Application Transformation Market Size, Share, Trends and Forecast by Service Type, Enterprise Size, End Use Industry, and Region, 2026-2034

Application Transformation Market Size and Share:

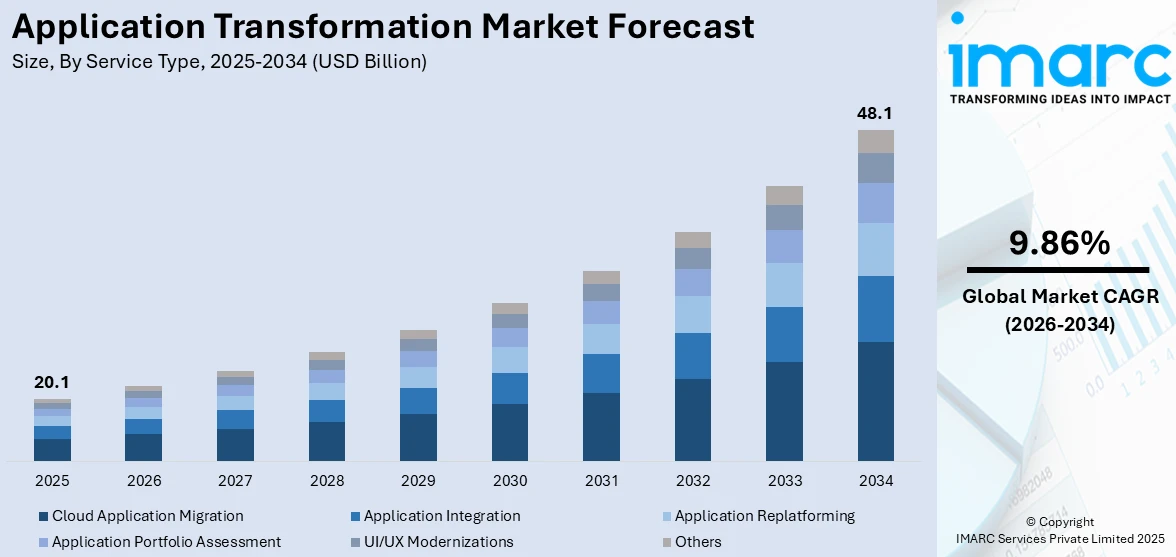

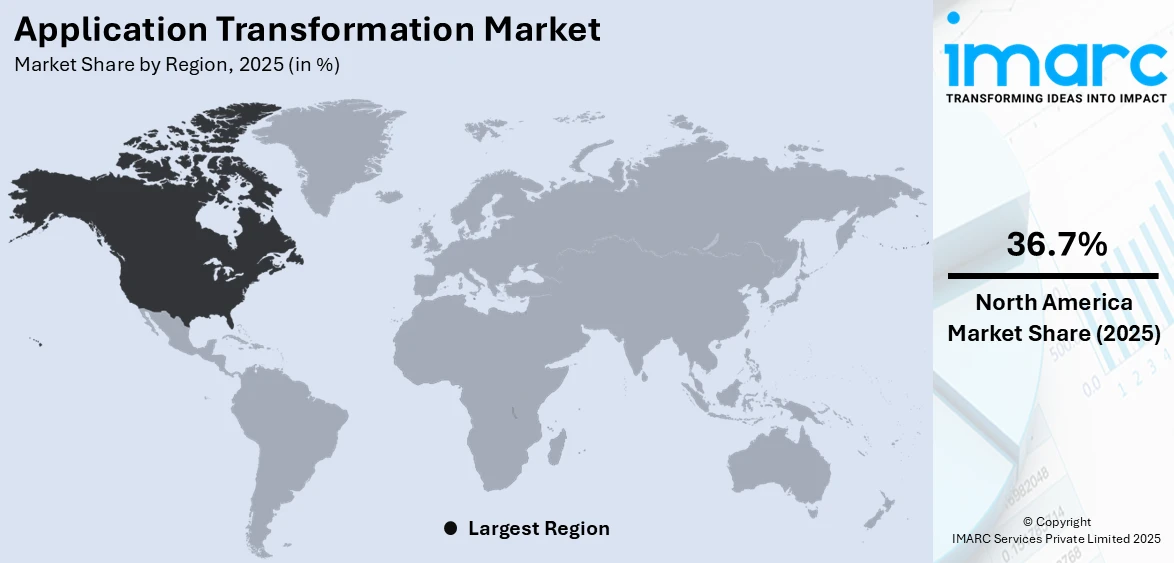

The global application transformation market size was valued at USD 20.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 48.1 Billion by 2034, exhibiting a CAGR of 9.86% from 2026-2034. North America currently dominates the market, holding a market share of over 36.7% in 2025. The application transformation market share is expanding, driven by the escalating need for businesses to align their information technology (IT) infrastructure with market requirements, customer expectations, and regulatory norms, rapid modernization of legacy systems by several organizations, and increasing demand for scalability and flexibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 20.1 Billion |

| Market Forecast in 2034 | USD 48.1 Billion |

| Market Growth Rate (2026-2034) | 9.86% |

The application transformation market is experiencing significant growth as organizations are looking to modernize legacy systems, improve operational efficiency, and migrate towards cloud-based solutions. Enterprises are increasingly shifting from traditional on-premises environment to the cloud, where they can achieve scalability, flexibility, and cost optimization. Migration through the cloud allows organizations to modernize legacy applications, reduce maintenance costs, and enhance system performance. This demand is also driven by the rise in hybrid and multi-cloud strategies that allow businesses to distribute workloads across different cloud environments for better resource utilization and security. Advanced tools and platforms are being offered by cloud service providers that can make application transformation seamless. This further increases the requirement for application transformation services.

To get more information on this market Request Sample

