Anti-Counterfeit Packaging Market Report by Technology (Barcodes, RFID (Radio-Frequency Identification), Holograms, Taggants, and Others), Feature Type (Overt Features, Covert Features), End Use Industry (Food and Beverage, Healthcare, Automotive, Consumer Electronics, and Others), and Region 2026-2034

Anti Counterfeit Packaging Market Size:

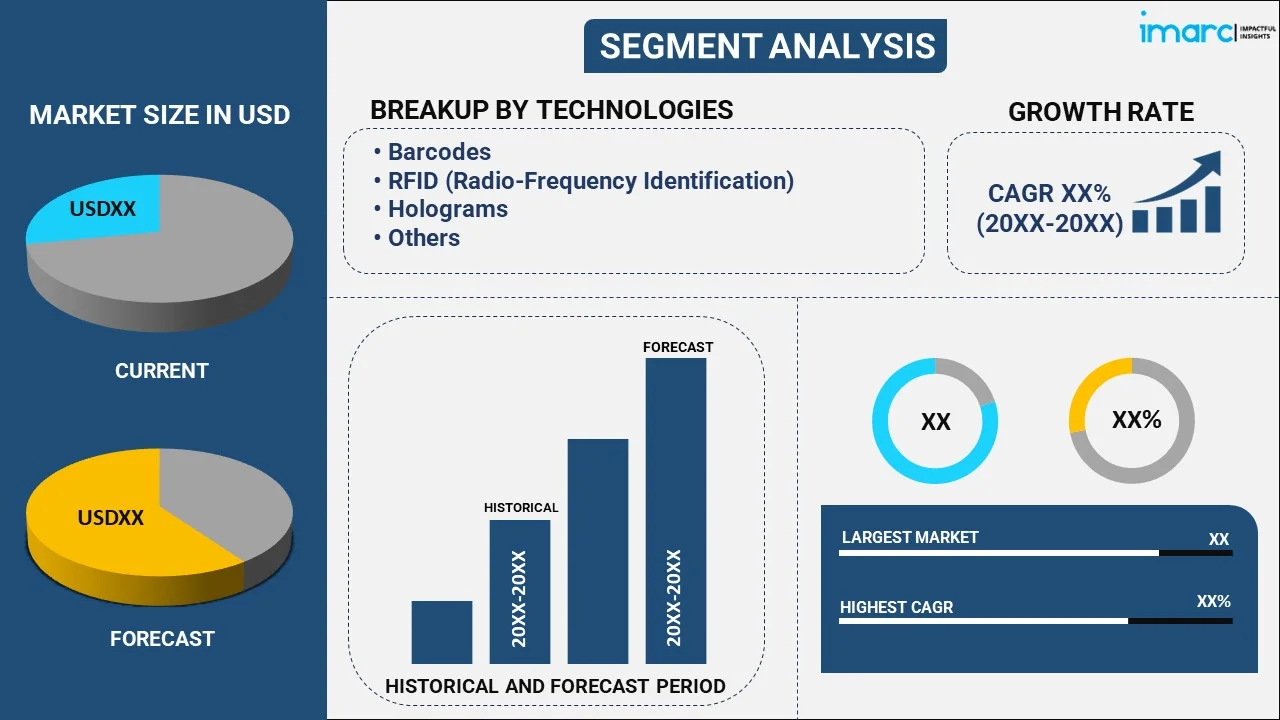

The global anti-counterfeit packaging market size reached USD 150.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 356.0 Billion by 2034, exhibiting a growth rate (CAGR) of 9.72% during 2026-2034. North America dominates the market, attributed to its solid regulatory framework, advanced technology adoption, and a strong presence of essential industries. The market is also experiencing significant growth mainly driven by the rising need for secure packaging solutions across various industries. Technological advancements like RFID, blockchain and AI powered analytics, along with the growth of smart packaging using QR codes and NFC tags, are also contributing positively to the market growth.

Market Size & Forecasts:

- Anti-counterfeit packaging market was valued at USD 150.8 Billion in 2025.

