Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2026-2034

Animal Health Market Share, Size, Growth and Research Report:

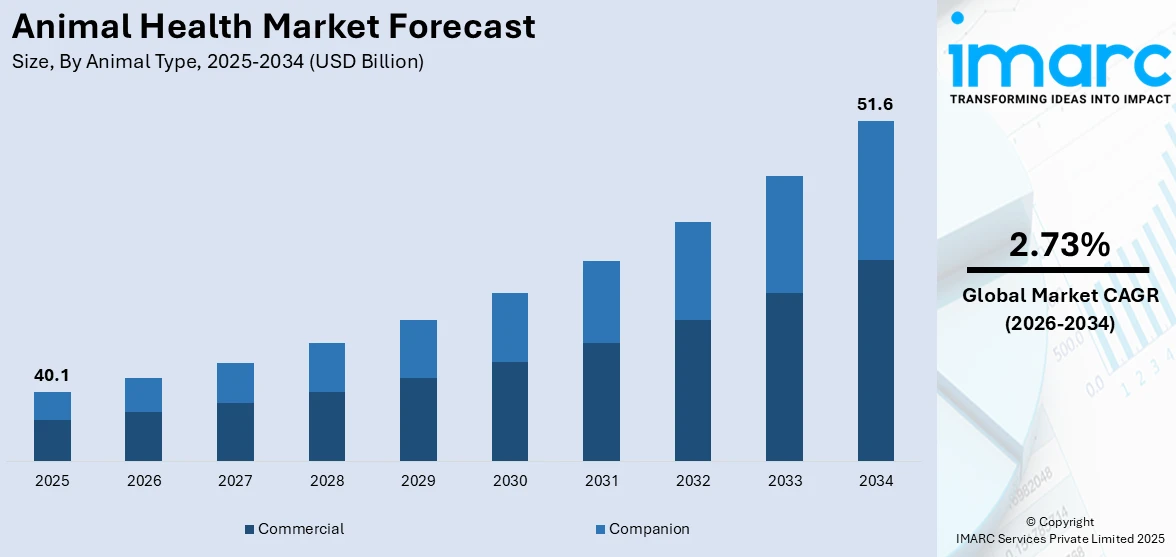

The global animal health market size was valued at USD 40.1 Billion in 2025. Looking forward, the market is projected to reach USD 51.6 Billion by 2034, exhibiting a CAGR of 2.73% during 2026-2034. North America currently dominates the market, holding a significant market share of 44.9% in 2025. The market is driven by the growing number of pet parents and their desire for high-quality veterinary care. Besides this, animal health market share is influenced by the rising awareness towards zoonotic diseases and various technological advancements across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 40.1 Billion |

|

Market Forecast in 2034

|

USD 51.6 Billion |

| Market Growth Rate (2026-2034) | 2.73% |

Rising outbreaks of zoonotic infections are encouraging investments in vaccines, diagnostics, and antimicrobial therapies for disease control. Governments are implementing stricter regulations and surveillance programs to monitor and prevent zoonotic disease transmission. Public awareness campaigns are promoting responsible pet ownership and vaccination to reduce disease risks in communities. The livestock industry is adopting biosecurity measures to minimize outbreaks and ensure food safety standards compliance. Advances in veterinary diagnostics are enabling early detection and rapid response to emerging zoonotic threats. Pharmaceutical companies are developing novel therapeutics and biologics to combat zoonotic diseases effectively in animals. Increased funding for veterinary research is driving innovation in zoonotic disease prevention and treatment solutions. The integration of digital technologies is enhancing disease monitoring, outbreak prediction, and real-time data sharing. Collaborative efforts between veterinary and human healthcare sectors are improving one health initiatives for disease management.

To get more information on this market Request Sample

The United States animal health market demand is driven by increasing requirements for targeted and safe treatments in canine dermatology. Rising pet adoption and greater awareness of skin disorders are fueling veterinary visits for dermatological conditions. Pet parents are seeking specialized treatments for allergies, infections, and autoimmune skin diseases affecting their dogs. Advances in veterinary pharmaceuticals are leading to the development of targeted biologics and safer topical therapies. In September 2024, Elanco announced the FDA approval and launch of Zenrelia™ (ilunocitinib tablets), a new treatment for canine dermatology. This solution provides an effective and safe option for managing dermatologic conditions in dogs, offering a targeted approach to enhance the quality of life for affected pets. Veterinary dermatologists are adopting precision medicine approaches to offer personalized treatment plans based on specific conditions. Increased availability of hypoallergenic diets and nutraceuticals is supporting holistic management of canine skin health issues. Innovations in diagnostic tools are enabling faster identification of dermatological diseases for effective treatment interventions. The expansion of veterinary telemedicine is improving access to dermatology consultations and remote treatment recommendations, thus strengthening market growth.

