Anti Crease Agent Market Size, Share, Trends and Forecast by Type, Cross-Linking Chemical, Application, and Region, and Region, 2025-2033

Anti Crease Agent Market Size and Share:

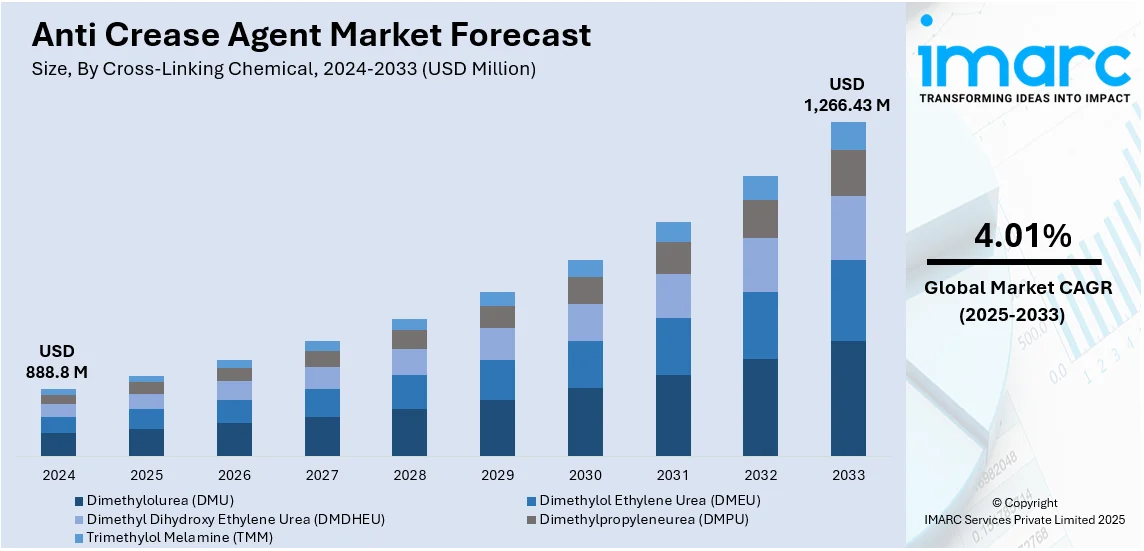

The global anti crease agent market size was valued at USD 888.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,266.43 Million by 2033, exhibiting a CAGR of 4.01% from 2025-2033. Asia Pacific currently dominates anti crease agent market share with 43.2% in 2024. The market is driven by rising cotton fabric demand, boosting consumer awareness about wrinkle-resistant textiles, and changing fashion trends. The growth of textile production in the region, especially in China and India, accelerates market expansion further. At present, Asia Pacific dominates the market on account of the increasing production of cotton textiles, along with the rising demand for wrinkle-free clothes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 888.8 Million |

| Market Forecast in 2033 | USD 1,266.43 Million |

| Market Growth Rate (2025-2033) | 4.01% |

The growing customer preference for crease-free and crinkle-free clothing is one major driver for this anti crease agent market growth. As the population becomes more sensitive to environmental matters, customers also demand clothes which are both environment friendly and durable enough. For instance, in May 2023, BASF launched Crease-Stop®, an eco-friendly wrinkle-reduction solution made from castor oil. Biodegradable and compostable, it effectively maintains fabric smoothness through multiple wash cycles. Moreover, anti-crease agents act as a finishing agent to strengthen the durability and maintain a rich appearance of textiles, supporting these changing trends. A new dimension in the pursuit of sustainability and strict environmental regulations have motivated the manufacturers to create advanced formulations that are compatible with biodegradable and organic textiles. The rise in popularity of wrinkle-free apparels and home textiles, supported by hectic lifestyles and demands for easy-care fabrics, has increased the uptake of anti-crease solutions further. This demand spans diverse sectors, including apparel, home décor, and automotive interiors, driving continuous innovation in product development to cater to industry requirements and sustain market growth.

