Antibacterial Products Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Antibacterial Products Market Size and Share:

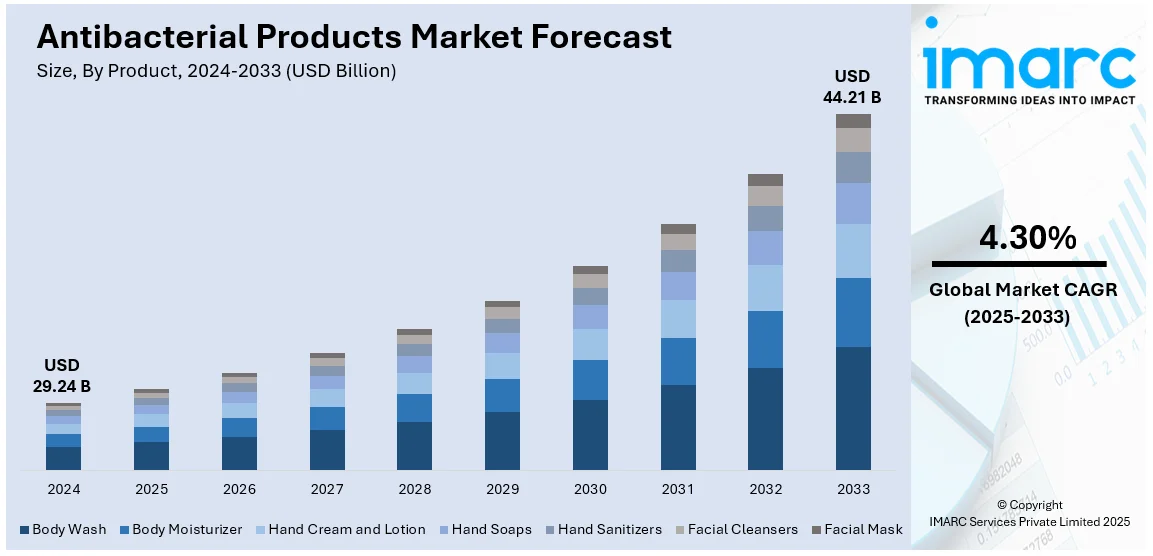

The global antibacterial products market size was valued at USD 29.24 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 44.21 Billion by 2033, exhibiting a CAGR of 4.30% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.2% in 2024. The increasing antibacterial products market share of the Asia Pacific region is driven by urbanization, rising disposable incomes, heightened health awareness, expanding healthcare infrastructure, and demand for hygiene-focused antibacterial products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.24 Billion |

| Market Forecast in 2033 | USD 44.21 Billion |

| Market Growth Rate (2025-2033) | 4.30% |

The rising occurrence of bacterial infections, including healthcare-associated infections (HAIs), is encouraging the use of antibacterial products in medical settings and households. Concerns about antibiotic resistance are also increasing the preference for over-the-counter antibacterial solutions to reduce the risk of infections. Furthermore, advances in antibacterial technology are leading to the introduction of improved formulations, such as non-alcohol-based sanitizers, antimicrobial textiles, and durable antibacterial coatings. These innovations appeal to a wide array of users, ranging from households to industrial sectors. Apart from this, the growing environmental concerns are leading to the development of sustainable and biodegradable antibacterial products. Eco-conscious individuals are seeking products that balance efficacy with minimal environmental impact, encouraging manufacturers to innovate in this direction.

The United States plays a crucial role in the market, driven by the ability of brands to adapt and innovate in response to user demands for high-performance, premium products. This includes the introduction of upgraded packaging, modernized formulations, and targeted distribution strategies to capture distinct market segments, ranging from mass-market to prestige offerings. Financial backing and investment in product innovation further enable brands to strengthen their presence and meet the demands of quality-conscious individuals. In 2024, Bravo Sierra made a comeback with a premium collection of hair and skin care items aimed at high-performance lifestyles, including products such as Antibacterial Body Wipes, within the U.S. The brand obtained $2.5 million in funding, unveiling updated packaging, scents, and formulas. Its original mass-market items will now be available solely on Amazon, upholding its dedication to top-notch, straightforward products.

