Argentina Construction Market Report by Sector (Commercial Construction, Residential Construction, Industrial Construction, Infrastructure (Transportation) Construction, Energy and Utility Construction), and Region 2026-2034

Argentina Construction Market Overview:

The Argentina construction market size reached USD 65.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 88.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.35% during 2026-2034. The market is propelled by economic expansion and major infrastructure development, the increasing need for residential, commercial, and industrial buildings, and rising foreign investment and public-private partnerships (PPPs).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 65.5 Billion |

|

Market Forecast in 2034

|

USD 88.2 Billion |

| Market Growth Rate 2026-2034 | 3.35% |

Access the full market insights report Request Sample

Argentina Construction Market Trends:

Economic Growth and Infrastructure Development

Argentina's economic expansion and major infrastructure development projects are the main drivers of the country's construction industry. As per the World Bank, with a Gross Domestic Product (GDP) of approximately US$640 Billion, Argentina is one of the largest economies in Latin America. Besides, the economy is expected to grow by 5 percent in 2025, driven by improved weather conditions, investments in the energy sector, and the normalization of agricultural production. The nation's infrastructure, including public utilities, energy projects, and transportation networks, has been given top priority by the government. Significant investments are being made in large-scale projects like the construction of renewable energy installations, the enlargement of roadways, and the refurbishment of airports. These initiatives seek to improve overall economic efficiency, lower logistical costs, and increase connection. Furthermore, Argentina's dedication to infrastructure development is consistent with its objective of drawing in foreign direct investment and promoting economic expansion. The government's infrastructure plan, which involves the public and private sectors, fosters job creation and technological breakthroughs in the construction industry by providing a favorable environment for construction enterprises.

Rising Urbanization and Housing Demand

Argentina's construction industry is significantly driven by the country's rapid urbanization and growing housing demand. As per UN Habitats, Argentina is a highly urbanized country. Out of a total estimated population of about 44.500.000 for 2018, more than 92% live in urban areas. There is a growing demand for residential, commercial, and industrial structures as metropolitan areas grow. In order to handle the expanding urban population, there is an increasing need for additional housing projects, commercial spaces, and infrastructure in cities like Buenos Aires, Córdoba, and Rosario. Construction activity is further stimulated by government efforts aimed at improving living circumstances for low- and middle-income families and providing cheap housing. Initiatives like Procrear, which provides home loans and subsidies, are essential in driving up the residential construction industry. In addition, the demand for contemporary residential and commercial spaces is met by private sector investments in real estate development.

Argentina Construction Market News:

- April 2024: Holcim announced the acquisition of Tensolite, a maker and distributor of pre-cast concrete systems in South America, which operates in Argentina, Paraguay and Uruguay. The latter had net sales of $22 Million in 2023 and will become part of Holcim's solutions & products division.

- November 2023: The Inter-American Development Bank (IDB) has approved a $700 Million credit line for Argentina and a $345 million first individual loan under this facility that will finance a new 772-meter-long bridge linking the provinces of Chaco and Corrientes, as well as the infrastructure for accessing the bridge.

Argentina Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on sector.

Sector Insights:

To get detailed segment analysis of this market Request Sample

- Commercial Construction

- Residential Construction

- Industrial Construction

- Infrastructure (Transportation) Construction

- Energy and Utility Construction

The report has provided a detailed breakup and analysis of the market based on the sector. This includes commercial construction, residential construction, industrial construction, infrastructure (transportation) construction, and energy and utility construction.

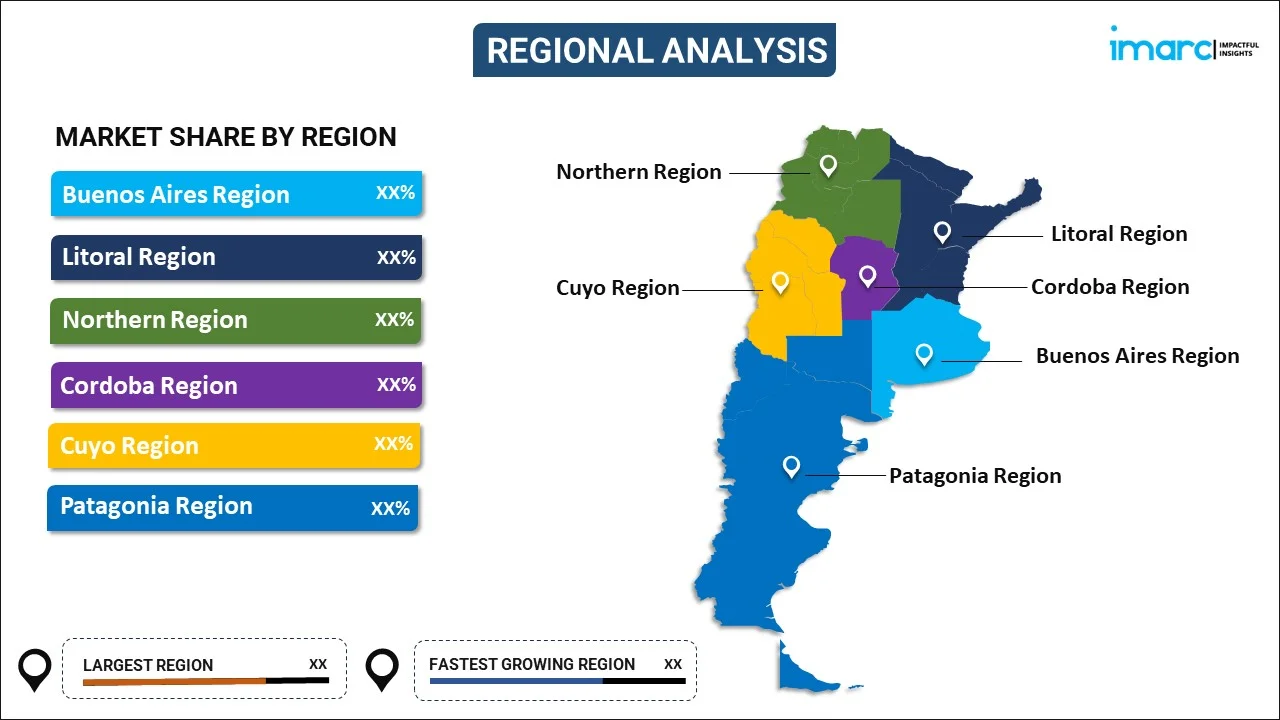

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Buenos Aires Region

- Litoral Region

- Northern Region

- Cordoba Region

- Cuyo Region

- Patagonia Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, and Patagonia Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Argentina Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sectors Covered | Commercial Construction, Residential Construction, Industrial Construction, Infrastructure (Transportation) Construction, Energy and Utility Construction |

| Regions Covered | Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, Patagonia Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Argentina construction market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Argentina construction market?

- What is the breakup of the Argentina construction market on the basis of sector?

- What are the various stages in the value chain of the Argentina construction market?

- What are the key driving factors and challenges in the Argentina construction?

- What is the structure of the Argentina construction market and who are the key players?

- What is the degree of competition in the Argentina construction market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Argentina construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Argentina construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Argentina construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)