The U.S. anti-crease agent market is driven primarily by the surge in demand for advanced textile solutions across various diverse industries. Country fashion and apparel sector thrives on high quality wrinkle free fabrics that find resonance with comfort and convenience-based consumer preferences. For example, In August 2023, Huntsman Corporation launched Aegis® CR, a silicone-based emulsion for personal care products, enhancing wrinkle resistance, reducing ironing needs, and promoting sustainable fabric care in hair care and skin care. Furthermore, technical textiles continue to gain mileage in automotive, healthcare, hospitality sectors, requiring the use of anti-crease agents to support durability and maintaining fabric aesthetics. Accelerating need for low-maintenance and sustainable fabrics with the onset of urbanization and lifestyle changes that meet wider environmental goals, U.S. market has considerable investment in innovation of textile and its use through manufacturers. It allows advanced technology usage for manufacturing formulations, making it more efficient and environment friendly. With this, e-commerce has added its boost as platforms where the reach can be vast, catering to demands by a wider set of consumers as needs are being developed accordingly.

Anti Crease Agent Market Trends:

Growth in Anti-Crease Demand

The rising production of cotton to meet its surging global demand is primarily driving the anti-crease agent market growth. Anti-crease agents are essential to prevent creasing in natural and synthetic fibers and enhance the physical appearance, miscibility, stability, and compatibility of finished textiles. According to reports, the percentage of natural fibers produced via programs with sustainability elements slightly increased in 2022, including cotton (25% in 2021 to 27% in 2022) and wool (3% in 2021 to 4.3% in 2022). Moreover, the product offers benefits, such as preventing chafing or crease marks during processing for all types of fabrics processed at low liquor ratios on machines with high shear forces, which is strengthening the market growth. Besides this, rapid urbanization, inflating disposable incomes of individuals, changing lifestyle and fashion trends, and the rising demand for wrinkle-free or anti-crease fabrics are propelling the anti-crease agent market growth. For instance, by 2050, it's projected that 1 in 7 people globally will live in urban areas. Moreover, the robust growth of the apparel industry, the increasing use of textiles in home décor and furniture, and the rising adoption of anti-crease agents in automotive interiors are driving market growth. Simultaneously, the growing utilization of anti-crease agents in creating durable, wrinkle-free, and long-lasting footwear, along with their extensive application in the hospitality sector for comfortable and crease-resistant bedding and other materials, is further supporting market expansion. Additionally, significant advancements in textile manufacturing processes, such as the adoption of advanced machinery and emerging technologies, along with innovations in fabric design, including improvements in patterns, colors, and textures, are shaping a favorable outlook for the anti-crease agent market.

Increasing Focus on Lightweight and High-Performance Fabrics

Growing demands for lightweight and high-performance fabrics in most industries, including sportswear, activewear, and outdoor gear, increase the demand for anti-crease agents. These fabrics must possess durability, flexibility, and wrinkle resistance to sustain functionality while remaining fashionable even under extreme conditions. Anti-crease agents enhance the resiliency of the fabric. These agents will not allow the formation of creases during either production or use. They form an integral part of advanced textile development. Comfort, performance, and aesthetic appeal are the emerging concerns of the consumers. As a result, manufacturers are increasingly using anti-crease technologies. Athleisure and hybrid clothing are the recent trends that involve casual wear and performance. This scope is increasing in the application of anti-crease agents. As the global demand for premium and multifunctional fabrics grows, the role of anti-crease agents in enhancing fabric properties and supporting innovation is becoming increasingly important, driving the market steadily.

