Antihypertensive Drugs Market Size, Share, Trends and Forecast by Therapeutic Class, Type, Distribution Channel, and Region, 2025-2033

Antihypertensive Drugs Market Size and Share:

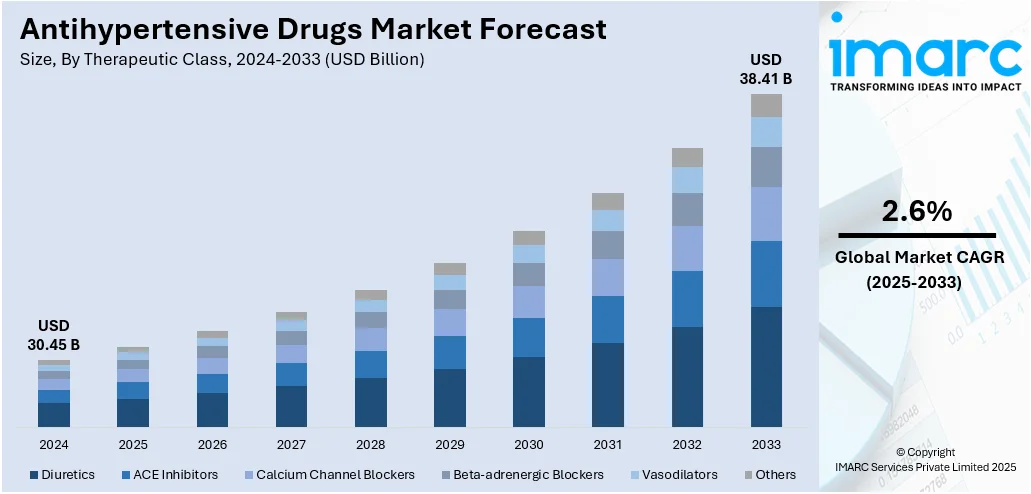

The global antihypertensive drugs market size was valued at USD 30.45 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 38.41 Billion by 2033, exhibiting a CAGR of 2.6% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 40.2% in 2024. The market is expanding due to the growing prevalence of hypertension and increased awareness of early diagnosis. In addition, improved access to affordable generics and combination therapies continues to support antihypertensive drugs market share across hospitals, clinics, and retail pharmacies worldwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 30.45 Billion |

|

Market Forecast in 2033

|

USD 38.41 Billion |

| Market Growth Rate 2025-2033 | 2.6% |

Fixed-dose combination (FDC) therapies are being increasingly preferred in the treatment of hypertension, offering clinical and economic advantages. These formulations simplify dosing and support long-term adherence by combining multiple antihypertensive agents in a single tablet. This approach is especially helpful for patients requiring multiple medications to achieve target blood pressure levels. Healthcare systems are recognizing the role of FDCs in reducing cardiovascular events by improving treatment consistency. Regulatory approvals for combination drugs have increased in recent years, expanding availability. As health providers aim to optimize patient compliance, FDC therapies are playing a greater role in the global antihypertensive drugs market growth.

To get more information on this market, Request Sample

In the United States, digital integration is transforming hypertension care. Devices such as Bluetooth-enabled blood pressure monitors, mobile health apps, and telemedicine platforms are helping physicians track real-time patient data. These tools support proactive intervention and reduce hospital visits, particularly for older adults managing chronic conditions. Insurers are also covering remote monitoring services under value-based care models, boosting adoption. Patients benefit from personalized alerts, reminders, and feedback, improving medication adherence. As digital health infrastructure continues to expand, the US market is seeing a shift toward more connected, technology-supported hypertension treatment strategies, reinforcing the demand for consistent and reliable drug therapies.

