Analog-to-Digital Converters Market Report by Product Type, Resolution, Application, and Region, 2025-2033

Analog-to-Digital Converters Market Size and Share:

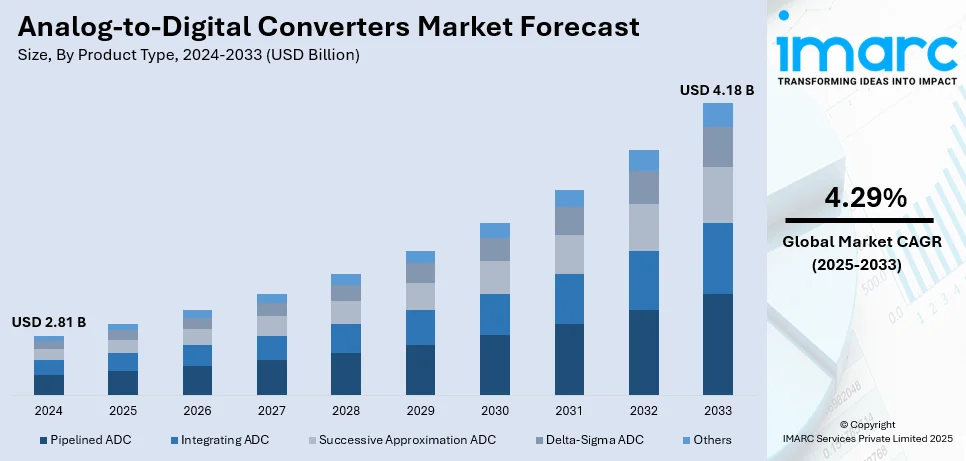

The global analog-to-digital converters market size was valued at USD 2.81 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.18 Billion by 2033, exhibiting a CAGR of 4.29% from 2025-2033. North America currently dominates, with 30.2% analog-to-digital converters market share, driven by its strong electronics manufacturing base, high demand for consumer electronics, advancements in automotive technologies, and significant growth in industrial automation and 5G infrastructure in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.81 Billion |

|

Market Forecast in 2033

|

USD 4.18 Billion |

| Market Growth Rate (2025-2033) | 4.29% |

The global analog-to-digital converters (ADC) market growth is driven by increasing demand for high-performance electronics, including smartphones, wearables, and Internet of Things (IoT) devices, as they require precise data conversion. In addition, ongoing advancements in automotive technologies, such as electric vehicles (EVs) and autonomous driving, fuel ADC demand for sensors and control systems, aiding the market growth. Moreover, the growth of the healthcare sector, with the rise of digital diagnostics and medical devices, boosts ADC usage which is providing an impetus to the market. For instance, Texas Instruments unveiled up to $1.6 billion in its research and development (R&D) budget to focus on advancing ADC technology. The investment focuses on fostering new applications across the telecommunications, automotive, and healthcare sectors. Besides this, the expanding 5G infrastructure requires ADCs for efficient signal processing, contributing to the market expansion. Also, industrial automation and smart grid implementations increase the integration of ADC, fueling the market demand. Furthermore, consumer electronics' shift toward high-definition video and audio technologies surges the adoption of ADC, thus impelling the market growth.

The United States is emerging as a key region with 80.0% market shares. The ADC market demand in this region is driven by the rapid growth of artificial intelligence (AI) and machine learning (ML) applications, as ADCs enable precise data acquisition for neural networks. In line with this, the demand for high-precision electronics in the defense sector for surveillance and communication systems boosts ADC adoption, strengthening the market share. Concurrently, the increasing investment in renewable energy (RE) sources, such as solar and wind, drives the need for ADCs in energy management systems, contributing to the market expansion. For instance, in 2023 the U.S. electric power sector generated power for 4,017 billion kWh of electricity with renewable energy sources delivering 874 billion kWh or 22% of the total output, emphasizing the need for ADCs in efficient energy monitoring and management. Moreover, the rise of augmented reality (AR) and virtual reality (VR) in entertainment and training is acting as another growth-inducing factor as they require precise and rapid ADC to deliver immersive experiences, particularly in gaming, simulation, and remote training. Apart from this, the growing trend of connected healthcare devices and automation in manufacturing is thereby propelling the market forward.

