Angioplasty Balloons Market Size, Share, Trends and Forecast by Product Type, Application, Material, End User, and Region, 2025-2033

Angioplasty Balloons Market 2024, Size and Trends:

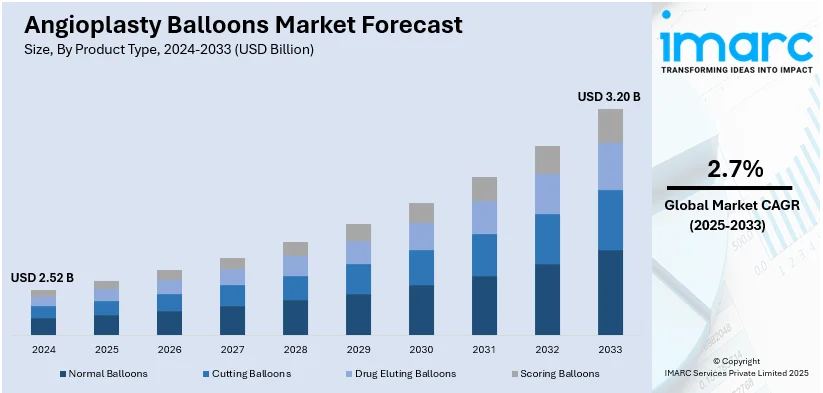

The global angioplasty balloons market size was valued at USD 2.52 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.20 Billion by 2033, exhibiting a CAGR of 2.7% during 2025-2033. North America currently dominates the angioplasty balloons market share by holding over 39.2% in 2024. The market is influenced positively by increasing cardiovascular diseases, rising aging population, advancements in medical technology, and growing demand for minimally invasive procedures. These factors, collectively, are aiding to increase the angioplasty balloons market share across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.52 Billion |

| Market Forecast in 2033 | USD 3.20 Billion |

| Market Growth Rate (2025-2033) | 2.7% |

One of the major driving factors behind the angioplasty balloons market growth is the increasing prevalence of coronary and periphery artery diseases around the globe. In line with this, the growing geriatric population and people suffering from obesity and high levels of cholesterol also help the market growth. Additionally, drug-coated angioplasty balloons are very popular because they increase safety, and effectiveness and provide better blood flow through the body. It has also led to a reduction in the use of vessel implants, such as stents, that could cause vessel fracture. Major growth-inducing factors include diverse technological advancements ranging from the invention of imaging technologies to various modified variants that may be implanted without general anesthesia. Other factors expected to aid the angioplasty balloons market growth include increasing health consciousness among consumers, the development of healthcare infrastructure, and extensive research and development (R&D) in medical sciences.

The angioplasty balloons market demand in the United States is influenced by the high incidence of cardiovascular diseases (CVDs), particularly coronary artery disease, which requires angioplasty procedures for treatment. The aging population, with an excessive risk of heart-related conditions, further contributes to market growth. Moreover, advancements in medical technology, such as the development of drug-eluting and balloon-expandable angioplasty balloons, improve treatment outcomes. For instance, in January 2025, Concept Medical, a Florida healthtech company, announced the enrollment of the first patient in its MAGICAL study, which compares a balloon coated with sirolimus to standard angioplasty for patients with peripheral artery disease (PAD) below the knee. The announcement follows the company's successful application for an Investigational Device Exemption (IDE) for the MagicTouch PTA from the US Food and Drug Administration (FDA). Two more trials are being initiated by the business to investigate its drug-coated substitute for conventional percutaneous transluminal angioplasty (PTA). The inclination for minimally invasive procedures due to shorter recovery times and reduced risks also drives market demand. Robust healthcare infrastructure, well-established reimbursement policies, and the existence of leading medical device manufacturers represent the key angioplasty balloons market trends supporting the growth of the market in the U.S.

Angioplasty Balloons Market Trends:

Increasing Prevalence of Cardiovascular Diseases (CVDs)

The rising cases of heart diseases, such as CAD and PAD, are influencing the angioplasty balloons market trends. Cardiovascular diseases are the leading cause of death globally, according to the WHO, which has amplified the demand for angioplasty as an essential intervention. As the number of patients diagnosed with heart conditions that require angioplasty continues to grow, the demand for angioplasty balloons rises in tandem.

