Aniline Market Size, Share, Trends and Forecast by Technology, Application, End-Use Industry, and Region, 2026-2034

Aniline Market Size and Share:

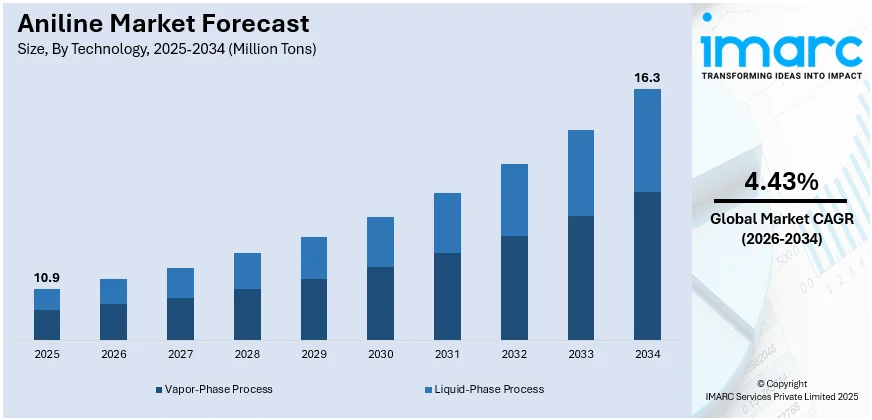

The global aniline market size reached 10.9 Million Tons in 2025. Looking forward, IMARC Group estimates the market to reach 16.3 Million Tons by 2034, exhibiting a CAGR of 4.43% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of 56.7% in 2025. The aniline market share is mainly driven by its extensive use in manufacturing polyurethane foams, rubber processing chemicals, and dyes. The rising demand from automotive, construction and textile industries are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 10.9 Million Tons |

| Market Forecast in 2034 | 16.3 Million Tons |

| Market Growth Rate (2026-2034) | 4.43% |

Technological developments in production are significantly driving the market share by improving efficiency and sustainability. Advanced catalytic processes enhance reaction efficiency, increasing yield while reducing raw material consumption and production costs. Innovations in hydrogenation techniques optimize selectivity, minimizing by-products and ensuring high-purity aniline production. Automation and AI integration streamline manufacturing operations, improving process control, safety, and real-time monitoring. Energy-efficient production technologies reduce carbon footprint, aligning with stringent environmental regulations and sustainability goals. Continuous research and development (R&D) investments drive development of novel catalysts, ensuring higher conversion rates and minimal waste generation. Process intensification strategies enable compact plant designs, reducing capital investment while enhancing production capacity.

To get more information on this market Request Sample

The expanding rubber industry is significantly driving the United States aniline market due to the rising overall demand. Aniline-derived chemicals are essential in manufacturing rubber-processing additives, including antioxidants, accelerators, and vulcanization agents. These additives enhance rubber durability, elasticity, and resistance, making them vital for various industrial applications. The expanding use in high-performance rubber tires, seals, and gaskets is further fueling aniline market demand. Additionally, rising investments in infrastructure and construction catalyzes the need for rubber-based industrial materials and components. Technological advancements in rubber manufacturing encourage efficient and sustainable production, further influencing aniline demand. As per the data published by the IMARC Group, the United States rubber market size is projected to exhibit a growth rate (CAGR) of 5.00% during 2024-2032. Additionally, the healthcare industry contributes by using rubber-based medical equipment and protective gear. Increased preference for synthetic rubber in various industries accelerates aniline-based additive consumption.

Aniline Market Trends:

Growth in Polyurethane and Adhesives Sectors

The growth in the polyurethane and adhesives sector significantly propels the aniline market growth. Aniline serves as a crucial intermediate in synthesizing polyurethane, which is extensively utilized in foam products for furniture, bedding, and automotive seating due to its lightweight and durable properties. In coatings, polyurethane provides protective and aesthetic finishes for surfaces in construction and electronics. High-performance adhesives derived from polyurethane are essential for automotive assembly, construction bonding, and electronics manufacturing, ensuring strong and reliable joins. Additionally, elastomers made from polyurethane offer flexibility and resilience for various industrial applications. In September 2024, the Center for the Polyurethanes Industry reported that North America's polyurethane production had reached 9.1 billion pounds by the end of 2023. Growth areas included spray foam for insulation, PU concrete coatings for durability, and molded composites used in decks and utility poles. The rising demand for advanced, sustainable, and high-performance polyurethane materials across these industries drives the increased consumption of aniline, reinforcing its pivotal role in market expansion.