Antihypertensive Drugs Market Trends:

Increasing Prevalence of Hypertension

The global burden of hypertension continues to rise, with the World Health Organization (WHO) reporting in 2023 that approximately 1.28 Billion adults aged 30–79 years are living with the condition. This growing prevalence is a central factor driving the expansion of the antihypertensive drugs market. As awareness increases regarding the long-term risks of uncontrolled blood pressure including stroke, myocardial infarction, and renal impairment more individuals are participating in routine health screenings. This trend has led to earlier diagnosis and timely therapeutic intervention, significantly boosting demand for pharmacological treatments. Hypertension is largely a chronic and progressive condition, requiring sustained management throughout a patient’s life. Consequently, once diagnosed, individuals typically require long-term medication regimens to maintain optimal blood pressure levels. This creates a recurring and stable demand base for antihypertensive therapies. The market is further supported by public health initiatives and government-led screening programs in both developed and emerging economies. These initiatives emphasize preventive care and early treatment, which in turn contribute to a continuous increase in prescription volumes. Healthcare providers, payers, and policymakers recognize the clinical and economic benefits of early hypertension control, reinforcing the need for consistent drug availability across various healthcare systems globally.

Growing Geriatric Population

The growing global geriatric population is a key demographic driver influencing the expansion of the antihypertensive drugs market. As reported by the World Health Organization (WHO) in 2024, the number of individuals aged 60 years and older is projected to reach 2.1 Billion by 2050. Aging is inherently associated with a higher risk of developing hypertension due to physiological changes in vascular structure and function. Consequently, the prevalence of chronic conditions including hypertension, diabetes, and cardiovascular diseases is markedly higher among elderly populations. Elderly patients often require multidrug therapy to manage co-existing conditions, making antihypertensive treatment a critical component of integrated chronic care. Additionally, longer life expectancy increases the duration over which patients require pharmacological management, thereby expanding the long-term demand for antihypertensive medications. Healthcare systems are increasingly prioritizing geriatric care, with a focus on early detection and regular monitoring of blood pressure. These efforts are supported by community outreach programs and public education campaigns aimed at improving adherence to treatment guidelines among older adults. Furthermore, enhanced access to healthcare services and prescription benefits in aging populations, particularly in developed economies, continues to fuel market growth. As awareness of hypertension-related risks improves among seniors, the volume of prescriptions is expected to rise accordingly, reflecting broader antihypertensive drugs market trends.

Rising Demand for Generic Drugs

The increasing adoption of generic antihypertensive drugs is a significant factor contributing to overall market growth. According to IMARC Group, the global generic pharmaceuticals market reached a value of USD 389.0 Billion in 2024, reflecting a strong shift toward cost-effective treatment alternatives. Generic antihypertensive drugs offer equivalent therapeutic outcomes at substantially lower prices compared to branded medications, making them attractive to both patients and healthcare providers. The affordability of generic products has broadened access to hypertension treatment, especially in low- and middle-income regions where healthcare budgets are constrained. Insurance providers and national healthcare systems often promote the use of generics through lower copay structures, reimbursement advantages, or formulary inclusion thereby incentivizing their uptake. Additionally, as patent protections on originator drugs expire, the number of manufacturers entering the antihypertensive generics space continues to grow, fostering price competition and driving down overall treatment costs. This increased availability of generic formulations enhances market penetration and ensures that a larger portion of the hypertensive population receives consistent and affordable therapy. The expanding footprint of generics supports not only economic sustainability, but also public health objectives related to broader treatment coverage and improved long-term health outcomes for hypertensive patients.

Antihypertensive Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global antihypertensive drugs market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on therapeutic class, type, and distribution channel.

Analysis by Therapeutic Class:

- Diuretics

- ACE Inhibitors

- Calcium Channel Blockers

- Beta-adrenergic Blockers

- Vasodilators

- Others

As per the antihypertensive drugs market outlook, in 2024, calcium channel blockers segment led the market accounted for the market share of 28.6%, driven by its clinical efficacy, favorable safety profile, and widespread adoption in first-line treatment protocols. These drugs effectively manage blood pressure by inhibiting calcium ion influx in vascular smooth muscle, resulting in vasodilation and improved blood flow. Their proven benefits in reducing stroke risk and myocardial infarction incidence have supported long-term usage among high-risk patients. The segment benefits further from strong physician confidence due to their consistent therapeutic outcomes in both monotherapy and combination therapy. Increasing diagnosis rates of hypertension in aging populations, especially among patients with comorbidities such as diabetes or kidney disease, also contribute to their prescription preference. In addition, growing access to generic formulations and inclusion in national and regional treatment guidelines enhance the accessibility and cost-efficiency of calcium channel blockers across both developed and emerging healthcare markets.