Animal Health Market Trends:

Increasing Focus on Preventive Healthcare

The animal health industry statistics suggest that it is experiencing a significant shift toward preventive healthcare practices for both companion animals and livestock. Pet parents and livestock producers recognize the importance of early detection and proactive management of health issues to improve overall animal well-being and reduce the risk of diseases. In May 2022, Government of India launched the Livestock Health and Disease Control Schemes with a ₹525 crore budget to manage critical livestock diseases and improve animal health nationwide. Additionally, efforts focus on making animal husbandry more cost-effective, as diseases cause 10-15% of production losses in livestock operations. Preventive healthcare practices are also on the rise among Gen Z pet parents across countries. For example, in India, there has been a significant rise in visits to the veterinarian, regulation of timely vaccinations, and eagerness for feeding pets with balanced and nutritious diets. As per the data published by the Global Health Security Index, Mexico, the Ministry of Health published its National Health Promotion Days plan, which includes the Guidelines for Disease Prevention and Control Programs: Zoonosis. The recommendations reflect on the idea of One Health and notably address campaigns to stop and prevent the spread of brucellosis, rabies, and porcine tapeworm.

Advancements In Biotechnology and Pharmaceuticals

The animal health industry is experiencing swift progress in biotechnology and pharmaceuticals, changing how diseases in animals are diagnosed and treated. Advanced research and groundbreaking technologies are driving the creation of specialized therapies, vaccines, and precision medicines designed for particular animal species and health conditions. Biotechnological advancements, including gene editing, cell therapies, polymerase chain reaction (PCR), DNA sequencing, and more, provide hopeful answers for difficult diseases. Furthermore, drug manufacturers are putting resources into research and development (R&D) to produce more efficient and safer drugs for animals. For example, QBiotics Group Limited (QBiotics), an Australian life sciences firm, is creating novel small-molecule anticancer and wound-healing medications. They have obtained approval from the Australian Pesticides and Veterinary Medicines Authority (APVMA) for their veterinary product STELFONTA (tigilanol tiglate). This endorsement marks Australia's initial pharmaceutical therapy accessible for all levels of canine non-metastatic medium chain triglycerides (MCT). Biotechnology is enabling the development of sophisticated imaging technologies, such as magnetic resonance imaging (MRI) and computed tomography (CT) scans, to offer comprehensive information regarding the internal structures and irregularities in animals, encompassing both pets and livestock.

Growing Pet Humanization and Specialty Pet Care

This relationship between humans and their pets continues to evolve toward pet humanization. Pets increasingly become part of the family circle, and in doing so create a significant transformation in customer behavior in the market of pet care. For instance, in the United States, 35% of young adults (24–35 years old) have either adopted a pet or intend to do so in the near future, and 19% have adopted a new pet during the COVID-19 lockdown. Pet parents are willing to spend more on premium and specialized pet care products and services to ensure their beloved companions lead healthy and fulfilling lives. This trend is increasing the demand for high-quality pet nutrition products, personalized treatments, advanced veterinary care, and a wide range of specialty items. For example, the requirement for pet care products, such as activity tracking collars, has increased recently, especially from the millennial or Gen Y generation, to measure the agility of their pet, to play sports with them, etc. In the United Kingdom, 100,000 dogs are currently fitted with activity monitoring devices, reports PitPat, a leading manufacturer of dog activity monitors.

Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global animal health market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on animal type and product type.

Analysis by Animal Type:

- Commercial

- Companion

The commercial segment typically includes animals, such as livestock and poultry, that are reared for commercial needs like milk and meat. Producers and farmers are increasingly focused on maintaining the health and productivity of their herds or flocks due to the rising demand for animal-derived products, including meat, dairy, and eggs. Healthy animals lead to higher yields and improved product quality, which directly impacts the profitability of commercial operations. To achieve optimal productivity, producers are investing in preventive healthcare measures, like vaccinations, parasite control, and disease management. This in turn, is augmenting the demand for a wide range of animal health products, such as vaccines, pharmaceuticals, feed additives, and hygiene solutions. The rising collaboration between commercial animal producers and veterinary professionals ensures the implementation of best practices in animal health management, thus strengthening the market growth. For instance, the Asian Development Bank (ADB) invested $10 million in Zenex Animal Health India Private Limited (Zenex) for improving the overall production and distribution of better animal healthcare products, aiming to reduce livestock disease risks and improve farmer incomes.

