Antacids Market Size, Share, Trends and Forecast by Drug Class, Formulation Type, Distribution Channel, and Region, 2025-2033

Antacids Market Size and Share:

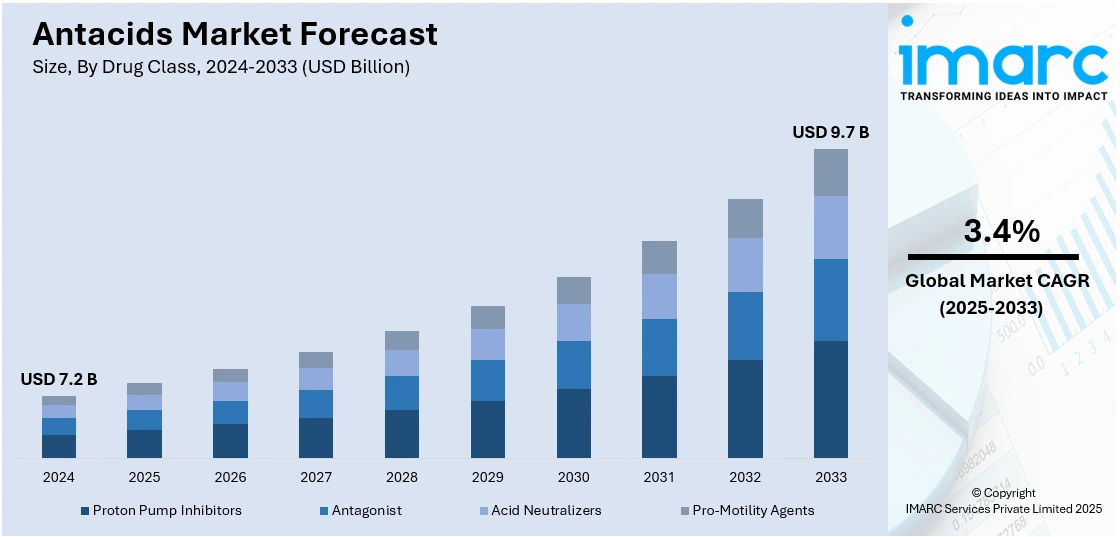

The global antacids market size was valued at USD 7.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.7 Billion by 2033, exhibiting a CAGR of 3.4% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 42.1% in 2024. The increasing number of patients experiencing gastroesophageal reflux disease (GERD), along with the rising availability of non-prescribed medicines in pharmacies, grocery stores, and online platforms is influencing the antacids market share positively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.2 Billion |

|

Market Forecast in 2033

|

USD 9.7 Billion |

| Market Growth Rate (2025-2033) | 3.4% |

Increasing cases of acid reflux, indigestion, and heartburn caused by unhealthy eating habits and rising stress levels are stimulating the market growth. As more people are consuming fast food items, processed meals, and caffeinated beverages, the demand for quick relief through over the counter (OTC) antacids is high. A sedentary lifestyle and irregular meal patterns are also contributing to gastrointestinal discomfort, enabling individuals to seek immediate solutions. Apart from this, the aging population, which is more prone to digestive issues, is supporting the market growth. Additionally, rising awareness among the masses about gastrointestinal health is encouraging early treatment of symptoms, thereby boosting the overall sales.

The United States has emerged as a major region in the antacids market owing to many factors. Increasing health awareness and proactive management of minor health issues are fueling the antacids market growth. High consumption of carbonated drinks and processed food items contributes significantly to digestive discomfort. A stressful lifestyle and irregular eating habits further worsen gastrointestinal issues, leading people to seek immediate relief through antacids. The country’s aging population is also experiencing more frequent digestive problems, driving the demand for quick-acting remedies like antacids. As per industry reports, the count of Americans aged 65 and above is expected to grow to 82 Million by 2050. OTC availability and diverse product formats, such as chewable, tablets, and liquids, add to user convenience. Moreover, easy access through pharmacies, supermarkets, and online platforms is supporting wider reach and item penetration.

