Anti-Obesity Drugs Market Size, Share, Trends and Forecast by Drug Class, Drug Type, Distribution Channel, and Region, 2026-2034

Anti-Obesity Drugs Market Size and Share:

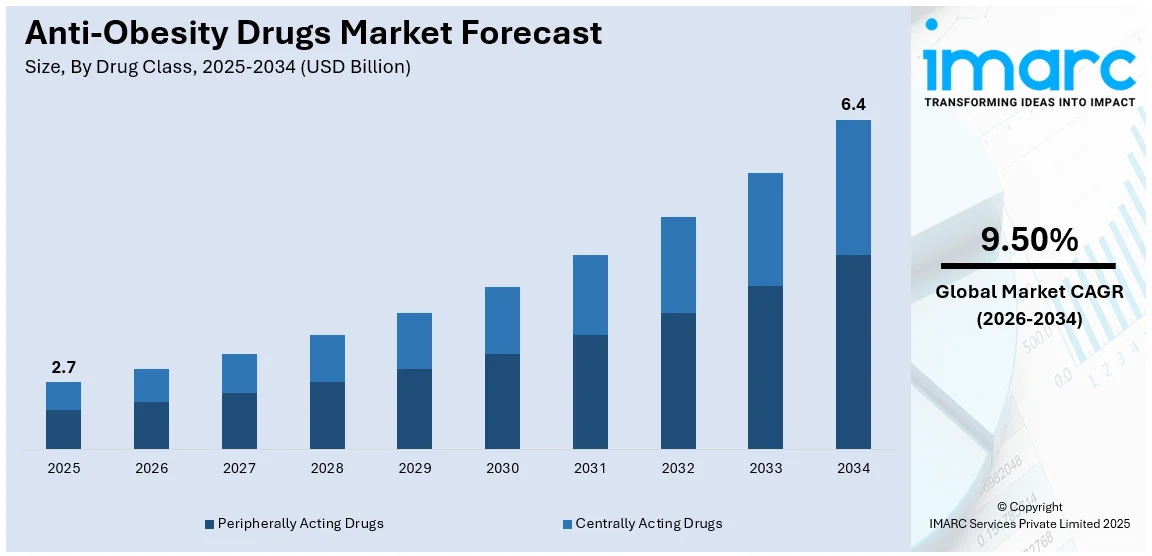

The global anti-obesity drugs market size was valued at USD 2.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2034, exhibiting a CAGR of 9.50% from 2026-2034. North America currently dominates the market, holding a market share of over 36.7% in 2025. The anti-obesity drugs market share is increasing due to the rising obesity rates, health awareness, demand for weight management solutions, drug development advancements, government initiatives, R&D investments, combination therapies, and availability of prescription and over-the-counter drugs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.7 Billion |

|

Market Forecast in 2034

|

USD 6.4 Billion |

| Market Growth Rate (2026-2034) | 9.50% |

The global anti-obesity drugs market growth is attributed to the increased prevalence of obesity, health consciousness, and better pharmaceutical treatments. The demand for medications that help people manage weight has been rising as more people seek medical solutions to this problem. Prescription drugs have gained popularity since they can support long-term weight loss by controlling appetite and regulating metabolism. Pharmaceutical companies are aggressively investing in the research and development process to offer novel drugs that have better safety profiles and potency. Regulatory sanctions and government-led campaigns for treating obesity are motivating the market toward growth. More recently, improper diets and lethargic lifestyle patterns have accelerated the demand for anti-obesity treatments. In this regard, the ever-growing popularity of telemedicine and digital health portals is further promoting patient access to obesity treatments and will ensure growth in the market for the years to come.

To get more information on this market Request Sample

The United States emerged as a key regional market for anti-obesity drugs, with an increased awareness about health and wellness. The growing interest in these solutions, both from the prescribed angle and treatment perspectives, further solidifies a base for support for weight management prescription treatments, where advanced medical facilities are there to help achieve results. Pharmaceutical companies continue to market new and better drugs, ones that give better results with fewer side effects. Healthcare providers are recommending prescription medication as part of a comprehensive weight management program, which includes diet and lifestyle changes. Finally, government-backed health initiatives and even insurance coverage have made many patients consider medical remedies for their obesity issues. Telehealth and online pharmacies also have further amplified the access to anti-obesity drugs, bringing treatment to a patient's fingertips.