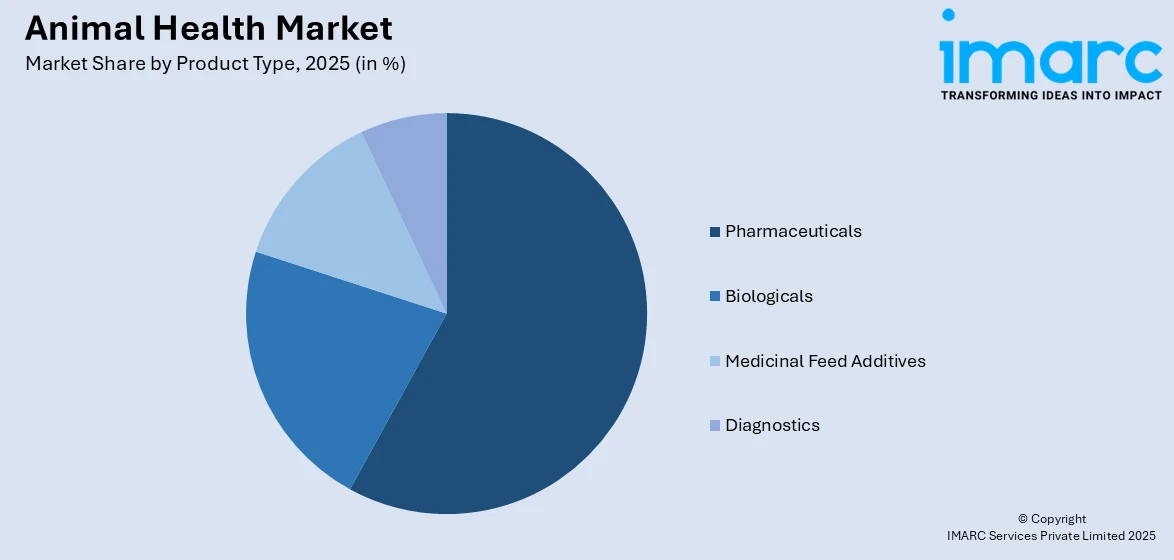

Analysis by Product Type:

Access the comprehensive market breakdown Request Sample

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

In 2025, pharmaceuticals dominate the market with a 57.0% share. Pharmaceutical products address the needs of both pets and farm animals, assisting in disease prevention and treatment, managing chronic illnesses, and improving overall animal health. Veterinary pharmaceutical firms are significantly investing in research and development (R&D) to produce innovative and effective medications designed for particular animal species and health requirements, thus aiding in the growth of the segment. For example, in March 2022, Hacarus Inc., collaborating with DS Pharma Animal Health, introduced an ECG platform designed to assess and analyze heart conditions in dogs, facilitating early diagnosis of cardiac diseases, which are the second primary cause of death among canines. Additionally, ongoing progress in pharmaceutical technologies, like controlled-release formulations and tailored medicine, enhances treatment results even more. For example, the Canadian Food Inspection Agency oversees veterinary biologics like vaccines to guarantee that the products administered to animals in the nation are pure, potent, safe, and effective. To bring veterinary vaccines into the country, a valid import permit issued by the CFIA-CCVB in Ottawa is necessary.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2025, North America accounted for the largest market share of 44.9%. The region encompasses a huge pet parents’ population that is focusing on the overall health and well-being of their companion animals, which is catalyzing the need for veterinary products and services. The continuously growing livestock industry in the region is also contributing to the requirement of animal health solutions for sustaining the productivity and health of the commercial animal sector. Moreover, a considerable number of pharmaceutical companies and research institutions are operating in the region that fosters continuous innovation in animal health products, including pharmaceuticals, diagnostics and vaccines, which, in turn, is propelling the market growth. Another major contributing factor is the support via government regulations and initiatives that is promoting animal welfare and biosecurity and encouraging investments in the animal health industry, thereby propelling the market growth. In April 2022, the FDA approved bovine somatotrophin, an animal growth hormone, to enhance milk production in dairy cows. Authorities are promoting industry participation and hormone therapies across the globe to strengthen North America’s market growth.

