insights report Request Sample

Argentina E-commerce Market Analysis:

- Major Market Drivers: The rising smartphone usage and improved mobile internet connectivity are facilitating easier online shopping, further driving the market's growth. Moreover, the rising adoption of digital payment methods, including credit cards, digital wallets, and mobile payment systems, has made online transactions more accessible and secure, thereby proliferating the Argentina e-commerce market demand.

- Key Market Trends: The growth of digital payment methods, including credit/debit cards, digital wallets, and other online payment systems, is making it easier and more convenient for consumers to make purchases online, thereby driving the Argentina e-commerce market growth. Additionally, advances in logistics and the expansion of delivery networks have enhanced the efficiency of shipping and handling, reducing delivery times and increasing customer satisfaction, further escalating the industry's demand.

- Competitive Landscape: The Argentina e-commerce market analysis report provides a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

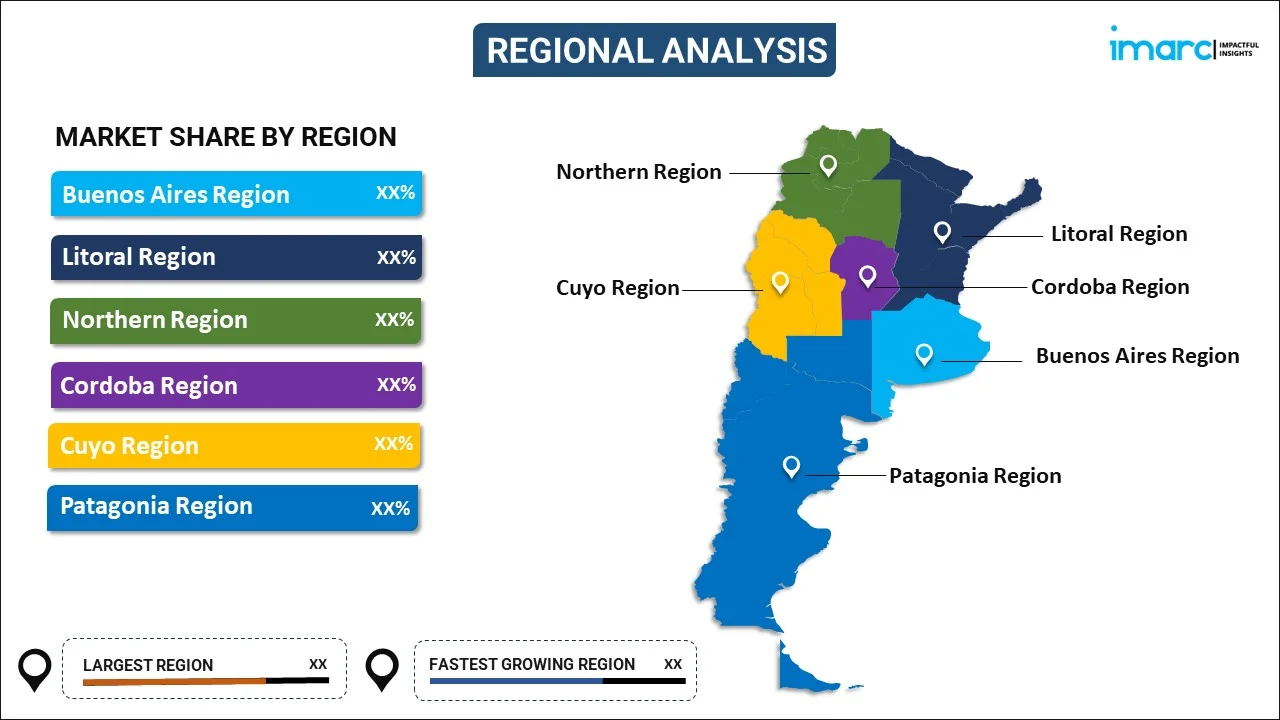

- Geographical Trends: Buenos Aires has the most prominent e-commerce demand in Argentina. The city and its metropolitan area are hubs of activity, with a large, tech-savvy population that frequently shops online. Moreover, the Northern Region, including provinces like Salta, Jujuy, and Tucumán, is seeing increasing e-commerce activity. The growth is driven by improved internet access and mobile device usage.

- Challenges and Opportunities: Heightened concerns over online payment fraud and the rising competition among key players are hampering the market's growth. However, the increasing access to the internet and mobile devices provides a growing customer base for e-commerce businesses. More people are becoming comfortable with online shopping.

Argentina E-commerce Market Trends:

Rising Internet Penetration

The increased internet penetration is a significant driver of growth in Argentina's e-commerce market. For instance, according to Statista, the population share of Argentina's internet users is expected to increase by 5.3 percentage points between 2024 and 2029. The internet penetration is expected to reach 98% by 2029. As more people gain access to the internet, e-commerce businesses can reach a larger and more diverse audience. This includes consumers in both urban and rural areas who may not have easy access to physical retail stores. These factors further positively influence the Argentina’s e-commerce market forecast.

