Anti-Ship Missile Defence System Market Size, Share, Trends and Forecast by Component, Launch Platform, Application, and Region, 2025-2033

Anti-Ship Missile Defence System Market Size and Share Analysis:

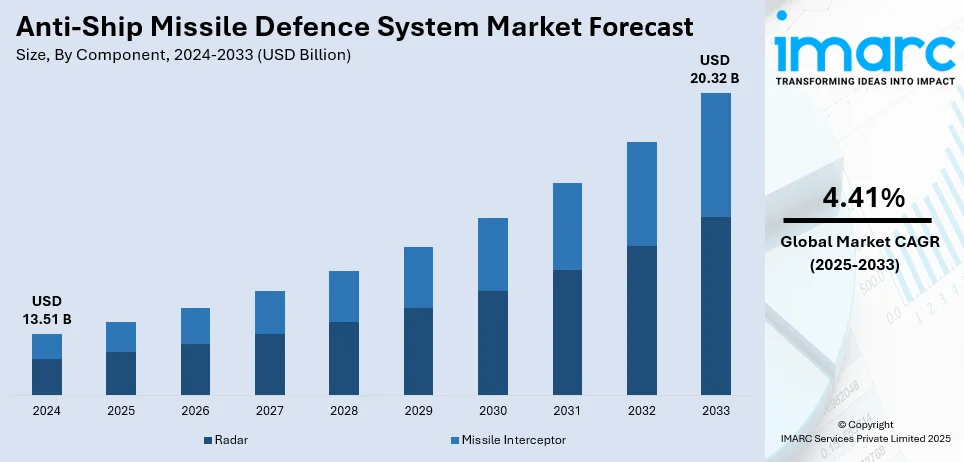

The global anti-ship missile defence system market size was valued at USD 13.51 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20.32 Billion by 2033, exhibiting a CAGR of 4.41% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 40.0% in 2024. The magnifying need for naval vessels, rapid incorporation of machine learning (ML) and artificial intelligence (AI) technologies, and increasing military modernization efforts represent some of the chief factors boosting the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.51 Billion |

|

Market Forecast in 2033

|

USD 20.32 Billion |

| Market Growth Rate (2025-2033) | 4.41% |

The global anti-ship missile defense system market is driven by several key factors, including escalating geopolitical tensions and regional conflicts that necessitate enhanced naval security. The proliferation of advanced missile technologies among state and non-state further compels nations to invest in robust defense systems. In addition to this, military modernization initiatives aimed at upgrading existing fleets and capabilities contribute to market growth. Moreover, the increasing focus on maritime trade security and the protection of critical infrastructure also play a significant role in driving demand for sophisticated anti-ship missile defense solutions, ensuring that naval forces remain prepared to counter emerging threats effectively.

The United States exhibits a critical role in the global anti-ship missile defense system industry through its significant military spending and state-of-the-art technological advancements. For instance, the Department of Defense has allocated USD 1.50 Trillion throughout its six sub-components, including the Army, Navy, Air Force, and international security programs, in FY 2025. Besides, the nation is actively prioritizing the development of innovative defense solutions for maritime security to combat threats posed by hostile nations. Furthermore, the robust focus remains strengthened by strategic partnerships with international entities as these work together to boost maritime security cooperation. In addition to this, the U.S. maintains continuous research and development operations through its innovation commitment to ensure its naval forces maintain top-flight defensive capabilities. Moreover, growing geopolitical tensions are anticipated to accelerate the market demand for powerful anti-ship missile defense systems.

Anti-Ship Missile Defence System Market Trends:

Increasing Demand for Advanced Naval Vessels

The rising demand for naval vessels across the globe is a major driver of the anti-ship missile defence (ASMD) system industry. It has been reported that Naval Vessels Market size is anticipated to elevate to USD 116.46 Billion by the year 2025. As a result, several nations are actively emphasizing on equipping their fleets with advanced ASMD systems. In line with this, such systems provide comprehensive protection from enemy missiles, significantly reducing casualties and minimizing the impact of attacks while enhancing operational efficiency. In addition, rapid increase in military modernization efforts, supported by increased defence budgets and government ventures to expand as well as strengthen naval fleets, is further bolstering the adoption of ASMD systems.