The United States has become a significant area in the application transformation market for multiple reasons. Cloud-based applications allow organizations to optimize operations, lower IT maintenance expenses, and enhance performance. The demand for hybrid and multi-cloud approaches is rising as companies aim to capitalize on the advantages of various cloud providers while maintaining control over their IT settings. The growing use of cloud-native technologies, including serverless computing, Kubernetes, and containerization, is further enhancing application transformation initiatives across various sectors. In 2024, Rancher Government Solutions (RGS) revealed a strategic alliance with Buoyant, the creators of Linkerd, the top open-source service mesh, aimed at secure and interoperable, cloud-native management of Containers and Kubernetes, tailored for the U.S. Government. This collaboration seeks robust, secure, and scalable Kubernetes management solutions designed to meet the rigorous demands of federal agencies.

Application Transformation Market Trends:

Increasing Demand for Scalability and Flexibility

Scalability and flexibility are the leading factors in this global market because businesses are ever-expanding. As the companies grow, so does the amount of work and the need to handle it through IT infrastructure that is efficient and does not sacrifice performance. The global IT services market size reached USD 1,218.6 Billion in 2024. Looking forward, the IMARC Group estimates that the market is expected to reach USD 2,289.3 Billion by 2033, growing at a CAGR of 7.26% during 2025-2033. Scalability is supported through application transformation, where the existing system is restructured to be more adaptive and responsive to business needs. It can support growing user demands, handle peak loads, and enable seamless modifications in business processes through incorporating technologies like microservices and containers. Also, transformed applications offer flexibility; businesses can swiftly adjust to market changes and customer preferences. In an era of rapid digitalization and evolving business landscapes, this flexibility and scalability have become critical for organizations, significantly driving the application transformation market demand.

