Antifog Additives Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Antifog Additives Market Size and Share:

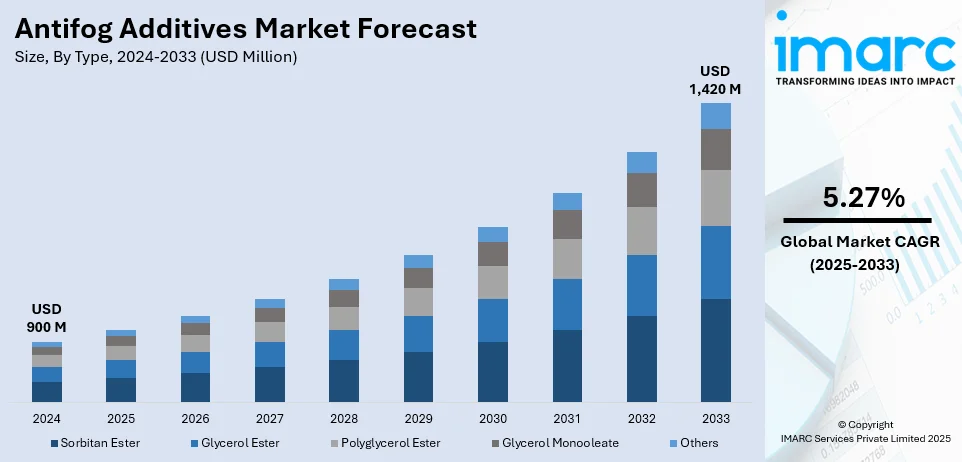

The global antifog additives market size was valued at USD 900 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,420 Million by 2033, exhibiting a CAGR of 5.27% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 36.7% in 2024, driven by its large food packaging and agricultural sectors, rising consumer demand for packaged food, expanding manufacturing base, and increasing adoption of plastic films in greenhouses.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 900 Million |

| Market Forecast in 2033 | USD 1,420 Million |

| Market Growth Rate (2025-2033) |

5.27%

|

One major driver of the antifog additives market is the increasing demand for fog-resistant packaging in the food industry. As consumers prioritize convenience and freshness, the need for clear, visually appealing packaging that preserves product quality has risen. Antifog additives are essential in preventing fog formation on packaging, particularly for fresh produce, meat, and dairy products, thereby enhancing product visibility and shelf appeal. Additionally, the growing trend toward online grocery shopping and home delivery further amplifies the need for packaging solutions that ensure product integrity during transportation. This shift drives the adoption of antifog additives, fueling market growth.

The United States plays a pivotal role in the antifog additives market by serving as a major consumer and innovator in the packaging industry. With a strong presence of leading packaging manufacturers and suppliers, the U.S. continues to drive demand for advanced antifog solutions, particularly in the food and beverage sector. The country’s emphasis on sustainable packaging practices, along with strict regulatory standards for food safety and quality, fosters the adoption of effective antifog additives. For instance, in 2024, Emery Oleochemicals will showcase sustainable polymer additives at Vinyltec, featuring LOXIOL® antifogging agents with up to 100% bio-based carbon content, excellent transparency, and food contact approval in PVC applications. U.S. companies are increasingly investing in research and development to create innovative formulations that meet consumer expectations for product visibility, preservation, and convenience in packaging.

Antifog Additives Market Trends:

Rise in Demand for Antifog Additives in the Food Packaging Industry

The rising packaged food industry is driving the demand for clear and transparent packaging which is boosting the growth of the market across the globe. According to IMARC, the U.S. food packaging market size was valued at USD 96.6 billion in 2024, with expectations to reach USD 143.4 billion by 2033, reflecting increasing demand for advanced packaging solutions. Antifog additives function by reducing the surface tension of water droplets that form on the packaging material. This alteration in surface tension causes the water droplets to spread out into a thin, transparent film, rather than forming visible foggy patches. This transparency enhancement allows consumers to clearly view the packaged products, contributing to a positive customer experience. This is further fueling its demand, thus influencing the growth of the market.

Rise in Research and Development Activities

As consumer preferences evolve towards convenient and visually appealing packaging, the need to address condensation-related challenges becomes more significant. The rise in consumer expectations has compelled packaging manufacturers to invest in R&D to develop effective antifog solutions. The market is also driven by significant technological advancements. According to SpecialChem, the development of smart coatings that respond to environmental conditions, such as humidity and temperature, is a promising area of research. These coatings provide improved anti-fogging properties and can offer additional functions like self-cleaning or antimicrobial effects. This trend extends the scope of antifog additives beyond traditional applications. The increasing research and development (R&D) activities in creating efficient and environment-friendly antifog additives are making these products more accessible and appealing to various industries, which is further propelling the growth of the market worldwide.