The angioplasty balloons market is propelled by the increasing incidence of CAD and PAD. Cardiac diseases are the primary cause of mortality in the world as per WHO which has increased the need for angioplasty as one of the beneficial treatments. Since the patient population with heart conditions that can be treated through angioplasty is increasing, so is the need for angioplasty balloons.

According to the Centers for Disease Control and Prevention (CDC), which reported in October 2024 that approximately 5% of adults aged 20 and above suffer from coronary artery disease (CAD), this is roughly 1 in 20 individuals. This upward trend in heart disease cases contributes immensely to the expansion of the market for angioplasty balloons since more people opt for treatment through angioplasty procedures.

FDA Approvals and New Technologies

The FDA approval of innovative devices is a major growth driver in the angioplasty balloons market share. For instance, Boston Scientific's AGENT Drug-Coated Balloon (DCB) has opened new avenues for the treatment of coronary interventions, especially for patients with coronary in-stent restenosis (ISR). In June 2024, the FDA approved the employment of drug-coated balloon (DCB) stents for angioplasty procedures, a milestone that is already transforming clinical practices, particularly at institutions like OhioHealth. In addition, the UPMC Heart and Vascular Institute in Central Pennsylvania treated its first patient with newly FDA-approved DCB therapy intended specifically to target ISR in October 2024.

Such improvements in treatments have better results, decrease restenosis, and even hasten patients' recovery. Ongoing novel balloon technologies continue to emerge, in addition to enlarging FDA clearances, where the market of angioplasty balloons is in its way toward expansion with greater demands for proper and less-invasive coronary intervention.

Rising Geriatric Population and Lifestyle Changes

The growing age population, predominantly in Asia and the Pacific region, is enhancing the angioplasty balloons market outlook. With ageing, people fall prey to greater cardiovascular diseases due to which higher numbers of such procedures are necessary. This combined with lifestyle changes and undesirable dietary habits further precipitates more cardiovascular illness. The increased emissions of risk factors for lifestyle diseases including smoking, diabetes, and hypertension among others is further driving the demand for angioplasty treatments across the globe.

According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), in 2023, an estimated 697 million older individuals (aged 60 and above) live in the region, accounting for about 60% of the world's elderly population. This increasing number of elderly people will further increase the demand for angioplasty interventions and, consequently, angioplasty balloons, as the incidence of cardiovascular conditions increases with age.

Angioplasty Balloons Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global angioplasty balloons market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on product type, application, material, and end user.

Analysis by Product Type:

- Normal Balloons

- Cutting Balloons

- Drug Eluting Balloons

- Scoring Balloons

Normal Balloons leads the market with around 54.8% of the market share in 2024. Normal balloons hold the largest share in the angioplasty balloons market because of their extensive use, proven efficacy, and affordability when compared to more specialized options like drug-eluting balloons. These balloons are frequently employed to widen constricted or obstructed arteries during routine angioplasty treatments, and they frequently produce dependable outcomes. Healthcare practitioners appreciate them because of their ease of use, simplicity, and track record of success in routine treatments. Additionally, a wider variety of healthcare facilities can use regular balloons due to their lower cost, particularly in developing nations with tight budgets.

Analysis by Application:

- Coronary Angioplasty

- Peripheral Angioplasty

Coronary Angioplasty leads the market with around 55.6% of the market share in 2024. Coronary angioplasty holds the largest share in the angioplasty balloons market owing to the high prevalence of coronary artery diseases (CAD), which require intervention to restore blood flow to the heart. As CAD remains a leading cause of death globally, coronary angioplasty is a widely performed procedure. Coronary angioplasty is growing fast as it's a quicker, lower-risk way to treat heart blockages compared to other surgical options. New technology in angioplasty balloons with drug-release capabilities makes this procedure even more successful and popular.