Rising Adoption in Medical and Healthcare Textiles

Another major driver of growth in the market is the increased use of anti-crease agents in medical and healthcare textiles. These include hospital bedding, surgical drapes, and patient gowns, which are required to meet strict standards of hygiene, durability, and wrinkle resistance. Anti-crease agents improve the quality and longevity of these fabrics, ensuring that they maintain their appearance and functionality even after multiple washes and high-temperature sterilizations. With the ever-expanding healthcare sector globally, especially in developing markets, medical textiles that are durable and maintenance-friendly are experiencing a surge in demand. On the other hand, the use of wrinkle-resistant solutions that are comfortable as well as aesthetic for both the patients and health care professionals drives the adoption rate. Anti-wrinkle agents also uphold innovations in medical textile designs to ensure that materials can be designed under the single headed requirement for both practicality and comfort, further entrenching their role in the growth of the healthcare sector.

Anti Crease Agent Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global anti crease agent market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, cross-linking chemical, and application.

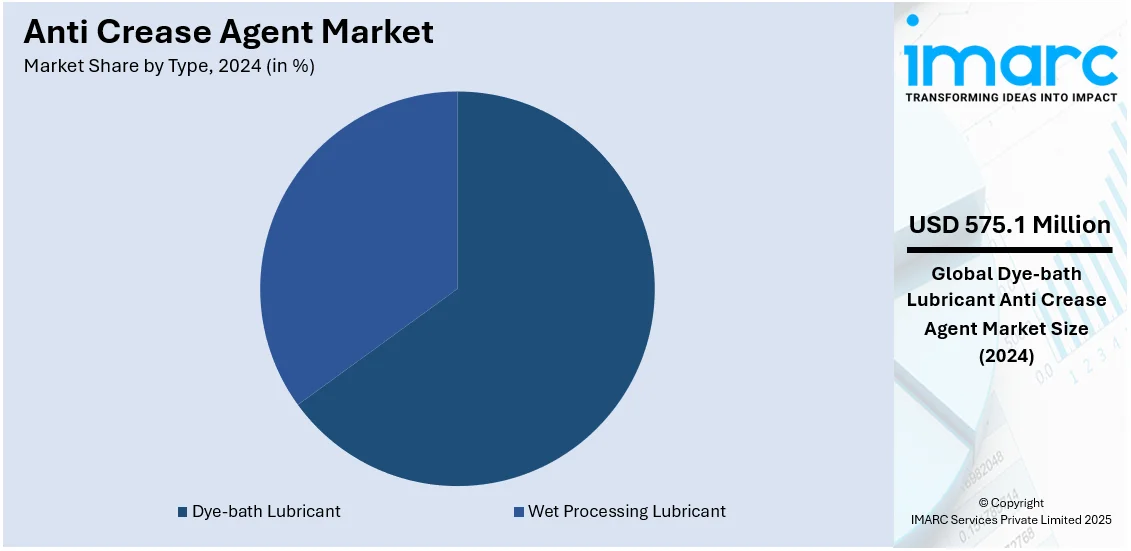

Analysis by Type:

- Dye-bath Lubricant

- Wet Processing Lubricant

Dye-bath lubricant stand as the largest component in 2024, holding around 64.7% of the market, due to its essential role in the textile dyeing process. It is widely used to reduce friction between fabrics during dyeing, preventing creases and maintaining fabric quality. The growing demand for high-quality, wrinkle-free textiles is leading to the adoption of these lubricants, particularly in large-scale textile manufacturing regions. The effectiveness in enhancing the dyeing process by ensuring even dye distribution and minimizing fabric damage is making dye-bath lubricants a critical component for textile producers.

Analysis by Cross-Linking Chemical:

- Dimethylolurea (DMU)

- Dimethylol Ethylene Urea (DMEU)

- Dimethyl Dihydroxy Ethylene Urea (DMDHEU)

- Dimethylpropyleneurea (DMPU)

- Trimethylol Melamine (TMM)

Dimethylolurea (DMU) leads the market share in 2024, because of its widespread use in the textile industry. This dominance is attributed to its high efficiency in forming durable cross-links with fibers, which notably minimizes fabric wrinkling and enhances crease resistance. DMU is particularly favored for its cost-effectiveness, making it an attractive option for large-scale textile manufacturers seeking quality at an economical price. Additionally, its versatility in application across various types of textile fibers, including cotton, polyester, and blends, broadens its usage. The increasing demand for wrinkle-resistant, easy-care garments in both formal and casual wear is bolstering the growth of the market.