Analog-to-Digital Converters Market Trends:

Miniaturization of Devices

The miniaturization trend in electronic devices has a great impact on the ADC market trends. Their miniaturization, along with the fact that current consumer electronics-maybe smartphones, wearables, and several IoT devices get even more compact and portable, also ensures ADCs get as small and efficient as possible. This is especially true in industries such as healthcare, where portable medical devices need smaller yet powerful ADCs to maintain accuracy while reducing the overall size of devices like diagnostic tools, wearables, and point-of-care equipment. According to the U.S. Semiconductor Industry Association, the U.S. semiconductor industry contributed USD 276.9 billion to the GDP in 2021. This growth is driven by sectors like healthcare, where portable medical devices require smaller yet powerful ADCs to maintain accuracy while reducing the overall size of devices like diagnostic tools, wearables, and point-of-care equipment. Miniaturized ADCs allow manufacturers to design products with enhanced functionality, greater portability, and lower power consumption without compromising performance. Moreover, improvements in semiconductor manufacturing technologies are enabling the production of smaller, more efficient ADCs, which will find their place in a wide spectrum of applications: from consumer electronics up to industrial equipment, thus augmenting the ADC market share. The aspect of miniaturization will go on as the requirement for smaller and more versatile electronic devices increases.

Integration with IoT and Automation

Critical drivers of growth lie in the main market trend through the integration of ADCs into IoT devices, as well as automation technologies; industry adoption of IoT solutions relies strongly on ADC, which converts data from a diversity of sensors into their digital form to then be transmitted for real-time analyses. This integration transforms industries such as manufacturing, agriculture, healthcare, and transportation by monitoring and analyzing data continuously. For instance, in smart agriculture, ADCs enable the monitoring of soil moisture, temperature, and other environmental factors in real-time, helping farmers optimize irrigation to improve crop yields. Similarly, in industrial automation, ADCs help monitor the conditions of machinery, detecting anomalies that could lead to equipment failure before it happens. An example of this trend is seen with Asahi Kasei Microdevices, which announced the AK5707, a low-power, monaural 16-bit ADC designed for IoT security applications. It operates at just 34μA and features an integrated Acoustic Activity Analyzer (AAA) to detect acoustic events, enhancing smart security devices like cameras and doorbells while reducing power consumption and extending battery life. As IoT and automation penetrate various sectors, the demand for more reliable, cost-effective, and accurate ADCs will only enhance the ADC market outlook.

Advancements in High-Resolution ADCs

With industries demanding greater precision and improved performance in applications that require accurate signal conversion, the demand for higher-resolution ADCs is expanding. High-resolution ADCs provide higher accuracy by converting analog signals into digital data with finer levels of detail. Such a requirement is necessary in industries like medical imaging, telecommunications, and scientific instrumentation, where the ability to detect subtle variations in signal is essential for optimal functionality. For instance, in medical equipment such as MRI scanners or electrocardiographs, high-resolution ADCs ensure that fine details in the signals are captured and converted with minimal noise which leads to accurate diagnoses. Similarly, in telecommunications, high-resolution ADCs are vital for processing high-frequency signals while maintaining signal integrity over long distances. According to PMC, the global biophotonics market, which includes medical imaging technologies, was expected to reach USD 63.1 billion by 2022. As the demand for high-resolution data conversion increases in these fields, ADC manufacturers are continuing to innovate and produce higher-resolution devices with performance, even at a significantly lower power consumption level. This is pushing the continued development of this segment.

Analog-to-Digital Converters Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global analog-to-digital converters market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, resolution, and application.

Analysis by Product Type:

- Pipelined ADC

- Integrating ADC

- Successive Approximation ADC

- Delta-Sigma ADC

- Others

Delta-sigma ADCs lead with 20% market share. These converters are widely favored for their high precision, excellent noise performance, and ability to operate efficiently at low sampling rates. Delta-sigma ADCs are extensively utilized in applications requiring accurate signal processing, such as medical imaging, industrial automation, and consumer electronics. Their capability to achieve superior resolution and dynamic range makes them ideal for modern systems demanding high fidelity. Furthermore, advancements in semiconductor technologies have enhanced the efficiency and integration of delta-sigma ADCs, further solidifying their market leadership. The growing demand for high-resolution data acquisition systems is expected to bolster their adoption across emerging applications like IoT devices and automotive systems.

