Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2026-2034

Animal Feed Market Size and Share:

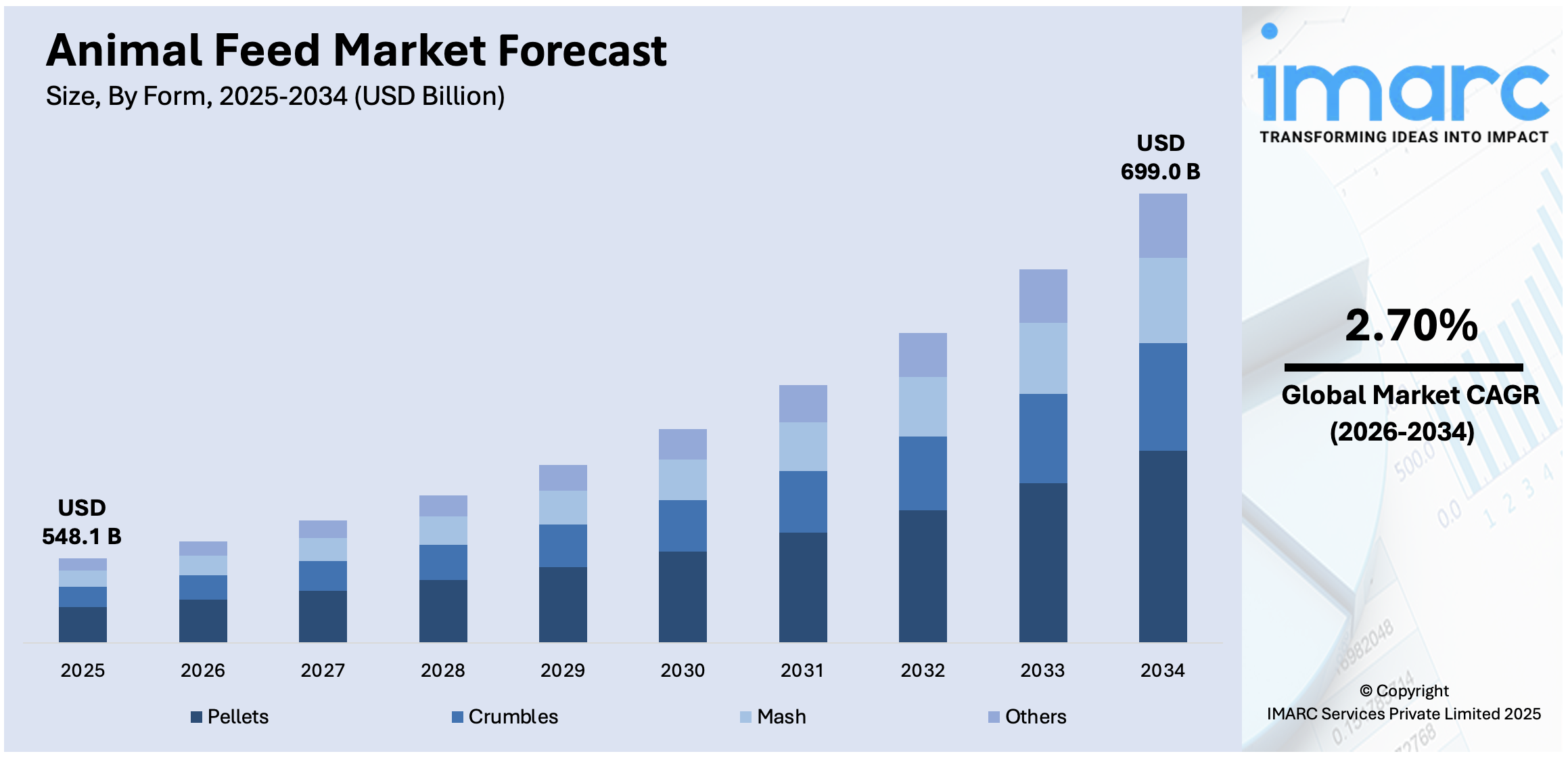

The global animal feed market size reached USD 548.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 699.0 Billion by 2034, exhibiting a CAGR of 2.70% from 2026-2034. Asia Pacific currently dominates the animal feed market share. The growth of the Asia Pacific region is driven by its large livestock population, increasing demand for animal protein, government support for agriculture, and advancements in feed production technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 548.1 Billion |