Anti-Obesity Drugs Market Trends:

Rising demand for GLP-1 receptor agonists

The most notable anti-obesity drugs market trend is the wide acceptance of GLP-1 receptor agonists. Many such drugs have shown a superior capacity to induce significant weight loss, such as semaglutide under the brand name Wegovy or tirzepatide (Zepbound), both of which ensure their popularity as they are beneficially metabolic in that they can provide beneficial effects on glucose and cardiovascular outcomes. Clinical studies have shown that tirzepatide (Zepbound) and semaglutide (Wegovy) are far more effective than typical anti-obesity drugs, reducing body weight by up to 15–22% over one year. The success of these drugs has led to shortages in supply, reflecting the strong demand. The strong clinical outcomes have led to increased prescriptions, robust sales, and expanded market penetration. Moreover, major pharmaceutical companies are actively investing in R&D to make GLP-1 receptor agonists more potent and safer drugs. The market trend is rising with these drugs over the old generation of anti-obesity drugs, and hence, it shifts the market to more effective and better-tolerated drugs. With further innovation, the market will continue growing with these drugs remaining the standard option for obese individuals.

Shift toward oral formulations

The market for anti-obesity drugs is shifting toward oral formulations to increase patient compliance and expand the treatment reach. Of patients with type 2 diabetes, between 60 and 70 percent chose oral GLP-1 receptor agonists over injectables, according to a 2022 study by the American Association of Clinical Endocrinology (AACE). The marked weight loss benefits of injectable therapies like semaglutide and tirzepatide are mostly linked with a high number of issues concerning their administration, compliance from the patients' side, and convenience. However, these restrictions can be mitigated due to much interest taken by pharmaceutical industries in oral formulations, especially as presented through Novo Nordisk's oral semaglutide. Orally administered semaglutide would have the same mechanism of action as its injectable counterpart. Therefore, orally administered formulations become more appealing to a vast population of patients, especially those who are afraid of injectables. Oral medications can also be introduced much earlier in the management of obesity when the disease does not progress further, and comorbidities decrease. Since various companies are interested in the discovery of novel oral anti-obesity drugs, further competition will take place in developing new, improved efficacy, and possibly cheaper compounds, which will drive this market in years to come. An expansion of insurance coverage and reimbursement policies substantially boosts the anti-obesity drugs demand.

Expanding insurance coverage and reimbursement policies

Obesity treatments have typically been underfunded, hence limiting patient access to pharmacologic interventions that could be effective. However, as a result of current findings declaring obesity a chronic disease with far-reaching health consequences, governments, and private insurers are now drafting policies to include weight-loss medication as part of their insurance coverage. An industrial survey reports that in 2024, around 44 percent of U.S. employers with 500 or more employees covered drugs for weight loss, up from 41 percent in 2023. Such a trend is indicative of the increasing understanding of obesity as a chronic disease, where medical intervention is necessary. In the United States, Medicare and many commercial insurance companies have increased reimbursement for GLP-1 receptor agonists and other anti-obesity therapies, so this is encouraging greater use. Obesity management is slowly being integrated into the treatment of chronic diseases across European healthcare systems, thereby facilitating greater access to medication for patients. This would most probably enhance market penetration and fuel further sales growth in pharmaceutical companies. As insurance will improve, thereby increasing the prevalence of medical attention for obesity and thus validating its role in pharma in maintaining weight, an upward long-term growth trajectory to the market ends.

Anti-Obesity Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global anti-obesity drugs market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on drug class, drug type, and distribution channel.

