Application Specific Integrated Circuit Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Application Specific Integrated Circuit Market Size and Share:

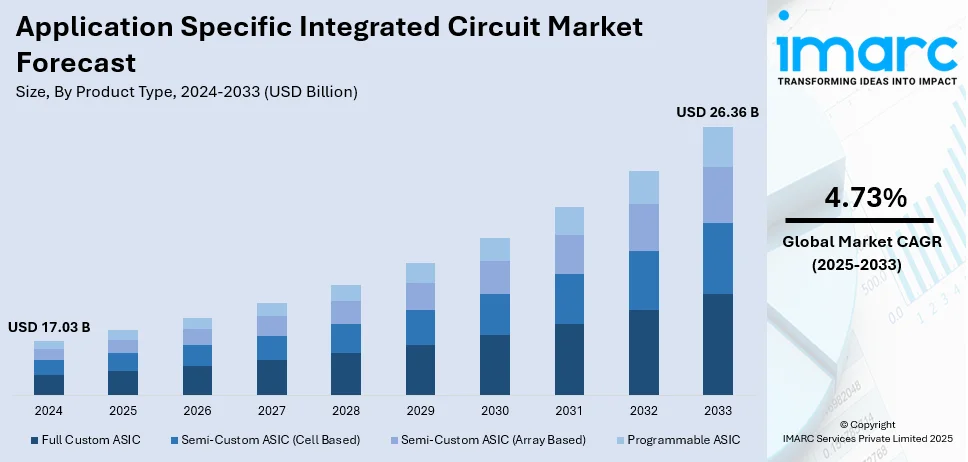

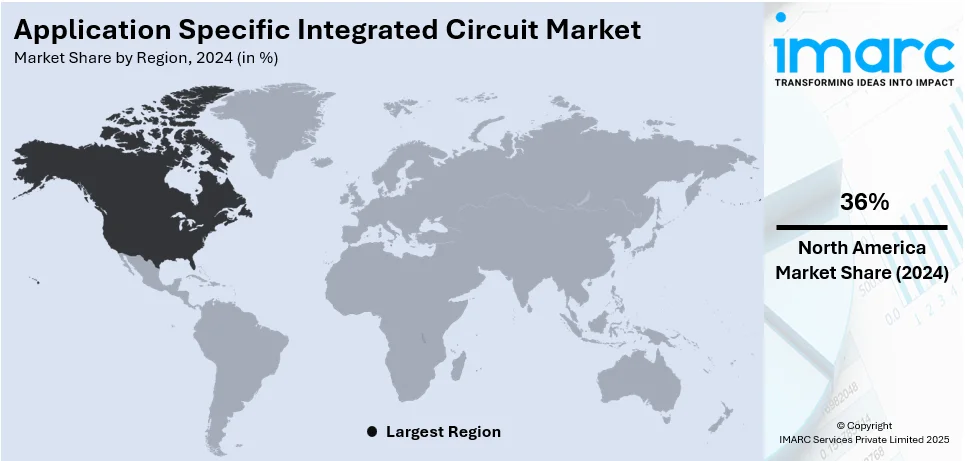

The global application specific integrated circuit market size was valued at USD 17.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 26.36 Billion by 2033, exhibiting a CAGR of 4.73% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36% in 2024. The market is witnessing significant growth driven by the rising utilization of various smart electronic devices, growing popularity of smartwatches for real-time tracking of physical activities and increasing adoption of mechatronics across industrial and automotive applications. The escalating demand for ASIC in consumer electronics and telecommunication equipment is expanding the application specific integrated circuit market share driving growth across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.03 Billion |

| Market Forecast in 2033 | USD 26.36 Billion |

| Market Growth Rate (2025-2033) | 4.73% |

The Application-Specific Integrated Circuit (ASIC) market is driven by the increasing demand for customized, high-performance and energy-efficient semiconductor solutions across industries. Growth in consumer electronics, automotive, telecommunications and industrial automation is fueling ASIC adoption. For instance, in November 2023, Alchip Technologies launched an advanced Automotive ASIC platform at the Design Solutions Forum, enhancing automotive IC production. The platform features six specialized modules that improve ADAS and autonomous vehicle technologies. The rise of AI, IoT and 5G technologies is further accelerating demand for high-speed processing and low-power consumption. Additionally, advancements in chip design and fabrication enable cost-effective compact solutions tailored for specific applications. The expansion of data centers, blockchain and autonomous vehicles is also boosting ASIC development.