|

Market Forecast in 2034

|

USD 699.0 Billion |

| Market Growth Rate 2026-2034 | 2.70% |

The increasing consumption of meat, dairy, and poultry products is driving the need for high-quality animal feed to improve livestock productivity, ensuring sufficient supply to meet dietary demands and preferences worldwide. Furthermore, continuous innovations in feed production, such as precision nutrition, customized formulations, and advanced additives like probiotics, amino acids, and feed acidifiers, are significantly enhancing animal health, growth efficiency, and overall productivity, making livestock farming more sustainable and profitable. In addition, the growing environmental concerns are leading to the adoption of eco-friendly feed solutions, including additives that reduce methane emissions and sustainable sourcing of raw materials. This shift supports the shift toward greener and more sustainable livestock farming practices. Moreover, governing bodies worldwide are implementing supportive policies and providing subsidies to encourage livestock farming and feed production. Investments in modern feed production technologies and infrastructure are supporting the market growth.

To get more information on this market Request Sample

The United States plays a crucial role in the animal feed market growth, driven by the development and adoption of advanced feed additives that enhance livestock health and productivity. These additives, often featuring advanced formulations, tackle particular health issues, enhance nutrient uptake, and promote overall animal health. The increasing transition to non-antibiotic methods for disease prevention is further driving the need for creative products that meet regulatory and personal standards for sustainable agricultural practices. For example, in 2024, Kemin Industries launched FORMYL, an advanced feed acidifier for swine health in the US, combining encapsulated calcium formate and citric acid for targeted gastrointestinal delivery. The additive enhances pathogen control, supports gut health, and improves swine productivity. This innovative solution offers a non-antibiotic approach to address Enterobacteriaceae and Escherichia coli challenges.

Animal Feed Market Trends:

Population growth

With the rise of the global population, the need for livestock products like meat, dairy, and eggs is increasing significantly. Reports indicate that the worldwide population has jumped from 2.5 billion in 1950 to 8 billion by 2022, with forecasts suggesting it will rise to 9.7 billion by 2050, leading to heightened demand for vital goods and services globally. This increase in demand highlights the essential importance of animal nutrition in satisfying protein requirements, thereby enhancing the animal feed market outlook. As nations work to feed their growing populations, the animal feed sector becomes increasingly important. Sufficient and well-balanced nutrition is crucial for promoting the best possible growth and well-being of livestock. This factor encourages advancements in feed recipes, as producers strive to improve nutritional quality while keeping costs manageable. The symbiotic relationship between population growth and the animal feed market highlights the industry's significance in global food security.

Economic fluctuations

Economic fluctuations wield a profound influence on the animal feed industry. As economies oscillate between periods of growth and recession, consumer purchasing power and preferences undergo transformation. Economic upturns bolster disposable income, potentially leading to increased consumption of animal-derived products. Conversely, economic downturns might prompt consumers to opt for more affordable alternatives. For instance, researches indicate a 35% probability of a U.S. and global recession before the end of 2024, with a 45% chance by 2025, highlighting rising economic downturn risks. These shifting consumption patterns ripple through the animal feed sector, prompting adjustments in feed formulations to align with changing demand. Furthermore, economic conditions influence investments in research and development, impacting the pace of innovation in animal nutrition.

Regulatory frameworks and standards

The regulatory landscape plays a crucial role in shaping the animal feed market trends, ensuring safety, quality, and sustainability throughout the value chain. Stringent regulations govern various aspects, including formulation, ingredient sourcing, production, labeling, and distribution, to maintain high standards and protect animal and human health. These frameworks are designed to prevent disease outbreaks, ensure the nutritional adequacy of feed, and support food safety initiatives. Compliance requirements also extend to the use of feed additives, antibiotics, and genetically modified ingredients, reflecting a growing emphasis on transparency and responsible practices. Industry players face challenges in navigating complex and evolving regulations but benefit from the user trust and confidence fostered by adherence to these standards. Additionally, regulatory bodies are increasingly promoting environmentally friendly practices, driving innovation in feed solutions that reduce emissions and improve resource efficiency. As these frameworks evolve, they continue to shape the industry’s trajectory, encouraging innovation while safeguarding health and safety.

Animal Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global animal feed market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on form, animal type, and ingredient.

