Analgesics Market Size, Share, Trends, and Forecast by Type, Drug Class, Route of Administration, Pain Type, Application, and Region, 2025-2033

Analgesics Market Size and Share:

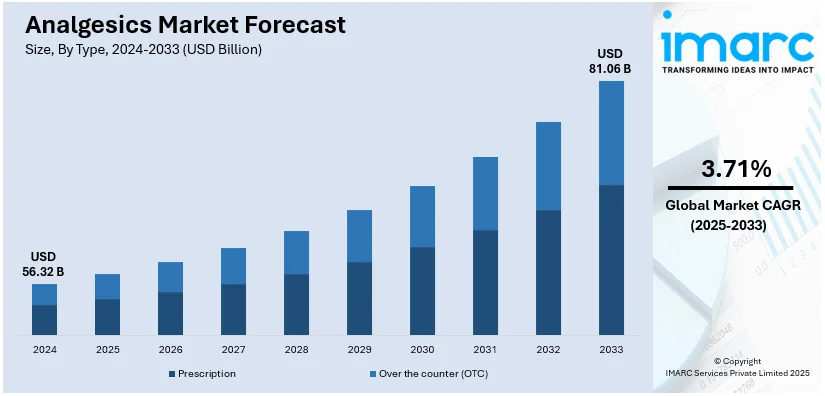

The global analgesics market size was valued at USD 56.32 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 81.06 Billion by 2033, exhibiting a CAGR of 3.71% during 2025-2033. North America currently dominates the market, holding a significant market share of over 32.8% in 2024. The market is mainly driven by the rising prevalence of chronic pain conditions, an increasing global geriatric population, and significant technological advancements in drug formulations. There is also a growing demand for non-opioid and over-the-counter (OTC) pain relievers which creates a positive outlook for the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 56.32 Billion |

|

Market Forecast in 2033

|

USD 81.06 Billion |

| Market Growth Rate (2025-2033) | 3.71% |

The growing number of elderly people and the prevalence of chronic pain disorders such neuropathic pain, migraines, and arthritis are driving the analgesics market. Growing awareness about pain management and the demand for effective OTC and prescription pain relief solutions contribute to market growth. Improvements in medication formulations, such as combination and extended-release treatments, improve patient efficacy and compliance. For instance, in May 2024, LSU Health New Orleans developed a novel and non-addictive painkiller for acute, chronic, and neuropathic pain indicating positive outcomes in Phase 1 trials. The breakthrough addresses pain management without the toxicity associated with opioids receiving FDA Fast Track designation for further clinical development. The rising adoption of non-opioid analgesics due to concerns over opioid addiction further boosts the market.

The increased prevalence of chronic pain problems, such as arthritis, migraines, and post-surgical pain, among the elderly population is driving the analgesics market in the United States. Improvements in pain management treatments are also favorably influencing the market's expansion. For instance, in August 2024, Concentric Analgesics presented promising data on vocacapsaicin a novel pain management therapy. Phase 2 trials for total knee arthroplasty and bunionectomy showed two weeks of effective pain relief and earlier opioid cessation highlighting vocacapsaicin’s potential to revolutionize postoperative pain management. Rising consumer preference for OTC pain relievers fueled by increasing awareness of pain management options significantly boosts market growth. The ongoing shift towards non-opioid analgesics due to the opioid crisis and associated regulations further accelerates demand for safer alternatives.

Analgesics Market Trends

Increasing Incidence of Chronic Conditions

The increasing incidence of several chronic conditions such as arthritis, cancer, and diabetes throughout the world is fueling increased demand for solutions to pain management. As estimated by the data published by the Centers for Disease Control and Prevention about 129,000,000 people in the United States suffer from at least one major chronic condition including heart disease, cancer, diabetes, obesity, and hypertension. In addition to this, approximately 42% of the total population has more than two or more chronic diseases and 12% of the population is suffering from at least five chronic diseases. As the global population ages the incidence of chronic pain conditions is on the rise which necessitates effective analgesic options. Nowadays older adults are more prone to developing these chronic conditions which often come with persistent pain.