Analysis by Drug Class:

- Peripherally Acting Drugs

- Centrally Acting Drugs

Central acting drugs represent the largest segment with a share of 64.5%. As centrally acting anti-obesity agents primarily affect or inhibit neurotransmitters that affect neural functions leading to the depression of appetite, a subsequent decrease in feeding, and an effective improvement in body weights, centrally acting anti-obesity drugs possess comparatively high effectiveness ratings as opposed to the drugs that are centrally acting. Highly commercialized and approved novel centrally acting anti-obesity drugs, for example, GLP-1 receptor agonists, further fueled market dominance. Together with the rapidly growing adoption of combination therapies, which include centrally acting agents, treatment results are also improved, and this drives market demand. Agencies such as the FDA and EMA have already approved newer drugs, for example, semaglutide and liraglutide, in the market, which has boosted their presence within this segment. Increasing obesity rates and growing awareness regarding medical weight loss solutions also spur the growth of centrally acting drugs in the market.

Analysis by Drug Type:

- Prescription Drugs

- OTC Drugs

Prescription drugs dominate the market with a share of 88.6% due to their higher efficacy, physician guidance, and strict regulatory approval processes to ensure safety. Prescription drugs go through extensive clinical trials compared to OTC medicines, hence being a preferred solution for long-term obesity management. The weight-loss benefits of semaglutide (Wegovy) and liraglutide (Saxenda) have been so promising that these drugs are being adopted more widely. Prescription drugs are also preferred by healthcare providers as they can treat comorbid conditions like diabetes and cardiovascular diseases related to obesity. An increasing number of patients opting for medical intervention and government-backed obesity management programs have contributed to the increased demand for prescription-based treatments. As obesity remains one of the world's biggest health challenges, pharmaceutical companies are investing heavily in R&D for innovative prescription drugs with improved efficacy and safety profiles, further strengthening the market position of this segment.

