Anxiety Disorders Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

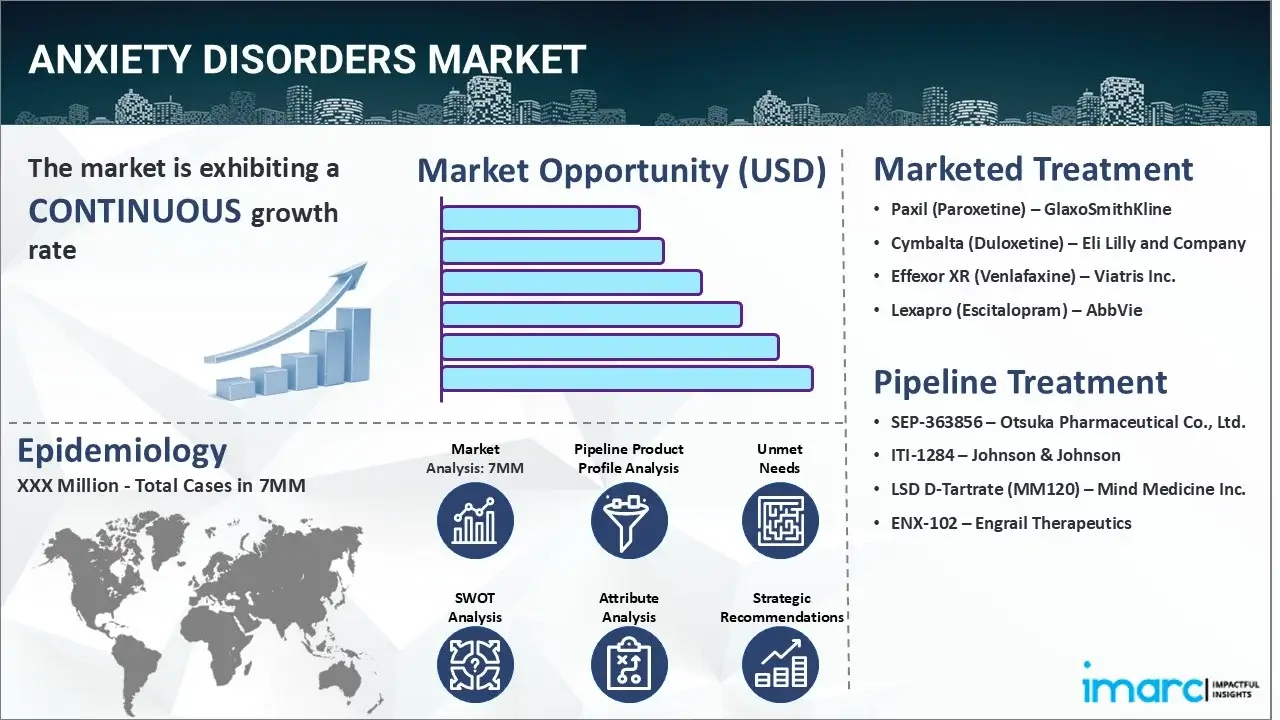

The top 7 (US, EU4, UK, and Japan) anxiety disorders markets are expected to exhibit a CAGR of 3.13% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Growth Rate (2025-2035)

|

3.23% |

The anxiety disorders market has been comprehensively analyzed in IMARC's new report titled "Anxiety Disorders Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Anxiety disorders refer to a group of mental health conditions characterized by excessive and persistent feelings of fear, worry, or anxiety that significantly interfere with daily life. Various other symptoms include restlessness, irritability, difficulty concentrating, muscle tension, sleep disturbances, feelings of impending doom or danger, etc. Additionally, numerous physical indications, such as a rapid heartbeat, shortness of breath, chest pain, dizziness, sweating, trembling, gastrointestinal distress, etc., may also be present. Individuals suffering from the disorders may have a heightened sensitivity to perceived threats, exhibit hypervigilance, and have an exaggerated startle response. These symptoms can significantly impact daily functioning, relationships, and overall well-being. The diagnosis of anxiety disorders typically begins with a thorough assessment of the patient's symptoms and medical history. The healthcare providers may use standardized questionnaires or interviews to gather information about the nature and severity of the anxiety indications. They will also explore any possible triggers or situations that elicit anxiety. In addition to this, numerous physical examinations and laboratory tests may be conducted to rule out other medical conditions that could contribute to the symptoms.

