Argentina Courier, Express and Parcel (CEP) Market Report by Service Type (B2B (Business-To-Business), B2C (Business-To-Consumer), C2C (Customer-To-Customer)), Destination (Domestic, International), Type (Air, Ship, Subway, Road), End-Use Sector (Services (BFSI- Banking, Financial Services, Insurance), Wholesale and Retail Trade (E-Commerce), Manufacturing, Construction and Utilities, and Others), and Region 2026-2034

Argentina Courier, Express and Parcel (CEP) Market Overview:

The Argentina courier, express and parcel (CEP) market size reached USD 3.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.5 Billion by 2034, exhibiting a growth rate (CAGR) of 6.63% during 2026-2034. The rising investments in infrastructure improvement projects, heightened online shopping activities among the masses, and the escalating demand for specialized healthcare logistics to safely deliver medical supplies, pharmaceuticals, and equipment are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.1 Billion |

| Market Forecast in 2034 | USD 5.5 Billion |

| Market Growth Rate (2026-2034) | 6.63% |

Access the full market insights report Request Sample

Argentina Courier, Express and Parcel (CEP) Market Trends:

Urbanization and Infrastructure Development

In 2023, the urban population of Argentina reached 43,138,225 individuals, according to the data provided by the GlobalData. The increasing number of individuals relocating to urban regions is driving the demand for fast and dependable delivery services. The funding from the governing body in improving infrastructure, like building better road systems and transportation amenities, helps meet this demand by allowing quicker and more effective transportation of goods. Improved infrastructure decreases transit times and operational expenses for courier, express and parcel (CEP) firms, enabling them to provide cost-effective services. Moreover, the establishment of urban logistics hubs and distribution centers enables improved inventory control and quicker final mile delivery. These developments simplify the task for CEP providers in meeting the demands of businesses and individuals, guaranteeing that deliveries are made swiftly and effectively.

Rise of E-commerce and Transition to Digital Platforms

The growing preference for online shopping is driving the need for dependable and quick delivery services in Argentina. The increasing internet access, widespread use of smartphones, and higher user confidence in online transactions are supporting this trend. E-commerce platforms and retailers are teaming up more with CEP providers to guarantee on-time deliveries, thereby enhancing user satisfaction and loyalty. Moreover, technological progress in the digital area is improving the efficiency of logistics tasks, allowing businesses to better handle orders, monitor shipments instantaneously, and enhance delivery routes. These technological advancements enhance operational effectiveness and lower expenses, enabling CEP firms to expand their activities and better address increasing demand.

Healthcare and Pharmaceutical Logistics Demand

Specialized logistics solutions are required in the healthcare industry to safely and promptly deliver medical supplies, pharmaceuticals, and equipment. An increase in elderly individuals and the rise of telemedicine and home healthcare services are also catalyzing the demand for dependable transportation of medical supplies to residences of patients. In 2023, individuals aged 65 and older made up 12.1% of the overall population in Argentina. Furthermore, CEP providers are creating custom services to manage shipments that are sensitive to temperature, in order to meet strict regulatory requirements. Moreover, the rising delivery of medications is driving need for effective logistical assistance. By catering to the unique needs of the healthcare and pharmaceutical sectors, CEP companies can tap into a lucrative market segment. Investments in strong healthcare logistics are crucial, improving the capacity and dependability of the CEP market in Argentina.

Argentina Courier, Express and Parcel (CEP) Market News:

- January 2023: Correo Argentino outlined its Sustainability Programme, which aimed to decrease environmental harm by collaborating on waste management, sustainable transportation, and energy efficiency. The program involved actions such as integrating electric cars and partnering with groups to recycle trash and obtain renewable power.

- September 2023: DHL Express introduced a specialized cargo route to Argentina, with six weekly flights from Miami to Buenos Aires through Santiago, Chile, in order to improve shipment consistency and speed up deliveries. This addition of a new pathway improved the effectiveness of shipments from the United States, enabling quicker customs clearance and speedier delivery from Argentina.

Argentina Courier, Express and Parcel (CEP) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service type, destination, type and end-use sector.

Service Type Insights:

To get detailed segment analysis of this market Request Sample

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- C2C (Customer-to-Customer)

The report has provided a detailed breakup and analysis of the market based on the product. This includes B2B (business-to-business), B2C (business-to-consumer), and C2C (customer-to-customer).

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes domestic and international.

Type Insights:

- Air

- Ship

- Subway

- Road

The report has provided a detailed breakup and analysis of the market based on the product. This includes air, ship, subway, and road.

End-Use Sector Insights:

- Services (BFSI- Banking, Financial Services and Insurance)

- Wholesale and Retail Trade (E-commerce)

- Manufacturing, Construction and Utilities

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes services (BFSI- banking, financial services, and insurance), wholesale and retail trade (e-commerce), manufacturing, construction and utilities, and others.