- The market is projected to reach USD 356.0 Billion by 2034, at a CAGR of 9.72% from 2026-2034.

Dominant Segments:

- Technology: RFID (radio-frequency identification) leads the market because it offers real-time tracking and product authentication. This technology improves supply chain security by allowing accurate identification and verification, maintaining product integrity, and stopping counterfeiting via smooth, automated oversight across distribution networks.

- Feature Type: Overt features account for the largest market share, as they are noticeable and simple for users to verify. These attributes provide instant verification, boosting client confidence and serving as a strong barrier to fake products. Their ease of access and simplicity make them popular in different industries for safeguarding brands.

- End Use Industry: Healthcare represents the largest segment owing to the critical need for safeguarding patient safety and guaranteeing the genuineness of pharmaceutical items. The sector's stringent regulatory standards, combined with the growing cases of counterfeit drugs, is encouraging the adoption of advanced packaging solutions to protect both individuals and healthcare providers.

- Region: North America dominates the anti-counterfeit packaging market, attributed to its solid regulatory framework, advanced technology adoption, and a strong presence of essential industries. The area's developed infrastructure, along with rising consumer interest in genuine products, promotes the extensive adoption of creative packaging solutions for brand security.

Key Players:

- The leading companies in anti-counterfeit packaging market include 3M Company, Alpvision SA, Applied DNA Sciences Inc., Authentix Inc. (Blue Water Energy LLP), Avery Dennison Corporation, CCL Industries Inc., DuPont, Savi Technology Inc. (Lockheed Martin), SICPA Holding SA, SML Group, and Zebra Technologies.

Key Drivers of Market Growth:

- Advancement in Technology: Improvements in anti-counterfeit packaging are propelled by RFID, blockchain, and IoT technologies. RFID facilitates instant tracking, blockchain guarantees secure transactions, and IoT provides ongoing monitoring for prompt product verification. These technologies boost product safety, enhance traceability, and optimize supply chain efficiency, protecting against fake products.

- Rise in Counterfeit Detection Systems: Incorporating AI and machine learning (ML) into counterfeit detection systems enhances both precision and efficiency. These systems examine data to identify counterfeit patterns, and ML adjusts to emerging methods, guaranteeing swift detection of counterfeit products. This progress enhances product safety and encourages wider industry acceptance.

- Need for Brand Protection: With companies experiencing financial setbacks and harm to their reputation due to counterfeits, safeguarding their brands takes precedence. Businesses allocate funds for sophisticated anti-counterfeit packaging technologies to safeguard product integrity and uphold user confidence. These actions protect brands in various sectors, stopping counterfeit products from reaching buyers and damaging brand reputation.

- E-Commerce and Online Sales: The swift expansion of online shopping is increasing the danger of counterfeit goods. With the rise of online transactions, fraudsters take advantage of digital platforms to sell fake products. This increases the demand for secure anti-counterfeit packaging, guaranteeing product authenticity and safeguarding both consumers and brand integrity in online marketplaces.

- Preference for Luxury Goods: Counterfeiters heavily target luxury items because of their high worth. To maintain their exclusivity, brands are putting money into sophisticated anti-counterfeit packaging technologies. Holograms and distinctive serial numbers guarantee product authenticity, safeguarding the integrity of high-value items and upholding user confidence.

- Stringent Regulatory Requirements: Increasing global regulations require industries like pharmaceuticals to adopt anti-counterfeiting packaging measures. Businesses need to implement secure packaging strategies to adhere to legal regulations, including tamper-evident seals and distinct identifiers.

Future Outlook:

- Strong Growth Outlook: The anti-counterfeit packaging market is poised for strong growth owing to increasing global concerns over product authenticity and rising counterfeit activities. Advancements in packaging technologies, stricter regulations, and heightened user demand for secure, reliable products contribute to a promising market outlook across various industries.

- Market Evolution: The anti-counterfeit packaging market is evolving rapidly, attributed to continuous advancements in security technologies and growing individual awareness. As counterfeiters become more sophisticated, the demand for innovative, multi-layered packaging solutions increases, fostering a dynamic shift towards smarter, more efficient methods of product authentication and protection.

