Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region 2025-2033

Aquaculture Market Size and Share:

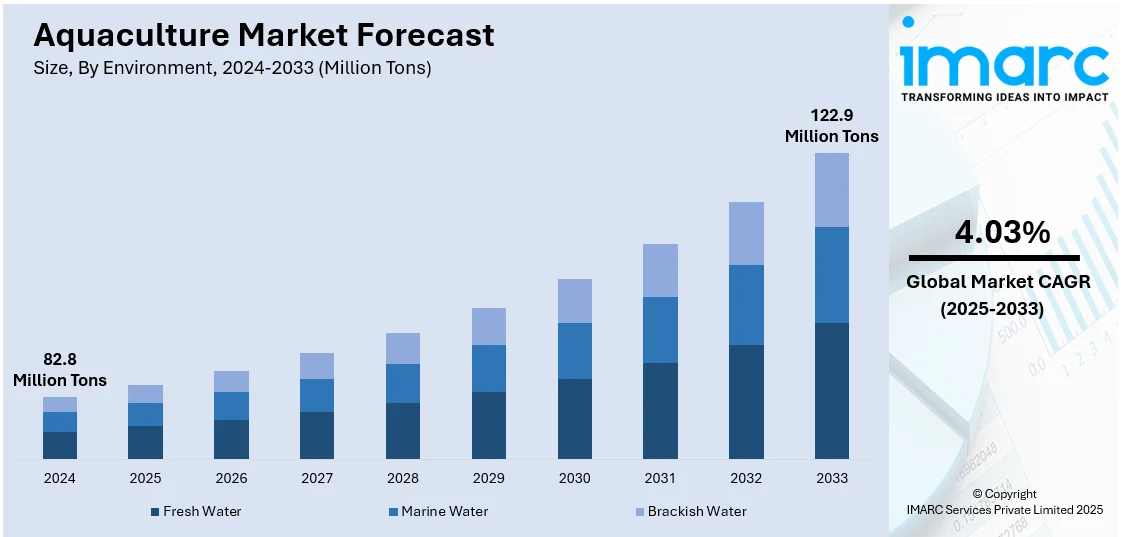

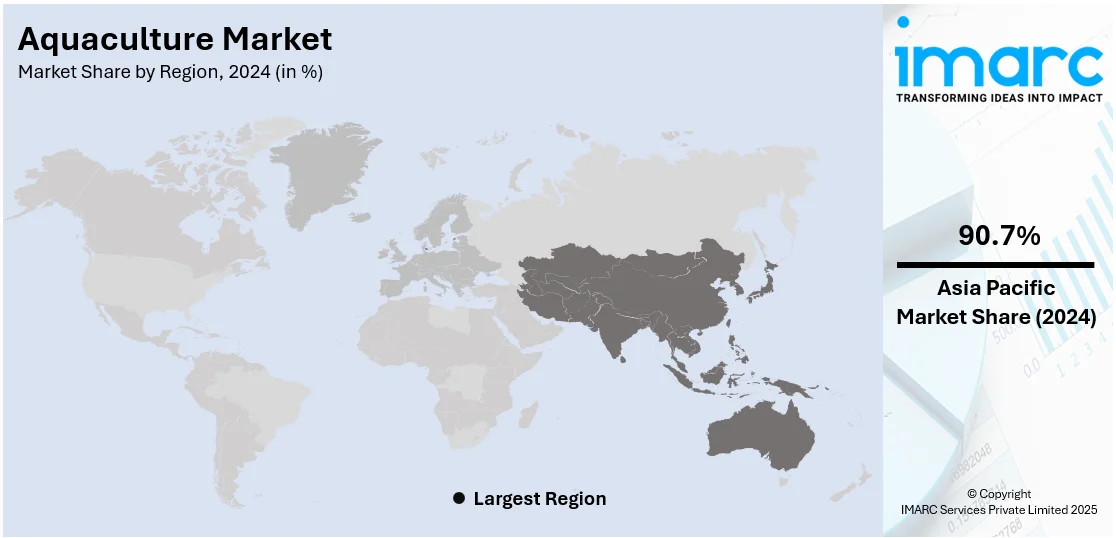

The global aquaculture market size was valued at 82.8 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 122.9 Million Tons by 2033, exhibiting a CAGR of 4.03% during 2025-2033. In 2024, the Asia-Pacific region is the leading force in the market, accounting for more than 90.7% of the total share. The market growth is fueled by rising demand for fish, greater public awareness of associated health benefits, adoption of advanced technologies, environmentally sustainable methods, shrinking wild fish populations, and strong regional demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 82.8 Million Tons |