Antibacterial Products Market Trends:

Growing Demand for Multi-Functional Products

Individuals are increasingly seeking products that offer multiple benefits, and antibacterial products are no exception. The rising demand for multi-functional solutions is driving innovation in the market, with people preferring products that combine antibacterial properties with additional features such as moisturization, soothing effects, and skin-friendly ingredients. Products that cater to specific skin needs, like those designed for sensitive skin or offering anti-aging benefits, are becoming more popular. These multi-functional products not only provide effective bacterial protection but also contribute to overall skin health and comfort. As individuals prioritize both hygiene and skincare, manufacturers are responding by formulating products that balance efficacy with additional wellness benefits. The focus on creating products that enhance the overall user experience, whether through calming scents, gentle ingredients, or added skin benefits, is helping to expand the antibacterial products market in a more holistic direction. In 2024, Touchland introduced "Gentle Mist," a new hand sanitizer specifically formulated for delicate skin. This item is vegan, cruelty-free, and contains calming components such as madecosside and niacinamide, accompanied by a soothing Lily of the Valley fragrance. It offers hydration properties while efficiently sanitizing, appealing to individuals with delicate skin and improving the hand hygiene experience.

Rising Demand for Sustainable and Eco-Friendly Products

Many individuals are now looking for products that not only offer protection from bacteria but are also environment-friendly. The demand for antibacterial products with natural ingredients, minimal chemical content, and eco-friendly packaging is increasing as part of the broader movement towards sustainability. Manufacturers are responding by developing biodegradable packaging, refillable dispensers, and formulations that use plant-based or organic ingredients. These eco-conscious offerings are gaining popularity among environmentally aware individuals who want to reduce their environmental footprint without sacrificing the effectiveness of antibacterial products. In 2024, Reckitt Pro Solutions introduced the Dettol Pro Cleanse Liquid Hand Wash, crafted for professional applications featuring an advanced antibacterial formulation. Offered in 5L and 500ml sizes, it enhances hand hygiene in business environments while remaining gentle on the skin. The item is environment-friendly, conserving up to 5kg of plastic each year through its refillable containers.

Innovation in Product Formulation

Individuals are seeking solutions that address specific hygiene concerns, such as bacteria and odors on fabrics, particularly for items like sportswear, towels, and undergarments. Products designed to offer powerful antibacterial protection while being gentle on fabrics are gaining popularity, as they provide a dual benefit of cleaning and maintaining textile quality. Additionally, the development of products that work effectively in cold water is broadening their appeal, allowing users to sanitize their laundry without the need for high-temperature washing. As people prioritize convenience and efficiency, manufacturers are focusing on creating specialized solutions that enhance fabric care, improve hygiene, and deliver superior performance without causing damage, making these innovations increasingly popular in both households and commercial laundry settings. In 2024, LABCCiN introduced its "Laundry SANITIZER" from Aekyung Industrial, aimed at disinfecting and removing bacteria from fabrics, efficiently tackling laundry smells. The item, offering 99.9% sterilization and antibacterial defense, is becoming popular for eliminating bacteria and odors from materials such as sports apparel, towels, and undergarments. It functions effectively in cold water and doesn't harm fabrics, representing a significant advancement in garment maintenance.

Antibacterial Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global antibacterial products market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Body Wash

- Body Moisturizer

- Hand Cream and Lotion

- Hand Soaps

- Hand Sanitizers

- Facial Cleansers

- Facial Mask

In 2024, hand soaps represented the biggest market share, achieving 35.5%. Hand soaps hold the biggest share in the market because they are commonly used in everyday hygiene practices. Serving as a main item for hand cleaning and sanitization, they are essential to personal care routines, as individuals continually look for products that provide both convenience and efficiency. The simplicity of use and the presence of hand soaps in different forms, such as liquid and bar soaps, render them reachable to a wide variety of users. Moreover, improvements in soap formulations providing better antibacterial qualities are playing a vital role in their market dominance. The increasing recognition about the significance of hand hygiene, backed by educational efforts and initiatives advocating for cleanliness, are increasing the demand. People commonly favor hand soaps made with natural or skin-friendly components, resulting in the rise of organic and hypoallergenic choices, enhancing their attractiveness among different user groups.