To get more information on this market Request Sample

Individuals are becoming more conscious about the hazards linked to fake products, including health risks and monetary loss. This increased awareness is encouraging manufacturers to implement anti-counterfeit packaging to guarantee trust and dependability in their products. Businesses allocate resources to packaging technologies that offer clear evidence of authenticity, enhancing user trust. Moreover, the growing popularity of online shopping is resulting in a rise in the sale of fake goods on the internet. Sellers require packaging that guarantees product authenticity, minimizing the chances of counterfeit goods being sold to buyers. Anti-counterfeit packaging acts as an essential resource for companies operating online, providing clarity and protection in virtual marketplaces. Apart from this, improvements in packaging technologies, including holograms, RFID tags, and nanotech, enable businesses to adopt anti-counterfeit measures more easily and affordably. These advancements offer novel methods to improve security and safeguard against forgery. With the evolution of these technologies, they become easily available, thereby driving the need for sophisticated packaging solutions.

Anti Counterfeit Packaging Market Trends:

Technological Advancements

Advancements in technology within the anti-counterfeit packaging sector are primarily fueled by the growing applications of RFID, blockchain, and Internet of Things (IoT). RFID allows for immediate tracking and verification of products, guaranteeing their legitimacy across the supply chain. Blockchain offers a permanent record for safe, transparent transactions, improving traceability. Integrated IoT devices within packaging enable ongoing oversight for immediate confirmation of product legitimacy. These technologies not only safeguard against forgery but also enhance supply chain effectiveness. For example, in May 2024, iTRACE Technologies, Inc. enhanced its iTRACE 2DMI® technology by incorporating AI and blockchain. The latest functionalities incorporated AI-driven fake detection, blockchain-based security for validation, and mobile access for confirmation. This development mirrors wider movements within the industry, establishing novel benchmarks for security. With the evolution of these technologies, the anti-counterfeit packaging sector is set for considerable expansion, as greater adoption across multiple industries improves product protection and supply chain visibility.

Rise in Counterfeit Detection Systems

The growth of counterfeit detection systems is driven by the integration of cutting-edge technologies, such as AI-driven analytics and machine learning (ML). These systems examine extensive datasets to uncover patterns that signify counterfeit items, allowing for quicker and more precise detection. ML algorithms consistently advance, efficiently identifying new techniques for counterfeiting. These developments promote wider acceptance in various sectors, greatly improving product safety and decreasing fake items. In April 2024, Koenig & Bauer teamed up with Graphic Security Systems Corporation to create anti-counterfeiting solutions. Through the integration of steganographic techniques with printing presses, the collaboration aimed to provide improved security and verification for highly sensitive printed materials and items. Such advancements not only tackle counterfeiting but also guarantee user safety and maintain brand integrity by stopping counterfeit goods from entering the market.

Increasing Need for Brand Protection

Brands are becoming more aware about the monetary losses and reputational harm that fake products can inflict. Businesses are allocating resources to creative packaging solutions to safeguard their products and maintain user confidence. This need for brand safeguarding is leading to the creation and adoption of sophisticated anti-counterfeit packaging solutions. These measures not only protect the brand but also guarantee that products stay authentic during their passage through the supply chain. As counterfeiting emerges as a worldwide concern, companies are acknowledging the need for improved packaging strategies to protect their goods and maintain client trust. The need for brand protection in various industries, particularly in pharmaceuticals, luxury items, and consumer electronics, is bolstering the expansion of anti-counterfeit packaging technologies and encouraging companies to incorporate these solutions into their regular practices.