Analysis by Material:

- Nylon

- Polyurethane

- Silicone Urethane Co-Polymers

- Others

Nylon's exceptional strength, flexibility, and durability are projected to contribute to its substantial market share in the angioplasty balloon industry. Because of its great tensile strength, balloons that can tolerate the pressures needed for angioplasty treatments can be produced. Additionally, nylon is very biocompatible, which makes it appropriate for prolonged bodily use. Its extensive use in the production of balloon catheters is also a result of its affordability and ease of processing.

The market for angioplasty balloons favors polyurethane because of its exceptional biocompatibility, flexibility, and durability. It ensures optimal performance during angioplasty treatments by enabling precise balloon inflation and offering exceptional compliance. For catheter balloons used in cardiac procedures, polyurethane is ideal because of its capacity to retain shape integrity at high pressure. Its exceptional strength-to-weight ratio and adaptable qualities further encourage its use in the medical device sector.

Silicone urethane co-polymers are preferred in the production of angioplasty balloons because of their superior strength, flexibility, and biocompatibility. During treatments, their exceptional flexibility and kink resistance provide dependable balloon expansion and ideal vascular dilatation. Additionally, these co-polymers provide a smooth surface, which lowers friction and lowers the possibility of issues. They are perfect for medical applications like angioplasty because of their great resistance to wear and tear and capacity to function well under pressure.

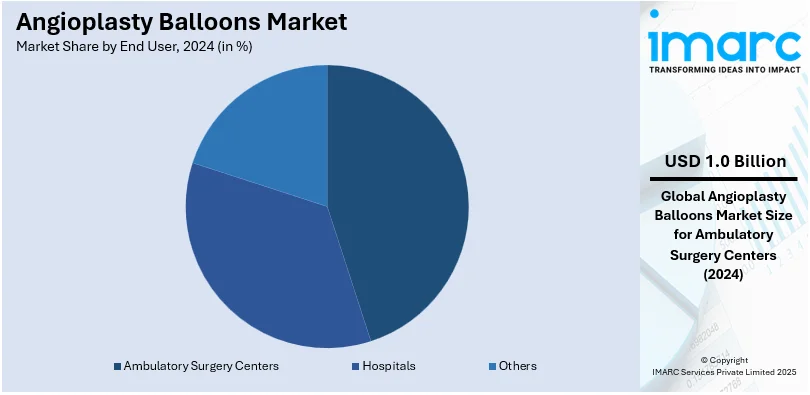

Analysis by End User:

- Hospitals

- Ambulatory Surgery Centers

- Others

Ambulatory Surgery Centers leads the market with around 32% of the market share in 2024 because they excel at delivering minimally invasive surgical services at lower costs with high efficiency. ASCs are popular with both patients and healthcare workers because their treatment costs are lower, patients don't stay in the hospital for long, and they recover faster. Due to the rising incidence of coronary artery diseases and the need for outpatient treatment, ASCs are increasingly performing angioplasty operations. Furthermore, angioplasty balloons and other technological and equipment developments have made it possible for ASCs to perform these procedures with extreme safety and precision, which has further increased their market domination.

Regional Analysis

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.2%. The increased prevalence of cardiovascular diseases (CVDs), such as coronary artery disease, which requires angioplasty operations, is plunging the market for angioplasty balloons in North America. Demand is further enhanced by an older population that has a higher prevalence of heart-related illnesses. The extensive use of minimally invasive procedures and sophisticated healthcare infrastructure both support market expansion. Furthermore, treatment results are improved by the availability of cutting-edge angioplasty balloon technology, such as drug-eluting balloons. The presence of leading medical device manufacturers in North America, government healthcare initiatives, and high healthcare spending all contribute to the market's growth.

Key Regional Takeaways:

United States Angioplasty Balloons Market Analysis

In 2024, the United States accounted for the largest market share of over 90.00% in North America. Heart disease remains the leading cause of death across the United States, cutting across men and women from all racial and ethnic backgrounds. In October 2024, it was reported that someone dies from cardiovascular disease every 33 seconds in the United States. This number is very high and reflects the heavy burden that heart disease has on public health, which will continue to create a need for successful cardiovascular therapies like angioplasty procedures.