| Market Forecast in 2033 | 122.9 Million Tons |

| Market Growth Rate 2025-2033 | 4.03% |

As the global population increases, traditional farming methods are facing mounting pressures to meet protein needs without causing further environmental strain. As a result, the demand for sustainable food sources is growing rapidly, wherein aquaculture bridges the gap by providing a reliable source of fish and shellfish while minimizing environmental impact. One of the key drivers for the growth of aquaculture is the decline in wild fish stocks. Overfishing and environmental degradation have led to reduced populations of wild fish, making aquaculture a vital solution to ensure a steady and consistent supply of seafood. This shift supports food security while helping preserve marine habitats by reducing the pressure on wild fish stocks.

The United States has emerged as a key regional market for aquaculture. The United States aquaculture market is driven by a greater emphasis on locally sourced and sustainable food production. Consumers and policymakers are seeking lesser reliance on imported seafood and more ecologically friendly agricultural methods. Advancements in sophisticated aquaculture methods, such as recirculating aquaculture systems, or RAS, and offshore aquaculture, improves production efficiency and environmental sustainability. It addresses issues with water use, waste management, and habitat conservation for a greater industrial integration. In addition, an increasing appetite for fresher, locally caught seafood, such as salmon, shrimp, and oysters, is fed by growing knowledge of the health benefits associated with eating seafood rich in omega-3 fatty acids and other nutritional value. As per the IMARC GROUP, the United States seafood market exhibits a CAGR of 1.80% during 2024-2032. Regulatory assistance, through subsidies and incentives from governmental bodies such as NOAA, is supporting further growth at aquaculture operations.

Aquaculture Market Trends:

Increasing Adoption of New Technologies

The escalating number of new technologies in the fish cultivation sector is majorly the aquaculture market size. When combined effectively and innovatively, these advancements pose a new level of aquaculture operators’ productivity, efficiency, and sustainability. Thus, automated feeding mechanisms feed fish right on schedule so that there are no leftovers, and fish are fed healthily. Additionally, water quality sensors and monitoring tools provide real-time control and necessary adjustments. Using genetically modified fish via biotechnology and selective breeding, fish have become faster-growing and more disease-resistant. On 22nd and 23rd March 2024, the ICAR-Central Institute of Brackishwater Aquaculture, Chennai organised a two-day programme on Smart Aquaculture 2024 to encourage the implementation of AI and IoT in the management of farms, farm water, farm feed, farm health, and farm supply chain. Furthermore, data science and AI enable forecasting; thus, recirculating aquaculture systems, wherein only a small portion of water is used and re-used, become more competitive and highly adaptive, which makes land-based aquaculture operators more competitive as well. Such feeding approaches are sufficient for satisfying the growing global demand for seafood and allow for compliance with sustainability requirements, thereby supporting the aquaculture market growth.

Rising Demand for Seafood Products

The industry is capitalizing on the rising demand for seafood products. This can be supported by dietary choices that cannot be met by the overexploited traditional fisheries, while other wild fisheries are being depleted. "Fish Consumption in India: Patterns and Trends," a study released by the Indian Council of Agricultural Research, Ministry of Agriculture and Farmers’ Welfare, Government of India, and WorldFish, reveals that 72.1% of India’s population, or 967 million individuals, consumed fish. The study included the collection of primary data from multiple Government sources such as National Family Health Survey reports covering about 15 years. However, aquaculture, as a competent and sustainable producer, can supply many aquatic species that are in high demand. Along with this, consumers are consuming seafood diets at a factual level due to their nutritional values, thereby expanding the aquaculture market share. Furthermore, many individuals have embraced seafood for its low fat and omega-3 fatty acids. Additionally, the rapidly growing global middle class, mostly located in emerging markets, is increasing its income, which now can afford to purchase seafood. Therefore, this is positively influencing the aquaculture market price. Aquaculture is capable of producing many aquatic species cons humorously in the chosen environments. Therefore, this is further creating a positive aquaculture market outlook.