Analysis by Form:

- Pellets

- Crumbles

- Mash

- Others

Pellets represent the largest segment due to their high efficiency and suitability across various livestock types. This form of feed offers consistent nutrient distribution, ensuring that animals receive a balanced diet in every bite. The dense composition of pellets reduces feed wastage, making them a cost-effective choice for farmers. Additionally, pellets are easier to handle, store, and transport, contributing to their widespread adoption. Their organized structure improves feed consumption and digestibility in animals, fostering enhanced growth and efficiency, particularly in poultry, swine, and aquatic farming. Cutting-edge feed pelleting techniques are enhancing the quality and strength of pellets, guaranteeing they stay whole during transport and feeding. The combination of these advantages, along with their adaptability, is establishing pellets as the favored feed type in the market. Their role in meeting the nutritional needs of diverse livestock types underlines their significance in modern feed production systems.

Analysis by Animal Type:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

Poultry (broilers, layers, turkeys, and others) holds the biggest market share owing to the growing demand for poultry products such as meat and eggs. Poultry farming requires high-quality feed to ensure efficient growth, optimal health, and improved productivity of broilers, layers, turkeys, and other birds. Feed formulations for poultry are designed to provide balanced nutrition, incorporating essential proteins, vitamins, and minerals to enhance growth rates and egg-laying capacities. The extensive use of compound feeds and the emphasis on minimizing feed waste is encouraging the utilization for poultry feed. With poultry farming being a major contributor to the global food supply chain, the need for specialized feed products that improve feed conversion ratios and ensure consistent output continues to grow. Technological advancements in feed production, coupled with increased awareness about nutrition's role in disease prevention, are strengthening the dominance of the poultry segment in the animal feed market.