Growing Threat of Cybersecurity Breaches

Cybersecurity represents a growing concern for businesses that are operating on legacy-based software. Most of the legacy systems now are not so robust in the face of today's sophisticated evolving cyber threats and challenges. When getting into such complex cyber threats and increasing acts of phishing attacks and data breaches, companies have a need to expedite their security solutions. Reports have shown that over 500 Million cyberattacks occurred in Q1 2024. This need is driving the demand for this process to bring state-of-the-art security features into current systems. The applications are being transformed to increase their resilience against cyber-attacks, protect sensitive data, and minimize the risk of business disruption. Moreover, this service also involves updating user access controls and developing more secure coding practices. As cybercrime incidents continue to increase, causing severe financial, operational, and reputational damage, the requirement for stronger security is impelling the application transformation market growth.

Emerging Regulations and Compliance Standards

Another factor driving the global market is emerging regulations and changing compliance standards of industries, such as healthcare, finance, and retail. Legacy systems are usually inadequate in fulfilling all of these regulatory requirements efficiently and put businesses at risk of non-compliance, penalty, and reputational damage. Here, application transformation becomes a strategic necessity for organizations to align their applications, systems, and processes with all current and future regulations. This includes revising data management policies, implementing proper, more advanced controls in access and integrating capabilities that track, report, and audit a data handling practice for compliance with data protection legislations under the GDPR and HIPAA. This way, the incorporation of these services assures businesses of compliance with the law but also contributes to the development of a trusting relationship between businesses and their customers, stakeholders, and regulatory bodies. The global enterprise data management market size has reached USD 85.5 Billion in 2024. Thus, the growing emphasis on regulatory compliance is offering a favorable application transformation market outlook.

Application Transformation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global application transformation market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on service type, enterprise size, and end use industry.

Analysis by Service Type:

- Cloud Application Migration

- Application Integration

- Application Replatforming

- Application Portfolio Assessment

- UI/UX Modernizations

- Others

Cloud application migration stand as the largest component of 2025, holding 36.5% of the market share. Businesses are moving their applications to the cloud for better operational agility and great cost savings. A transition toward remote working creates a need for remote data and application accessibility that accelerates this type of migration. Technological advancements in cloud services continue to motivate enterprises toward optimizing application performance and scalability through the cloud. Cloud migration improves security by taking advantage of innovative protection offered by cloud service providers. Leading cloud providers have mature security frameworks in place that include encryption and continuous monitoring to protect applications and data. Cloud migration helps applications in terms of performance and reliability because cloud providers offer high-speed networking, global data centers, and built-in load-balancing capabilities.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises hold 60.0% of the market share. Large enterprises lead the application transformation market because of their complex IT infrastructure, significant legacy systems, and investment capabilities. These global organizations need applications that are more scalable, more secure, and support digital transformation. Large enterprises are increasingly using cloud-based solutions, microservices architecture, AI-driven automation, and DevOps practices to simplify operations and make business more agile. The demand for application transformation is further driven by the need to comply with regulatory requirements, ensure data security, and integrate smoothly across business units. Companies engaged in finance, healthcare, retail, and manufacturing are predominantly focusing on application modernization to optimize workflows, improve customer engagement, and keep pace within the rapidly evolving digital economy.