Increasing Demand for Non-Opioid Analgesics

The opioid crisis with high addiction and abuse rates has shifted preference towards non-opioid analgesics for safer pain management. Non-opioid options like nonsteroidal anti-inflammatory drugs (NSAIDs) and acetaminophen are increasingly popular due to their lower risk profiles. For instance, in January 2024, VX-548 demonstrated positive results in two major clinical trials showing significant pain relief after surgery compared to a placebo with few side effects. Vertex plans to seek FDA approval for the drug in treating moderate-to-severe acute pain. The results bring hope for an alternative to addictive opioid medications amidst the ongoing opioid crisis. These solutions are effective for different types of pain conditions offering a safer alternative for the management of acute and chronic pains. This shift is driving innovation and market growth in non-opioid solutions for pain relief which addresses the requirement for safer alternatives of therapy.

Rise in Use of OTC Analgesics

OTC analgesics are widely used for self-medication, as they are easily accessible, and the advent of e-commerce. These over-the-counter options which consist of NSAIDs (nonsteroidal anti-inflammatory drugs), acetaminophen, and combination products provide easy relief for many conditions. For instance, in April 2024, Glenmark Pharmaceuticals obtained USFDA approval for its generic Acetaminophen and Ibuprofen tablets. The company's drug – a generic version of Advil 2 Dual Action, will be distributed in the US market by Glenmark Therapeutics Inc, USA. OTC analgesics are widely used because it is now easy to get them due to the expansion of internet pharmacies. The availability of these drugs without a prescription helps consumers manage pain effectively and promptly, thus driving the growth of the OTC analgesics market.

Analgesics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on type, drug class, route of administration, pain type, and application.

Analysis by Type:

- Prescription

- Over the counter (OTC)

Prescription analgesics segment leads the market with around 70.0% market share in 2024. Prescription analgesics holds the largest market share because of their efficacy in relief of moderate to severe and chronic pain including postoperative pain, cancer pain, and severe arthritis. These medications including opioids and other potent pain relievers are necessary for conditions which other medications cannot effectively treat. The stringent regulation and physician supervision associated with prescription analgesics ensure appropriate use, driving their demand. Advancements in personalized medicine and targeted therapies contribute to the growth of prescription analgesics within the market.

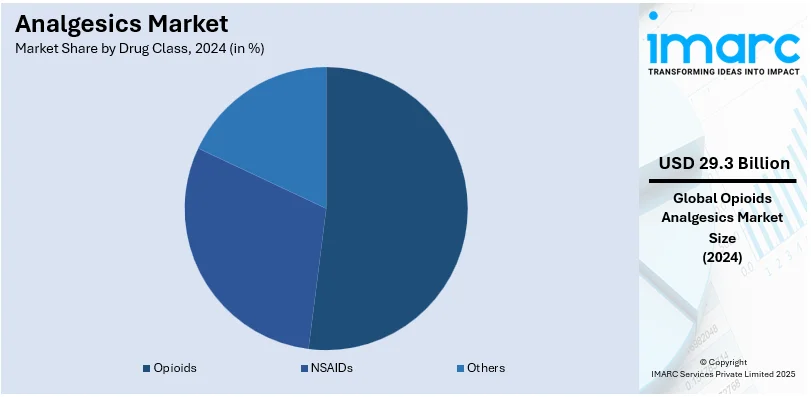

Analysis by Drug Class:

- Opioids

- NSAIDs

- Others

Opioids segment leads the market with around 52.0% market share in 2024. Opioids dominate the market share of analgesics since they remain the most effective in controlling extreme and chronic pain. The opioids include morphine, oxycodone, and fentanyl which help in managing severe pain during and after operations, such as cancer-related, and major injury pain. Despite the significant concerns over addiction and abuse, the medical necessity for potent pain relief in specific conditions ensures the continued demand for opioids. Regulatory efforts to control misuse and advancements in formulation to reduce addiction potential are shaping the market. Additionally, ongoing research into safer opioid alternatives and combination therapies further underscores the dominant position of opioids in the analgesics market.

Analysis by Route of Administration:

- Oral

- Parenteral

- Topical

- Transdermal

- Rectal

Oral leads the market with around 48.7% market share in 2024. Oral analgesics represent the leading segment in the analgesics market due to their convenience, ease of administration, and wide availability. These are in the form of tablets, capsules, and liquid and are preferred in different sorts of pains ranging from headaches to even moderate post-operative pains. This availability of over-the-counter oral solid drugs such as acetaminophen and ibuprofen plays a major role in the segment growth. Advancements in oral drug formulations such as extended-release tablets enhance patient compliance and effectiveness, further solidifying the leadership of oral analgesics in the market.