Anti Counterfeit Packaging Market Growth Drivers:

Growing E-Commerce and Online Sales

The swift expansion of e-commerce is greatly heightening the danger of fake products saturating the market. Due to the simplicity of online transactions, fraudsters are taking advantage of digital platforms to sell fake items, complicating the process for users to verify the authenticity of products. With the rise of global supply chains and digital marketplaces, the demand for trustworthy anti-counterfeit packaging is increasing. E-commerce sites, which frequently ship products worldwide, are emerging as major targets for counterfeiters. In reaction, companies are adopting advanced packaging methods, such as secure labeling, QR codes, and digital verification tools, to guarantee product authenticity. These actions not only shield individuals but also protect brands' images in the online environment. As global B2C e-commerce sales are projected to hit USD $5.5 trillion by 2027, with a 14.4% compound annual growth rate, the need for anti-counterfeit packaging solutions is anticipated to increase, as businesses aim to stop counterfeit products from getting to individuals.

Rising Demand for Luxury Goods

High-end brands, due to their premium value, are increasingly targeted by counterfeiters. To protect their exclusivity and reputation, these brands are investing heavily in advanced packaging technologies. Anti-counterfeit solutions for luxury goods typically incorporate features like holograms, unique serial numbers, and smart labels that are hard to replicate. The authenticity of these products is crucial for maintaining user trust, as counterfeit items can severely damage the brand’s image. With the worldwide luxury goods market expected to reach a value of USD 405.80 Billion by 2033 as per the IMARC Group, the need for secure packaging to guard against counterfeiting is increasing. These sophisticated packaging options not only guarantee the authenticity of luxury items but also maintain the integrity and reputation of high-value brands, crucial for sustaining market presence and client loyalty.

Stringent Regulatory Requirements

Governing bodies and regulatory agencies worldwide are enforcing stricter regulations that require the adoption of anti-counterfeit measures across multiple industries, such as pharmaceuticals, food and beverage (F&B), and luxury products. These regulations frequently necessitate that companies implement packaging solutions that include security elements, including tamper-proof seals, holograms, and distinctive serial numbers. The necessity to adhere to these regulatory frameworks is encouraging companies to invest in sophisticated packaging technologies that fulfill these legal obligations. Failure to comply with these regulations can result in severe penalties and damage to a company’s reputation. With governing authorities increasing their efforts to fight counterfeit goods, businesses are more focused on making sure that their packaging solutions comply with these regulations. The growing focus on regulatory compliance is a significant factor propelling the adoption of anti-counterfeit packaging solutions.

Anti Counterfeit Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on technology, feature type, and end use industry.

Breakup by Technology:

To get detailed segment analysis of this market Request Sample

- Barcodes

- RFID (Radio-Frequency Identification)

- Holograms

- Taggants

- Others

RFID (Radio-Frequency Identification) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology. This includes barcodes, RFID (radio-frequency identification), holograms, taggants, and others. According to the report, radio-frequency identification (RFID) accounted for the largest anti counterfeit packaging market share.

According to the market research report, RFID (Radio-Frequency Identification) dominates the market due to its ability to provide real-time tracking and authentication of products throughout the supply chain. This technology is particularly favored in industries like pharmaceuticals and electronics, where the need for accurate and secure identification is critical. RFID tags enable efficient monitoring and verification, reducing the risk of counterfeiting by ensuring that products are genuine and traceable. The scalability and integration capabilities of RFID systems further enhance their adoption, making them a preferred choice for companies aiming to protect their brand integrity and comply with stringent regulatory standards. These advancements in RFID technology, along with increasing strategic collaborations within the industry, are creating a positive anti counterfeit packaging market outlook by driving innovation, improving product security, and enhancing traceability across various sectors.

Breakup by Feature Type:

- Overt Features

- Covert Features

Overt Features holds the largest share of the industry

A detailed breakup and analysis of the market based on the feature type have also been provided in the report. This includes overt features and covert features. According to the report, overt features represented the largest segment.

Overt features, which include visible security elements such as holograms, color-shifting inks, and watermarks, hold the largest share of the Anti-Counterfeit Packaging industry due to their immediate and easy-to-verify nature. These features are widely used across various sectors, particularly in consumer goods, pharmaceuticals, and luxury products, where brand protection and consumer trust are paramount. The popularity of overt features stems from their ability to provide quick visual authentication without the need for specialized equipment, making them accessible to both consumers and professionals. The integration of these visible security measures into packaging not only deters counterfeiting but also enhances brand image, driving their continued dominance in the anti-counterfeit packaging market. These visible security measures, along with the growing consumer awareness and the demand for product authenticity, are expected to significantly enhance the anti counterfeit packaging market value in the coming future. As more industries prioritize brand protection and regulatory compliance, the adoption of overt features is likely to expand, thus further supporting the anti counterfeit packaging market growth.