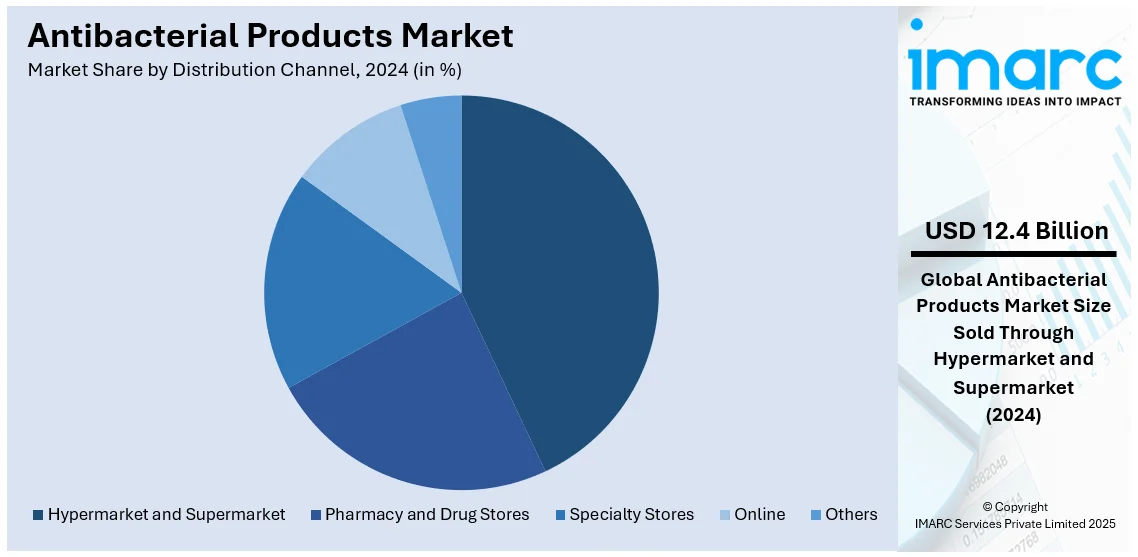

Analysis by Distribution Channel:

- Hypermarket and Supermarket

- Pharmacy and Drug Stores

- Specialty Stores

- Online

- Others

Hypermarket and supermarket segment leads the market, holding a 42.5% share in 2024. Hypermarkets and supermarkets represent the largest segment, offering an extensive range of personal care and hygiene products, including antibacterial soaps, hand sanitizers, and body washes. These retail outlets provide the convenience of one-stop shopping, enabling buyers to purchase multiple items in a single visit, which is a key factor driving their popularity. Frequent promotions, discounts, and loyalty programs further enhance their appeal, encouraging repeat purchases and attracting price-sensitive shoppers. Additionally, hypermarkets and supermarkets benefit from high foot traffic, particularly in urban and suburban areas, which allows for greater visibility and accessibility of antibacterial products. These stores often dedicate prominent shelf space and end-cap displays to highlight new or popular products, further boosting user interest. With the ability to offer a wide selection from multiple brands, including both premium and budget-friendly options, this segment effectively caters to the diverse needs of a broad user base.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, Asia Pacific accounted for the largest market share, reaching 45.2%. The Asia Pacific region occupies a notable portion of the market, propelled by an increased awareness regarding hygiene and health. Countries in this region are adopting antibacterial products due to increasing concerns about infections and public health. Additionally, the development and launch of innovative, user-friendly antibacterial products tailored to meet regional preferences and lifestyle demands is impelling the antibacterial products market growth. Businesses in the area are utilizing cutting-edge technology to develop distinctive products that merge practicality with visual attractiveness, increasing their appeal to consumers. Additionally, the focus on aspects such as touchless operation, durable antibacterial formulas, and prolonged product lifespan corresponds with the rising need for efficient and convenient hygiene options. In November 2024, Xiaomi, the Chinese technology powerhouse, introduced a Mijia Automatic Soap Dispenser Line Friends Limited Edition in China. Featuring an adorable Sally design, it is touchless, boasts a 99.9% antibacterial formula, and can last for up to 180 days on its battery.