Emergence of Directed Energy Weapons and AI Integration

The advancement of affordable directed energy weapons, including high-powered microwaves and high-energy lasers, is creating positive anti-ship missile defence system market outlook. These systems offer low maintenance and can quickly neutralize hypersonic missiles. The global high energy lasers market size, for instance, is anticipated to reach USD 12.6 billion by the year 2024. Moreover, incorporating artificial intelligence (AI) and machine learning (ML) into ASMD systems is improving the ability to identify, monitor, and counter threats. Notably, 49% of technology executives in PwC’s October 2024 Pulse Survey reported that AI was easily integrated into their organization’s chief strategy, reflecting the growing role of AI in defence technologies.

Advancements in Radar Technology and Rising Military Tensions

The introduction of multi-function radars (MFR) capable of engaging multiple targets simultaneously is boosting situational awareness in ASMD systems. Alongside this, significant growth in the defense industry, increasing global military tensions, and a rise in asymmetric warfare threats are driving investment in ASMD research and development. For instance, as per industry reports, 2024 was highlighted by numerous geopolitical conflicts that complicated global stability and geopolitical ecosystem. These conflicts included Ukraine-Russia war and elevating strains across the Middle East. As a consequence, several governments and organizations are currently prioritizing cutting-edge technologies to address such challenges, guaranteeing enhanced security and operational readiness for their naval forces.

Anti-Ship Missile Defence System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global anti-ship missile defence system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, launch platform, and application.

Analysis by Component:

- Radar

- Missile Interceptor

Radar is the leading component in 2024. The global anti-ship missile defence system market heavily relies on radar systems since detection and tracking of threats remain vital operations. Through advanced radar technologies naval forces acquire real-time capability to track incoming missile threats for vital situational awareness. Moreover, with phased-array radar integration military forces can speed up their ability to detect targets while securing their positions for potential attacks. Radar signal processing combined with data fusion technologies enhances both the precision and trustworthiness of threat evaluations. In addition to this, the rising complexity of naval operations generates sustained market demand for advanced radar systems which fosters developmental innovation within this field. In modern naval defence strategies, the importance of multi-functional radar systems operating in different environments becomes increasingly crucial for defending against diverse maritime threats.

Analysis by Launch Platform:

- Air

- Surface

- Submarine

Surface launch platforms represent a dominant segment in the global anti-ship missile defense system market, as they provide the necessary infrastructure for deploying missile systems effectively. These platforms, which include naval vessels such as destroyers, frigates, and corvettes, are designed to enhance the operational capabilities of naval forces. The versatility of surface launch platforms allows for the integration of various missile types, enabling a multi-layered defense approach against potential threats. Additionally, advancements in platform design and technology, such as vertical launch systems and automated targeting, have significantly improved launch efficiency and response times. As nations prioritize naval modernization and seek to enhance their maritime security, the demand for advanced surface launch platforms continues to rise, reinforcing their critical role in the overall anti-ship missile defense strategy.