Breakup by End Use Industry:

- Food and Beverage

- Healthcare

- Automotive

- Consumer Electronics

- Others

Healthcare Sector represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes food and beverage, healthcare, automotive, consumer electronics, and others. According to the report, healthcare accounted for the largest anti counterfeit packaging market share.

Healthcare sector leads the end user segment due to the critical need for ensuring the authenticity of medical products. Pharmaceuticals and medical devices are highly susceptible to counterfeiting, which can have severe consequences for patient safety and brand integrity. Anti-counterfeit packaging solutions, such as holograms, RFID tags, and tamper-evident seals, are widely adopted in this sector to prevent the distribution of fake products. Stringent regulatory requirements and the growing global trade of healthcare products further drive the demand for advanced packaging technologies in this market segment, ensuring product safety and compliance. For instance, in September 2023, MM Packaging and Crane Automation unveiled new micro-optic technology at PACK EXPO Las Vegas. This technology offers anti-counterfeit, anti-tamper, and tamper-evident labels for pharmaceuticals, aiming to enhance patient safety in the pharmaceutical industry through easily identifiable security features and educational tools for consumers. The technology is flexible and allows for customization, including tamper-evident labels with brand-specific designs, which could potentially engage consumers and enhance supply chain security. These advancements in micro-optic technology, along with the increasing regulatory pressures and global trade of healthcare products, are driving anti counterfeit packaging demand in the healthcare sector. The need for secure packaging solutions that ensure product authenticity and patient safety is becoming more critical, leading to a rise in the adoption of innovative anti-counterfeit measures. The ability to customize tamper-evident labels with brand-specific designs further enhances consumer engagement and supply chain security, making such technologies essential in combating counterfeiting in the pharmaceutical industry.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest anti counterfeit packaging market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for anti-counterfeit packaging.

North America leads the Anti-Counterfeit Packaging market, accounting for the largest market share due to several key factors. The region has stringent regulatory frameworks, particularly in the healthcare and pharmaceutical sectors, which mandate the use of advanced anti-counterfeit technologies. Additionally, the high demand for secure packaging solutions in industries like food and beverages, electronics, and luxury goods further drives anti counterfeit packaging market growth. The presence of major industry players and continuous technological innovations, such as RFID and holographic labels, also contribute to North America's dominant position in the global market. For instance, in April 2023, Amazon introduced the Anti-Counterfeiting Exchange (ACX) to enhance online shopping safety and combat counterfeit products. The exchange facilitates the sharing of information on confirmed counterfeiters across participating stores, enabling quick identification and prevention of illicit activities. This collaborative effort aims to protect consumers and brands from counterfeiters, promoting a secure retail environment. The initiative has garnered support from industry experts and encourages broader participation to strengthen the fight against counterfeit goods.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the anti-counterfeit packaging industry include:

- 3M Company

- Alpvision SA

- Applied DNA Sciences Inc.

- Authentix Inc. (Blue Water Energy LLP)

- Avery Dennison Corporation

- CCL Industries Inc.

- DuPont

- Savi Technology Inc. (Lockheed Martin)

- SICPA Holding SA

- SML Group

- Zebra Technologies

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The Anti-Counterfeit Packaging market is highly competitive, driven by the rising need for secure packaging solutions across industries such as pharmaceuticals, food and beverages, and electronics. Anti counterfeit packaging companies are focusing on advanced technologies like RFID, holograms, and tamper-evident seals to differentiate their offerings. The competition is also intensified by regional players providing cost-effective solutions tailored to local needs. Strategic partnerships and acquisitions are common as businesses seek to expand their product lines and global presence. Furthermore, stringent government regulations mandating anti-counterfeit measures are pushing companies to innovate and maintain a competitive edge in this rapidly evolving market. Moreover, the increasing global trade and e-commerce activities are further amplifying the demand for robust anti-counterfeit packaging solutions, as companies strive to protect their products from counterfeiting in an increasingly interconnected marketplace. These factors, along with the growing consumer awareness and demand for product authenticity, are expected to increase anti counterfeit packaging market revenue in the coming future.