Growing Consumption of Organic Seafood Items

The consumption of organic seafood items represents one of the major aquaculture market trends. Multiple countries are major players in global seafood markets with varying production and consumption profiles. According to trade map data, the top countries importing seafood in 2019 were the US (15% of global trade by value), China (12%), Japan (9%), Spain (6%), and France (4%). For numerous consumers across the globe, the importance of eating properly and healthily is becoming more apparent, making organic seafood a popular choice. Thus, this is further contributing to the large size of the aquaculture industry. Along with this, organic aquaculture employs environmentally and ethically conscious methods, minimizing the use of antibiotics and chemicals. This results in safer food options, aligning with consumer preferences for safer purchases. Organic seafood is particularly suitable for consumers who wish to avoid contaminants. In addition, the accelerating shift toward organic and healthier food options is driving this market trend in aquaculture, emphasizing sustainability and responsibility. Moreover, organic aquaculture is leading the way with sustainable and responsible fishing techniques, aiming to conserve fish populations for future generations.

Increasing demand for aquatic organisms and flora from the pharmaceutical sector

The pharmaceutical industry is witnessing a rising demand for aquatic organisms and plants due to their exceptional medicinal properties and potential applications in drug development. Marine species such as sponges, algae, and certain fish are rich in bioactive compounds, including antioxidants, anti-inflammatory agents, and antimicrobial peptides, which are highly sought after for the development of innovative pharmaceuticals. Similarly, aquatic plants like seaweed and microalgae are being explored for their health benefits, including their roles in treating chronic diseases and promoting overall wellness. The growing focus on natural and sustainable sources of therapeutic agents is driving researchers to tap into the vast biodiversity of aquatic ecosystems. Furthermore, advancements in aquaculture techniques are playing a pivotal role in meeting this demand by providing a reliable and sustainable supply of marine organisms without overexploiting natural resources. This trend aligns with the industry's emphasis on environmental responsibility and the pursuit of novel, nature-derived solutions to meet healthcare needs. In 2024, Engineers from the University of California San Diego have created tiny algae-based robots, referred to as microrobots, that can navigate through the lungs to administer cancer-treating drugs directly to metastatic tumors. This method has demonstrated potential in mice, as it suppressed the development and dissemination of tumors that had spread to the lungs, resulting in improved survival rates relative to control treatments.

Aquaculture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aquaculture market, along with forecasts at the global, country, and regional levels for 2025-2033. Our report has categorized the market based on fish type, environment, and distribution channel.