The U.S. Application-Specific Integrated Circuit (ASIC) market is driven by rising demand for customized, high-performance semiconductors in AI, IoT, 5G, and cloud computing. Growth in automotive electronics, including EVs and autonomous vehicles, is fueling ASIC adoption. Expanding data centers and blockchain applications further boost demand for power-efficient, high-speed processors. The rapid expansion of 5G infrastructure is further accelerating ASIC adoption, as telecom companies seek high-performance, low-power chips for network optimization. For instance, the FCC's 2024 report reveals significant U.S. investment in 5G networks totaling $30.2 billion in 2023. Major providers, including AT&T, T-Mobile and Verizon expanded coverage to 97% of the population. Innovative technologies like Massive MIMO and Open RAN are enhancing capacity, speed, and user experience across the network. Additionally, government initiatives supporting domestic semiconductor manufacturing, along with advancements in chip design and fabrication technologies, enhance market growth. The defense and aerospace sectors also contribute to ASIC innovation in the U.S.

Application Specific Integrated Circuit Market Trends:

Increasing Product Demand in Consumer Electronics and Diverse Industry Applications

The growing demand for consumer electronics, including smartphones, smartwatches, and tablets, is driving market expansion. An Application-Specific Integrated Circuit (ASIC) is a type of integrated circuit specifically designed for a particular application or function. These circuits enable a complete integration of the entire system by combining the capabilities of several smaller and medium-sized integrated circuits into one chip, ensuring compatibility with system needs. Consequently, integrated circuits find widespread use across various industries, including medical, telecommunications, automotive, and electrical electronics. In the automotive industry, the increasing implementation of advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies is heightening the need for specialized chips. According to industry reports, Japan's automotive sector produced approximately 7.77 million passenger vehicles in 2023, featuring a range of electric and technologically advanced models. Additionally, the rising need for application-specific integrated circuits (ASICs) in telecommunications and consumer electronics is fueled by the demand for high-efficiency, compact, and customizable solutions.

Growing Customization, Efficiency, and High-Volume Production Needs

Application-specific integrated circuits (ASICs) are customized integrated circuits (ICs) designed to meet certain criteria specifically. The IC is built and designed with applications and requirements in mind. ASIC is highly recommended for high volume production; therefore, it is widely utilized in several industries, such as manufacturing, automotive, and industrial, among others. For example, in January 2025, Infineon launched new EiceDRIVER™ isolated gate driver ICs specifically designed for traction inverters in electric vehicles. These devices, which support IGBT and SiC technologies and are AEC-qualified as well as ISO 26262-compliant, enhance the performance of HybridPACK™ Drive G2 Fusion modules, allowing high-performance inverters of up to 300 kW with advanced safety and monitoring capabilities. Japan’s automotive sector, producing approximately 9 million vehicles in 2023, further highlights the growing demand for efficient and specialized chip solutions. Application-specific integrated circuits are valuable as they can perform multiple functions on a single chip, which is expected to drive interest in ASICs and positively influence the ASIC market landscape.

Increasing usage of ASIC technology in aerospace applications

ASICs are increasingly being utilized in various aircraft applications, such as managing cockpit illumination to adapt from daylight to night vision, implementing onboard data handling protocols, and processing accelerometer data with high speed and precision for inertial steering. Consequently, the anticipated rise in the adoption of ASIC technology within the aerospace sector is expected to boost the market throughout the forecast period. Additionally, field programmable gate arrays (FPGAs) offer significant advantages for logical solutions in aeronautics, including impressive performance and robust IP-like microprocessors along with memory interfaces within programmable devices, making them more attractive for aerospace use. Furthermore, ASIC chips play a key role in aviation and marine security identification by ensuring that individuals have successfully undergone security screening. Several companies specialize in manufacturing ASICs specifically for the aerospace industry. For example, Honeywell International Inc. has developed custom ASICs capable of accommodating up to 15 million gates. Furthermore, supportive government regulations are encouraging the adoption of advanced technologies, which is helping to foster growth in the aerospace sector and drive recent advancements in the application-specific integrated circuit market.