Animal Health Market Regional Takeaways:

United States Animal Health Industry Analysis

The United States accounts for 86.50% of the animal health market share in North America. The United States market is influenced by various drivers, such as growing awareness of animal health, advances in veterinary medicine, and a rising demand for animal-derived products. A rising number of pet parents in the region increases the expenditure on pet care and veterinary services. In 2024, 66% of US households have adopted a pet, as stated in reports. In this regard, the increase in green and ethical productions of farming is prompting a growing demand for health solutions that ensure the well-being of livestock. This includes providing animals with better living conditions, reducing the use of antibiotics, and focusing on more natural farming processes. This is rising the demand for high-end animal health solutions that enhance the prevention of disease, animal welfare, and productivity while being ethical. Apart from this, innovations in pharmaceuticals, vaccines, and diagnostics, particularly chronic diseases and zoonotic infections, are fueling market growth. There is also an increased emphasis on food safety, where improved animal health would direct impact on the safety and quality of meat, dairy, and other animal-based products. Additionally, government regulations and initiatives, such as antimicrobial stewardship programs, do affect market dynamics as they require safer usage and encourage companies to develop better animal health solutions.

Asia Pacific Animal Health Industry Analysis

The market is growing rapidly in Asia Pacific, driven by the increasing consumption and production of meat, increasing awareness about animal diseases, and the rapid growth of the livestock sector in the region. Countries like China and India are experiencing high population growth, which is creating a larger demand for animal protein, such as poultry and beef, thereby driving the need for better animal healthcare. PIB reported the estimated total meat production in India during 2023–24 as 10.25 million tons, thereby increasing by a margin of 4.85% during the past decade. Apart from these trends, demand for veterinary services and pet products also grew, due to increasing urban-based pet parents. These include growing incidences of zoonotic diseases and the requirement for increased efficiency in disease control, which is propelling market growth as governments and health organizations are investing in more advanced diagnostics and treatments. Secondly, increased focus on food security and health in the global food supply chain in the region promotes greater investment in advancing animal health for risk-free high-quality food production. In addition, there is a movement towards sustainable and ethical farming practices that promotes farmers and producers to adopt the methods that benefit the welfare of livestock.

Europe Animal Health Industry Analysis

In Europe, the market is primarily influenced by the increasing demand for high-quality animal products, rising awareness among masses about animal welfare, and stricter regulatory standards. Moreover, the rising livestock population in the region is impelling the market growth. Reports indicate that in 2023, Spain held 25.4% of the EU’s pig population and 23.6% of its sheep, while Greece accounted for 25.8% of the EU’s goats, and France had 22.8% of the bovine population. In line with this, there is a rise in the trend of sustainable agriculture and livestock farming practices that prioritize animal well-being, resulting in higher spending on veterinary care, vaccines, and animal pharmaceuticals. Besides this, the European Union’s commitment to food safety and biosecurity is inducing growth, as governments implement stricter regulations related to animal health and disease control. Additionally, the European market benefits from technological advancements in animal diagnostics and treatments, which contribute to improved livestock management. The rise of zoonotic diseases, such as avian influenza and African swine fever further highlights the importance of robust animal health solutions. The increasing focus on pet healthcare also play significant roles in driving demand for veterinary services in the region.

Latin America Animal Health Industry Analysis

The Latin American market is driven by the region’s expanding livestock sector, particularly in countries like Brazil and Argentina, which are major exporters of meat and poultry. According to the Brazilian Animal Protein Association (ABPA), Brazil exported 5.138 million tons of poultry products in 2023. In addition, the increasing demand for protein-rich diets, along with the growing need for animal health products to ensure high-quality production, is bolstering the market growth. Besides this, increasing pet parents in urban areas is also contributing to the demand for veterinary care and related services. Governing agencies in the region are focusing on controlling animal diseases and improving agricultural productivity through improved animal health standards further supports the market’s growth.