Analysis by Type:

- Primary Hypertension

- Secondary Hypertension

In 2024, the primary hypertension led the antihypertensive drugs market accounted for the market share of 72.0%, driven by the increasing global prevalence of essential hypertension, often linked to modifiable lifestyle factors such as sedentary behavior, poor dietary habits, obesity, and stress. With most cases of hypertension categorized as primary where no specific underlying cause can be identified—there is continuous demand for pharmacologic intervention. The rising burden of cardiovascular disease, coupled with national screening programs and awareness campaigns, is driving early diagnosis and consistent treatment adoption. Additionally, advancements in home blood pressure monitoring have improved disease detection, especially in asymptomatic individuals. Healthcare providers are increasingly prescribing long-term drug regimens for primary hypertension to prevent complications such as heart failure, stroke, and renal dysfunction. Ongoing innovations in fixed-dose combinations and once-daily formulations also support treatment adherence and effectiveness in this patient population.

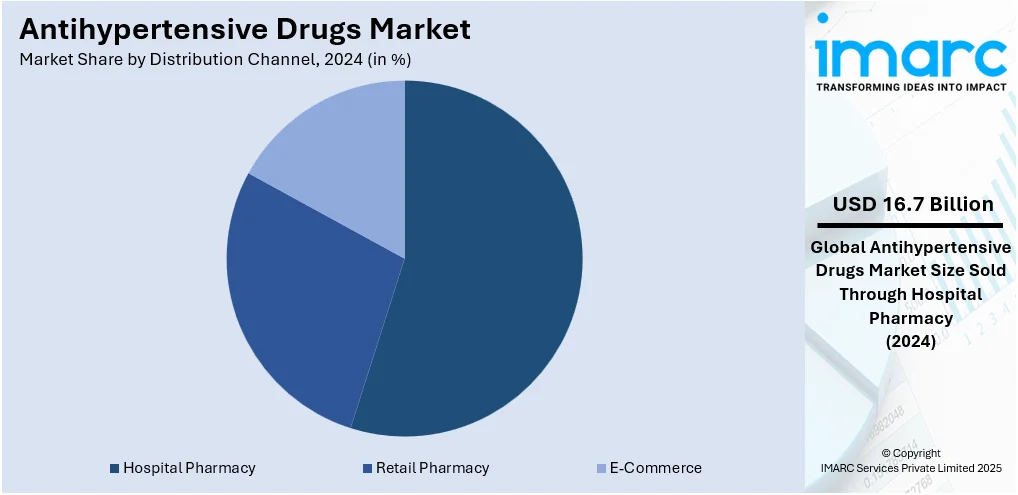

Analysis by Distribution Channel:

- Retail Pharmacy

- Hospital Pharmacy

- E-Commerce

Based on the antihypertensive drugs market forecast, in 2024, the hospital pharmacy segment led the market accounted for the market share of 54.8% driven by high patient volume, clinical supervision, and access to comprehensive treatment protocols in institutional settings. Hospitals are the primary point of care for patients with moderate to severe hypertension, including those presenting with hypertensive emergencies or related cardiovascular complications. The availability of specialized diagnostic equipment and real-time monitoring enables accurate drug titration and optimized therapeutic management. Moreover, hospital-based formularies often include a wider range of branded and generic antihypertensive medications, ensuring timely and uninterrupted treatment initiation. Clinical pharmacists play a key role in advising on drug interactions, dosage adjustments, and adherence strategies. Hospital pharmacies also manage procurement through centralized systems, allowing for better inventory control and cost efficiency. The emphasis on integrated care models, coupled with insurance-driven prescription reimbursements, further reinforces the dominance of hospital channels in antihypertensive drug distribution.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the North America led the antihypertensive drugs market accounted for the market share of 38.9%, driven by high disease prevalence, advanced healthcare infrastructure, and consistent pharmaceutical innovation. The region has one of the highest documented rates of hypertension, with a large proportion of the adult population undergoing pharmacological treatment. Government initiatives such as the CDC’s Million Hearts campaign, along with American Heart Association guidelines, promote routine blood pressure screening and patient awareness. Moreover, access to specialized care, robust insurance coverage, and the widespread adoption of electronic health records support proactive disease management. North America also benefits from the strong presence of leading pharmaceutical companies engaged in continuous drug development, including combination therapies and novel formulations designed for improved compliance. The high penetration of generic drugs and patient assistance programs further ensures affordability and availability. Overall, the region’s emphasis on preventive care, clinical monitoring, and therapeutic innovation collectively sustains its leadership in the global antihypertensive drugs market.