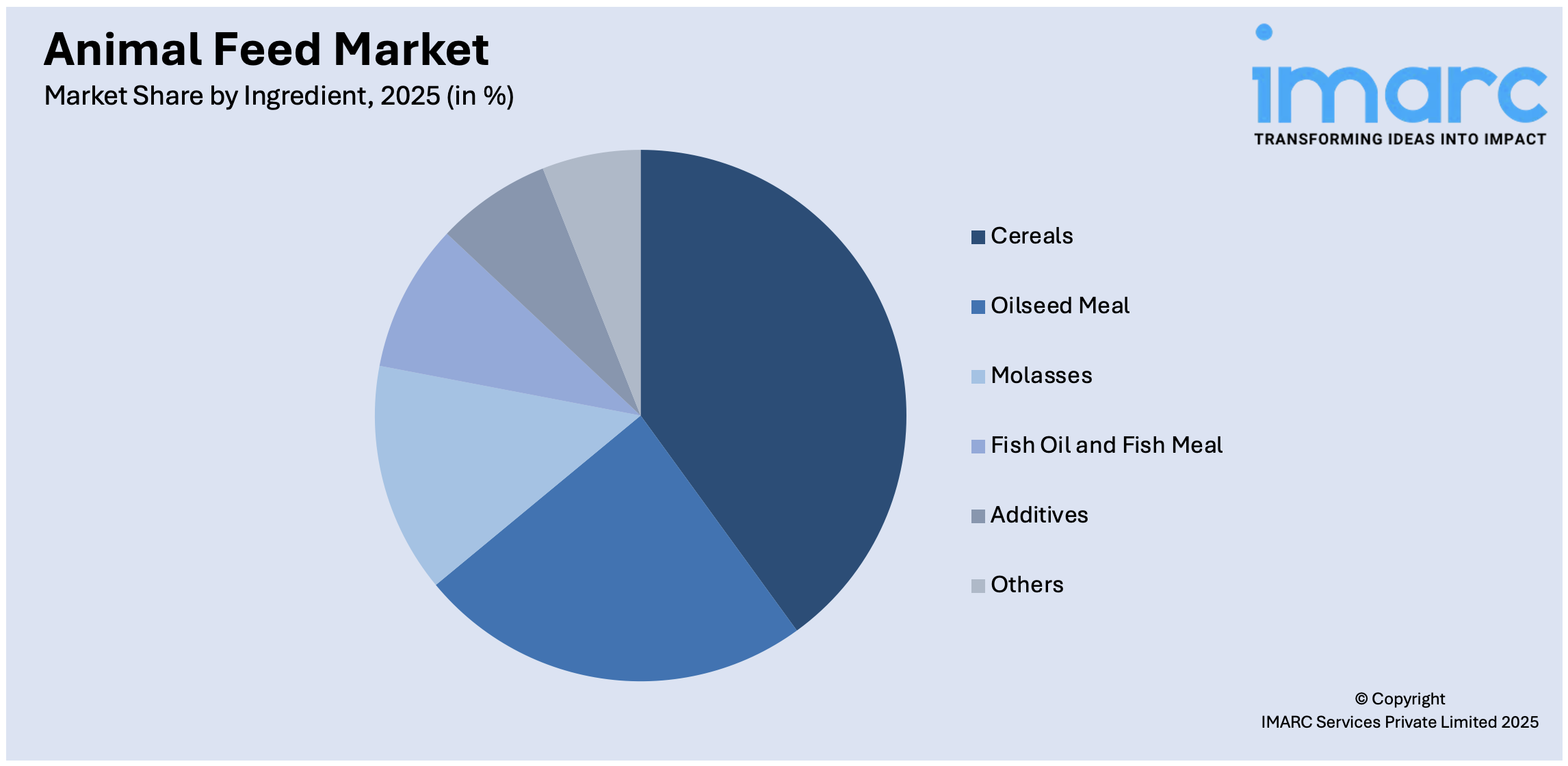

Analysis by Ingredient:

Access the comprehensive market breakdown Request Sample

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

Cereals dominate the market, primarily due to their role as a reliable and cost-effective energy source for livestock. Cereals such as corn, wheat, barley, and sorghum are rich in carbohydrates, making them essential for meeting the high energy demands of animals across poultry, swine, and cattle industries. Their widespread availability and ease of integration into feed formulations enhance their appeal for both small-scale and industrial farming operations. The high digestibility of cereals contributes to improved feed conversion ratios, supporting efficient growth and productivity in livestock. Additionally, the versatility of cereals allows their use in diverse feed products, catering to varying nutritional needs across animal types. The increasing adoption of cereal-based compound feeds further strengthens this segment’s market leadership, driven by the need for consistent and balanced diets for optimal livestock health and output.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific holds the largest animal feed market share due to its substantial livestock population and increasing focus on enhancing livestock productivity. The region is home to major meat-consuming countries that drive the animal feed market demand for efficient feed solutions to meet the growing protein requirements. Countries like China, India, and Japan are heavily investing in advanced feed formulations to support poultry, swine, and aquaculture industries. Increasing awareness among farmers about the benefits of balanced nutrition for livestock health also contributes to market growth. Furthermore, the expansion of advanced feed production facilities is enhancing supply capabilities and promoting sustainable agricultural practices to meet the region's increasing demand for high-quality feed. In 2024, a cutting-edge animal feed facility with a daily production capacity of 800 metric tons was launched in Gujarat, for Rs 210 crore. The center seeks to assist farmers, encourage sustainable farming methods, and improve rural growth. The initiative also emphasized advancements in milk production and natural farming.

Key Regional Takeaways:

United States Animal Feed Market Analysis

The increasing demand for protein-rich diets is boosting animal feed production as livestock farming grows in response to changing consumer preferences. According to the NIH, there is growing shift toward poultry consumption, however, red meat still represents the largest proportion of meat consumed in the US accounting for 58% of overall meat consumption. Technological advancements in feed formulations, including specialized additives that enhance nutritional value, are supporting livestock health and productivity. Large-scale investments in automation and precision feeding technologies are streamlining operations, reducing feed waste, and maximizing yields. Additionally, the growing focus on sustainability has led to the adoption of alternative feed ingredients, such as insect-based and plant-derived proteins, as viable substitutes for traditional sources. Domestic production of grains and oilseeds is meeting the demand for raw materials, while research initiatives aim to improve feed efficiency, ensuring optimal animal growth with reduced resource input. The expansion of commercial farming operations and the rising need for specialized nutrition tailored to poultry, swine, and cattle are driving innovation in feed products. Consumers’ increasing focus on animal welfare has further propelled demand for high-quality feed products designed to support better livestock conditions. Furthermore, regulatory measures are promoting the use of safe, non-antibiotic feed additives, accelerating the shift toward organic and functional feed. Such developments are enabling producers to balance profitability while meeting stricter standards for safety and animal health, ensuring continued growth in livestock production efficiency.