Middle East and Africa Animal Health Industry Analysis

The region’s growing demand for livestock products, including dairy, meat, and eggs is offering a favorable market outlook. Rapid urbanization and the rising consumption of animal-based food items is contributing to the market’s expansion. Additionally, the prevalence of zoonotic diseases and the need for effective animal disease control systems play a significant role in promoting investments in veterinary care and animal health solutions. The rising awareness of animal welfare and health issues among pet parents is strengthening the market growth. Apart from this, growing number of pet parents is bolstering the market growth in the region. Industry reports estimates that there were 928.4 Million pets in the UAE in 2023.

List of Top Animal Health Companies:

Pharmaceutical companies are developing advanced veterinary drugs, vaccines, and biologics to prevent and treat animal diseases effectively. Diagnostic firms are introducing rapid and accurate testing solutions to enhance disease detection and monitoring efforts. Biotechnology companies are leveraging genetic engineering and microbiome research to create targeted therapies and nutritional supplements. Veterinary service providers are expanding telemedicine and digital health platforms to improve accessibility and treatment outcomes. Government agencies are implementing stringent regulations and funding initiatives to ensure animal welfare and food safety compliance. Livestock producers are adopting precision farming technologies to enhance productivity, disease prevention, and overall animal well-being. Pet food manufacturers are formulating nutritionally enhanced diets with functional ingredients to support animal health. Research institutions are collaborating with industry leaders to develop novel therapeutic approaches and disease management strategies. For example, in February 2024, Merck Animal Health, a subsidiary of Merck has acquired Elanco Animal Health's aqua business outside the US and Canada for 1.3 billion USD. This acquisition includes a portfolio of medicines, vaccines, nutritional, and supplements for aquatic species, along with manufacturing facilities in Canada and Vietnam, and a research facility in Chile.

The report provides a comprehensive analysis of the top animal health companies in the market with detailed profiles of all major companies, including:

- Bayer

- Elanco

- Merck

- Merial

- Zoetis Inc.

- Biogenesis Bago

- Boehringer Ingelheim

- Ceva Sante Animale

- Heska

- Neogen

- Novartis

- Thermo Fisher Scientific

- Vetoquinol

- Virbac

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- January 2025: Ceva Animal Health announced that it has attained the rights to produce and launch products in the future with Touchlight’s dbDNA technology in the animal health sector. Led by Dr. Ian Thompson, a global expert in vaccines, Ceva and Touchlight aim to collaborate for developing a program to create innovative DNA vaccines for animal health.

- November 2024: MSD Animal Health, which is a part of Merck & Co., declared that the European Commission has approved BRAVECTO® TriUNO, a new chewable tablet for dogs. This product, a formulation of BRAVECTO (fluralaner), targets both internal and external parasites.

- October 2024: The Indian government announced to implement a USD 25 million G20 Pandemic Fund aimed at enhancing livestock health coverage in response to pandemics like COVID-19. Announced by Union Animal Husbandry Minister Rajiv Ranjan Singh on October 25, 2024, the fund will improve animal health security through upgrades to laboratories and networks. The initiative, to be completed by August 2026, will be executed in partnership with the Asian Development Bank (ADB), World Bank, and FAO.

Global Animal Health Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Bayer, Elanco, Merck, Merial, Zoetis Inc., Biogenesis Bago, Boehringer Ingelheim, Ceva Sante Animale, Heska, Neogen, Novartis, Thermo Fisher Scientific, Vetoquinol, Virbac. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, animal health market outlook and dynamics of the market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global animal health market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The animal health market was valued at USD 40.1 Billion in 2025.

The animal health market is projected to exhibit a CAGR of 2.73% during 2026-2034, reaching a value of USD 51.6 Billion by 2034.

The animal health market growth is driven by rising pet adoption, increasing livestock production, and zoonotic disease concerns. Advances in veterinary medicine, including biologics, pharmaceuticals, and diagnostics, are improving disease prevention and treatment. Government regulations on food safety and animal welfare are further influencing market expansion.

North America currently dominates the animal health market, accounting for a share of 44.9% in 2025. Rising pet adoption and increasing humanization of animals are driving demand for premium veterinary services. Strong government regulations support food safety, disease control, and animal welfare. Leading pharmaceutical companies invest heavily in research, developing innovative biologics, vaccines, and diagnostics.

Some of the major players in the animal health market include Bayer, Elanco, Merck, Merial, Zoetis Inc., Biogenesis Bago, Boehringer Ingelheim, Ceva Sante Animale, Heska, Neogen, Novartis, Thermo Fisher Scientific, Vetoquinol, Virbac. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)