Antacids Market Trends:

Rising cases of GERD

The growing cases of GERD are positively influencing the market. As per the report released by the National Library of Medicine in 2022, 783.95 Million people were impacted by GERD in 2019. As the prevalence of GERD is rising due to factors, such as poor diet, sedentary lifestyles, and high obesity rates, people are turning to antacids to get relief from the frequent symptoms of heartburn, acid reflux, and indigestion associated with the condition. The need for accessible and affordable treatments for GERD is fueling the market growth. With the increasing awareness about the long-term effects of untreated GERD, more individuals are utilizing antacids to prevent further complications. Antacids help GERD patients by soothing the esophagus, neutralizing stomach acid, and preventing further irritation.

Growing geriatric population

Rising geriatric population is offering a favorable antacids market outlook. According to the 2022 report from the World Health Organization (WHO), by 2030, 1 in 6 people will be aged 60 years or older. The worldwide number of individuals aged 60 and older will hit 2.1 Billion, an increase from 1.4 Billion in 2020. As the elderly population is growing, the prevalence of age-related digestive issues, such as acid reflux, is rising. Older adults often experience a slower digestive system and weakened stomach acids, making them more prone to these conditions. This has led to a higher demand for antacid products, particularly in tablet and liquid forms, to manage these symptoms. With an expanding elderly population, there is also a greater emphasis on healthcare solutions tailored for senior citizens, boosting the availability and usage of antacids. The trend of longer life expectancy and the desire to maintain a good quality of life are driving the demand for effective and easily accessible antacid items.

Increasing reliance on OTC medicines

Rising reliance on OTC medicines is propelling the market growth. OTC antacids are easily available in pharmacies, grocery stores, and online platforms, making them convenient for individuals seeking relief from heartburn, acid reflux, and indigestion without needing a prescription. This ongoing trend of self-medication is supported by the increasing awareness among people about digestive health and the desire for quick and non-invasive treatments. Additionally, the rising cost of healthcare and long wait times for doctor consultations are making OTC options more appealing. As individuals are becoming more knowledgeable about their health conditions, the demand for OTC antacids is growing. This shift in consumer behavior plays a crucial role in enhancing the sales and availability of antacids across various regions. Non-prescribed remedies, including OTC medicines, are highly preferred in the world to cure mild symptoms, which is catalyzing the demand for antacids. As per the IMARC Group, the global market for OTC drugs is set to attain USD 275.9 Billion by 2032.

Antacids Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global antacids market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on drug class, formulation type, and distribution channel.

Analysis by Drug Class:

- Proton Pump Inhibitors

- H2 Antagonist

- Acid Neutralizers

- Pro-Motility Agents

Proton pump inhibitors held 32.0% of the market share in 2024. They offer long-lasting and effective relief from acid-related disorders, such as GERD, ulcers, and chronic heartburn. They work by blocking the final step of acid production in the stomach, making them more potent than traditional antacids or H2 blockers. They are widely prescribed by healthcare professionals due to their proven efficacy in healing the esophagus and preventing acid reflux recurrence. As gastrointestinal disorders have become more common due to unhealthy diets, stress, and sedentary lifestyles, the demand for proton pump inhibitors is high. These drugs are often recommended for long-term treatment, contributing to consistent demand. In response, pharmaceutical firms are developing and launching advanced proton pump inhibitors. For instance, Daewon Pharmaceutical introduced its first proton pump inhibitor medicine in Korea in 2022, known as Escorten. The availability of proton pump inhibitors in both prescription and OTC forms is making them accessible to a broader user base. Moreover, ongoing clinical research and pharmaceutical innovations are improving their safety profile and expanding their indications. Consequently, proton pump inhibitors are maintaining a strong position in the market.

Analysis by Formulation Type:

- Tablet

- Liquid

- Powder

- Others

Tablet represents the largest segment because it offers ease of use, portability, and accurate dosage, making it a preferred choice among people. It is convenient to store and carry, allowing users to take it as needed without preparation. It also has a longer shelf life compared to liquid antacids, which appeals to both users and retailers. Manufacturers often enhance tablet formulations with flavors or fast-dissolving properties to improve user experience and compliance. With advancements in pharmaceutical technology, tablet dissolves quickly and provides fast relief from acidity, heartburn, and indigestion. The widespread availability of tablets in supermarkets is positively influencing the market, making them easily accessible to a large population. Health professionals also tend to prescribe tablets due to their standardized composition and predictable results.