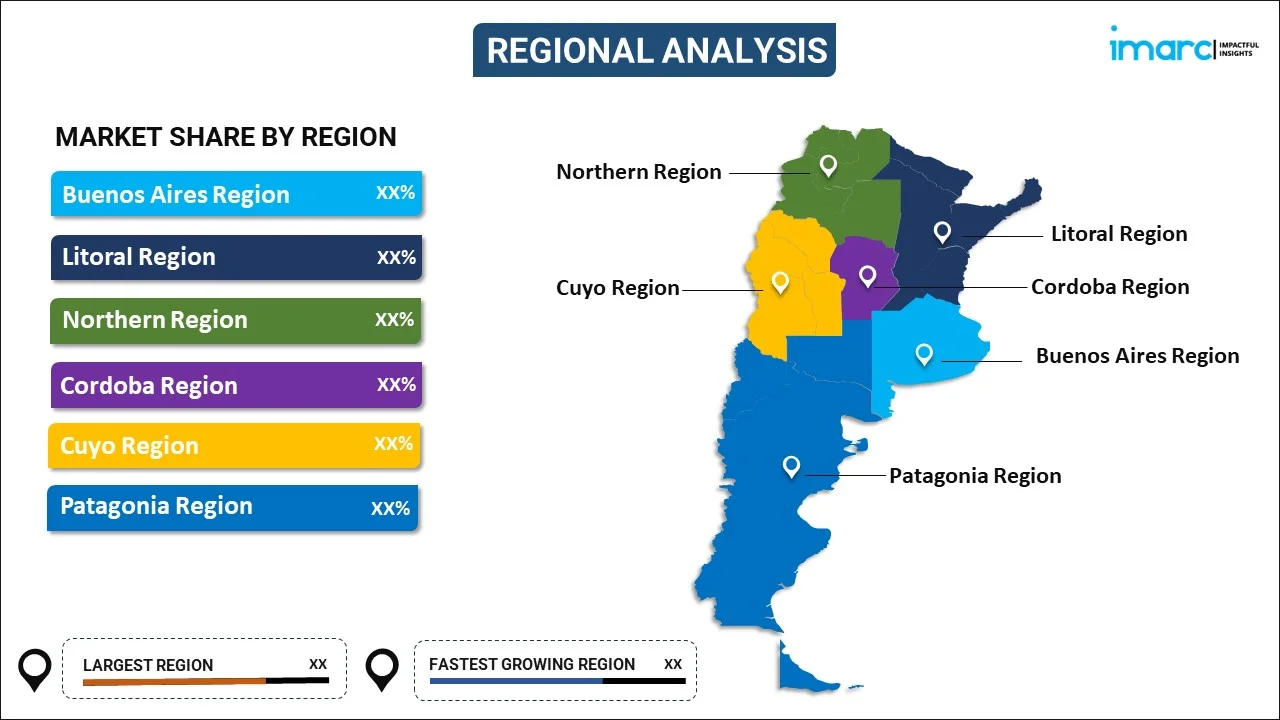

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Buenos Aires Region

- Litoral Region

- Northern Region

- Cordoba Region

- Cuyo Region

- Patagonia Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, and Patagonia Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Argentina Courier, Express and Parcel (CEP) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Service Types Covered | B2B (Business-To-Business), B2C (Business-To-Consumer), C2C (Customer-To-Customer) |

| Destinations Covered | Domestic, International |

| Types Covered | Air, Ship, Subway, Road |

| End-Use Sectors Covered | Services (BFSI- Banking, Financial Services, Insurance), Wholesale and Retail Trade (E-Commerce), Manufacturing, Construction and Utilities, Others |

| Regions Covered | Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, Patagonia Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Argentina courier, express and parcel (CEP) market performed so far and how will it perform in the coming years?

- What is the breakup of the Argentina courier, express and parcel (CEP) market on the basis of service type?

- What is the breakup of the Argentina courier, express and parcel (CEP) market on the basis of destination?

- What is the breakup of the Argentina courier, express and parcel (CEP) market on the basis of type?

- What is the breakup of the Argentina courier, express and parcel (CEP) market on the basis of end-use sector?

- What are the various stages in the value chain of the Argentina courier, express and parcel (CEP) market?

- What are the key driving factors and challenges in the Argentina courier, express and parcel (CEP)?

- What is the structure of the Argentina courier, express and parcel (CEP) market and who are the key players?

- What is the degree of competition in the Argentina courier, express and parcel (CEP) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Argentina courier, express and parcel (CEP) market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Argentina courier, express and parcel (CEP) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Argentina courier, express and parcel (CEP) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)