To get more information on this market, Request Sample

The increasing cases of imbalances in certain neurotransmitters, such as serotonin, norepinephrine, gamma-aminobutyric acid (GABA), etc., which play a role in regulating mood, emotions, and the body's stress response, are primarily driving the anxiety disorders market. In addition to this, the rising prevalence of various risk factors, including traumatic or stressful life events, distorted thinking patterns, specific personality traits like high levels of neuroticism, etc., is also creating a positive outlook for the market. Moreover, the widespread adoption of effective medications, such as selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs), for regulating mood and reducing anxiety is further bolstering the market growth. Apart from this, the inflating application of cognitive behavioral therapy, which focuses on identifying and challenging negative thought patterns that cause anxiety and replacing them with more positive ones, is acting as another significant growth-inducing factor. Additionally, the emerging popularity of mindfulness-based stress reduction techniques to treat the condition on account of their numerous associated benefits, including enhanced emotional regulation skills, increased resilience, alleviated anxiety symptoms, improved overall well-being, etc., is expected to drive the anxiety disorders market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the anxiety disorders market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for anxiety disorders and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the anxiety disorders market in any manner.

Key Highlights:

- Anxiety disorders are the most frequent mental disorder, affecting an estimated 4% of the world's population.

- Anxiety disorders are more common in women, with the maximum frequency occurring after midlife.

- According to the Centers for Disease Control and Prevention, nearly 9% of children between the ages of three and seventeen suffer from anxiety disorders.

- As per large population-based surveys, up to 33.7% of the population are affected by an anxiety disorder during their lifetime.

- Portugal has the highest prevalence of anxiety disorders, followed by Brazil, Iran, and New Zealand.

Drugs:

Paroxetine is a selective serotonin reuptake inhibitor (SSRI) and so classified as an antidepressant. It is FDA-approved for treating major depressive disorder, social anxiety disorder, and generalized anxiety disorder. Paroxetine is taken orally. In addition to conventional tablets, it comes in a controlled-release tablet and liquid form. Paroxetine can be administered at any time of day, depending on tolerability.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the anxiety disorders market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the anxiety disorders market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current anxiety disorders marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Paxil (Paroxetine) | GlaxoSmithKline |

| Cymbalta (Duloxetine) | Eli Lilly and Company |

| Effexor XR (Venlafaxine) | Viatris Inc. |

| Lexapro (Escitalopram) | AbbVie |

| SEP-363856 | Otsuka Pharmaceutical Co., Ltd. |

| ITI-1284 | Johnson & Johnson |

| LSD D-Tartrate (MM120) | Mind Medicine Inc. |

| ENX-102 | Engrail Therapeutics |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Anxiety disorders market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Anxiety disorders across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Anxiety disorders across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of anxiety disorders across the seven major markets?

- What is the number of prevalent cases (2019-2035) of anxiety disorders by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of anxiety disorders by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of anxiety disorders by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with anxiety disorders across the seven major markets?

- What is the size of the anxiety disorders patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend of anxiety disorders?

- What will be the growth rate of patients across the seven major markets?

Anxiety Disorders: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for Anxiety disorders drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the Anxiety disorders market?

- What are the key regulatory events related to the Anxiety disorders market?

- What is the structure of clinical trial landscape by status related to the Anxiety disorders market?

- What is the structure of clinical trial landscape by phase related to the Anxiety disorders market?

- What is the structure of clinical trial landscape by route of administration related to the Anxiety disorders market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)