Europe Animal Feed Market Analysis

Efforts to achieve sustainability in livestock farming are accelerating the adoption of precision feeding practices, optimizing feed use while minimizing environmental impacts. Technological advancements are improving feed formulations through enhanced digestibility and nutrient absorption, resulting in higher livestock efficiency and reduced greenhouse gas emissions. The focus on functional feed additives, such as probiotics, prebiotics, and organic trace minerals, is addressing health challenges and supporting animal welfare. A growing demand for organic meat and dairy has also led to the development of chemical-free feed products that align with strict food safety regulations. For instance, the EU, producing around 150 Million Tons of milk annually, ranks as the second-largest global producers, with rising demand for dairy products driving growth in high-value exports like cheese and supporting animal feed benefits, as production yields per cow can reach 10,000 kg annually. Feed manufacturers are investing in research and development to produce innovative protein alternatives, including algae, insects, and single-cell proteins, as part of ongoing efforts to reduce dependency on conventional soy and fishmeal. Increased consumer demand for locally sourced and ethically produced animal products has prompted farmers to adopt feed practices that ensure better livestock health and quality. Additionally, initiatives promoting circular agriculture, such as utilizing agricultural by-products in feed production, are reducing waste and input costs. Automation and digital technologies, including feed monitoring systems, are enabling more efficient feeding strategies, helping producers meet productivity goals. This dynamic transformation is shaping a modern feed sector focused on balancing sustainability, profitability, and efficiency.

Asia Pacific Animal Feed Market Analysis

The rising shift toward high-protein diets, paired with rapid urbanization, is catalyzing a demand for increased livestock production, subsequently driving feed requirements. The region's expanding middle-class population is increasingly able to afford diverse meat and dairy products due to higher disposable incomes. For instance, India's rapidly growing middle class, projected to comprise 41% of the population by 2031, is driving economic activity and boosting demand for animal feed, with over 250 Million people transitioning out of poverty, fostering increased protein consumption and livestock production. Enhanced focus on modernizing traditional farming techniques has accelerated the adoption of nutrient-enriched feed products that improve livestock yields. In addition, agricultural advancements in cultivating raw feed ingredients, such as grains and oilseeds, are ensuring steady supply chains, minimizing input costs for feed manufacturers. Innovations in aquafeed and poultry nutrition are gaining traction to support large-scale fish and poultry farming industries. Consumer-driven trends emphasizing sustainable farming practices are also encouraging the development of eco-friendly feed alternatives, including plant-based and algae-derived proteins. Government-backed initiatives to strengthen agricultural infrastructure are boosting production capabilities and improving feed quality standards. Simultaneously, technological advancements, such as automated feeding systems, are contributing to enhanced livestock efficiency while reducing labor requirements. Market demand for feed products tailored to different livestock categories, including swine and ruminants, continues to grow alongside the increased focus on meat export opportunities.

Latin America Animal Feed Market Analysis

The growing adoption of e-commerce platforms and digital supply chain solutions is simplifying access to high-quality feed products for livestock farmers. Online marketplaces are connecting small and medium-scale producers with suppliers, enhancing price competitiveness and boosting purchasing convenience. For instance, Latin America's e-commerce market has grown 2.8 times in sales value and 3.1 times in transactions, reaching approximately USD 364 Million between 2019-2023, with over 300 Million digital buyers benefiting sectors like animal feed through improved accessibility and distribution, poised for 20% growth by 2027. Increasing investments in feed solutions tailored for poultry and aquaculture industries are meeting evolving consumer preferences for protein-rich diets. Additionally, advancements in feed formulations are improving animal health and reducing overall production costs, helping farmers enhance profitability. Sustainability-driven practices, such as the use of agricultural residues in feed production, are gaining traction to reduce environmental impact. The region's improving agricultural infrastructure is further supporting feed production growth while catering to emerging consumer demands.

Middle East and Africa Animal Feed Market Analysis

Rising investments in contemporary agricultural methods are driving the demand for innovative feed solutions that enhance livestock productivity and quality. For example, in 2023, Saudi Arabia's FDI inflow in the agriculture, forestry, and fishing sectors was around USD 41 Million, increasing agricultural investments that improve animal feed production. Advancements in feed additives, including vitamins and enzymes, are tackling nutritional gaps in conventional feed options, promoting better livestock health. The increasing utilization of intensive poultry and aquaculture farming is generating prospects for nutrient-rich and affordable feed products. Moreover, climate-resilient feed options, such as drought-resistant ingredients, are assisting producers in maintaining livestock production in the face of difficult environmental circumstances. Regional food security initiatives are promoting better feed management systems to meet growing protein requirements. Ongoing technological advancements are further enabling efficient feed distribution and production, driving transformation in the livestock sector.