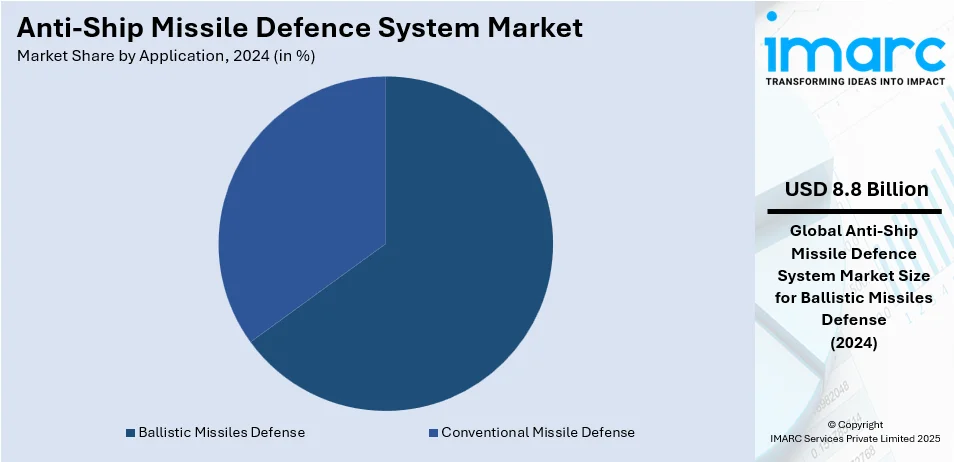

Analysis by Application:

- Ballistic Missiles Defense

- Conventional Missile Defense

Ballistic missiles defence leads the market with around 65.0% of market share in 2024, with the rising demand to combat advanced missile threats driving this dominance. These applications operate to destroy ballistic missiles during their flight path and protect naval assets as well as coastal installations. Furthermore, advanced tracking and interception technologies when integrated with ballistic missile defences enable accurate threat targeting throughout different operational ranges. In addition, nation-states are actively increasing their funding for ballistic missile defence platforms as they perceive escalating geopolitical risks along with increasing missile technology availability. Moreover, the market for maritime security is anticipated to witness significant growth through the development of effective defence applications as nations demand to protect their interests in intensifying maritime conflicts.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 40.0%. The Asia-Pacific region's anti-ship missile defence market is driven by rising tensions in the South China Sea, maritime disputes, and a regional arms race. Nations like China, India, Japan, and South Korea are heavily investing in modernizing naval fleets to counter evolving missile threats. Notably, India is planning for a USD 450 Million deal to sell BrahMos supersonic cruise missiles to Indonesia, targeted at fortifying Indonesia's defence abilities. If approved, Indonesia would become the second country, after the Philippines, to procure these missiles. The deal, which includes technology transfer discussions, highlights India's growing role as a defence exporter despite challenges like budget constraints. Additionally, regional collaborations, such as the Quad alliance involving Australia, India, Japan, and the U.S., emphasize interoperability and shared security objectives. These developments, combined with indigenous defence initiatives like India's "Make in India," are shaping the market’s growth and technological advancements across the region.

Anti-Ship Missile Defence System Market Regional Takeaways:

United States Anti-Ship Missile Defence System Market Analysis

The United States’ anti-ship missile defence system market is driven by growing geopolitical tensions and the need to protect maritime borders, trade routes, and naval assets. Rising threats of sophisticated missile attacks, particularly from nations like China and Russia, have prompted the U.S. Department of Defence to prioritize advanced missile defence technologies. Key focus areas include integrating cutting-edge radar systems, electronic warfare (EW) capabilities, and next-generation interceptors into naval platforms. Additionally, significant private-sector interest is fueling innovation in hypersonic defence technologies. For instance, venture capitalists have invested at least USD 356 Million in startups that are U.S.-based and actively develop hypersonic systems and technologies, as per the reports. Such investments complement government initiatives, enabling rapid advancements in detection and interception capabilities. The development of space-based sensors and hypersonic interceptors further enhances the operational readiness of the U.S. Navy. Programs like the Aegis Combat System underscore the growing demand for state-of-the-art solutions. Moreover, the government’s focus on interoperability with allied forces and sustained funding for research and development (R&D) fosters collaboration with leading defence contractors such as Raytheon Technologies, Lockheed Martin, and Northrop Grumman, ensuring the U.S. maintains its strategic edge in missile defence.