Analysis by Resolution:

- 8-bit

- 10-bit

- 12-bit

- 14-bit

- 16-bit

8-bit ADCs are widely used in cost-sensitive applications, providing sufficient resolution for basic consumer electronics like audio systems, home appliances, and simple embedded devices. They offer faster conversion speeds at lower power consumption but with limited accuracy in complex tasks, which is fostering the market growth.

10-bit ADCs strike a balance between resolution and processing speed, commonly used in mid-range applications like digital cameras, audio processing, and automotive sensors. They offer more precise data conversion than 8-bit ADCs while still maintaining relatively low power consumption, providing an impetus to the market.

12-bit ADCs are preferred in applications requiring higher accuracy, such as medical devices, industrial control systems, and precision measurement tools. Their higher resolution enables finer data acquisition, making them suitable for a broad range of consumer, automotive, and healthcare devices, thus impelling the market growth.

14-bit ADCs are used in high-precision applications where accuracy is critical, including scientific instruments, high-definition imaging, and advanced automotive sensors. Their enhanced resolution allows for more detailed data representation, ideal for sophisticated systems requiring high fidelity, contributing to the market expansion.

16-bit ADCs are ideal for high-end applications, such as professional audio recording, high-definition imaging, and complex industrial automation. Their superior resolution enables extremely detailed data conversion, essential for applications that require high accuracy and low signal distortion, thereby catalyzing the market growth.

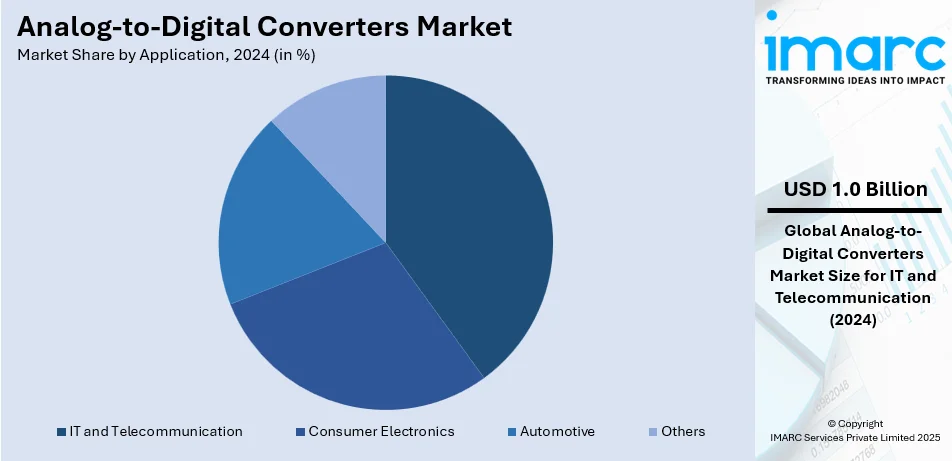

Analysis by Application:

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Others

The information technology (IT) and telecommunications industry dominate the ADC market growth with 20.2% share, driven by the rising 5G network deployment and data transmission speed requirements. ADCs transform analog signals into digital data for communication systems through their signal-processing functions. As IoT devices grow in number ADCs need to process large sensor data streams while enabling connection between smart devices. Besides this, organizations utilise advanced digital converters as they build more data centers and cloud infrastructure for their high-performance computing workloads. Furthermore, the growing need for high-speed telecommunications networks encourages producers to make enhanced ADCs that support faster processing and better resolution. This makes the IT, and telecommunications sector the largest segment driving the demand in the ADC market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the ADC market with 30.2% shares, driven by continuous advancements in the telecommunications, automotive, and healthcare sectors. The rapid expansion of 5G networks drives ADC purchases because these devices need fast data transfer and superior signal handling systems. For example, the Federal Communications Commission approved to spend $30 billion on 5G network deployment through 2025. The growing 5G network rollout creates strong market needs for ADCs in both signal processing and fast data transmission applications. Also, EV technology and autonomous driving create new opportunities for ADC systems to monitor sensors and control systems in vehicles. Besides this, medical device manufacturers use ADCs more often to make better diagnostic tools and health monitors which grows the market. Furthermore, the leadership of the region in AI and IoT technology makes ADC demand grow stronger, especially for applications needing rapid and exact data conversion. Apart from this, leading firms in this market area invest in R&D to create advanced ADC technology which is driving the market forward.