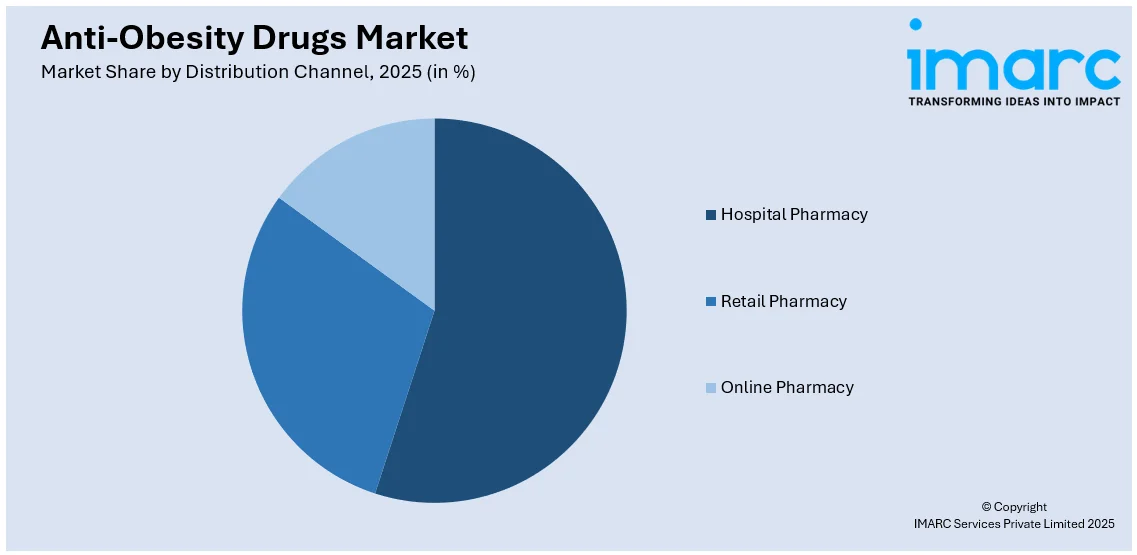

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Hospital pharmacies lead the market with a share of 45.3%. The increased frequency of hospital admissions for obesity-related health issues encourages physicians to recommend weight loss medicines as part of the overall treatment. A larger variety of prescription-based anti-obesity medicines and the most recent FDA-approved ones are readily available in hospital pharmacies, thus becoming a strong contender against retail pharmacies and online drugstores. Well-trained pharmacists who offer individual guidance to patients on proper drug administration, dosage adjustment, and possible side effects do add to the patient's trust and compliance with the regimens. Most patients also obtain their prescription drugs under insurance coverage and reimbursement policies available in hospitals. Additionally, obesity-related comorbid conditions requiring hospital-based interventions and longer treatments further accentuate the strong market position for hospital pharmacies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the largest share of 36.7%, driven by the high prevalence levels, increasing expenditure for healthcare facilities, and intense governmental efforts supporting the management of obesity. Both the U.S. and Canada have the highest obesity levels in the world, with more than 40% of adults in the U.S. considered obese, leading to huge demand for weight-loss medicines. The region has state-of-the-art healthcare infrastructure, prescription drugs are highly available, and obesity-related health risk awareness is high. Besides, regulatory agencies, such as the FDA, have been actively approving new and innovative anti-obesity drugs, which boosts the growth of the market. The main pharmaceutical companies operating in North America, including Novo Nordisk and Eli Lilly, are spending heavily on R&D, thus accelerating the pace of commercialization of effective weight-management solutions. Favorable reimbursement policies, combined with growing physician prescriptions for prescription-based therapies, further consolidate North America's lead in the anti-obesity drugs market.

The steady growth of anti-obesity drugs in Europe is based on the increasing prevalence of obesity, consciousness regarding health, and government initiatives promoting weight management. Strong healthcare infrastructure and prescription medications are widespread in countries such as Germany, the UK, and France. The EMA has approved innovative drugs for the treatment of anti-obesity conditions, further fueling market expansion. Further, an aging population within the region that is more vulnerable to obesity-linked diseases increases demand for successful treatments for obesity-related conditions, contributing to overall growth in the market.

Asia Pacific is the fastest-growing market for anti-obesity drugs. Increased prevalence of obesity, urbanization, and diet patterns are on the rise, which boosts growth in this market. The significant contributors are countries such as China, India, and Japan due to the growth in disposable income and awareness about health. Government initiatives that focus on raising awareness about obesity and preventive measures are boosting the market demand. Moreover, the growing pharmaceutical sector, with increased R&D spending, has come up with novel weight-loss drugs. The adoption of digital health platforms for obesity management in the region is another factor fostering the growth of the market.

In the Latin American anti-obesity drugs market, increased obesity rates are driving healthcare spending up and enhancing awareness about managing weight. Major contributors in Brazil and Mexico attributed to the high lifestyle-related disorder cases, especially diabetes and cardiovascular diseases. Improvement in prescription-based and over-the-counter anti-obesity medications becomes possible due to advancements in healthcare infrastructure. Awareness campaigns led by governments and insurance coverage for obesity treatment are also propelling market growth. Furthermore, the region's growing pharmaceutical sector is driving new obesity treatments' development and distribution.

The Middle East and Africa anti-obesity drugs market is increasing with the growing prevalence of obesity, urbanization, and sedentary lifestyles in the region. The GCC countries, such as Saudi Arabia and the UAE, are significant contributors due to high obesity rates and increasing healthcare investments. Government initiatives focused on obesity management, along with growing medical tourism for weight-loss treatments, are boosting market growth. Increasing pharmaceutical collaborations and drug approvals are also improving the availability of anti-obesity medications. However, in some African regions, limited access to healthcare hinders broader market penetration.

Key Regional Takeaways:

United States Anti-Obesity Drugs Market Analysis

In 2025, the United States held a market share of 92.0%, driven by a rising trend in the obesity population, increased healthcare expenses, and enhanced awareness about medical weight loss treatments. According to CDC data, 42.4% of American adults were obese in 2023, which raised the need for pharmacological therapies. Semaglutide and tirzepatide, which are GLP-1 receptor agonists, are increasingly being prescribed by healthcare providers for obesity management. Other support factors for this market are the expansion of insurance and employer-based treatment for obesity. The U.S. government is helping address the problem through a series of public health programs and research grants on the management of obesity. Novo Nordisk and Eli Lilly are investing in next-generation therapies and combination treatments and oral formulations. Direct-to-consumer marketing and telemedicine platforms expand the reach of prescription weight-loss drugs to patients. Continued R&D and regulatory support mean that the U.S. may continue to lead in the global anti-obesity drug market.