Key Regional Takeaways:

United States Antibacterial Products Market Analysis

In North America, the United States accounted for 78.50% of the total market share. The market for antibacterial products in the United States is witnessing significant growth, supported by rising awareness about hygiene and infection control among individuals. The increased emphasis on health and hygiene is driving the need for antibacterial products in homes, medical centers, and workplaces. Ongoing product innovation is crucial for this growth as manufacturers roll out advanced formulations like alcohol-free sanitizers, durable antibacterial wipes, and eco-friendly disinfectants. The healthcare sector plays a crucial role, depending extensively on antibacterial items for controlling infections and ensuring patient safety in hospitals, clinics, and nursing facilities. The trend of clients preferring high-quality, multifunctional items, particularly those featuring improved skin-friendly attributes and environment-friendly packaging, is bolstering the market growth. Furthermore, strong retail networks guarantee the extensive accessibility of these products, catering to the needs of various demographics. E-commerce platforms are greatly enhancing market accessibility, providing buyers with easy buying choices, an extensive range of products, and attractive prices, positioning online channels as a primary growth catalyst. In November 2024, The Department of Commerce's Census Bureau reported that anticipated US retail e-commerce sales for the third quarter of 2024 hit $300.1 billion, reflecting a rise of 2.6 percent from the second quarter of 2024.

Europe Antibacterial Products Market Analysis

Europe is characterized by high user awareness and stringent regulatory standards, making it a crucial market for antibacterial products. Countries such as Germany, the UK, and France exhibit significant demand for eco-friendly and sustainable antibacterial solutions. Additionally, the aging population in the region necessitates the use of these products in medical and care settings, supported by well-established healthcare systems that prioritize hygiene and infection control. A strong preference for premium and dermatologically tested products further defines the market landscape in Europe, with individuals willing to invest in trusted brands offering proven efficacy. Apart from this, increasing number of strategic partnerships among key players and major retail chains are enhancing product accessibility and visibility. Affordable pricing and alignment with user values, such as sustainability and cruelty-free practices, further boost market appeal in this region. In 2024, Yorkshire-based cleaning company Astonish introduced 10 of its top-selling vegan and cruelty-free items, featuring the Pomegranate & Raspberry Antibacterial Cleanser, in more than 200 Tesco locations throughout the UK. Prices begin at £1 RRP, providing budget-friendly, environmentally conscious cleaning options.

Asia Pacific Antibacterial Products Market Analysis

he Asia Pacific region is a major hub for antibacterial products, driven by rapid urbanization, rising awareness about hygiene, and increasing disposable incomes. Government campaigns promoting sanitation, coupled with the high demand for products in densely populated urban areas, contribute to robust sales. Additionally, the presence of cost-effective manufacturing hubs supports the production of a wide range of antibacterial solutions. Furthermore, the development of products that address local user needs, often leveraging collaborations with international experts to incorporate advanced ingredients and formulations. This approach combines cultural relevance with international standards, creating solutions tailored to unique skin types, lifestyles, and environmental conditions in the region. For example, Cosmus Skincare, introduced in 2024, provides cutting-edge skincare solutions tailored for Indian skin, emphasizing enduring health via research and partnerships with specialists from France and Japan. The brand utilizes antibacterial components like Japanese turmeric to tackle skin issues including hyperpigmentation, acne, and photoaging. Emphasizing gentle yet effective care, Cosmus places importance on tailored solutions and premium formulations.

Latin America Antibacterial Products Market Analysis

The Latin American market is witnessing growth, with countries like Brazil and Mexico leading in terms of demand. Increased awareness about hygiene and sanitation, coupled with improving economic conditions, supports the adoption of antibacterial products across households, healthcare facilities, and public spaces. Government-led health initiatives, such as campaigns to promote hand hygiene and sanitation in schools, further encourage the use of these products. Local manufacturers are addressing challenges like price sensitivity by introducing cost-effective solutions tailored to regional preferences. Besides this, the increasing number of e-commerce platforms are expanding accessibility, providing buyers with convenient shopping options and a broader product range. As per the predictions from the IMARC Group, the size of the Mexico e-commerce market is expected to show a growth rate (CAGR) of 12.40% from 2024 to 2032.

Middle East and Africa Antibacterial Products Market Analysis

In the Middle East and Africa, the antibacterial products market is steadily expanding, fueled by rising urbanization and a growing focus on health and hygiene. Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the UAE, drive the demand with their higher disposable incomes, advanced healthcare systems, and increasing investments in public health infrastructure. Across Africa, hygiene awareness campaigns and international aid programs are promoting the adoption of antibacterial solutions. For example, in 2024, The Gauteng Department of Health celebrated World Hand Hygiene Day, highlighting the importance of hand hygiene as an essential measure in disease prevention. Handwashing campaigns were launched across health facilities from May 5–10, 2024.