Key Regional Takeaways:

United States Analog-To-Digital Converters Market Analysis

The U.S. ADC market is growing significantly, fueled by an increase in demand from several key industries, such as consumer electronics, telecommunications, and automotive. The U.S. consumer technology industry was expected to create a retail revenue of USD 485 billion in 2023, as estimated by the CTA, indicating strong demand among consumers for electronic items like smartphones, wearables, and home automation systems, which rely a great deal on ADC technology to process signals. More important, 5G network deployments are now an ongoing process; and, meanwhile, IoT adoption is going higher and higher every day, leading to further growing demand for high-performance ADCs in the telecom world. Automotive continues to evolve; with EVs, autonomous driving will see more deployment of ADCs in safety and navigation systems, electrification, and connected vehicle applications. It is followed by Texas Instruments and Analog Devices, the leading U.S. companies, that led the innovation in ADC technologies to make them ready to meet the growth demand in all these sectors.

Europe Analog-To-Digital Converters Market Analysis

Europe's consumer electronics market is experiencing rapid growth. The demand for refurbished electronics and innovation in technology is at the heart of this boom. According to the European Consumer Electronics Association (ECEA), Back Market, a French refurbished electronics company, posted a turnover of €320 million (USD 342.4 million) in 2023, with an increase of 45% compared to the previous year. The refurbished electronic market in France is estimated at €1 billion (USD 1.03 Billion), reflecting consumers' growing desire for sustainable yet affordable electronics. The increasing concentration on sustainability besides the growing requirement for smart home devices, mobile phones, and wearables contributed to the increased market size as a whole. The European market for consumer electronics is poised to continue its growth track with technological upgrades in the fields of 5G, smart devices, and automation systems. Key players in the region are focusing on innovation, green technologies, and enhanced product offerings to meet emerging consumer needs.

Asia Pacific Analog-To-Digital Converters Market Analysis

The Asia Pacific continues to see consumer electronics market growth, with continued technological advancement and increased consumer demand. In 2023, investment in network infrastructure by the region's telecommunications companies hit USD 259 billion, of which a huge amount was dedicated to 5G technology development, as per reports. It will bring about changes to the region's digital landscape through better connections between smart devices, which should enhance further penetration of consumer electronics products such as smartphones, smart wearables, and home automation systems. Demand for advanced electronics also continues to be high in some key markets in Asia, particularly in China, Japan, and South Korea, keeping this region at the top of electronics manufacturing and innovation hubs. Strong increases in consumer electronics spending and innovation are the keys that will foster continued growth within this particular Asian Pacific Market.

Latin America Analog-To-Digital Converters Market Analysis

Latin America is experiencing growing consumer electronics as technological adoption becomes a reality for increasing consumer demands on advanced electronics. An industrial report shows that the automotive sector in the region expanded by 8.2% year over year in 2023. The overall trend points to economic recovery and increased spending among consumers. The growth in the automotive sector, with increasing disposable incomes and better access to technology, is fueling demand for consumer electronics, particularly in the automotive tech segment, which includes smart in-car devices and infotainment systems. The region's growing middle class and increased smartphone penetration also support the market for consumer electronics, including wearables and home appliances. Further growth in the sector comes from the proliferation of online retail platforms and mobile commerce. Latin America remains an important player in global electronics markets. Companies continue to make investments in innovation and sustainability that will be necessary to stay ahead of changing consumer needs.

Middle East and Africa Analog-To-Digital Converters Market Analysis

Rapid technological advancement coupled with the consumer demand for a connected device benefits the consumer electronics market in the Middle East and Africa. In 2023, Turkey emerged as the leading vehicle manufacturer in the MENA region and produced almost 1.47 million units in the region, an industrial report stated. This growth is expected to raise the demand in the automotive electronics arena, such as advanced in-car systems and connectivity solutions. Also, the growing number of mobile networks, mainly 5G, is stimulating smart device penetration throughout the region. The expansion of the middle class and its corresponding increase in disposable incomes further contributes to consumer electronics demand. This includes high-end smartphones, wearables, and home appliances, which witness strong demand in this region. As infrastructure investments continue in key markets, particularly in the UAE and Saudi Arabia, the region is witnessing a surge in the adoption of digital technologies, further fueling the growth of the consumer electronics sector.