Rise in Regulatory Compliance

Evolving food safety regulations emphasize the necessity of maintaining product quality and safety throughout the supply chain. Antifog additives aid in preventing condensation within packaging, which can otherwise compromise the integrity of packaged food products. Governments and regulatory bodies are implementing stringent standards for packaging, particularly in the food and pharmaceutical industries which are facilitating the growth of the market. For instance, the European Union’s Regulation (EC) No. 1935/2004 mandates strict compliance for food-contact materials, including antifog additives, ensuring their safety and effectiveness. This is further creating a compulsion to adhere to quality standards, which is driving the market across the globe.

Antifog Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global antifog additives market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Sorbitan Ester

- Glycerol Ester

- Polyglycerol Ester

- Glycerol Monooleate

- Others

Glycerol ester leads the market with around 34.3% of market share in 2024. Glycerol ester is highly effective in reducing surface tension, which prevents the formation of fogging or water droplets, thus driving its demand in the market. This characteristic is crucial in applications, such as food packaging, where product visibility is vital for consumer appeal. In line with this, glycerol ester is compatible with a broad spectrum of polymers and plastics, thereby making it a versatile choice for different types of packaging materials and agricultural films. In addition to this, glycerol ester is generally recognized as safe for food contact applications and is often compliant with relevant regulatory guidelines. This compliance facilitates its usage in food packaging, meeting both manufacturer and consumer safety concerns. Apart from this, the economic viability of glycerol ester, as compared to other antifog agents, makes it an attractive option for cost-sensitive applications.

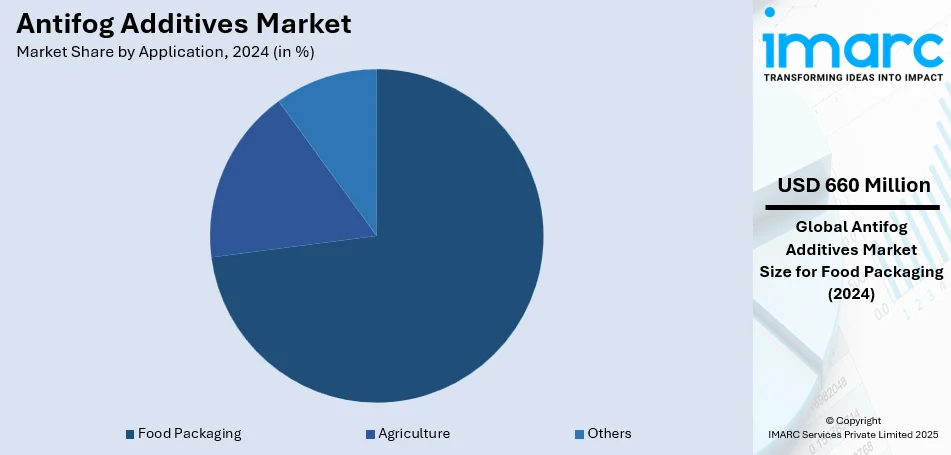

Analysis by Application:

- Food Packaging

- Agriculture

- Others

Food packaging leads the market with around 72.8% of market share in 2024. The application of antifog additives in food packaging is propelled by the rising need to maintain product visibility through transparent packaging. Fogging on the interior of food packages reduces visibility, negatively impacting consumer perception and choices. Antifog additives solve this issue by reducing the surface tension of moisture and preventing condensation. In line with this, the extension of shelf life is acting as a major growth-inducing factor. The use of antifog additives helps to reduce the buildup of moisture inside the packaging, thereby reducing the likelihood of microbial growth and spoilage. This is particularly beneficial for perishable items like meat, fruits, and vegetables. Moreover, consumer demand for high-quality and aesthetically pleasing packaging is rising. The clarity provided by antifog additives meets this consumer expectation, thus making products more marketable. In addition to this, there is a growing focus on sustainability and safety in food packaging. Many antifog additives are now being developed to be both eco-friendly and compliant with food safety regulations.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 36.7%. In the Asia Pacific region, the rapid expansion of the food and beverage industry necessitates the use of antifog additives in packaging to maintain product quality and visibility which is driving the market growth across the region. For instance, as per industry reports, the food processing and packaging market is anticipated to grow steadily, reaching USD 133.27 Billion in 2028 with a CAGR of 5.8%. The growing agricultural sector employs these additives in greenhouse films to improve light penetration and crop yield. The rise in consumer electronics manufacturing uses antifog additives for optical clarity in screens and lenses. Apart from this, increasing consumer awareness about product quality is bolstering the demand for advanced packaging solutions, including antifog features.