Anti-Counterfeit Packaging Market News:

- In May 2025, Digimarc launched the Digimarc Validate mobile app, enabling field agents to authenticate products in real-time using smartphones, combating counterfeit goods. The app uses digital watermarks for covert, scalable protection, enhancing brand security and reducing costs. It is available for download on both the Apple App Store and Google Play Store.

- In May 2025, Avery Dennison launched its AD InsightX studio in Pune, India, offering a co-creation platform for packaging innovation. The facility focuses on sustainability, functional packaging, premiumization, and anti-counterfeit solutions.

- In April 2025, it was announced that the Sino-Label 2026, scheduled from March 4-6, 2026, will be held at the China Import & Export Fair Complex in Guangzhou. It will showcase innovations in label printing technology, including RFID solutions and anti-counterfeiting technologies.

- In March 2025, Alkem Laboratories launched Empanorm, a generic version of empagliflozin for type-2 diabetes, chronic kidney disease, and heart failure in India. The product features an anti-counterfeit band and patient education materials with QR codes.

- In February 2023, Genefied, a Delhi-based IT technology company, introduced an anti-counterfeiting system using QR code technology. This system is designed to provide customers with transparency in product production and sales.

- In July 2023, Unitag.io and PiQR.io formed a strategic partnership to enhance QR code security in the packaging industry. By integrating copy-protection technology with Unitag's QR code platform, the collaboration aims to revolutionize brand-consumer engagement. This partnership will enable brands to provide consumers with dynamic content, product authentication, and loyalty programs through QR codes.

Anti-Counterfeit Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Barcodes, Radio-Frequency Identification (RFID), Holograms, Taggants, Others |

| Feature Types Covered | Overt Features, Covert Features |

| End Uses Industries Covered | Food and Beverage, Healthcare, Automotive, Consumer Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Alpvision SA, Applied DNA Sciences Inc., Authentix Inc. (Blue Water Energy LLP), Avery Dennison Corporation, CCL Industries Inc., DuPont, Savi Technology Inc. (Lockheed Martin), SICPA Holding SA, SML Group, Zebra Technologies, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the anti-counterfeit packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global anti-counterfeit packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the anti-counterfeit packaging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global anti-counterfeit packaging market was valued at USD 150.8 Billion in 2025.

We expect the global anti-counterfeit packaging market to exhibit a CAGR of 9.72% during 2026-2034.

The rising application of anti-counterfeit packaging solution across the electronics, healthcare, automotive, and F& B sectors to aid in preventing imitation and production of unauthorized replicas of trademarked products is primarily driving the global anti-counterfeit packaging market.

The sudden outbreak of the COVID-19 pandemic has led to the growing demand for anti-counterfeit packaging solutions to remotely administer precise supply of the products on account of the rising trend of e-commerce services during the stringent lockdown regulations.

Based on the technology, the global anti-counterfeit packaging market can be categorized into barcodes, RFID (Radio-Frequency Identification), holograms, taggants, and others. Currently, RFID (Radio-Frequency Identification) technology exhibits clear dominance in the market.

Based on the feature type, the global anti-counterfeit packaging market has been segmented into overt features and covert features, where overt features represent the largest market share.

Based on the end use industry, the global anti-counterfeit packaging market can be bifurcated into food and beverage, healthcare, automotive, consumer electronics, and others. Among these, the healthcare industry currently accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global anti-counterfeit packaging market include 3M Company, AlpVision SA, Applied DNA Sciences Inc., Authentix Inc., Avery Dennison Corporation, CCL Industries Inc., DuPont de Nemours Inc., Savi Technology Inc., SICPA Holding SA, SML Group Limited, and Zebra Technologies Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)