Key Regional Takeaways:

United States Antihypertensive Drugs Market Analysis

In 2024, the United States accounted for 95.00% of the antihypertensive drugs market in North America, driven by multiple factors. United States has witnessed a significant surge in antihypertensive drug market due to the rising demand for generic drugs. For instance, generic drugs play a pivotal role in the pharmaceutical landscape, constituting approximately 84% of total pharmaceutical sales in the U.S. As healthcare costs remain a critical concern, both patients and healthcare providers are increasingly opting for cost-effective generic antihypertensive drugs. This trend is reinforced by supportive regulatory frameworks promoting the approval and market entry of generics. Insurance providers also favor generic alternatives, ensuring broader accessibility. The availability of a wide range of approved generic formulations has enhanced prescription rates, particularly for chronic hypertension management, making generics a central component in treatment strategies.

Asia Pacific Antihypertensive Drugs Market Analysis

Asia-Pacific is experiencing rising antihypertensive drugs adoption due to the growing prevalence of hypertension. According to the Ministry of Health and Family Welfare, as of March 5, 2025, a total of 42.01 Million individuals have received treatment for hypertension. Sedentary lifestyles, increasing obesity rates, high salt consumption, and urban stress are contributing to an alarming rise in hypertension cases. Public health initiatives and awareness campaigns have amplified early diagnosis and continuous monitoring, leading to increased prescriptions for antihypertensive drugs. Governments and health agencies are prioritizing hypertension control as a public health imperative, integrating antihypertensive treatment into national programs. As hypertension becomes more common across diverse age groups, particularly in urban areas, the need for effective long-term treatment options intensifies.

Europe Antihypertensive Drugs Market Analysis

The market for antihypertensive drugs in Europe is being driven by the presence of a growing geriatric population. According to the WHO, the population aged 60 and older is rapidly growing in the WHO European Region. In 2021, there were 215 Million; by 2030, it is projected to be 247 Million, and by 2050, over 300 Million. As aging individuals are more prone to chronic conditions like hypertension, the demand for sustained blood pressure management has escalated. Geriatric patients often present with comorbidities, requiring multidrug regimens, which include antihypertensive drugs as a primary component. Medical institutions across Europe have prioritized elderly care, implementing guidelines that standardize hypertension control in older adults. The region’s pharmaceutical sector continues to focus on geriatric-friendly drug formulations, such as controlled-release tablets and combination therapies that enhance adherence.

Latin America Antihypertensive Drugs Market Analysis

The increased market for antihypertensive drugs in Latin America is due to growing e-commerce and retail pharmacy expansion. For instance, in the Brazilian e-commerce market, monthly revenues in June of 2025 were USD 3,478 Million. Consumers are leveraging digital platforms and accessible pharmacy chains to conveniently obtain antihypertensive medications. These channels provide affordability, product availability, and enhanced customer support, making treatment adherence easier. Retail pharmacy outlets in urban and semi-urban areas have also improved patient access to essential drugs, including those for hypertension, thus stimulating wider adoption.

Middle East and Africa Antihypertensive Drugs Market Analysis

Middle East and Africa have seen a rise in the antihypertensive drugs market supported by growing investment in healthcare facilities and sector. For the 2025 fiscal year, the UAE allocated AED 5.745 Billion, equivalent to 8% of the federal budget, to healthcare and community prevention services, reflecting its sustained commitment to developing the health sector. Expansion of clinics, hospitals, and diagnostic centres has facilitated early detection and treatment of hypertension. Improved healthcare infrastructure, supported by both public and private investment, ensures consistent availability of antihypertensive drugs and monitoring services, fostering regular patient engagement and better disease control.