Analysis by Pain Type:

- Musculoskeletal

- Surgical and Trauma

- Cancer

- Neuropathic

- Migraine

- Obstetrical

- Fibromyalgia

- Pain due to Burns

- Dental/Facial

- Pediatric

- Others

Musculoskeletal pain management exhibits a clear dominance in the analgesics market due to the high prevalence of conditions such as arthritis, back pain, and sports injuries. These conditions are widespread among the aging population and active individuals, driving significant demand for effective pain relief. Both prescription and over-the-counter analgesics are extensively used to manage musculoskeletal pain making it a critical segment within the market. The ongoing research and development in targeting specific pain pathways and improving drug formulations further bolsters this dominance. The rise in sedentary lifestyles and increasing awareness of pain management options contribute to the sustained growth of this segment.

Analysis by Application:

- Internal

- External

Internal application of analgesics relates to the medication taken orally as well as administered through injection within the body, which includes managing pain from the inside. Thus, it includes tablets, capsules, and liquids for internal application administration, along with intravenous and intramuscular injections. All these conditions include chronic pain, post-operative pain, and other acute severe pains. Hence, internal applications are a sizeable market segment for analgesics mainly driven by their efficiency in providing systemic pain relief.

External application of analgesics: The topical preparations in the form of creams, gels, sprays, and patches applied on the skin surface are examples of external application of analgesics. These are more effective in the treatment of localized pain conditions such as muscle strain, joint pain, and minor injuries. These have the added advantage of site-specific therapy with minimal systemic side effects. Patients prefer this for non-invasive pain management. These non-systemic treatment preferences and progress in topical drug delivery systems propel the popularity of topical applications within the analgesics market.

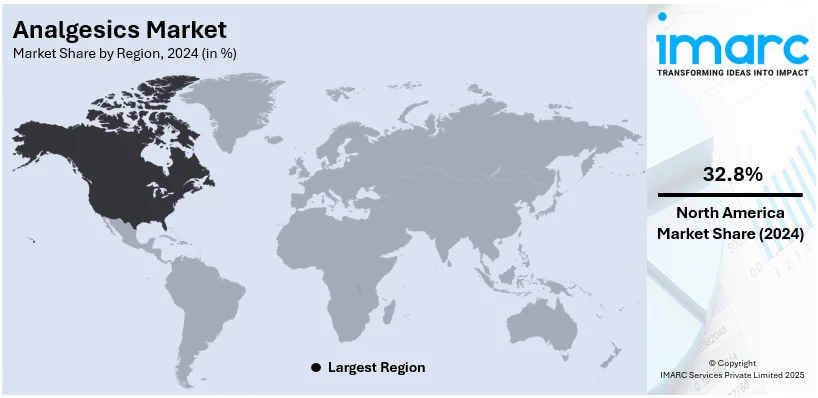

Regional Analysis

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 32.8%. North America leads the analgesics market, accounting for the largest market share due to high healthcare expenditure, advanced medical infrastructure, and a high prevalence of chronic pain conditions. According to a report published by the Centers for Medicare & Medicaid Services, U.S. healthcare spending grew 4.1% in 2022 reaching $4.5 trillion or $13,493 per person. As a share of the nation's Gross Domestic Product, health spending accounted for 17.3%. The region's robust regulatory environment ensures the availability of prescription as well as over-the-counter analgesics. The ongoing opioid crisis has encouraged the development and adoption of non-opioid pain relief alternatives. The presence of major pharmaceutical companies and continuous research and development activities further strengthen North America's leading position in the analgesics market.

Key Regional Takeaways:

United States Analgesics Market Analysis

In 2024, the United States captured 90.80% of revenue in the North American market. This is because more patients are suffering from chronic diseases than before, which, coupled with enhanced methods of handling pain, enhances the uptake of analgesics in the United States. Arthritis is among the common causes of chronic pain and as per the CDC it affects 58.5 million adults or 23.7% of the population, the conditions are more common in the female sex, and the aged population. In addition, growing numbers of surgeries also contribute to the increasing demand for relief from pain. The National Center for Biotechnology Information estimates approximately 310 million major surgeries that occur annually of which around 40-50 million occur in the U.S. This clearly explains the demand for effective post-surgical pain management. The opioid crisis is yet another factor ruling the market. The U.S. FDA has initiated significant efforts in February 2022 to create non-addictive opioids. This has improved the prospects for safer pain management. These regulatory initiatives are likely to enhance the demand for prescription and over-the-counter analgesics and will drive sustained growth in the market over time.