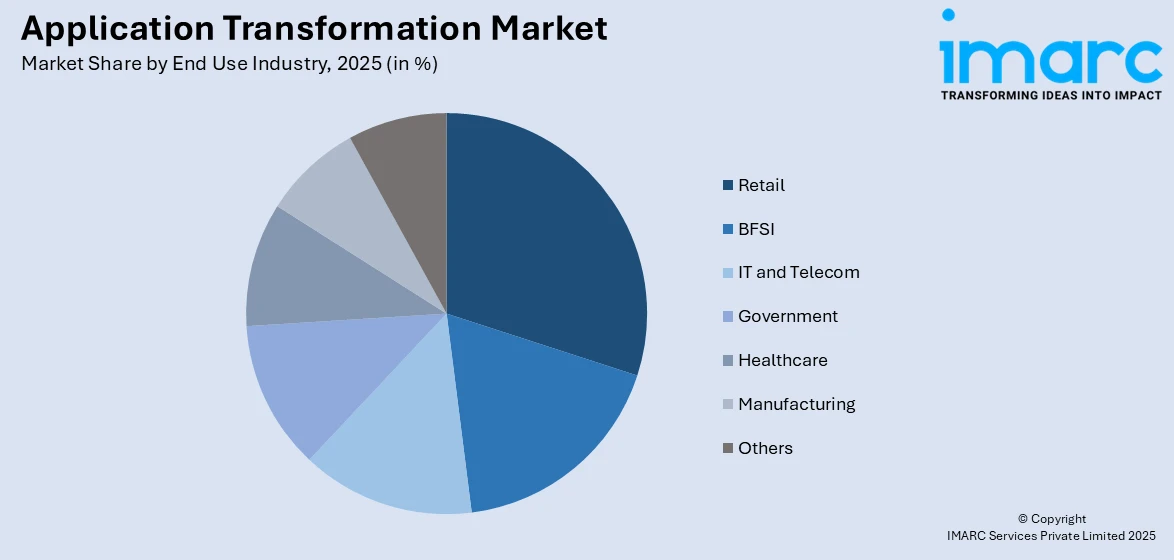

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Government

- Healthcare

- Retail

- Manufacturing

- Others

Retail holds 26.8% of the market share. The growing embrace of Industry 4.0 and smart manufacturing technologies propels the manufacturing sector towards application transformation. Manufacturers need integrated systems for efficient supply chain and inventory management. The necessity for real-time data access to make informed decisions also encourages application transformation in the manufacturing sector. The retail industry is undergoing significant digital transformation, with application modernization playing a crucial role in enhancing e-commerce, supply chain management, and customer experience. Retailers are shifting from traditional legacy systems to cloud-native applications, enabling real-time inventory management, automated demand forecasting, and seamless omnichannel integration. AI-driven analytics and recommendation engines help retailers personalize customer experiences, optimize pricing strategies, and improve targeted marketing efforts.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 36.7%. North America leads in application transformation due to its advanced IT infrastructure and the presence of major technology firms. High adoption rates of new technologies among businesses in North America foster growth in this market segment. Artificial intelligence (AI) and automation are transforming the way organizations approach application modernization. Businesses are leveraging AI-driven tools to enrich application development, optimize workflows, and advance decision-making methods. AI-powered analytics enable enterprises to gain insights into system performance, identify inefficiencies, and predict potential failures before they occur. Automation is also streamlining application transformation initiatives by reducing manual intervention and accelerating deployment processes. DevOps practices, robotic process automation (RPA), and low-code/no-code development platforms are enabling businesses to modernize applications more efficiently. By automating repetitive tasks, enterprises can reduce operational costs, minimize errors, and enhance overall productivity. AI-driven chatbots, virtual assistants, and predictive analytics are also being integrated into modernized applications to improve customer engagement and support services. In 2024, Syntheia Corp., a frontrunner in conversational AI in Canada, reveals that its groundbreaking SaaS platform, aimed at revolutionizing the management of inbound phone calls for businesses, is scheduled to debut in January 2025. Using cutting-edge Natural Language Processing (NLP), Syntheia’s virtual assistants improve communication and productivity aimed at small and medium enterprises (SMEs) within this vast international market.

Key Regional Takeaways:

United States Application Transformation Market Analysis

The United States hold 85.80% of share in North America. The U.S. application transformation market is being significantly influenced by the growing adoption of cloud-based solutions. According to reports, 51% of businesses report using some form of cloud services, including IaaS, PaaS, and SaaS. Furthermore, 21% of businesses utilize IaaS or PaaS to replace or complement their existing IT infrastructure. This shift towards cloud environments is driven by the need for enhanced operational efficiency, scalability, and flexibility, which cloud services provide. As companies look to modernize legacy systems, they are increasingly integrating AI, automation, and machine learning to streamline processes and improve decision-making. The demand for cloud solutions enables businesses to reduce costs and drive innovation, all while maintaining the agility necessary in a rapidly evolving market. Furthermore, legacy system complexity remains a barrier, leading to investments in modernization strategies for improved performance, security, and integration. With a growing emphasis on customer-centric solutions, businesses in sectors like finance, healthcare, and retail are prioritizing the transformation of their applications. Cloud adoption, combined with a focus on data-driven insights and cybersecurity, continues to drive the expansion of the U.S. application transformation market as companies strive to stay competitive and leverage emerging technologies for sustained growth.