Application Specific Integrated Circuit Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type and application.

Analysis by Product Type:

- Full Custom ASIC

- Semi-Custom ASIC (Cell Based)

- Semi-Custom ASIC (Array Based)

- Programmable ASIC

Semi-custom ASIC (cell based) leads the market with around 49.8% of market share in 2024. In the semi-custom ASIC market, the cell-based sub-category holds the largest share, making up the majority of global revenue. This dominance is due to its digital logic and electrical characteristics, such as inductance and capacitance, which lead to enhanced electrical performance and greater component density. Additionally, the integration of advanced static random-access memory and internet protocol cores adds to the versatility of cell-based ASICs, enabling their use across a diverse range of products, regardless of design complexity, and ensuring smooth system operation. Unlike fully custom ASICs, cell-based semi-custom ASICs utilize pre-designed logic cells, which helps to lower development time and expenses. This method strikes a balance between customization and cost-effectiveness, presenting an appealing option for companies seeking tailored solutions without the high costs typically associated with full custom designs, thereby reinforcing their market leadership.

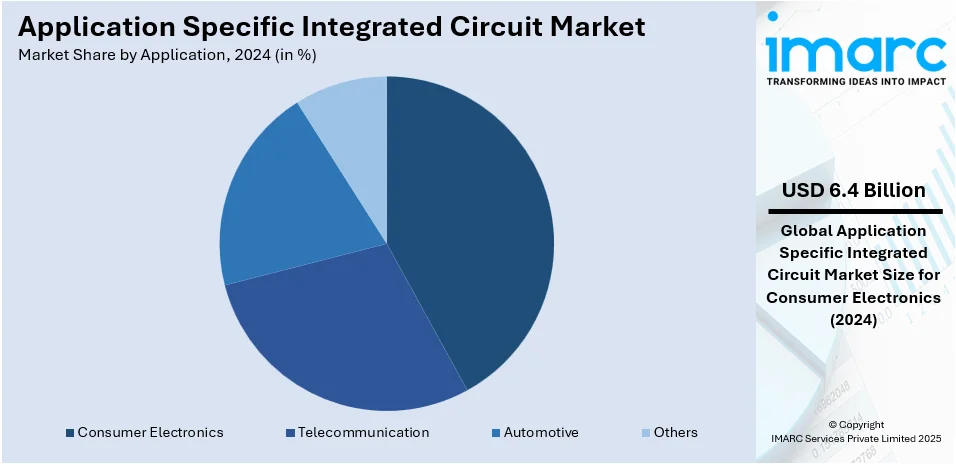

Analysis by Application:

- Telecommunication

- Automotive

- Consumer Electronics

- Others

Consumer electronics leads the market with around 37.6% of market share in 2024. The consumer electronics industry holds the largest market share and contributes to the positive application specific integrated circuit market outlook. This sector is set to offer significant growth prospects for all participants in the value chain, mainly due to the rising adoption of application-specific integrated circuits (ASICs) in smartphones, tablets, and laptops globally. ASICs offer various advantages, such as reduced power consumption, enhanced IP security, compact form factors, and greater bandwidth. These integrated circuits are extensively utilized across different industries, including telecommunications, healthcare, and industrial applications, in addition to consumer electronics. Furthermore, the fast-paced innovation cycle in consumer electronics creates a demand for customized solutions that provide specific functionalities, like superior graphics, high-speed connectivity, and improved battery performance. The large-scale production and widespread adoption of consumer electronics further amplify the application specific integrated circuit market demand in this segment, solidifying its position as the largest market share holder.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36%. The North America region has positioned itself as a leading player in the application specific integrated circuit (ASIC) market, experiencing substantial revenue growth during the forecast period. This substantial increase can be linked to several critical factors driving the demand for ASICs in the region. There is an increasing need for energy-efficient devices, spurred by rapid economic advancement and industrial development. Additionally, the rise in smartphone usage within the region is playing a significant role in expanding the market. The growing prevalence of these devices fosters a favorable environment for the growth of the ASIC market. Other contributing factors include ongoing digitization efforts, a surge in the adoption of advanced technology, innovations in automotive electronics, and an increasing demand for miniaturization.