Key Regional Takeaways:

United States Antifog Additives Market Analysis

US accounts for 84.60% share of the market in North America. The U.S. antifog additives market is growing because various sectors, such as automotive, food packaging, and sports, are on the lookout to produce items with antifog solutions. The U.S. Bureau of Economic Analysis reported in 2023 that the U.S. automotive industry produced about 10.6 million vehicles, which increased the demand for antifog additives in automotive glass and mirrors. Further, demand in protective gear and eyewear with antifog solutions is another factor boosting growth in the market. The leaders in the field, 3M and BASF, drive innovation with visibility and safety improvement solutions. Environmentally conscious concerns are leading the way for sustainability and eco-friendliness, and the preference for green, environmentally friendly antifog additives is increasing. The development of new, versatile additives is driving market growth, and the U.S. is a leading participant in this global market trend.

North America Antifog Additives Market Analysis

The North America antifog additives market is experiencing significant growth, driven by the increasing demand for clear, high-quality packaging in the food industry. The region is a key consumer of antifog additives, particularly in fresh produce, meat, and dairy packaging, as consumers prioritize convenience, freshness, and product visibility. For instance, the U.S. online grocery market is projected to reach USD 209.28 Billion by 2026. The rise of online grocery shopping and home delivery services further boosts demand for packaging that preserves product integrity during transportation. Additionally, North American companies are focusing on sustainable packaging solutions, with an emphasis on reducing waste and improving shelf-life. The presence of major manufacturers and suppliers, along with advancements in packaging technologies, strengthens the market's growth potential, positioning North America as a leading player in the global antifog additives market.

Europe Antifog Additives Market Analysis

The market for antifog additives in Europe is growing steadily because of the growing demand for high-performance coatings used in automotive and food packaging. According to ACEA, around 10.5 million automobiles were produced by the automotive industry in Europe during 2023, which creates a higher demand for antifog solutions used in automotive glass. There are also growth trends in the packaging of food in Europe, as Eurostat reports a steady increase in the production and consumption of packaged foods. European producers include biodegradable and eco-friendly antifog products as priorities in their production to be aligned with the European Union's Green Deal. The main involved companies are Clariant and Croda International, which are the leading innovators and concentrate on natural-based additives. In addition, increasing awareness of occupational safety is also driving demand for antifog solutions in industrial protective equipment.

Asia Pacific Antifog Additives Market Analysis

The Asia Pacific antifog additives market is growing at a tremendous rate based on the growth in the automotive, consumer goods, and food industries. In 2023, according to China Association of Automobile Manufacturers, around 30 million vehicles were produced in China, up 11.6% from the previous year, which fuels the demand for antifog additives in automotive products. The growth of automobile production in India, estimated at 4.5 million units for the year 2023, is expected to boost the demand for antifog solutions as per the India's Ministry of Heavy Industries and Public Enterprises. Food packaging solutions, also being used extensively with the increasing middle-class population in the region, continue to grow and push the market further. The top leaders of this innovation include Samsung Cheil Industries and LG Chem. Governments' emphasis on safety standards and sustainability will fuel the demand for innovative, eco-friendly additives in the region.

Latin America Antifog Additives Market Analysis

The Latin American antifog additives market is gradually growing due to increasing automotive and food packaging production. According to the Brazilian Institute of Geography and Statistics (IBGE), Brazil's automotive sector produced more than 2.32 million vehicles in 2023, which has significantly driven the need for antifog solutions in automotive glass and mirrors. In food packaging, the surge in consumer demand for fresh fruits and vegetables along with packaged commodities is driving adoption of antifog additives. Increasingly, the middle-class population in this region is seeking protective eyeglasses, making antifog solutions more pertinent. Local manufacturing companies such as Braskem are investing heavily in research, looking to discover sustainable additives for use in its products that reflect the green ambition of the region. Other factors that contribute to the growth of the market are government programs designed to increase local manufacturing.