Analysis by Application:

- Personal Use

- Public Use

Personal use leads the market share in 2024, due to the increasing demand for easy-care and wrinkle-resistant fabrics. Individuals prioritizing convenience and preferring clothing that requires minimal ironing, particularly in casual and professional wear. Anti-crease agents play a crucial role in enhancing the durability and appearance of garments, making them more appealing for daily use. The growing trend of home textile care, coupled with the increasing awareness about fabric maintenance, are driving the demand in this segment.

Public use encompasses textiles used in commercial and institutional settings, such as hotels, hospitals, and public transportation. In these environments, maintaining a professional and clean appearance is essential, and anti-crease agents help ensure that fabrics used for uniforms, linens, and upholstery remain wrinkle-free despite heavy use. This segment benefits from the growing emphasis on maintaining aesthetic standards in public spaces, particularly in industries where fabric durability and appearance directly impact customer satisfaction.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific has the highest market share of 43.2% in the anti-crease agent market in 2024. The region dominates due to its rapid industrialization, urbanization, and higher demand for wrinkle-resistant textiles in countries such as China, India, Japan, and South Korea. Its growth is spurred by the huge textile manufacturing base, especially in China and India. Demand increases for easy-care fabrics with growth in disposable income and changes in fashion trends. Government support with subsidies and better infrastructure for textile development further bolsters the textile industry. Enhanced awareness of responsible textile solutions increases the interest among manufacturers to put investments into such eco-friendly anti-crease agents. Accelerating presence of e-commerce and retail in the region would help sustain the demand, ensuring Asia Pacific remained the market leader.

Key Regional Takeaways:

North America Anti Crease Agent Market Analysis

The North America anti-crease agent market is growing steadily due to the advanced textile industry in the region and the rising demand for quality, wrinkle-free fabrics. Growing consumer demand for sustainable and durable materials increases the adoption of anti-crease agents in apparel, home décor, automotive interiors, and healthcare industries. The well-established manufacturing infrastructure, technological advancements, and a focus on eco-friendly textile solutions drive the growth of the market. Additional aspects stimulating the demand of anti-crease agents are growth in athleisure and casual wear, increase in the hospitality industry, need for comfortable fabrics that last, urbanization and higher disposable income, and also changes in the current way of living. Regional players also invest in more research and development to innovate for sustainable and effective formulations that may comply with stronger environmental regulations. This also increases accessibility in the market for e-commerce platforms, thus tapping a larger customer base.

United States Anti Crease Agent Market Analysis

The increasing adoption of anti-crease agents is driven by the rising trend of urban lifestyles that prioritize convenience and efficiency. As more individuals shift toward fast-paced living, the demand for wrinkle-free and low-maintenance clothing has surged. For instance, in 2022, sales at clothing and clothing accessories stores were up 1.1% month-on-month and by 30.6% compared to the same period a year ago. This change in consumer preferences has encouraged industries to utilize advanced textile treatments that ensure longer lasting and crease-resistant fabrics. The growing number of modern households and professional setups is further contributing to the adoption of these agents, as they cater to the need for durable, aesthetically pleasing textiles. The use of anti-crease agents in casual wear, formal apparel, and home textiles reflects the demand for high-performance solutions that complement modern living standards. These developments highlight the pivotal role of anti-crease technology in meeting urban demands while promoting time saving, low-maintenance fabric care solutions.