Competitive Landscape:

Key players in the market are innovating, entering strategic alliances, and expanding their capacity to enhance their market presence. They invest resources in research projects intended to create innovative feed solutions that enhance the health, productivity, and sustainability of livestock. Moreover, companies use digital tools and data-driven technologies to make feed production and supply chain efficiency more effective. Many businesses are expanding geographically and exploring emerging markets as an opportunity to capture a rising demand while also responding to ecological issues through sustainable practices. For instance, in May 2024, Elanco Animal Health obtained approval from the U.S. FDA for Bovaer, a novel feed supplement for lactating dairy cows. Bovaer reduces methane emissions by approximately 30%, addressing environmental problems linked to livestock farming. This approval signifies considerable progress in alternatives for sustainable animal feed. The breakthrough highlights the growing focus on reducing agricultural emissions and promoting sustainable methods.

The report provides a comprehensive analysis of the competitive landscape in the animal feed market with detailed profiles of all major companies, including:

- Alltech

- Anova Feed

- Archer-Daniels-Midland Company

- Bunge Global SA

- Cargill Incorporated

- Charoen Pokphand Foods PCL

- Godrej Agrovet Limited

- Nutreco N.V

- Purina Animal Nutrition LLC

Latest News and Developments:

- November 2024: UPL and CH4 Global have revealed a collaboration to introduce Methane Tamer, a feed additive that decreases methane emissions from cattle by as much as 90%. Aiming at major livestock markets such as India and Brazil, the program encourages sustainable farming practices. This partnership bolsters worldwide initiatives to reduce greenhouse gas emissions.

- November 2024: TrinamiX GmbH and Eurofins Agro Testing revealed a strategic collaboration at EuroTier 2024, facilitating on-farm forage testing with a portable device. This innovation helps farmers swiftly optimize silage production and feed rations, enhancing animal health and boosting farm productivity. The technology empowers advisors and farmers to identify issues effectively, reducing environmental impact. This marks a significant step forward in livestock management and sustainable animal feed practices.

- November 2024: Angel Yeast, in partnership with PT. Tunas Baru Lampung Tbk is investing USD 43.46 Million to launch a yeast production facility in Indonesia's Lampung Province. This strategic expansion will enhance Angel Yeast’s market presence across Asia, leveraging Indonesia’s abundant raw materials and growing demand for yeast in sectors like animal feed. The facility is expected to boost production infrastructure, benefiting regional trade through its strategic location near the Straits of Malacca.

- March 2024: EW Nutrition launched Axxess XY, a thermostable xylanase, at VICTAM 2024. The product breaks down fiber in feed ingredients like sunflower cakes, corn, and wheat, unlocking nutrients from cell walls. Axxess XY improves the intestinal environment and helps feed producers reduce costs while enhancing feed efficiency. This innovation addresses key challenges in the animal feed industry by maximizing nutrient utilization.

Animal Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alltech, Anova Feed, Archer-Daniels-Midland Company, Bunge Global SA, Cargill Incorporated, Charoen Pokphand Foods PCL, Godrej Agrovet Limited, Nutreco N.V, Purina Animal Nutrition LLC., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the animal feed market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global animal feed market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Animal feed refers to the food given to domestic animals and livestock to support their growth, health, and productivity. It typically includes a wide range of ingredients, such as grains, forages, oilseeds, and by-products from various industries, formulated to meet the nutritional needs of different animal species.

The animal feed market size reached USD 548.1 Billion in 2025.

IMARC estimates the global animal feed market to exhibit a CAGR of 2.70% during 2026-2034.

The global animal feed market is driven by the growing demand for meat, dairy, and poultry products, rising livestock populations, and advancements in feed formulations. The increasing awareness about animal health and productivity, coupled with the adoption of compound feed, also support the market growth.

In 2025, pellets represented the largest segment by form, driven by their high nutrient density, ease of storage and transport, and suitability for various livestock species, enhancing feed efficiency.

Poultry (broilers, layers, turkeys, and others) leads the market by animal type owing to rising global demand for poultry products, cost-effective feed conversion ratios, and increasing poultry farming practices worldwide.

Cereals are the leading segment by ingredient due to their high carbohydrate content, affordability, widespread availability, and role as a primary energy source in balanced animal feed formulations.

Asia Pacific currently dominates the animal feed market, driven by increasing livestock farming, rising meat consumption, expanding aquaculture industry, and growing awareness about high-quality feed to enhance animal health and productivity.

Some of the major players in the global animal feed market include Alltech, Anova Feed, Archer-Daniels-Midland Company, Bunge Global SA, Cargill Incorporated, Charoen Pokphand Foods PCL, Godrej Agrovet Limited, Nutreco N.V, Purina Animal Nutrition LLC., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)