Key Regional Takeaways:

United States Application Specific Integrated Circuit Market Analysis

In 2024, the United States accounted for over 85.50% of the application specific integrated circuit market in North America. Rising demand from many sectors, including telecommunications, automotive, and consumer electronics, is rapidly expanding the application-specific integrated circuits (ASICs) market in the United States. According to the Semiconductor Industry Association, the U.S. semiconductor market stood at around USD 250 billion as of 2023. Electric vehicles (EVs) constitute a considerable proportion of the demand for specialized chips, with almost 1.2 million-electric vehicles sold in the U.S. in 2023 accounting for 7.6% of total vehicle sales. High-tech industries push growth with innovation such as 5G technology and data centers. They are duty-bound to the big names in the market, like Intel, NVIDIA, and Qualcomm, to ensure U.S.-matched global competitiveness. Federal policy encouraging semiconductor manufacturing is boosting in-country capacity building and positioning the U.S. high and above the pack in the ASICs industry.

Europe Application Specific Integrated Circuit Market Analysis

The European application-specific integrated circuits (ASICs) industry is evolving with the region's drive for technological advancement in automobile and industrial industries. Industrial reports indicate that, in 2023, electric vehicle (EV) sales in Europe recorded substantial growth. Data shows that more than 1.84 million battery electric vehicles (BEVs) were sold and captured 16% of the entire market share (Inside-Evs.com). This means that the use of EVs is impacting demand for specialized chips, such as ASICs, as car manufacturers implement sophisticated semiconductor technologies for efficiency and automation. Germany and France are at the forefront of autonomous driving projects, which further propels ASIC development. European semiconductor companies, such as Infineon and STMicroelectronics, are investing in next-generation chip design to improve vehicle safety and connectivity. Government policies backing domestic semiconductor production are consolidating Europe's role in ASIC innovation.

Asia Pacific Application Specific Integrated Circuit Market Analysis

Asia Pacific application-specific integrated circuits (ASICs) market is growing on account of innovations in automotive, telecom, and consumer electronics. The strong automobile sector of Japan is one of the major ASIC demand drivers. As per industrial reports, during 2023, Japan manufactured about 7.77 million passenger vehicles, which was a growth from about 6.57 million units the previous year. The aggregate home production quantity, including buses and trucks, reached about 9 million units. The increasing convergence of advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies is propelling the use of ASICs in the automotive industry. China, on the other hand, continues to be a significant consumer of semiconductors with rising investments in ASICs for telecommunications and AI-based applications. India is also becoming a semiconductor hotspot as government support encourages chip production locally. Regional competitors are reinforcing their supply chains in order to decrease dependence on imports, making Asia Pacific a prime competitor in the global ASIC industry.

Latin America Application Specific Integrated Circuit Market Analysis

Latin America's ASICs market is increasing steadily due to investments in automotive electronics, telecom, and industrial use. Brazil, the largest economy in the region, has seen an increasing demand for niche chips, especially in the automotive industry. According to industrial reports, Brazil's automotive sector in 2022 manufactured over 2 million vehicles, translating into the demand for high-performance ASICs. The expansion of the region's digital infrastructure and mobile connections are also driving the market. Mexico is rapidly emerging as a hub for semiconductor production, which is consolidating the regional supply chain, says an industrial report. Local producers are increasingly turning their attention to partnerships with foreign players to introduce advanced ASIC technologies to the region.

Middle East and Africa Application Specific Integrated Circuit Market Analysis

The Middle East and Africa's market for ASICs is expanding based on the evolution of technology in industries such as telecommunications, defense, and automobiles. Saudi Arabia's expenditure in defense and technology was around USD 40 billion in 2022, says the International Trade Administration, and this is reflecting on the demand for customized integrated circuits. In Africa, nations such as South Africa are embracing ASICs for telcos and auto industries, while the auto industry targets electric vehicles and intelligent technology. In the Middle East, emphasis on digital transformation in nations such as the UAE is influencing investment in leading-edge ASIC solutions, further advancing the region in the global semiconductor landscape.