Asia Pacific Anti Crease Agent Market Analysis

The rising utilization of anti-crease agents in the region's automotive industry can be attributed to the focus on enhancing interior comfort and aesthetics. According to India Brand Equity Foundation, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000 - December 2023. With increasing vehicle production and consumer preferences for high-quality interiors, manufacturers are integrating crease-resistant treatments in materials like seat covers, upholstery, and other fabric components. Anti-crease agents ensure that these fabrics maintain their appearance and durability despite prolonged use. The focus on improving passenger experiences has driven demand for advanced textile technologies that meet stringent performance standards. Automotive textiles treated with anti-crease agents not only enhance visual appeal but also reduce maintenance efforts, aligning with consumer expectations for premium and convenient solutions. Additionally, the shift toward innovative designs in automotive interiors further amplifies the demand for these treatments, as they support the creation of elegant and long-lasting products tailored to evolving market trends.

Europe Anti Crease Agent Market Analysis

The emphasis on sustainable practices has significantly influenced the adoption of anti-crease agents in Europe. For instance, 46.5% of Europeans bought sustainable fashion items in 2022, and more people see sustainable products as fashionable. With a strong inclination toward natural fibers and eco-conscious textiles, the textile industry is leveraging innovative treatments to enhance the performance of sustainable materials. Anti-crease agents play a crucial role in maintaining the quality and appearance of organic and biodegradable fabrics, ensuring their durability without compromising environmental considerations. This integration supports the growing demand for clothing and home textiles that align with green principles. Furthermore, the focus on reducing energy and water consumption in garment maintenance has increased the appeal of anti-crease solutions, as they contribute to prolonged fabric life and easier care. These developments highlight how environmentally aligned textile enhancements are driving the adoption of treatments that balance sustainability with functionality, catering to consumers seeking ethical and practical choices.

Latin America Anti Crease Agent Market Analysis

The increasing disposable income across the region has contributed to greater adoption of anti-crease agents. For instance, total disposable income in Latin America is set to rise by nearly 60% in real terms over 2021-2040. With enhanced purchasing power, consumers are prioritizing premium fabrics that combine style with convenience. The preference for wrinkle-free clothing has grown, particularly among working professionals and urban households, as it complements their busy lifestyles. Anti-crease treatments ensure that garments and home textiles retain their neat appearance, reducing the time and effort required for maintenance. This trend reflects a broader shift toward investing in quality textile products that offer long-lasting benefits. As more individuals seek affordable luxury in their everyday lives, the integration of advanced fabric care technologies continues to meet these evolving expectations effectively.

Middle East and Africa Anti Crease Agent Market Analysis

The growing adoption of anti-crease agents in the Middle East and Africa is driven by the expanding textile industry across the region. According to reports, in 2022, the UAE textile market was valued at more than USD10 billion and is now expected to expand by more than 5% a year over the medium term. As demand for high-quality fabrics increases, textile manufacturers are focusing on enhancing fabric durability and appearance, fuelling the use of anti-crease agents to prevent wrinkles during processing. Rapid urbanization and rising disposable incomes are further propelling the demand for fashionable and wrinkle-free clothing, boosting the market for these agents. Additionally, the increasing adoption of advanced textile technologies in countries like Saudi Arabia, UAE, and South Africa highlights the need for specialized fabric care chemicals like anti-crease agents. Eco-friendly formulations and innovations in textile chemicals are also aligning with the region's sustainability goals, strengthening market growth. These factors collectively underscore the significance of anti-crease agents in meeting the evolving demands of the thriving textile sector in the Middle East and Africa.

Competitive Landscape:

The anti-crease agent market has many players that have been vying to establish their position by means of innovative products and new technology. In terms of competition, market participants are looking for solutions that are environment-friendly and sustainable as more environmental concerns rise and fit in with global trends towards sustainability. In recent times, high-performance products meant for diverse applications such as apparels, home textiles, automotive interiors, and healthcare textiles have intensified the competition of the industry. The companies also employ advanced manufacturing processes and strategic alliances to enhance efficiency in production along with the improvement of market penetration. Investments in research and development that help produce new formulations improving the durability of fabric, less creasing, and compatibility with diverse textile materials shape the dynamics of competition. With the boom in e-commerce and digital marketing, the competition gets fiercer since producers can effectively access a broader base of consumers and establish networks for global distribution.