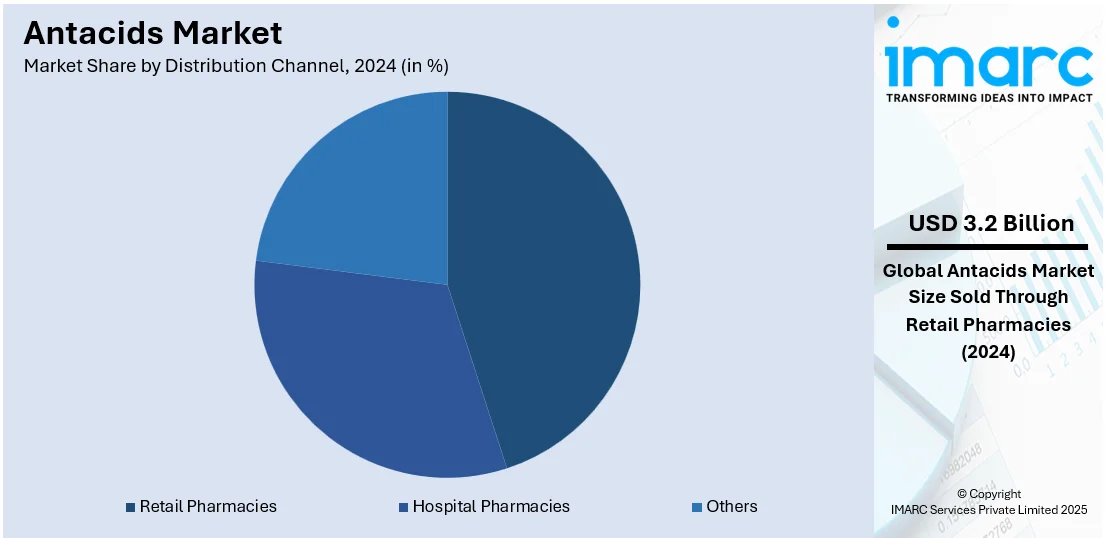

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Others

Retail pharmacies account for 43.9% of the market share. They offer easy accessibility, convenience, and immediate availability of medications without prescriptions. People prefer retail pharmacies for OTC antacids, as they can quickly purchase them for instant relief from acidity, heartburn, and indigestion. The growing presence of pharmacy chains in both urban and semi-urban areas ensures wider reach and better product visibility. These pharmacies often stock a broad range of antacid brands, allowing individuals to choose based on preference or familiarity. High foot traffic in retail stores is supporting impulse purchases, especially for common ailments like acid reflux. Additionally, pharmacists often guide customers in selecting suitable items, improving the overall buying experience. With increasing user awareness and self-medication trends, more people rely on retail outlets for minor gastrointestinal discomforts. The convenience of 24/7 operations in some stores is also boosting sales. Moreover, the rising focus of leading competitors in the retail pharmacy market on acquisition & expansion to increase their reach is bolstering the market growth. The purchase of Pharmaca by Medly Pharmacy in 2021 to deliver 360-degree pharmacy services is one such example.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 42.1%, enjoys the leading position in the market. The region is noted for its large and growing population, which is driving the demand for digestive health products. The region is experiencing a high prevalence of gastrointestinal disorders due to changing dietary habits, increased consumption of spicy and processed food products, and rising stress levels. Rapid urbanization and an increasing working-class population are also contributing to irregular eating patterns, leading to more cases of acidity and indigestion. The presence of developing countries with improved healthcare access is encouraging people to use OTC solutions like antacids. Increasing awareness about digestive health and the availability of affordable antacid options are further supporting the market growth. In addition, local and international pharmaceutical companies are expanding their presence in countries, such as India, China, and Indonesia, which is boosting product accessibility. Moreover, the broadening of retail outlets is enhancing the accessibility of antacid medicines. According to industry reports, retail sales in Mexico grew by 2.7% year-on-year in January 2025.