The study revealed that a study appeared in February 2023 in the Journal of the American College of Cardiology, which proved that the incidence rate of ASCVD is considerably higher in patients who have risk predictions with the 10-year and 30-year being elevated, and this rate goes up to as high as 2.60 per 1,000 person-years in at-risk individuals. This increasing incidence of cardiovascular disease, particularly among those at higher risk, is likely to fuel the demand for angioplasty treatments, thereby driving growth in the U.S. angioplasty balloons market. The continuous requirement for interventional procedures to treat atherosclerosis supports the growing market for angioplasty balloons in the region.

Europe Angioplasty Balloons Market Analysis

A rising number of heart and circulatory diseases in Europe is one of the main drivers for the angioplasty balloons market. Around 7.6 million people in the UK suffered from heart and circulation disorders in 2021, with 4 million males and 3.6 million women afflicted, according to research released in July 2022 by the British Heart Foundation. This growing burden of cardiovascular conditions puts an imperative to develop more effective treatments like angioplasty. Angioplasty is the common procedure in restoring blood flow to blocked arteries.

Because there is an age increase in populations and more incidences of the disease, especially heart disease, demand for balloons in angioplasty is on the rise. There is going to be even greater emphasis put on cardiovascular diseases with the improvement of medical and advanced technologies within Europe, where there will consequently be increased applications of angioplasty balloons in treatment services. The area is expected to see growth throughout the forecasted period due to the higher level of heart diseases and the involvement of interventional care.

Asia Pacific Angioplasty Balloons Market Analysis

The main driving factor for the angioplasty balloons market in the Asia Pacific region is the growing number of CVD cases. According to an NCBI report in 2023, "There were about 330 million cases of CVD in China, which includes 13 million strokes, 11.39 million coronary heart disease, 8.9 million heart failure cases, and pulmonary heart disease in 5 million people". This heavy burden on cardiovascular health doubles the requirement of interventions such as angioplasty.

As the region becomes increasingly urbanized, and demographic changes become rampant, more individuals are becoming victimized by various cardiovascular treatments like angioplasty. High and widespread prevalence of CVD is expected to make the region flourish in the next few years due to advancements in the balloon technology associated with angioplasty. High patient demands of coronary and peripheral artery treatment further increase the future market size for angioplasty balloons.

Latin America Angioplasty Balloons Market Analysis

Cardiovascular diseases (CVD) are the leading cause of death in Mexico, accounting for about 20% of total deaths, with ischemic heart disease (IHD) responsible for 68.5% of these deaths, according to the NIH in 2019. This high prevalence of heart disease in the region is a significant driver for the Latin American angioplasty balloons market. As the burden of cardiovascular conditions continues to rise, the demand for effective treatments, including angioplasty procedures, is increasing.

The increasing prevalence of ischemic heart disease and other CVDs in Mexico and other Latin American countries is fueling the demand for angioplasty balloon technologies. The increasing number of patients requiring interventions to treat CAD and PAD is a strong growth opportunity for the market. Angioplasty balloons are also enhancing patient outcomes and, therefore their demand in this region is accelerated. This development is likely to propel the sector growth in Latin America's Angioplasty Balloons market.

Middle East and Africa Angioplasty Balloons Market Analysis

According to the report from BMC Cardiovascular Disorders, in 2021, the United Arab Emirates had the highest age-standardized prevalence rate of cardiovascular diseases, with 11,066.8 cases per 100,000 people. In the same year, the age-standardized incidence rate of CVD was highest in the Syrian Arab Republic. Such alarming statistics show the rising burden of heart diseases in the MEA region, which further increases the demand for angioplasty procedures and, consequently, angioplasty balloons.

The increasing incidence and prevalence of cardiovascular diseases such as CAD and PAD are promoting interventional therapy. Angioplasty balloons are an essential component of these therapies, which try to reestablish blood flow in diseased arteries. As the medical infrastructure improves and knowledge about CVD increases, the MEA angioplasty balloons market is projected to grow highly. Advances in balloon technologies, including drug-coated balloons, are also contributing to better treatment outcomes, further supporting market growth in the region.