Rising Demand from Dyes and Pigments Industry

Aniline plays a pivotal role in producing azo dyes and pigments, which are essential for imparting vibrant colors and enhancing aesthetic appeal across various industries. In the textile sector, azo dyes derived from aniline ensure fabrics achieve rich, durable, and colorfast hues, meeting demands for quality and variety. The automotive industry relies on aniline-based pigments for vehicle coatings, providing not only attractive finishes but also protection against corrosion and environmental damage. In construction, these pigments are integral to paints and coatings, offering both functionality and visual enhancement for buildings and infrastructure. In July 2024, Asian Paints doubled the capacity of its Mysuru plant in India to 600,000 KL per annum, investing Rs 1,305 crore to meet medium-term demand. Initially built with a 300,000 KL capacity, the plant now operates at 78% utilization. The consistent and growing demand for colorful, high-quality products in textiles, automotive, and construction sectors significantly drives the aniline market growth, underscoring its importance as a key chemical intermediate.

Escalating Demand from Pharmaceuticals and Agrochemicals

Aniline is essential in pharmaceuticals and agrochemicals as a key precursor for synthesizing a wide range of active pharmaceutical ingredients (APIs) and pesticide compounds. In the pharmaceutical industry, aniline derivatives are used to produce analgesics, antipyretics, antidepressants, and other therapeutic agents, enabling the development of effective medications. In agrochemicals, aniline serves as an intermediate for manufacturing herbicides, insecticides, and fungicides, which are crucial for enhancing crop protection and agricultural productivity. As per the data published by India Brand Equity Foundation, India's agrochemical exports are projected to exceed Rs. 80,000 crore (USD 9.61 billion) by 2027, driven by insights from ACFI and EY. In 2022-23, exports reached Rs. 43,223 crore (USD 5.50 billion), surpassing domestic demand. The versatility and reactivity of aniline facilitate the creation of diverse chemical structures needed in these sectors. Consequently, the continuous advancements and growing demand in both pharmaceuticals and agriculture ensure a sustained and expanding need for aniline, thereby strengthening its market growth.

Aniline Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aniline market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on technology, application, and end-use industry.

Analysis by Technology:

- Vapor-Phase Process

- Liquid-Phase Process

Liquid-phase process stands as the largest component in 2025, holding 60.6% of the market. It is a cost-effective production method, lowering operational and maintenance costs, making it ideal for large-scale manufacturing. Additionally, this process provides consistent product quality by allowing better control over reaction conditions, ensuring uniform purity while minimizing by-products. Its energy efficiency further enhances its appeal, as it utilizes less energy compared to gas-phase alternatives, reducing overall production costs. The scalability advantage makes it suitable for meeting rising global demand, especially in industries such as polyurethane manufacturing. Furthermore, it requires lower catalyst consumption, reducing downtime and maintenance expenses. The reduced environmental impact of the liquid-phase process, with fewer emissions and by-products, aligns with stricter environmental regulations and sustainability goals. It is also preferred for MDI production, as aniline is a crucial precursor to methylene diphenyl diisocyanate (MDI), widely used in polyurethane applications. With widespread industrial adoption, leading manufacturers rely on this technology for its reliability and well-established operational framework.

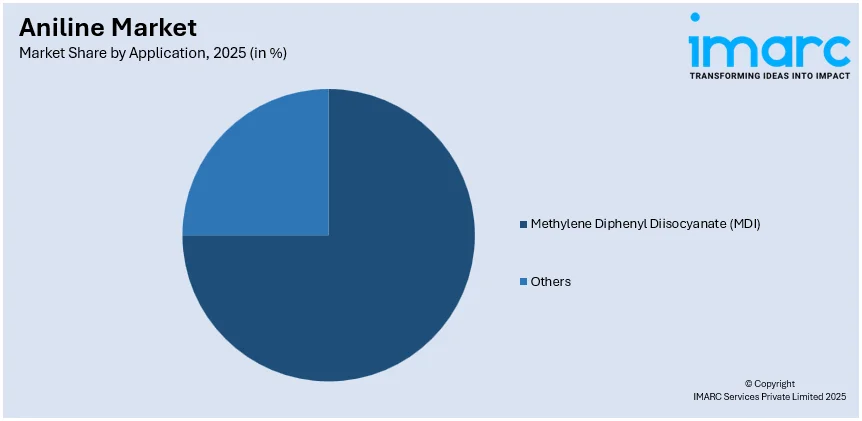

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Methylene Diphenyl Diisocyanate (MDI)