Competitive Landscape:

Companies operating in the antihypertensive drugs market are implementing strategic measures to align with evolving healthcare demands and regulatory standards. Key initiatives include leveraging data analytics and digital platforms to enhance R&D efficiency, accelerate clinical trial timelines, and improve patient targeting. Automation is being adopted to streamline manufacturing and ensure consistent product quality across dosage forms. Firms are also investing in integrated systems to coordinate regulatory compliance, pharmacovigilance, and market access activities. These approaches enable faster response to market needs, reduce operational inefficiencies, and support evidence-based decision-making—ensuring effective delivery of antihypertensive therapies in an increasingly competitive and compliance-driven environment.

The report provides a comprehensive analysis of the competitive landscape in the antihypertensive drugs market with detailed profiles of all major companies, including:

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Daiichi Sankyo Company Limited

- Johnson & Johnson Services Inc.

- Lupin Pharmaceuticals Inc

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi

- Sun Pharmaceutical Industries Ltd.

Latest News and Developments:

- June 2025: The FDA approved the first antihypertensive drugs polypill, Widaplik, for initial hypertension treatment, based on two positive phase 3 trials presented at the 2024 European Society of Cardiology Congress. George Medicines announced the approval of the triple-therapy polypill containing telmisartan, amlodipine, and indapamide, marking it as the first FDA-approved triple combination therapy for patients needing multiple antihypertensive drugs.

- June 2025: The FDA approved GMRx2, a novel single-pill combination of telmisartan, amlodipine, and indapamide, marking the first and only triple-agent therapy for hypertension. Clinical trials had demonstrated superior efficacy of this antihypertensive drug over dual therapies and placebo, with favorable safety outcomes.

- June 2025: Ajanta Pharma launched its Met XL AMT 25 mg triple fixed‑dose combination—comprising extended‑release metoprolol succinate, telmisartan, and amlodipine—after securing DCGI approval for patients with uncontrolled hypertension and stable coronary artery disease who remained suboptimally managed on dual therapy.

- May 2025: The US FDA approved 12.5 mg chlorthalidone tablets for hypertension, offering a guideline-backed low-dose antihypertensive drug option to enhance patient care. PRM Pharma announced the launch, making the formulation available nationwide to align with ACC/AHA recommendations.

- March 2025: Mineralys Therapeutics announced positive topline results from its Launch-HTN and Advance-HTN trials, where lorundrostat significantly reduced systolic blood pressure in patients with uncontrolled or resistant hypertension. The antihypertensive drug achieved up to an 11.7 mmHg placebo-adjusted reduction and showed strong safety and tolerability, supporting its potential for regulatory approval.

Antihypertensive Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Antihypertensive Drugs Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapeutic Classes Covered | Diuretics, ACE Inhibitors, Calcium Channel Blockers, Beta-Adrenergic Blockers, Vasodilators, Others |

| Types Covered | Primary Hypertension, Secondary Hypertension |

| Distribution Channels Covered | Retail Pharmacy, Hospital Pharmacy, E-Commerce |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AstraZeneca, Boehringer Ingelheim International GmbH, Daiichi Sankyo Company Limited, Johnson & Johnson Services Inc., Lupin Pharmaceuticals Inc, Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi, Sun Pharmaceutical Industries Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, antihypertensive drugs market forecasts, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global antihypertensive drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the antihypertensive drugs industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The antihypertensive drugs market was valued at USD 30.45 Billion in 2024.

The antihypertensive drugs market is projected to exhibit a CAGR of 2.6% during 2025-2033, reaching a value of USD 38.41 Billion by 2033.

The antihypertensive drugs market is driven by the rising global prevalence of hypertension, aging populations, sedentary lifestyles, and increasing awareness of cardiovascular health. Advances in combination therapies and improved patient compliance also contribute to sustained market demand across both developed and emerging healthcare systems.

In 2024, North America dominated the antihypertensive drugs market accounting for the market share of 38.9%, driven by high hypertension prevalence, widespread healthcare access, strong pharmaceutical infrastructure, favorable reimbursement policies, and the growing adoption of advanced combination therapies for improved treatment outcomes and compliance.

Some of the major players in the global antihypertensive drugs market include AstraZeneca, Boehringer Ingelheim International GmbH, Daiichi Sankyo Company Limited, Johnson & Johnson Services Inc., Lupin Pharmaceuticals Inc, Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi, Sun Pharmaceutical Industries Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)