Competitive Landscape:

Global ADC market players are emphasizing product innovation, strategic partnerships, and expansion into emerging markets. Leading companies are heavily investing in R&D to create high-speed, low-power ADCs tailored for applications such as 5G, AI, and automotive systems. Several players are also enhancing their ADC portfolios to include multi-channel and integrated solutions for consumer electronics and industrial automation. Partnerships with semiconductor firms and collaborations with tech giants are becoming increasingly common to leverage advanced technologies. Additionally, companies are expanding manufacturing capabilities in Asia-Pacific to address rising demand. The increase in mergers and acquisitions reflects a trend toward market consolidation, enabling firms to enhance their positions and diversify product portfolios.

The report provides a comprehensive analysis of the competitive landscape in the analog-to-digital converters market with detailed profiles of all major companies, including:

- Advanced Micro Devices Inc.

- Analog Devices Inc.

- Asahi Kasei Corporation

- Cirrus Logic Inc.

- Microchip Technology Inc.

- National Instruments Corporation

- NXP Semiconductors N.V.

- Onsemi

- Renesas Electronics Corporation

- Rohm Co. Ltd.

- STMicroelectronics and Texas Instruments Incorporated

Latest News and Developments:

- December 2024: AMD unveiled the Versal RF Series adaptive SoCs, single-chip devices offering exceptional computing performance. These SoCs integrate direct RF-sampling data converters, DSP hard IP, AI Engines, and programmable logic, optimized for RF systems in aerospace, defense, and test & measurement markets.

- June 2024: Cirrus Logic launched its new professional audio product line, including the CS4308P, CS4304P, CS4302P DACs, and CS4282P CODEC, targeting advanced audio applications. These are for recording artists, live performers, and other audio enthusiasts, and they provide ultra-high performance, transparent audio conversion, following Cirrus Logic's previous ADC product launch.

- March 2024: Renesas Electronics has unveiled the RA2A2 MCU Group, including a 24-bit Sigma-Delta analog-to-digital converter (SDADC) and dual-bank flash with support for over-the-air (FOTA) update capabilities. These low-power devices, built around the Arm Cortex-M23 processor, are for energy management, medical devices, and IoT applications, and deliver energy efficiency and long battery life.

- February 2024: Asahi Kasei Microdevices announced the AK5707, a low-power, monaural 16-bit ADC for IoT security applications. It operates at just 34μA, with an integrated Acoustic Activity Analyzer (AAA) to detect acoustic events, enhancing smart security devices like cameras and doorbells while reducing power consumption and extending battery life.

Analog-to-Digital Converters Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pipelined ADC, Integrating ADC, Successive Approximation ADC, Delta-Sigma ADC, Others |

| Resolutions Covered | 8-bit, 10-bit, 12-bit, 14-bit, 16-bit |

| Applications Covered | Consumer Electronics, IT and Telecommunication, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Micro Devices Inc., Analog Devices Inc., Asahi Kasei Corporation, Cirrus Logic Inc., Microchip Technology Inc., National Instruments Corporation, NXP Semiconductors N.V., onsemi, Renesas Electronics Corporation, Rohm Co. Ltd., STMicroelectronics and Texas Instruments Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the analog-to-digital converters market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global analog-to-digital converters market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the analog-to-digital converters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The analog-to-digital converters market was valued at USD 2.81 Billion in 2024.

IMARC estimates the analog-to-digital converters market to exhibit a CAGR of 4.29% during 2025-2033, expecting to reach USD 4.18 Billion by 2033.

Key factors driving the analog-to-digital converters market include the growing demand for high-performance electronics, advancements in automotive technologies, increased adoption of IoT devices, expansion of 5G networks, the rise of AI and machine learning applications, and the growth of consumer electronics with enhanced audio and video capabilities.

North America currently dominates the market, driven by rapid advancements in electronics manufacturing, a high concentration of semiconductor companies, and increased demand for consumer electronics, automotive technologies, and industrial automation.

Some of the major players in the analog-to-digital converters market include Advanced Micro Devices Inc., Analog Devices Inc., Asahi Kasei Corporation, Cirrus Logic Inc., Microchip Technology Inc., National Instruments Corporation, NXP Semiconductors N.V., Onsemi, Renesas Electronics Corporation, Rohm Co. Ltd., STMicroelectronics and Texas Instruments Incorporated.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)