- Others

Methylene Diphenyl Diisocyanate (MDI) leads the market with 74.5% of market share in 2025. Since MDI is synthesized from aniline derivatives, aniline remains an essential precursor. The rising demand for MDI-based polyurethane foams, coatings, adhesives, and elastomers stems from its durability, flexibility, and high-performance characteristics. These properties make MDI indispensable in industries like construction, automotive, furniture, and electronics, where energy-efficient insulation and lightweight materials are essential. Additionally, advancements in MDI production technologies and a growing focus on sustainable, eco-friendly materials further solidify its dominance. The increasing adoption of high-performance polyurethane solutions for industrial and personal applications continues to drive demand, ensuring market growth and long-term stability. As industries prioritize energy efficiency and advanced materials, MDI’s role in the aniline sector remains strong and expanding globally.

Analysis by End-Use Industry:

- Insulation

- Rubber Products

- Consumer Goods

- Transportation

- Packaging

- Agriculture

- Others

Insulation dominates the market with 45.6% of market share in 2025. Polyurethane foam, synthesized from aniline-based MDI, offers high thermal resistance, lightweight structure, and durability, making it indispensable for residential and commercial buildings, automotive manufacturing, refrigeration systems, and industrial equipment. The growing need for energy-efficient solutions, coupled with strict insulation regulations, is driving market expansion. Rising urbanization and infrastructure development further influences demand for high-performance insulation materials. Additionally, technological advancements in polyurethane production and the increasing focus on sustainable, eco-friendly insulation alternatives strengthen this segment’s growth. Industries are continuously seeking cost-effective, high-performance, and regulatory-compliant solutions, reinforcing the widespread adoption of polyurethane-based insulation. As governments and businesses emphasize energy conservation and carbon footprint reduction, insulation remains the leading segment in the aniline industry, ensuring continued market growth, innovation, and long-term stability.

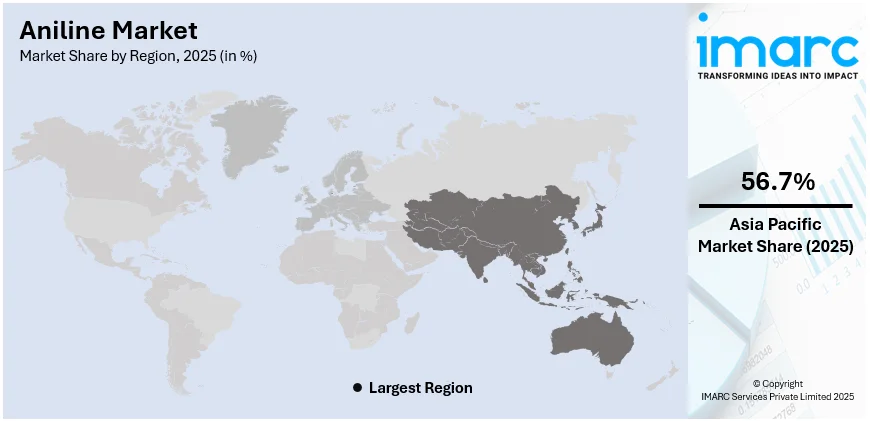

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2025, Asia-Pacific accounted for the largest market share of 56.7%. The region leads the aniline market, accounting for the largest share due to rapid industrialization and robust economic growth in the region. Key drivers include the booming textile, automotive, and electronics industries in countries like China and India, which are major users of aniline for dyes, pigments, and polyurethane production. For example, the Union Budget 2024-25 raised the textiles sector allocation by ₹974 crore, reaching ₹4,417.09 crore. Research and capacity building received ₹686 crore, up from ₹380 crore. The National Technical Textiles Mission saw a 120.59% increase to ₹375 crore, compared to ₹175 crore previously. Meanwhile, the National Handicraft Development Programme’s allocation rose 38% to ₹236 crore, up from ₹171 crore. Additionally, significant investments in infrastructure and manufacturing facilities enhance production capacity. The region benefits from a vast supply chain network, skilled labor, and competitive raw material availability, particularly benzene. Increasing urbanization and rising disposable incomes further catalyzes demand across various sectors. Favorable government policies and strategic trade agreements also support market expansion, solidifying Asia Pacific’s dominant position in the aniline industry.