North America Anti-Ship Missile Defence System Market Analysis

North America's position as a significant player in the global anti-ship missile defence system market stems from its combination of superior military technology capabilities together with robust defence budgets. For instance, according to the U.S. Department of Defence, in March 2024, USD 849.8 billion request for defence budget was presented that is anticipated to fund operations in FY 2025. Furthermore, advanced naval defence technologies represent the United States' greatest innovation because it maintains the most powerful maritime defences as it confronts modern maritime threats. Modernization as well as enhancements between federal authorities and military contractors leads to high-tech defence solutions throughout the region. In addition to this, the critical nature of maritime security as well as ascending political tensions creates further momentum for spending in anti-ship missile defence systems. North American strategic naval defence investments are anticipated to maintain expansion of anti-ship missile defence system market share while confirming North America's dominance as a technology leader in this maritime security sector.

Europe Anti-Ship Missile Defence System Market Analysis

The anti-ship missile defence market in Europe is driven by heightened security concerns in the Baltic and Mediterranean regions, along with evolving naval threats from adversaries like Russia. Nations across the continent are focusing on enhancing maritime security and strengthening critical sea lanes. In the UK, for instance, BAE Systems was granted EUR 270 Million (USD 281 Million) contract by the government granted to aid, enhance, and sustain crucial radar systems that protect Royal Navy warships from airborne and seaborne attacks. This investment, which also boosts the specialist radar workforce, underscores the UK's commitment to modernizing its naval defence infrastructure. Additionally, the European Defence Fund (EDF) promotes cross-border collaboration to develop advanced missile defence systems, further fueling technological innovation. Major countries like France, Germany, and Italy are upgrading their naval fleets with advanced radar, electronic warfare systems, and hypersonic interceptors to counter emerging threats. The ongoing Russo-Ukrainian conflict has amplified the urgency for robust coastal defences, driving demand for systems like the Sea Ceptor and SMART-L radar. Europe’s emphasis on strengthening its defence industrial base, alongside partnerships with global defence manufacturers, ensures steady growth in this sector while maintaining strategic maritime security and operational readiness.

Latin America Anti-Ship Missile Defence System Market Analysis

The anti-ship missile defence system market growth in Latin America is driven by efforts to safeguard maritime trade routes, natural resources, and Exclusive Economic Zones (EEZs). Brazil, in particular, is prioritizing defence modernization through the Growth Acceleration Program (PAC), which provides around 53 Billion Reals (USD 11 Billion) for defence ventures. This includes expenditure for the development and acquisition of the Astros missile system from Avibras and armored vehicles from Iveco Defence, a Italy-based manufacturer. Such investments underscore Brazil’s commitment to strengthening its naval and missile capabilities. Regional collaboration with global defence firms further enhances the readiness to address transnational threats and territorial challenges.

Middle East and Africa Anti-Ship Missile Defence System Market Analysis

The Middle East’s anti-ship missile defence system market demand is driven by the need to secure vital oil trade routes and address growing regional security threats. Nations like Saudi Arabia are making significant investments in advanced missile defence systems to counter evolving threats from state and non-state actors. For instance, in 2022, the U.S. approved the sale of Patriot and THAAD systems to Saudi Arabia in deals valued around USD 5.3 Billion, highlighting the region's focus on acquiring cutting-edge technologies. Partnerships with global defence firms and investments in radar and interceptor systems strengthen the region’s maritime and territorial defence capabilities.

Top Anti-ship Missile Defence System Market Leaders:

Several major defence contractors and emerging technology firms shape the competitive landscape in the global anti-ship missile defence system industry. Leading companies dedicate substantial funds to product development through research initiatives which emphasize artificial intelligence along with sensor fusion and network-centric warfare systems. Furthermore, reliable partnerships and collaborations serve as common business strategies for companies that strive to combine complementary assets and expand their market coverage. Moreover, firms are expanding their operations through international defence contracts to appeal bolstering naval defence requirements across different regions globally. For instance, in January 2025, Indonesian Navy announced a strategic visit to BrahMos Aerospace, India, to boost tactical alliance between Indonesia and India and indulge in capabilities of BrahMos supersonic cruise missile. Both nations expressed plans for further partnership to fuel technological exchange, training, and tactical defence cooperation. In addition to this, rapid innovations along with threat adaptation needs drive organizations to pursue constant solution enhancements for maintaining competitive superiority within a competitive landscape.