The report provides a comprehensive analysis of the competitive landscape in the anti-crease agent market with detailed profiles of all major companies, including:

- Fineotex Chemical Limited

- Golden Technologia

- Kolorjet Chemicals Pvt Ltd

- Prochem Ltd

- Sarex Chemicals

- Siam Pro Dyechem Group

Latest News and Developments:

- November 2024: Fineotex Chemical Limited showcased its innovative anti-crease agents at the Clean India Show 2024, Asia’s largest integrated exhibition held from November 21–23. The event highlighted Fineotex's commitment to green industry practices and sustainable solutions in textile chemicals. Their cutting-edge products, including eco-friendly formulations, garnered significant attention from industry leaders. This participation reinforced Fineotex's position as a pioneer in sustainable chemical solutions.

- July 2024: Fineotex Chemical Limited's R&D Laboratory achieved its second-year accreditation from the National Accreditation Board for Testing and Calibration Laboratories (NABL). This milestone underscores the company's commitment to quality and innovation in specialty chemicals. The accreditation strengthens Fineotex’s ability to develop advanced products, including anti-crease agents for textiles. This recognition reinforces its position as a leader in sustainable and efficient textile solutions.

- January 2024: Fineotex Chemical Limited announced the acquisition of new factory premises, marking a significant expansion in its production capabilities. This move aims to enhance its manufacturing of specialty chemicals, including anti-crease agents for the textile industry. The expansion aligns with the company's strategy to meet growing global demand for sustainable textile solutions. Fineotex continues to strengthen its position as a leader in innovative chemical solutions.

- August 2023: the American Textile Company (ATC) launched a technology center in Pittsburgh, U.S., as part of its digital transformation efforts. The facility aims to enhance manufacturing operations and innovation. Its open design fosters collaboration while offering dedicated spaces for focused work. The initiative supports the development of advanced solutions, including anti-crease agents, to meet evolving textile demands.

Anti Crease Agent Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dye-bath Lubricant, Wet Processing Lubricant |

| Cross-linking Chemicals Covered | Dimethylolurea (DMU), Dimethylol Ethylene Urea (DMEU), Dimethyl Dihydroxy Ethylene Urea (DMDHEU), Dimethylpropyleneurea (DMPU), Trimethylol Melamine (TMM) |

| Applications Covered | Personal Use, Public Use |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Fineotex Chemical Limited, Golden Technologia, Kolorjet Chemicals Pvt Ltd, Prochem Ltd, Sarex Chemicals, Siam Pro Dyechem Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the anti crease agent market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global anti crease agent market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the anti crease agent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anti crease agent market was valued at USD 888.8 Million in 2024.

IMARC Group estimates the market to reach USD 1,266.43 Million by 2033, exhibiting a CAGR of 4.01% from 2025-2033.

Key factors driving the anti-crease agent market include rising cotton production, increasing demand for wrinkle-free fabrics, rapid urbanization, growing disposable incomes, expanding apparel and home décor sectors, advancements in textile manufacturing, adoption in automotive and medical textiles, and the hospitality sector's need for durable materials.

Asia Pacific currently dominates the market which is driven by strong textile production in China, India, and Japan, increasing demand for wrinkle-resistant fabrics, rapid urbanization, and government support for the textile industry’s growth and innovation.

Some of the major players in the anti crease agent market include Fineotex Chemical Limited, Golden Technologia, Kolorjet Chemicals Pvt Ltd, Prochem Ltd, Sarex Chemicals, Siam Pro Dyechem Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)