Key Regional Takeaways:

United States Aniline Market Analysis

The United States hold 89.70% of the market share in North America. The US aniline market is experiencing rapid growth, primarily driven by the growing demand for polyurethane products. Aniline is an important raw material used in the creation of methylene diphenyl diisocyanate (MDI), which is widely used in the manufacturing of rigid polyurethane foams. These foams are essential in various industries, particularly in construction for insulation, automotive for seat cushions and interior components, and refrigeration. According to industry reports, the US polyurethane (PU) foam market is projected to expand at a 7.20% CAGR from 2024 to 2032. As energy efficiency becomes increasingly important, the demand for insulation materials such as polyurethane foams, has grown substantially. Furthermore, the automotive and construction industries across the region are expanding, driving up the need for MDI and, in turn, aniline. The use of aniline in producing dyes and pigments is another important market driver, as it supports various consumer goods, textiles, and industrial applications. The growing need for aniline in pharmaceuticals and agricultural chemicals further contributes to industry expansion. Technological advancements in production processes are also leading to increased efficiency, reducing manufacturing costs and expanding aniline production.

Asia Pacific Aniline Market Analysis

The Asia Pacific aniline market growth is primarily driven by the rapid industrialization and growing demand for automotive, construction, and textile products in the region. Aniline is a vital component in the production of methylene diphenyl diisocyanate (MDI), which is used in making polyurethane foams for insulation in buildings, refrigeration, and automotive parts. As urbanization continues to rise in countries like China and India, the demand for energy-efficient insulation materials has heightened, further driving the market for MDI and aniline. According to recent industry reports, 67.5% of China’s population is projected to reside in urban areas in 2025, totaling approximately 956.55 million people. Similarly, 37.1% of India’s population is expected to live in urban cities, reaching around 542.74 million individuals. Additionally, the rapid shift toward more sustainable and eco-friendly chemical products in the region is also driving innovation in aniline applications, leading to more efficient and greener production processes.

Europe Aniline Market Analysis

The Europe market growth is primarily linked to the expanding demand for polyurethane-based products. Aniline is a vital raw material for producing methylene diphenyl diisocyanate (MDI), which is essential in manufacturing rigid polyurethane foams used in insulation for the construction and automotive industries. With the regions ongoing focus on energy efficiency and sustainability, the demand for such insulation materials has increased, driving the need for aniline. Moreover, the automotive sector in Europe, one of the largest in the world, also continues to drive market demand, as MDI is used in manufacturing various car components including interior parts, seats, and safety systems. Industry reports indicate that in 2023, the European Union recorded nearly 10.6 million new automobile registrations, marking a 14% increase from the previous year. Battery electric vehicles (BEVs) accounted for approximately 15% of total new car sales. Furthermore, environmental concerns and the EU’s commitment to reducing carbon emissions have led to increased use of aniline-derived products in energy-efficient technologies. Additionally, advancements in manufacturing technologies have made the production of aniline more efficient, helping to meet growing market demand.

Latin America Aniline Market Analysis

The Latin American market is rapidly expanding as a result of the increasing demand for polyurethane products, particularly in the automotive and construction industries. As the region continues to urbanize and industrialize, there is an increasing need for energy-efficient insulation materials such as rigid polyurethane foams, which are produced using aniline-derived MDI. According to recent industry reports, 88.1% of Latin America's population lived in urban areas in 2024, totaling approximately 383.66 million people. Additionally, the growing textile sector in countries such as Brazil and Argentina catalyze demand for aniline in the production of dyes and pigments. Furthermore, improvements in production technology and regulatory support for sustainable products are encouraging the adoption of aniline-based solutions across multiple industries in the region.

Middle East and Africa Aniline Market Analysis

The market in Middle East and Africa is witnessing significant growth due to the expanding industrial base and the increasing need for advanced chemicals in manufacturing processes in the region. The growing demand for aniline derivatives in the production of rubber chemicals, antioxidants, and stabilizers plays a significant role, particularly in the rubber and automotive industries. Moreover, the growing emphasis on improving agricultural productivity in the region also leads to a higher demand for aniline in the production of agrochemicals including fungicides and herbicides. As per the data published by the IMARC Group, the Middle East agrochemicals market is expected to expand at a 2.79% CAGR from 2024 to 2032. Additionally, the rising focus on energy-efficient technologies has increased the use of aniline in coatings and adhesives, further supporting industry expansion.