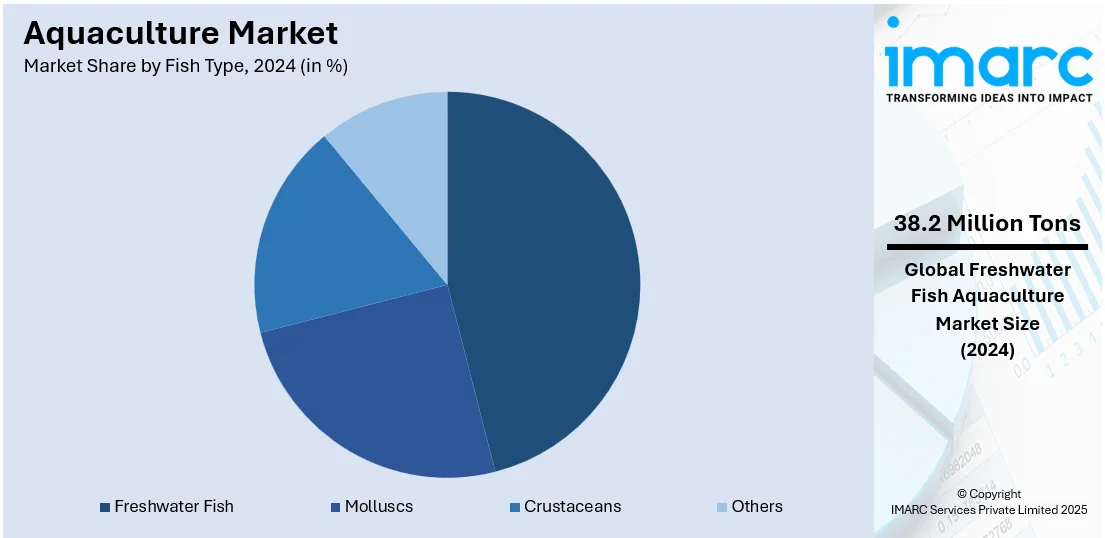

Analysis by Fish Type:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

According to the aquaculture market report, freshwater fish leads the market with around 46.2% of market share in 2024. The specific species of freshwater fish found in tilapia, catfish, and carp are considered some of the most desirable due to their general appeal and adaptability. With high growth rates, relative ease of aquaculture, and ability to grow under contrasting environmental conditions, these fish are amongst the preferred choices for aquaculture. Moreover, the need for lean types of meat, furled by a global promotion of healthy eating, aligns with the further supply of protein-rich goods. Therefore, with the increasing consumer interest in freshwater fish, aquaculture producers prioritize its cultivation, ensuring relevant and necessary aspects are widely available and accessible. According to the aquaculture market forecast, expected progress in breed knowledge and established best practices in farming will ensure the necessary varieties of products are delivered without fail, driving the market without periods of low availability.

Analysis by Environment:

- Fresh Water

- Marine Water

- Brackish Water

Fresh water leads the market with around 46.2% of market share in 2024. These environments, including rivers, lakes, and ponds, provide suitable habitats for various aquatic species typically bred for commercial purposes. Freshwater aquaculture presents several advantages, such as relatively low operating costs, ease of connectivity, and minimal harm to the external ecosystem compared to marine aquaculture. Along with this, the availability of abundant freshwater aids in the breeding of popular species such as tilapia, catfish, and carp, thus contributing significantly to enhancing the aquaculture market value. Furthermore, freshwater ecosystems often act as excellent breeding grounds due to the low salinity, simplifying production activities. This aquaculture industry trend supports environmental responsibility by eliminating the need for more exploitation of such vulnerable ecosystems. With the responsible use of freshwater sources, the sector can fulfil market demands while acknowledging the need for resource conservation.

Analysis by Distribution Channel:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

Traditional retail leads the market with around 32% of market share in 2024. The demand for aquaculture is also supported by traditional retail, serving as a cornerstone for market expansion. This sector includes physical stores, fish markets, and local seafood retailers, which have historically been the main suppliers of seafood to consumers. The significance of traditional retail is supported by several factors. Additionally, it offers accessibility and a wide range of seafood selections, from fresh and frozen to processed products. In addition, the opportunity for physical selection of goods enhances consumer confidence in their quality and suitability for consumption. Moreover, traditional retailers often maintain direct trade relations with local producers, ensuring a constant supply of fresh seafood. Through these channels, consumers can purchase quality, environmentally friendly, and locally sourced seafood, aligned with their preferences for freshness and environmental care. Additionally, these factors support the promotion of aquaculture products, raising consumer awareness and encouraging responsible purchasing decisions.

Regional Analysis:

- Asia Pacific

- China

- Indonesia

- India

- Vietnam

- Philippines

- South Korea

- Japan

- Thailand

- Malaysia

- Australia

- Others

- Latin America

- Chile

- Brazil

- Ecuador

- Mexico

- Others

- Europe

- Norway

- Spain

- Russia

- United Kingdom

- France

- Italy

- Greece

- Netherlands

- Ireland

- Denmark

- Germany

- Others

- Middle East and Africa

- Egypt

- Turkey

- Saudi Arabia

- Others

- North America

- United States

- Canada

In 2024, Asia-Pacific accounted for the largest market share of over 90.7%. The Asia Pacific currently holds the most powerful and largest segment in the worldwide aquaculture market. This achievement has been possible due to the extensive and well-developed activities in countries such as China, India, Vietnam, and Indonesia. China, in particular, is a key player in this success, as it actively provides both the Asian and global markets with the products of farming aquatic species. The market spot of the region can be further explained by the optimal climatic and rich biodiversity conditions, as well as the abundant presence of water bodies, which naturally favor aquaculture. Additionally, the majority of governments facilitate this process through financial subsidies and modernization programs, as well as favorable policies create a positive climate for developing the industry. Asia Pacific also has the highest demand for aquatic food, primarily due to cultural and historical background; as the consumption of seafood is generally less stigmatized and more sustainable, the region combines both the highest supply and the most efficient mechanisms of production.