Asia Pacific Application Transformation Market Analysis

In APAC, the application transformation market is driven by rapid digitalization, cloud adoption, and evolving consumer expectations. According to industry reports, AI investment in Asia Pacific is expected to surge five-fold, reaching USD 117 Billion by 2030, fueling demand for modernized applications that incorporate AI and automation for enhanced business performance. Enterprises across sectors, such as finance, retail, and manufacturing, are focusing on modernization to improve operational efficiency and meet the growing demand for seamless digital experiences. The region’s shift toward hybrid cloud environments further accelerates the need for application transformation, ensuring scalability and flexibility. Moreover, businesses are increasingly prioritizing cybersecurity and regulatory compliance, especially in countries like China and India. With a growing emphasis on data analytics, real-time insights, and customer-centric solutions, organizations in APAC are adopting advanced technologies to stay competitive, driving substantial growth in the application transformation market.

Europe Application Transformation Market Analysis

Europe’s application transformation market is driven by digitalization, cloud adoption, and the need for improved security. According to an article by AAG, 32% of UK businesses reported experiencing a cyber attack or breach in 2023, with the figure rising to 59% for medium-sized businesses and 69% for large businesses. This surge in cybersecurity incidents is spurring organizations to prioritize the modernization of their applications to bolster security and compliance with regulations such as GDPR. The adoption of agile methodologies, cloud technologies, and AI is enabling companies to transform their legacy systems for enhanced performance and resilience. Additionally, the increasing complexity of cybersecurity threats and the growing need for real-time data analytics have accelerated investments in application transformation. As industries like finance, healthcare, and manufacturing prioritize innovation and customer-centric strategies, application modernization becomes essential for ensuring competitive advantage and operational efficiency. The rising demand for mobile-first, cloud-native applications further emphasizes the need for robust, flexible, and secure platforms in the evolving digital landscape.

Latin America Application Transformation Market Analysis

In Latin America, the application transformation market is being driven by the heightened acceptance of cloud technologies and the need for enhanced cybersecurity. The cybersecurity market in the region is expected to grow at a CAGR of 7.30% from 2024 to 2032, reflecting heightened awareness of security risks and the demand for more secure systems. Businesses are prioritizing the modernization of applications to safeguard sensitive data, comply with regulations, and enhance operational efficiency. As companies across sectors such as finance and retail prioritize digital transformation, the demand for secure and scalable cloud-native solutions is fueling growth in the market.

Middle East and Africa Application Transformation Market Analysis

In the Middle East, the application transformation market is increasingly driven by cybersecurity concerns. According to reports, 82% of organizations in the region and Türkiye reported experiencing at least one cybersecurity incident between 2022 and 2024, with the majority facing multiple attacks. This growing threat landscape is prompting businesses to modernize their applications to improve security and protect sensitive data. As organizations shift towards cloud-based and AI-driven solutions, enhancing application security becomes crucial. These factors, combined with the demand for operational agility and regulatory compliance, continue to fuel the region’s application transformation market.

Competitive Landscape:

In the dynamic landscape of the global application transformation market, key players are implementing multifaceted strategies to enhance their business operations and maintain a competitive edge. Leading companies are heavily investing in technological advancements to modernize legacy systems and integrate AI into their offerings. For instance, companies are transitioning from traditional data center-based sales to cloud subscriptions, with only a third of its customers having moved to the cloud, indicating significant growth potential. Forming strategic partnerships and pursuing acquisitions are pivotal strategies for market leaders aiming to broaden their service offerings and enter new markets. Companies are also focusing on expanding their market presence and diversifying their service portfolios to cater to a broader client base. Despite the advancements, financial services firms globally are undertaking extensive technology transformation efforts but often face significant cost overruns and delays.