Competitive Landscape:

Key players are focusing on enhancing process efficiency, reducing costs, and ensuring high-quality aniline derivatives for various applications. Major companies expand manufacturing capacities to meet the growing demand for aniline-based polyurethane foams and chemicals. Strategic collaborations and joint ventures help strengthen supply chains, ensuring uninterrupted raw material availability for industries. Companies invest in sustainable production methods, reducing environmental impact and aligning with global regulatory standards. Continuous innovations in catalysts and production processes improve yield efficiency and energy conservation. Key players emphasize mergers and acquisitions, expanding their geographical footprint and enhancing market share. They actively engage in marketing and distribution strategies, ensuring wider product reach across industries. For example, in April 2024, China’s Risun Group’s Jilin Connell launched a 150,000-tonne aniline plant, doubling its total production capacity to 300,000 tonnes. This expansion strengthens global supply chains, leveraging Risun’s operational expertise and Connell’s production strengths. Jilin Connell is also focusing on international market expansion, improving efficiency, and revitalizing Northeastern China’s industrial sector.

The report provides a comprehensive analysis of the competitive landscape in the aniline market with detailed profiles of all major companies, including:

- BASF Corporation

- Bayer Material Science

- Borsodchem Mchz

- First Chemical Corporation

- Jilin Connell Chemical Industry Co., Ltd.

- Hindustan Organics Chemicals Limited

- Huntsman International

- Mitsubishi Chemical

- Mitsui Chemical

- Narmada Chematur Petrochemicals Limited

- Petrochina Co. Ltd.

- Sabic

- Sp Chemicals Holdings Ltd.

- Sumitomo Chemical

- Sumika Bayer Urethane Co., Ltd.

- The Dow Chemical Company

- Tosoh Corporation

Latest News and Developments:

- December 2024: BASF Corporation commenced its trail for its Polyurethane MDI optimization project in Chongqing. This expansion includes a new MMDI processing plant with an annual capacity of 130,000 tons. Additionally, existing facilities, including aniline production units, are being upgraded to remove bottlenecks and extend manufacturing cycles, optimizing overall operations.

- April 2024: Pili, a French producer of bio-based dyes, advanced chemical sector decarbonization by industrializing bio-based aniline. This achievement results from a consistent, scalable industrial process, enabling ton-scale production and commercial availability of the aromatic compound.

- March 2024: Covestro, a German polymer manufacturer, launched a pilot project to produce aniline from sugar instead of oil at one of Europe’s largest chemical plants. This initiative aligns with the chemical sector’s efforts to reduce carbon emissions, helping the company lower its environmental footprint.

Aniline Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Vapour-Phase Process, Liquid-Phase Process |

| Applications Covered | Methylene Diphenyl Diisocyanate (MDI), Others |

| End-Use Industries Covered | Insulation, Rubber Products, Consumer Goods, Transportation, Packaging, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | BASF Corporation, Bayer Material Science, Borsodchem Mchz, First Chemical Corporation, Jilin Connell Chemical Industry Co., Ltd., Hindustan Organics Chemicals Limited, Huntsman International, Mitsubishi Chemical, Mitsui Chemical, Narmada Chematur Petrochemicals Limited, Petrochina Co. Ltd., Sabic, Sp Chemicals Holdings Ltd., Sumitomo Chemical, Sumika Bayer Urethane Co., Ltd., The Dow Chemical Company, Tosoh Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, aniline market outlook, and dynamics of the market from 2020-2034.

- The aniline market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aniline industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aniline market size reached 10.9 Million Tons in 2025.

The aniline market is projected to exhibit a CAGR of 4.43% during 2026-2034, reaching a volume of 16.3 Million Tons by 2034.

The aniline market growth is driven by several key factors including the rising demand for polyurethane, where aniline-based MDI is widely used in foams, coatings, and adhesives. The expanding automotive sector increases the need for rubber-processing chemicals and polyurethane-based components. Besides this, infrastructure development fuels usage through construction and insulation materials.

Asia Pacific currently dominates the aniline market, accounting for a share of 56.7% in 2024. The regions thriving construction sector is driving demand for aniline-based polyurethane foams. Expanding automotive and electronics industries further strengthens the market growth. Countries like China and India lead production, benefiting from low-cost labor, abundant raw materials, and government support. Additionally, rising demand for agrochemicals and rubber-processing chemicals also fuels market expansion.

Some of the major players in the aniline market include BASF Corporation, Bayer Material Science, Borsodchem Mchz, First Chemical Corporation, Jilin Connell Chemical Industry Co., Ltd., Hindustan Organics Chemicals Limited, Huntsman International, Mitsubishi Chemical, Mitsui Chemical, Narmada Chematur Petrochemicals Limited, Petrochina Co. Ltd., Sabic, Sp Chemicals Holdings Ltd., Sumitomo Chemical, Sumika Bayer Urethane Co., Ltd., The Dow Chemical Company, Tosoh Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)