Key Regional Takeaways:

United States Antacids Market Analysis

The United States holds 84.90% of the market share in North America. The market is experiencing growth, owing to the rising prevalence of gastrointestinal disorders such as acid reflux, heartburn, and GERD. According to the National Institutes of Health, as of 2018, approximately 18.1% to 27.8% of individuals in the United States were suffering from GERD. As these conditions have become more common, particularly among aging populations and individuals with poor dietary habits, the demand for OTC antacids is high. The OTC drugs market in the United States was valued at USD 41.9 Billion in 2024 and is expected to attain USD 65.1 Billion by 2033, growing at a CAGR of 5.4% during 2025-2033. Additionally, increased awareness about digestive health and the availability of a wide assortment of antacid items, including chewable tablets, liquids, and dissolvable powders, is contributing substantially to market expansion. The growing preferences for self-medication and convenience are promoting the usage of antacids. Furthermore, the ongoing shift towards more natural and herbal products is influencing user choices, as numerous individuals seek alternatives to traditional medications.

Europe Antacids Market Analysis

The Europe market is expanding due to increasing healthcare expenditure and the growing adoption of preventive health measures. According to reports, the average amount spent on healthcare in the EU in 2022 was €3685 per person, recording a rise of 38.6% in comparison to 2014 at €2658. As healthcare systems across Europe continue to evolve, more emphasis is being placed on managing chronic conditions, such as acid reflux and GERD, resulting in higher usage of antacids. Moreover, the high incidence of unhealthy eating habits, such as the consumption of processed food items, alcohol, and high-fat diets, has led to an uptick in digestive issues, further driving the demand for antacid products. The market is also shaped by the increasing employment of digital health tools and apps that help individuals track and manage their digestive health, promoting early intervention and the utilization of OTC antacids. Furthermore, as the European market is becoming more diverse, there is a growing demand for antacids catering to specific dietary preferences like gluten-free, vegan, and sugar-free formulations.

Asia-Pacific Antacids Market Analysis

In the Asia-Pacific region, the market is witnessing growth, driven by the presence of a large and growing population, increasing urbanization activities, and rising healthcare awareness. As per industry estimates, as of 2024, the population of Asia accounted for 59.05% of the total worldwide population, with an estimated yearly growth rate of 0.60%. As individuals in countries, such as China and India, are adopting Westernized diets that are high in processed food items, sugar, and fats, the prevalence of gastrointestinal issues like acid reflux, heartburn, and GERD is steadily rising, driving the demand for antacids. In addition, increasing stress levels, sedentary lifestyles, and a rise in smoking and alcohol utilization are also contributing substantially to digestive health problems, driving antacid demand. Furthermore, the shift towards self-medication has positively influenced the market, with people seeking safer and more accessible treatments.

Latin America Antacids Market Analysis

The Latin America antacids market is experiencing growth, owing to the growing health awareness and increasing focus on digestive health. As people are becoming more educated about the impact of lifestyle choices on digestion, there is a rising demand for antacids to manage conditions like indigestion and acid reflux. Furthermore, the expansion of retail channels, combined with rising internet penetration, is making these items more accessible. As per industry reports, high-speed internet penetration increased across Latin America, with a total of 67 Million 5G internet connections in Q3 2024, recording a growth rate of 19%.

Middle East and Africa Antacids Market Analysis

In the Middle East and Africa region, the market is experiencing expansion due to the increasing prevalence of obesity and lifestyle-related diseases, which is contributing to digestive issues, such as acid reflux and heartburn. As the region is witnessing rapid economic growth, individuals are adopting sedentary lifestyles and high-calorie diets, exacerbating gastrointestinal conditions. Additionally, the broadening healthcare infrastructure and improved access to pharmacies are supporting the market growth. Moreover, the expansion of e-commerce platforms in the area has made antacids more accessible to a broader population. For instance, according to a report by the IMARC Group, the Africa e-commerce market reached USD 317.0 Billion in 2024 and is set to grow at a CAGR of 13.8% during 2025-2033.