The report provides a comprehensive analysis of the competitive landscape in the application transformation market with detailed profiles of all major companies, including:

- Accenture plc

- Atos SE

- Capgemini SE

- Cognizant

- Fujitsu Limited

- HCL Technologies Limited (HCL Enterprise)

- Infosys Limited

- International Business Machines Corporation

- Micro Focus International plc

- Microsoft Corporation

- Oracle Corporation

- Tata Consultancy Services Limited

- Unisys Corporation

Latest News and Developments:

- January 2025: IBM declared strategies to acquire Applications Software Technology LLC, a major Oracle consultancy. The acquisition aims to enhance IBM’s Oracle Cloud capabilities, particularly in the public sector, addressing challenges such as legacy system transitions, security, and compliance. Applications Software Technology specializes in Oracle Fusion Cloud ERP, HCM, EPM, OCI, JD Edwards, and NetSuite, with additional expertise in Salesforce and MuleSoft.

- December 2024: Sonata Software has launched IntellQA, an AI-powered testing automation platform aimed at enhancing software delivery for enterprises. Addressing challenges like fragmented tools, high framework costs, and frequent script maintenance, IntellQA leverages AI/ML to improve test coverage and streamline Agile and DevOps adoption. It integrates with enterprise tools, including Jira, Azure DevOps, Xray, and CI/CD pipelines, enabling faster, high-quality software delivery.

- June 2023: Accenture plc invested USD 3 Billion in AI, to create accelerators for data and AI readiness across 19 distinct industries as well as pre-built industry and functional models that take advantage of new generative AI capabilities. The Data & AI practice will double its AI talent to 80,000 professionals through a mix of hiring, acquisitions and training.

- July 2023: Atos announced their successful delivery of data-driven digital services for the European Games 2023, which took place between June 21 and July 2, 2023 in Kraków and the regions of Malopolska and Silesia in Poland. For the third edition of the European Games, Atos served as the IT integrator, responsible for securely capturing, processing and distributing data for all sports events.

- May 2023: Capgemini announced the launch of a 6G research lab in Gurugram, India. The lab will build advanced test beds and simulators to explore use cases for next generation wireless networks, 6G ideation, and the creation of energy saving solutions.

Application Transformation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Cloud Application Migration, Application Integration, Application Replatforming, Application Portfolio Assessment, UI/UX Modernizations, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| End Use Industries Covered | BFSI, IT and Telecom, Government, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Atos SE, Capgemini SE, Cognizant, Fujitsu Limited, HCL Technologies Limited (HCL Enterprise), Infosys Limited, International Business Machines Corporation, Micro Focus International plc, Microsoft Corporation, Oracle Corporation, Tata Consultancy Services Limited, Unisys Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the application transformation market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global application transformation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the application transformation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The application transformation market was valued at USD 20.1 Billion in 2025.

The application transformation market is projected to exhibit a CAGR of 9.86% during 2026-2034, reaching a value of USD 48.1 Billion by 2034.

The market is driven by the rapid modernization of legacy systems, increasing adoption of cloud computing, demand for scalability and flexibility, rising cybersecurity threats, and stringent regulatory compliance requirements. The shift towards hybrid and multi-cloud environments, AI-driven automation, and microservices architecture further accelerate market growth.

North America currently dominates the application transformation market, accounting for a share of 36.7% in 2025. The region’s leadership is driven by strong cloud adoption, advanced IT infrastructure, rising cybersecurity concerns, and investments in AI-driven automation for application modernization.

Some of the major players in the application transformation market include Accenture plc, Atos SE, Capgemini SE, Cognizant, Fujitsu Limited, HCL Technologies Limited (HCL Enterprise), Infosys Limited, International Business Machines Corporation, Micro Focus International plc, Microsoft Corporation, Oracle Corporation, Tata Consultancy Services Limited, Unisys Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)