Key Regional Takeaways:

United States Aquaculture Market Analysis

In 2024, United States accounts for over 70% of the aquaculture market in North America. The country focuses on high-value species such as salmon and shrimp, filling local demand for sustainable and locally sourced seafood. Developments such as NOAA's "Aquaculture Opportunity Areas" are promoting offshore aquaculture, and technological breakthroughs such as RAS improve efficiency and mitigate impacts on the environment. Strong consumer demand for high-value seafood products and environmentally responsible practices boosts investment in infrastructure and technology. The U.S. Department of Agriculture invested USD 75 million in research during 2024 to promote sustainable aquaculture practices. Companies such as Cooke Aquaculture and BlueNalu are creating products for changing consumer demands. Although its share in the overall world production is meagre, the US market supports the needs for sustainability and will experience growth as there is increasing awareness about benefits from seafood consumption.

Europe Aquaculture Market Analysis

The region is dominated by Norway and Scotland's salmon production and represents more than 30% of regional production, while France and Spain focus on shellfish culture. Regulatory frameworks such as the EU's Common Fisheries Policy aim to promote sustainability. Organic and sustainably sourced seafood are on increasingly high demand by health-conscious consumers. Climate-resistant aquaculture systems such as recirculating aquaculture systems (RAS) are gaining popularity across Europe. Leaders in the market, such as Mowi and Leroy Seafood Group, are adopting advanced technologies for production and sustainability, and Europe is emerging at a leadership position in the premium aquaculture markets due to focus on innovation and eco-friendly practices.

Asia Pacific Aquaculture Market Analysis

The three countries leading other Asia Pacific nations are China, India, and Indonesia, with their increased seafood export and rising domestic consumption. Over 60% of regional production comes from China, which has adopted integrated multi-trophic aquaculture (IMTA) systems with advanced technology. Government initiatives such as India’s Pradhan Mantri Matsya Sampada Yojana (USD 3 billion investment) are enhancing production capacity and sustainability. Technological innovations, including IoT-based monitoring and AI-driven feed optimization, are transforming the aquaculture landscape. Increasing urbanization and a growing middle-class population are fuelling demand for high-quality seafood. Regional companies, such as Nippon Suisan Kaisha and Thai Union Group, are making massive investments in sustainable practices and innovative farming methods that are further cementing Asia Pacific's hold on global aquaculture.

Latin America Aquaculture Market Analysis

Chile leads with salmon farming, while shrimp export contributes significantly to Ecuador's economy. The regional development in this sector is promoted by the government's investment initiatives. Latin America is gaining immense momentum as a regional player, boasting of high demand for sustainable practices and increasing exports.

Middle East and Africa Aquaculture Market Analysis

Egypt leads with tilapia farming, whereas Saudi Arabia's Vision 2030 aims for 600,000 tons of annual production, which will be supported by USD 200 million investments. Innovations such as RAS and government-backed initiatives such as those in the UAE and Kenya will promote sustainable growth. Increasing demand for protein-rich diets encourages regional aquaculture development.

Competitive Landscape:

Major companies are enhancing market dynamics and growth through strategic actions and innovations. These leading entities in research and development are advancing aquaculture practices, fostering healthier fish, and mitigating environmental impacts. They are pioneers in developing Recirculating Aquaculture Systems (RAS), which are efficient systems that consume less water and recycle it, promoting sustainable aquaculture. Furthermore, these leading firms are venturing into alternative species to meet rapidly changing consumer preferences, thereby appealing to emerging consumer needs and creating new business lines. These aquaculture firms are also addressing global environmental concerns by promoting events and responsible aquaculture certifications. They have expanded their global supply through distribution networks, ensuring a steady supply for seafood consumers. Additionally, these companies are achieving optimal employment levels and training experts to support the sector’s operations in the long run.

The report provides a comprehensive analysis of the competitive landscape in the aquaculture market with detailed profiles of all major companies, including:

- Blue Ridge Aquaculture

- Cermaq Group AS

- Charoen Pokphand Foods PCL

- Cooke Aquaculture

- Grieg Group

- Leroy

- Maruha Nichiro Corporation

- Mowi

- SalMar ASA

- Stehr Group

- Tassal Group

Latest News and Developments:

- May 2025: Thai Union Group secured a landmark USD 150 million Blue Loan from the Asian Development Bank (ADB), the first of its kind in Thailand's seafood industry, to advance sustainable shrimp procurement and climate goals under its SeaChange® 2030 strategy. The loan supports sourcing shrimp certified by Global Sustainable Seafood Initiative-recognized schemes, promoting environmental sustainability and social responsibility. This financing aligns with Thailand’s climate commitments and ADB’s Strategy 2030, emphasizing climate resilience and inclusive development, setting a benchmark for sustainable aquaculture finance.