Adoption of Digital Payment Methods

The adoption of digital payment methods, including credit and debit cards, digital wallets, and mobile payment platforms, has made online transactions more convenient and secure for consumers. For instance, according to Statista, Argentina saw an average of 2.6 debit card payments per adult in 2019, up from 1.7 in 2016. In July 2020, more than 106 million debit card payments were logged in Argentina, with roughly 28% made through e-commerce platforms. These factors are further contributing to the Argentina e-commerce market share.

Growing Usage of Social Media Platforms

The growing utilization of social media platforms is a significant driver of the e-commerce market growth in Argentina. For instance, according to an article published by Datareportal, in January 2023, Argentina had around 36.35 million social media users, accounting for 79.7% of the total population. Social media platforms like Instagram, Facebook, and TikTok provide businesses with the opportunity to reach a large and engaged audience. By leveraging these platforms, e-commerce brands can enhance their visibility and attract more potential customers. These factors are augmenting the market growth.

Argentina E-commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at country and regional levels for 2026-2034. Our report has categorized the market based on type and transaction.

Breakup by Type:

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

The Argentina e-commerce market report has provided a detailed breakup and analysis of the market based on the type. This includes home appliances, apparel, footwear and accessories, books, cosmetics, groceries, and others.

Growing innovations in home appliances, such as smart devices and energy-efficient products, drive consumer interest and demand. Online platforms offer detailed product information and reviews, making it easier for consumers to make informed decisions. Moreover, e-commerce platforms offer a vast selection of apparel that caters to various fashion trends and personal preferences. Consumers are drawn to the extensive variety and the ability to explore new styles from different brands. Furthermore, online platforms provide access to a wide range of footwear and accessories, from high-end designer items to affordable everyday options, catering to different tastes and budgets.

Breakup by Transaction:

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

A detailed breakup and analysis of the market based on the transaction have also been provided in the report. This includes business-to-consumer, business-to-business, consumer-to-consumer, and others.

According to the Argentina e-commerce market outlook, consumers increasingly prefer the convenience of shopping online for a wide range of products, from clothing and electronics to groceries and cosmetics. The ability to shop from home and have products delivered directly contributes to B2C growth. Moreover, B2B e-commerce platforms streamline procurement processes, reduce administrative costs, and improve supply chain efficiency. Businesses are increasingly adopting online solutions to manage bulk orders and negotiate better deals. Furthermore, C2C platforms facilitate peer-to-peer transactions, allowing individuals to buy and sell goods directly. Popular platforms and marketplaces make it easy for consumers to list items and reach potential buyers.

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Buenos Aires Region

- Litoral Region

- Northern Region

- Cordoba Region

- Cuyo Region

- Patagonia Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, and Patagonia Region.

According to the Argentina e-commerce market statistics, Buenos Aires region is the most developed and densely populated region, which translates to a high e-commerce demand. The City of Buenos Aires and the surrounding metropolitan area are the primary hubs for online shopping. Moreover, the Litoral Region has a developing infrastructure, and a smaller population compared to Buenos Aires. However, there is increasing internet penetration and a growing interest in online shopping, particularly for local and niche products.

Competitive Landscape:

The Argentina e-commerce market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Argentina E-commerce Market News:

- August 2024: Gaucho Group Holdings, Inc., recognized for its e-commerce platforms, launched its Algodon Extra Virgin Olive Oil in Argentina.

- March 2024: Mabaya, an e-commerce media tech business, collaborated with Linio, a marketplace in Latin America that operates in Colombia, Mexico, Argentina, and five other countries. Linio's e-commerce sites will feature sponsored product ads as well as headline ads for merchants and brands.

- February 2024: Falabella announced that its e-commerce proposition would evolve. Falabella Retail and Falabella.com will jointly offer a wide coverage of categories and Sodimac and Tottus will deepen their specialist proposal. This will allow individuals to find most of the categories they are looking for with valuable products and brands.

Argentina E-commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others |

| Transactions Covered | Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, Others |

| Regions Covered | Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, Patagonia Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Argentina E-commerce market performed so far and how will it perform in the coming years?

- What is the breakup of the Argentina E-commerce market on the basis of type?

- What is the breakup of the Argentina E-commerce market on the basis of transaction?

- What are the various stages in the value chain of the Argentina E-commerce market?

- What are the key driving factors and challenges in the Argentina E-commerce?

- What is the structure of the Argentina E-commerce market and who are the key players?

- What is the degree of competition in the Argentina E-commerce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Argentina e-commerce market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Argentina e-commerce market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Argentina e-commerce industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)