Competitive Landscape:

Key players are working to develop advanced formulations to meet the high global antacids market demand. They are launching a variety of products in tablets, liquids, and chewable forms for catering to different user preferences. These companies are also focusing on attractive and convenient packaging to enhance customer experience. Strong branding and wide-scale advertising help increase product visibility and trust among people. Key players are collaborating with pharmacies, supermarkets, and online platforms to ensure wide distribution and availability. They are also engaging in strategic pricing to remain competitive and affordable. Additionally, these companies are investing in awareness campaigns about digestive health, encouraging people to choose preventive solutions. Their innovations and strategic marketing are fueling the market growth. For instance, in March 2024, Lil’ Drug Store Products (LDSP) revealed a collaboration with Procter & Gamble (P&G) to distribute its antacid brand, Rolaids, to travel vendors. This collaboration aimed to enhance LDSP's position as a leader in the industry and reinforced its vital role as Rolaids' official convenience provider.

The report provides a comprehensive analysis of the competitive landscape in the antacids market with detailed profiles of all major companies, including:

- Abbott Laboratories

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Dr. Reddy’s Laboratories Ltd.

- GlaxoSmithKline plc

- Johnson & Johnson

- Pfizer Inc.

- Procter & Gamble Company

- Reckitt Benckiser Group PLC

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

Latest News and Developments:

- January 2025: Haleon, the prominent healthcare firm based in the UK, revealed intentions to invest USD 54 Million to enhance its research and development (R&D) facility in Northside Richmond, Virginia. The enhancements were anticipated to finish in 2025, with the updated plant projected to be functional later that year, boosting Haleon’s R&D capabilities for upcoming innovations.

- August 2024: ENO by Haleon, India's top OTC antacid brand, introduced its new 3-in-1 antacid variant made from ENO, cumin, carom seeds, and black salt for rapid and effective relief. The innovative item alleviated gastric unease, acidity, and indigestion.

- July 2024: The US Food and Drug Administration (FDA) authorized a novel therapy for GERD. The new medication, vonoprazan (Voquezna), was to be used daily to alleviate heartburn due to GERD in adults.

- June 2024: Akums, the well-known pharmaceutical firm in India, introduced a chewable antacid tablet for reflux containing sodium alginate and potassium bicarbonate. It was categorized as a reflux inhibitor, which could alleviate discomfort and pain by forming a barrier over the stomach's contents to prevent acid from reaching the esophagus.

Antacids Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Antacids Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Proton Pump Inhibitors, H2 Antagonist, Acid Neutralizers, Pro-Motility Agents |

| Formulation Types Covered | Tablet, Liquid, Powder, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, AstraZeneca plc, Bayer AG, Boehringer Ingelheim International GmbH, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc, Johnson & Johnson, Pfizer Inc., Procter & Gamble Company, Reckitt Benckiser Group PLC, Sanofi S.A., Sun Pharmaceutical Industries Ltd., Takeda Pharmaceutical Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the antacids market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global antacids market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the antacids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The antacids market was valued at USD 7.2 Billion in 2024.

The antacids market is projected to exhibit a CAGR of 3.4% during 2025-2033, reaching a value of USD 9.7 Billion by 2033.

Rising aging population in many countries is positively influencing the market, leading to higher demand for quick-relief products like antacids. In addition, increasing OTC availability in supermarkets and pharmacies is fueling the market growth. Moreover, innovations in flavors, formulations, and packaging are making antacids more appealing to a wider user base.

Asia-Pacific currently dominates the antacids market, accounting for a share of 42.1% in 2024, driven by its large population, changing dietary habits, rising cases of digestive issues, and the growing access to OTC medications. The rising awareness among people about gastrointestinal health and the expansion of retail pharmaceutical networks are fueling the market growth.

Some of the major players in the antacids market include Abbott Laboratories, AstraZeneca plc, Bayer AG, Boehringer Ingelheim International GmbH, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc, Johnson & Johnson, Pfizer Inc., Procter & Gamble Company, Reckitt Benckiser Group PLC, Sanofi S.A., Sun Pharmaceutical Industries Ltd., Takeda Pharmaceutical Company Limited., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)