- April 2025: South Korea’s first land-based salmon farm, operated by Eco Aquafarm in Busan, began operations, aiming to produce 500 tons of Atlantic salmon annually using advanced recirculating aquaculture system (RAS) technology from AKVA group. This marks a major shift from total reliance on imports and supports the nation’s Smart Aquaculture Cluster initiative. The eco-friendly facility, featuring closed-loop filtration and smart monitoring, began stocking eggs in fall 2024, with harvest set for late 2026. Expansion to 5,000 tons and global investment are planned.

- March 2025: Kelly Cove Salmon Ltd. (KCS), a division of Cooke Aquaculture Inc., acquired the defunct Aqua Bounty Canada Inc. operations on Prince Edward Island (PEI). Aqua Bounty specialized in land-based biotech and genetically engineered salmon. KCS plans to use the acquired hatchery and RAS facilities to produce large smolts for its Atlantic Canadian ocean farms. This acquisition supports Cooke’s commitment to sustainable aquaculture, local job creation, and innovation, while expanding its presence and operations in PEI.

- March 2025: Stolt-Nielsen announced significant investments exceeding $400 million to expand and enhance its US operations in liquid logistics and land-based aquaculture. New projects include building a state-of-the-art cleaning facility with water reuse technology and launching CleanRight, an innovative chemical cleaning service. Additionally, Stolt Sea Farm plans to introduce sustainable RAS for responsible seafood farming, reinforcing the company’s commitment to innovation, environmental safety, and growth in the US market.

- February 2025: Lerøy Seafood Group advanced its sustainability goals by integrating chicken meal into fish feed to reduce greenhouse gas emissions by 46% by 2030. Partnering with EWOS and supported by Bellona, Lerøy aims to industrialize by-product utilization, enhancing resource efficiency and fish health. Extensive testing ensures high quality and sustainability standards. Production will begin in spring 2025 with gradual scaling.

Aquaculture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | China, Indonesia, India, Vietnam, Philippines, South Korea, Japan, Thailand, Malaysia, Australia, Chile, Brazil, Ecuador, Mexico, Norway, Spain, Russia, United Kingdom, France, Italy, Greece, Netherlands, Ireland, Denmark, Germany, Egypt, Turkey, Saudi Arabia, United States, Canada |

| Companies Covered | Blue Ridge Aquaculture, Cermaq Group AS, Charoen Pokphand Foods PCL, Cooke Aquaculture, Grieg Group, Leroy, Maruha Nichiro Corporation, Mowi, SalMar ASA, Stehr Group, Tassal Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aquaculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global aquaculture market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aquaculture industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cultivation of aquatic species, such as fish, shellfish, and plants, in regulated settings such as tanks, ponds, or marine enclosures is known as aquaculture. It is employed in the production of food, the restoration of ecosystems, and for economic endeavors such as the trade in ornamental fish. Aquaculture meets the increasing demand for aquatic products worldwide while promoting a sustainable seafood supply by lowering dependency on wild fisheries.

The aquaculture market was valued at 82.8 Million Tons in 2024.

IMARC estimates the global aquaculture market to exhibit a CAGR of 4.03% during 2025-2033.

The increasing population worldwide and demand for protein-rich food sources, exhaustion of wild fish stock on account of overfishing and environmental changes, increasing investments and support from governments for aquaculture development are driving the aquaculture market.

According to the report, freshwater fish represented the largest segment by fish type, driven by their capacity to adapt to a variety of farming environments, reduced production costs, and the strong demand for species such as catfish and tilapia in domestic and international markets.

Fresh water leads the market by environment owing to as it is inexpensive, abundantly available, and appropriate for raising a variety of aquatic species that are highly adopted worldwide, such as carp, tilapia, and catfish.

The traditional retail is the leading segment by distribution channel, driven by its broad availability, consumer confidence, and the ease of instant product availability.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global aquaculture market include Blue Ridge Aquaculture, Cermaq Group AS, Charoen Pokphand Foods PCL, Cooke Aquaculture, Grieg Group, Leroy, Maruha Nichiro Corporation, Mowi, SalMar ASA, Stehr Group, Tassal Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)