Competitive Landscape:

The angioplasty balloons market is highly competitive, with key players such as Boston Scientific, Medtronic, Abbott Laboratories, and Terumo Corporation dominating the industry. Product innovation includes drug-eluting balloons, bioresorbable balloons, and next-generation technology to improve the nature of the clinical outcomes these companies offer. As companies attempt to expand their product portfolio and global reach, strategic collaborations, mergers, and acquisitions are general. Other emerging players also are gaining traction by selling cost-effective solutions, despite striking underserved markets. Regulatory approval and adherence to strict quality standards are critical for maintaining a competitive edge in this growing market.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Abbott Laboratories

- B. Braun Melsungen AG

- BD (Becton, Dickinson, and Company)

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Cardinal Health Inc.

- Cook Medical LLC

- Endocor GmbH & Co. KG

- Johnson & Johnson

- Medtronic Inc.

- Terumo Corporation

Recent Developments:

- November 2024: The DCB-BIF experiment, which was presented at TCT 2024, examined how well drug-coated balloons treated side branches in coronary bifurcation lesions following provisional stenting in comparison to non-compliant balloons.

- July 2024: The FDA approved the first catheter for percutaneous transluminal coronary angioplasty, the Ringer Perfusion Balloon Catheter (PBC), manufactured by Teleflex Incorporated. The innovative catheter is provided with a helical balloon design that helps to maintain coronary blood flow during the inflation of the balloon, enhancing myocardial perfusion and enabling the delivery of additional devices during the procedure.

- March 2024: The FDA approved the use of its AGENT drug-coated balloon for Boston Scientific Corporation. It will be utilized for the treatment of coronary in-stent restenosis or ISR in people who have already experienced coronary artery disease. Further options for such people would come about through additional treatment alternatives as far as their conditions involving plaque buildup or scar tissue in already stented arteries.

- March 2024: A first-of-its-kind BIDMC-led trial led to the FDA approval of coronary drug-coated balloons. This marks the most critical development in managing coronary artery disease. Results of the first randomized controlled trial prove that DCBs are effective against restenosis and improve outcomes for patients.

Angioplasty Balloons Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Normal Balloons, Cutting Balloons, Drug Eluting Balloons, Scoring Balloons |

| Applications Covered | Coronary Angioplasty, Peripheral Angioplasty |

| Materials Covered | Nylon, Polyurethane, Silicone Urethane Co-Polymers, Others |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, B. Braun Melsungen AG, BD (Becton, Dickinson, and Company), Biotronik SE & Co. KG, Boston Scientific Corporation, Cardinal Health Inc., Cook Medical LLC, Endocor GmbH & Co. KG, Johnson & Johnson, Medtronic Inc. and Terumo Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the angioplasty balloons market from 2025-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global angioplasty balloons market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the angioplasty balloons industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The angioplasty balloons market was valued at USD 2.52 Billion in 2024.

IMARC estimates the angioplasty balloons market to exhibit a CAGR of 2.7% during 2025-2033, expecting to reach USD 3.20 Billion by 2033.

The angioplasty balloons market is driven by the rising prevalence of cardiovascular diseases, an aging global population, advancements in balloon technologies (e.g., drug-eluting balloons), and increasing preference for minimally invasive procedures. Additionally, improved healthcare access in emerging markets and growing demand for cost-effective treatment options contribute to market growth.

North America is the fastest growing region in the angioplasty balloons, accounting for a share of over 39.2% in 2024. The angioplasty balloons market in North America is driven by the high prevalence of cardiovascular diseases, an aging population, advanced healthcare infrastructure, and technological innovations in minimally invasive treatments.

Some of the major players in the global angioplasty balloons market include Abbott Laboratories, B. Braun Melsungen AG, BD (Becton, Dickinson, and Company), Biotronik SE & Co. KG, Boston Scientific Corporation, Cardinal Health Inc., Cook Medical LLC, Endocor GmbH & Co. KG, Johnson & Johnson, Medtronic Inc. and Terumo Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)