The report provides a comprehensive analysis of the top companies in the anti-ship missile defence system market with detailed profiles of all major companies, including:

- BAE Systems plc

- Lockheed Martin Corporation

- Rafael Advanced Defence Systems Ltd.

- Raytheon Technologies Corporation

- Saab AB

Latest News and Developments:

- December 2024: Saab announced the securing of a contract with Swedish Defence Materiel Administration, worth USD 76 Million, to facilitate modernization of Sweden's coastal anti-ship missile systems. Deliveries, anticipated to initiate in 2026, will encompass the incorporation of the RBS15 Mk3 missile onto truck-mounted launcher modules, substituting the older RBS15 Mk2 currently in deployment.

- November 2024: The Defence Research and Development Organisation (DRDO) announced plans to test a long-range anti-ship ballistic missile highly able of striking moving aircraft carriers or warships for more than 1,000 km. Developed for the Indian Navy, the missile can be launched from both shore-based and warships platforms, boosting long-range naval strike abilities.

- November 2024: European defence contractor MBDA introduced its submarine-launched missile SM40, developed to target heavily safeguarded naval vessels. As the newest in the Exocet line, it is incorporated with a doubled range of 120 km with a turbojet engine, latest J-Band seeker, and enhanced algorithms for high-intensity environments. The SM40 is exclusively developed for Naval Group submarines, catering to the French shipbuilder's global clientele.

- August 2024: U.S. defence start-up Ares Industries announced the successful flight testing of a cost-efficient, compact anti-ship cruise missile concept just 11 weeks after its developing. Aided by technology incubator Y Combinator, the firm targets to cater to the fueling need for affordable standoff munitions amid U.S. military preparations for mega-intensity conflicts.

- May 2022: The Defence Research and Development Organisation (DRDO) and the Indian Navy announced conduction of the first successful flight test of an indigenously developed Naval Anti-Ship Missile. Launched from a naval helicopter at the Integrated Test Range (ITR) in Chandipur, Odisha, the missile addressed all mission aims. The system, integrated with enhanced guidance, navigation, and avionics technologies, exhibited accuracy with a sea-skimming trajectory and precise target engagement. Sensors tracked the missile throughout the test, confirming performance across all subsystems.

Anti-Ship Missile Defence System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Radar, Missile Interceptor |

| Launch Platforms Covered | Air, Surface, Submarine |

| Applications Covered | Ballistic Missiles Defense, Conventional Missile Defense |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BAE Systems plc, Lockheed Martin Corporation, Rafael Advanced Defense Systems Ltd., Raytheon Technologies Corporation, Saab AB, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the anti-ship missile defence system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global anti-ship missile defence system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the anti-ship missile defence system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anti-ship missile defence system market was valued at USD 13.51 Billion in 2024.

IMARC estimates the anti-ship missile defence system market to reach USD 20.32 Billion by 2033, exhibiting a CAGR of 4.41% during 2025-2033.

The market is mainly being impacted by the elevating geopolitical tensions, increase in military modernization, and innovations in technology like sensor systems and AI. In addition to this, the need for naval vessels and the incorporation of electronic warfare systems are notable contributors to market expansion.

Asia Pacific currently dominates the anti-ship missile defence system market, accounting for a share exceeding 40.0%. This dominance is fueled rapid increase in geopolitical tensions and the robust demand for innovative naval capabilities in the region.

Some of the major players in the anti-ship missile defence system market include BAE Systems plc, Lockheed Martin Corporation, Rafael Advanced Defence Systems Ltd., Raytheon Technologies Corporation, Saab AB, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)