Competitive Landscape:

Leading market participants are emphasizing innovation, product variation, and strategic alliances to uphold their competitive advantage. Numerous organizations are significantly investing in research activities to develop more efficient, sustainable, and user-friendly antibacterial solutions. Moreover, top companies are improving their marketing strategies to increase awareness regarding the significance of hygiene and infection prevention. Firms are broadening their product ranges to incorporate natural components, addressing the growing user desire for health-oriented skincare options. In 2024, Hempz upgraded its Beauty Actives Collection by launching two new moisturizers: Vanilla Lux, which contains Niacinamide for anti-aging benefits, and Tea Tree, enriched with Tea Tree Oil for its antibacterial and anti-inflammatory effects. The brand launched new Herbal Body Oils available in three fragrances, providing hydration with 100% pure hemp seed oil.

The report provides a comprehensive analysis of the competitive landscape in the antibacterial products market with detailed profiles of all major companies, including:

- BIELENDA Group S.A.

- Colgate-Palmolive Company

- GOJO Industries Inc

- Henkel Corporation

- Himalaya Wellness Company

- Reckitt Benckiser Group PLC

- Sebapharma

- Unilever Plc

Latest News and Developments:

- August 2024: VAX launched the SpinScrub™ Power Plus carpet washer, featuring SpinScrub™ technology, larger tanks, and VAX HEATBLAST™ technology for faster drying. It also includes VAX Platinum Antibacterial Solution for a hygienic clean and versatile tools for carpets, upholstery, and stairs.

- October 2024: Touchland collaborated for the first time with Hello Kitty on the 50th anniversary of this character. A limited-edition Hello Kitty-themed case is used with the Berry Bliss Power Mist, and this mist includes a fruity scent while killing germs effectively. The hand sanitizer mist is crafted to be a practical, no-mess necessity featuring a keychain hook.

- August 2024: Dial introduced two new scents of its Antibacterial Defense Hand Soap with Aloe: Eucalyptus & Mint and Sandalwood & Vanilla. These hand soaps kill over 99.9% of bacteria, being tested by a dermatologist, and are cruelty-free.

- February 2024: Dial® Hand Soap with an antibacterial formula, along with Dial® Exfoliate & Restore™ Cocoa Butter & Orange Extract Body Wash, won the 2024 Product of the Year USA Award in the categories Hand Soap and Personal Hygiene. Products were recognized for innovative appeal, with over 40,000 US people voting in the survey.

Antibacterial Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Body Wash, Body Moisturizer, Hand Cream and Lotion, Hand Soaps, Hand Sanitizers, Facial Cleansers, Facial Mask |

| Distribution Channels Covered | Hypermarket and Supermarket, Pharmacy and Drug Stores, Specialty Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BIELENDA Group S.A., Colgate-Palmolive Company, GOJO Industries Inc, Henkel Corporation, Himalaya Wellness Company, Reckitt Benckiser Group PLC, Sebapharma, Unilever Plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the antibacterial products market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global antibacterial products market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the antibacterial products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global antibacterial products market was valued at USD 29.24 Billion in 2024.

The global antibacterial products market is estimated to reach USD 44.21 Billion by 2033, exhibiting a CAGR of 4.30% from 2025-2033.

The global antibacterial products market is driven by the increasing awareness about hygiene and infection prevention, rising prevalence of bacterial infections, and concerns about antibiotic resistance. Advancements in antibacterial technologies, such as innovative formulations and eco-friendly solutions, and the growing demand for multifunctional and sustainable products further contribute to the adoption of antibacterial products across various sectors.

Asia Pacific currently dominates the global antibacterial products market. The growth of the Asia Pacific region is driven by increasing urbanization, rising disposable incomes, heightened health awareness, expanding healthcare infrastructure, and demand for hygiene-focused antibacterial products.

Some of the major players in the global antibacterial products market include BIELENDA Group S.A., Colgate-Palmolive Company, GOJO Industries Inc, Henkel Corporation, Himalaya Wellness Company, Reckitt Benckiser Group PLC, Sebapharma, Unilever Plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)