Europe Anti-Obesity Drugs Market Analysis

Europe's anti-obesity drug market is growing due to rising obesity rates and supportive healthcare policies. The WHO reports that in the WHO European Region, over one-third of children (29% of boys and 27% of girls) and 60% of adults suffer from overweight or obesity. Therefore, many governments are seeing medical interventions as a priority for consideration. Obesity drugs have the highest adoption in Germany, France, and the UK. Some prescription weight loss medications are also covered by the healthcare system in Germany, along with increased awareness from consumers and newly approved drugs, boosting the expansion of the market. Novo Nordisk and Roche lead in the segment. However, contributions from newly emergent biotech companies also drive the sector. Moreover, with the use of telemedicine increasing, so is the rate of prescriptions. With increasing investment in pharmacological solutions, Europe is fast emerging as a significant player in the world's anti-obesity treatment market.

Asia Pacific Anti-Obesity Drugs Market Analysis

The Asia Pacific anti-obesity drug market is growing rapidly with the increasing rate of obesity and investments in health care. According to a 2020 study by China's National Health Commission, 34.3% of Chinese individuals were overweight and 16.4% were obese. The Economic Survey 2023-24 for India states that the obesity rate is more than twice as high in rural regions as it is in metropolitan ones. For example, in urban areas, 24% of women and 29.8% of males are impacted. The growing rates of obesity, especially in cities, are fueling the demand for anti-obesity drugs. The key markets lie in China and India, as patients increasingly become concerned about their weight and are eager to adopt weight-loss medication. Schemes by governments to promote health and wellness and the high-rising trend of lifestyle diseases are creating a conducive market environment. The major players are focusing on these regions for expansion, while continuous R&D is introducing new and more effective anti-obesity medications.

Latin America Anti-Obesity Drugs Market Analysis

The market for anti-obesity drugs in Latin America is positively influenced due to rising obesity rates, healthcare expenses, and demand for weight management products." According to a new study, 48% of Brazilian adults will face obesity by 2044, and another 27% will be overweight. It will further be evident that the obesity burden in the region will rise prominently. The largest economy in Latin America, Brazil, leads the adoption of anti-obesity drugs, showing strong market potential due to high disposable incomes and increased awareness. Mexico and Argentina are also emerging as regions witnessing a growing issue of obesity and related health problems, leading to increased investment in obesity management solutions. Pharmaceutical companies are focusing on the region's growth and are working to make obesity treatment accessible. The government is also spending its budget on combating obesity, thus fueling the market growth. In the Latin American market, growth will be driven by the increase in demand for pharmacological solutions in the coming years.

Middle East and Africa Anti-Obesity Drugs Market Analysis

Rising obesity rates, investments in health care infrastructure, and increasing awareness over weight management are the principal drivers for demand for anti-obesity drugs from the Middle East and Africa region. As per WHO, as of 2023, more than 35% of adults were obese in Saudi Arabia and the UAE, and this sets off a huge demand for pharmaceutical intervention. With a massive positive response to government initiatives and public health drives against obesity, the demand for medical weight-loss solutions increases. In Saudi Arabia, the government has made significant thrusts on obesity prevention and treatment. Thus, the adoption of anti-obesity medications is slowly increasing in that region. In the UAE, obesity treatment has been under great emphasis with its national wellness strategy targeting the health care policy toward obesity management. Companies working there have allied with pharmaceutical companies around the world to establish new anti-obesity medications. The Middle East and Africa are, therefore, positioned as promising markets for the anti-obesity drug industry worldwide due to the increasing developed infrastructures throughout the healthcare sector and greater consumer access to treatments.

Competitive Landscape:

Major players are very actively investing in research and development to bring to the market the most innovative drug with enhanced safety and efficacy of the anti-obesity drugs. Drug companies are currently focusing on newer mechanisms like GLP-1 receptor agonists, which appear to have encouraged results in obesity management. Other strategic collaborations, mergers and acquisitions are carried out by the company to increase its market presence along with expanding its product lines. Regulatory approvals have been quick in coming, multiple new drugs get approved by regulatory agencies such as the FDA or EMA, which in turn increases commercialization and prescription-based anti-obesity treatments. There is an increasing trend toward digital health integration, wherein companies are leveraging telemedicine platforms to improve access of patients to medicines. Players are also entering into emerging markets with a demand for obesity treatment owing to changes in lifestyle and greater awareness regarding health care. These efforts create a positive anti-obesity drugs market outlook.