Middle East and Africa Antifog Additives Market Analysis

Middle East and Africa market for antifog additives is growing, fueled by growing industries such as the automotive, food packaging, and protective gear sectors. According to industrial reports, over 259,000 vehicles were sold in the UAE in 2023, creating a high demand for antifog solutions in automotive applications. Furthermore, the rise of protective eyewear and sports equipment is pushing demand for antifog additives within the region. Companies like SABIC and PetroRabigh are innovating with modern antifog technologies, thus becoming the industry leaders because these products have better effectiveness and friendly environmental features.

Competitive Landscape:

Major players in the industry are investing in research and development (R&D) to create advanced and eco-friendly antifog additives that allow key players to stay competitive. This helps in keeping up with the latest technological advancements and consumer demands. Players are focusing on sustainability by developing environmentally friendly antifog additives, aligned with global trends and regulations regarding environmental conservation.Moreover, they are extending their reach into emerging markets and different industries by setting up new distribution channels, subsidiaries, or through acquisitions, thus making their products more accessible globally. In line with this, the key players are forming alliances or merging with other companies, to leverage shared expertise, expand product portfolios, and penetrate new markets. For instance, in 2024, LANXESS Corporation’s Polymer Additives unit received Avient Corporation’s Supplier of the Year award for its high-quality, innovative antifog additives and industry-leading sustainability achievements in polymer solutions.

The report provides a comprehensive analysis of the competitive landscape in the antifog additives market with detailed profiles of all major companies, including:

- Ampacet Corporation

- Ashland Inc.

- Avient

- ChemPoint (Univar Solutions Inc)

- Corbion

- Evonik Industries AG

- Lifeline Technologies

- Palsgaard A/S

- Polyvel Inc

- Primex Plastics Corporation

- SABO S.p.A.

Latest and New Developments:

- August 2024: DSM introduced a novel antifog component targeted at the medical and healthcare sectors. This product aims to improve the clarity of medical devices and packaging by stopping fogging, thereby guaranteeing maximum visibility and safety for users. DSM’s innovation addresses the rising need for dependable, high-performance solutions in healthcare environments.

- July 2024: Clariant launched a new eco-friendly antifog additive. This cutting-edge additive seeks to minimize environmental effects while ensuring peak performance for fog prevention across different uses. By focusing on sustainability, Clariant is responding to increasing consumer demand for environmentally friendly solutions while maintaining product performance in the food packaging and automotive industries.

- June 2024: BASF introduced a new line of antifogging additives intended for food packaging and automotive uses. These additives aid in preserving clarity and visibility by avoiding condensation, enhancing product quality and the consumer experience. The advancement demonstrates BASF’s dedication to sustainable and efficient solutions in packaging technology.

- April 2024: Evonik Industries has revealed the creation of a novel antifog additive technology specifically designed for automotive and construction uses. This innovative solution boosts visibility by stopping condensation on surfaces, thus enhancing safety and efficiency. Evonik’s progress corresponds with rising industry trends that emphasize high-performance, functional materials catering to market demands across various sectors.

Antifog Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sorbitan Ester, Glycerol Ester, Polyglycerol Ester, Glycerol Monooleate, Others |

| Applications Covered | Food Packaging, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ampacet Corporation, Ashland Inc., Avient, ChemPoint (Univar Solutions Inc), Corbion, Evonik Industries AG, Lifeline Technologies, Palsgaard A/S, Polyvel Inc, Primex Plastics Corporation, SABO S.p.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the antifog additives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global antifog additives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the antifog additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The antifog additives market was valued at USD 900 Million in 2024.

IMARC estimates the antifog additives market to reach USD 1,420 Million by 2033, exhibiting a CAGR of 5.27% during 2025-2033.

Key factors driving the antifog additives market include the rising demand for clear, visually appealing packaging in the food industry, especially for fresh produce, increased online grocery shopping, and the need for sustainable packaging solutions. Additionally, the growing focus on product visibility, preservation, and consumer convenience contributes to market growth.

Asia Pacific currently dominates the market with 36.7% share, driven by the region's rapidly growing food and beverage packaging sector. The increasing demand for fresh produce, coupled with expanding e-commerce and logistics networks, further fuels the need for antifog additives to maintain product quality and shelf appeal.

Some of the major players in the antifog additives market include Ampacet Corporation, Ashland Inc., Avient, ChemPoint (Univar Solutions Inc), Corbion, Evonik Industries AG, Lifeline Technologies, Palsgaard A/S, Polyvel Inc, Primex Plastics Corporation, SABO S.p.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)