Competitive Landscape:

Prominent application specific integrated circuit companies are reputed entities that are actively focusing on research and development initiatives to strengthen their market presence. Prominent application-specific integrated circuit (ASIC) companies are investing in advanced design technologies and expanding their production capacities to ensure market growth. They are focusing on developing more energy-efficient and high-performance ASICs to cater to the growing demand in sectors like consumer electronics, automotive, and telecommunications. Additionally, these companies are forming strategic partnerships and collaborations with industry leaders to enhance their design capabilities and accelerate time-to-market for new products. By adopting flexible and scalable manufacturing processes, they are also reducing production costs and improving accessibility for a wider range of customers, including smaller companies. They are also forming strategic partnerships with other tech firms and industry leaders for expanding market reach thereby contributing to application specific integrated circuit market revenue.

The report provides a comprehensive analysis of the competitive landscape in the application specific integrated circuit market with detailed profiles of all major companies, including:

- Analog Devices Inc.

- Infineon Technologies AG

- Intel Corporation

- Maxim Integrated Products Inc.

- NXP Semiconductors N.V.

- ON Semiconductor

- Qualcomm Incorporated

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

Latest News and Developments:

- January 2025: Infineon launched new EiceDRIVER™ isolated gate driver ICs specifically designed for traction inverters in electric vehicles. These devices, which are AEC-qualified and compliant with ISO 26262, support both IGBT and SiC technologies. They enhance HybridPACK™ Drive G2 Fusion modules, allowing for high-performance inverters up to 300 kW, featuring advanced safety and monitoring capabilities.

- December 2024: Onsemi announced its acquisition of Qorvo’s SiC JFET technology business, including United Silicon Carbide, for USD 115 million. This strategic move boosts Onsemi’s EliteSiC portfolio, improving AI data center power efficiency and facilitating the use of this technology in EV battery disconnects and solid-state circuit breakers.

- September 2024: Intel secured up to USD 3 billion in CHIPS Act funding for its Secure Enclave program, which bolsters semiconductor manufacturing in the U.S. This initiative complements Intel’s collaborations with the DoD through SHIP and RAMP-C, aimed at ensuring a secure domestic chip supply and advancing Intel Foundry’s 18A process for high-volume production by 2025.

- August 2024: Texas Instruments (TI) entered into a preliminary agreement to obtain up to USD 1.6 billion in funding from the CHIPS and Science Act. This investment will facilitate the construction of three 300mm semiconductor wafer fabs in Texas and Utah. TI plans to boost its analog and embedded processing semiconductor capacity, aiming for additional investments totaling USD 18 billion by 2029.

- September 2023: Intel announced its plans to create an application-specific integrated circuit (ASIC) accelerator intended to minimize the performance overhead linked to fully homomorphic encryption (FHE). Additionally, the company is set to launch a beta version of an encrypted computing software toolkit for developers later this year.

Application Specific Integrated Circuit Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Full Custom ASIC, Semi-Custom ASIC (Cell Based), Semi-Custom ASIC (Array Based), Programmable ASIC |

| Applications Covered | Telecommunication, Automotive, Consumer Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc., Infineon Technologies AG, Intel Corporation, Maxim Integrated Products Inc., NXP Semiconductors N.V, ON Semiconductor, Qualcomm Incorporated, Renesas Electronics Corporation, STMicroelectronics N.V, Texas Instruments Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the application specific integrated circuit market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global application specific integrated circuit market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the application specific integrated circuit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The application specific integrated circuit market was valued at USD 17.03 Billion in 2024.

IMARC estimates the application specific integrated circuit market to reach USD 26.36 Billion by 2033, exhibiting a CAGR of 4.73% during 2025-2033.

The application specific integrated circuit market is driven by rising demand for high-performance, power-efficient chips in consumer electronics, automotive, AI, IoT, and 5G networks. Growth in data centers, blockchain, and industrial automation, along with advancements in chip design and fabrication technologies, further accelerates market expansion.

North America currently dominates the market. North America accounted for the largest market share, driven by strong demand for AI, IoT, 5G, automotive, and data center applications.

Some of the major players in the application specific integrated circuit market include Analog Devices Inc., Infineon Technologies AG, Intel Corporation, Maxim Integrated Products Inc., NXP Semiconductors N.V, ON Semiconductor, Qualcomm Incorporated, Renesas Electronics Corporation, STMicroelectronics N.V, Texas Instruments Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)