The report provides a comprehensive analysis of the competitive landscape in the anti-obesity drugs market with detailed profiles of all major companies, including:

- Boehringer Ingelheim International GmbH

- Currax Pharmaceuticals LLC

- Gelesis

- GlaxoSmithKline plc

- Merck & Co. Inc.

- Norgine B.V.

- Novo Nordisk A/S

- Pfizer Inc.

- Rhythm Pharmaceuticals Inc.

- SHIONOGI & Co. Ltd.

- Takeda Pharmaceutical Company Limited

- Vivus LLC.

Latest News and Developments:

- January 2025: Pfizer CEO Albert Bourla stated that the business is completely committed to improving obesity therapies, stating that it has a strong commitment to creating an obesity medicine. Pfizer wants to increase its market share in the expanding anti-obesity medication sector.

- December 2024: The FDA granted an extended indication for IMCIVREE® (setmelanotide), allowing Rhythm Pharmaceuticals to treat kids as young as two years old. The medication is now authorized for the reduction of excess body weight in children with syndromic or monogenic obesity who are 2 years of age or older.

- December 2024: Merck signed a pact worth up to USD 2 billion with China's Hansoh for developing a novel oral weight-loss drug. The collaboration has Hansoh's metabolic-disorder expertise in line to produce the product, a big stride for Merck to enter the anti-obesity treatment arena.

- September 2024: Novo Nordisk A/S announced that monlunabant (formerly known as INV-202), a cannabinoid receptor 1 inverse agonist, has shown promising results in the Phase 2a study for obesity. Significant weight loss was shown in the research at all levels, with the 10 mg dose resulting in a decrease of 7.1 kg. With minimal neuropsychiatric side effects, many adverse events were gastrointestinal and dose dependent.

- January 2024: Novo Nordisk's shares touched an all-time high as the company's market value surpassed USD 500 billion. This was after the company's obesity and diabetes drugs, Wegovy and Ozempic, recorded soaring sales driven by runaway demand despite struggling to meet orders.

Anti-Obesity Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Peripherally Acting Drugs, Centrally Acting Drugs |

| Drug Types Covered | Prescription Drugs, OTC Drugs |

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Pharmacy |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boehringer Ingelheim International GmbH, Currax Pharmaceuticals LLC, Gelesis, GlaxoSmithKline plc, Merck & Co. Inc., Norgine B.V., Novo Nordisk A/S, Pfizer Inc., Rhythm Pharmaceuticals Inc., SHIONOGI & Co. Ltd., Takeda Pharmaceutical Company Limited, Vivus LLC |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the anti-obesity drugs market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global anti-obesity drugs market.

- The study maps the leading, and the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the anti-obesity drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anti-obesity drugs market was valued at USD 2.7 Billion in 2025.

The anti-obesity drugs market is estimated to exhibit a CAGR of 9.50% during 2026-2034.

The anti-obesity drugs market is driven by rising obesity rates, health awareness, demand for weight management solutions, drug development advancements, government initiatives, R&D investments, combination therapies, and availability of prescription and over-the-counter drugs.

North America currently dominates the market, driven by the high obesity rates, robust healthcare infrastructure, increasing weight-loss medication adoption, favorable reimbursement policies, key pharmaceutical players, extensive R&D activities, and growing consumer awareness.

Some of the major players in the anti-obesity drugs market include Boehringer Ingelheim International GmbH, Currax Pharmaceuticals LLC, Gelesis, GlaxoSmithKline plc, Merck & Co. Inc., Norgine B.V., Novo Nordisk A/S, Pfizer Inc., Rhythm Pharmaceuticals Inc., SHIONOGI & Co. Ltd., Takeda Pharmaceutical Company Limited and Vivus LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)