Europe Analgesics Market Analysis

The growing elderly population in Europe is a significant factor driving increased demand for analgesics as older people are more prone to chronic pain and associated health conditions. In 2020, 21% of the European population, or 94.7 million people, were 65 years of age or older. This age group according to the European Commission constitutes a fifth of the population but represents over 62% of new cancer diagnoses at 1.7 million and 76% of cancer-related deaths at 0.98 million. This clearly indicates a growing need for effective pain management solutions particularly concerning cancer-related pain in the elderly population. Another significant driver of the need for analgesics includes neuropathic pain that affects 7-8% of the European population. Prescription and over the counter analgesics are in high demand as more patients are suffering from cancer and neuropathic pain that continues to increase. A change in demographics and growth in the burden of the conditions causing pain will continue to promote the market growth of analgesics in Europe.

Asia Pacific Analgesics Market Analysis

The increasing rate of incidence of cancer in Asia has been one of the reasons for driving the analgesics market in the region. In 2020, the reported cancer incidence rate was 169.1 per 100,000 people, accounting for nearly 49.3% of the global cases. Lung cancer accounted for 13.8%, breast cancer accounted for 10.8% and colorectal cancer accounted for 10.6% of the most common types in the region as per an industry report. This situation presents a significant demand for effective pain management solutions particularly given the rising rates of cancer which are predominantly observed in the elderly population.

The increasing incidence of cancer is thereby driving a higher demand for prescription as well as over-the-counter analgesics, which are significant for both acute and chronic pain management. Rising population and prevalence of cancer will continue to fuel demand for pain relief options to drive growth in the market for analgesics in the Asia-Pacific region and ensure steady market growth over the next few years.

Latin America Analgesics Market Analysis

The aging population is a key driving factor for the growing demand for analgesics in Latin America and the Caribbean. According to an industry report, 2022 recorded 88.6 million people who were 60 years of age or older hence constituting 13.4% of the overall population and this portion is projected to increase by 2030 to about 16.5%. As the elderly population grows so does the demand for pain management as the elderly are even more susceptible to chronic pain and other related health problems.

Moreover, the incidence of cancer is increasing, especially cervical cancer, raising the demand for pain relief further. The Pan American Health Organization reports that over 56,000 women have been diagnosed with cervical cancer in the region killing over 28,000. With cancer cases burgeoning, especially among the geriatric population the pressure to seek prescription or non-prescription pain relief also will continue to rise. The shifting demographic balance and rising cancer burden will provide impetus to the Latin America analgesics market going forward.

Middle East and Africa Analgesics Market Analysis

One of the key factors propelling the analgesics market in the Middle East and Africa (MEA) region is the rising prevalence of osteoarthritis. The age-standardized prevalence of OA in MENA was reported to be 5,342.8 per 100,000 people in 2019 according to the National Institutes of Health (NIH). The growing need for efficient pain management options is significantly impacted by osteoarthritis, which is a common source of chronic pain in the aged population.

With an aging population in MEA and an increase in chronic conditions, the need for analgesics prescription as well as over-the-counter medications is also on the rise. Osteoarthritis causes continuous pain in the joints and leads to disability compelling people to look for relief from the condition. The above demographic trend in combination with an overall rise in chronic pain conditions is also expected to drive further demand for analgesics in the Middle East and Africa thereby facilitating further growth in the market.

Competitive Landscape:

The analgesics market is highly competitive with major pharmaceutical companies like Pfizer, Johnson & Johnson, and GlaxoSmithKline leading the industry. These companies invest heavily in research and development to introduce new and effective pain relief formulations including non-opioid alternatives and advanced drug delivery systems. For instance, in January 2024, Vertex Pharmaceuticals released positive results from two large clinical trials of its non-opioid painkiller VX-548 which significantly reduces post-surgery pain compared to a placebo. The market also sees significant competition from generic drug manufacturers which offer cost-effective alternatives to branded medications. Additionally, emerging players focusing on natural and herbal analgesics are gaining traction. Strategic collaborations, mergers and acquisitions are common as companies seek to expand their product portfolios and market reach intensifying the competitive landscape in the analgesics market.

The report provides a comprehensive analysis of the competitive landscape in the analgesics market with detailed profiles of all major companies, including:

- Bayer AG

- Novartis International AG

- GlaxoSmithKline PLC

- Pfizer Inc.

- Johnson & Johnson Pvt. Ltd.

- Reckitt Benckiser (RB) Group PLC

- Endo Pharmaceuticals PLC

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Sanofi SA

Recent Developments:

- July 2024: Concentric Analgesics reported that Vocacapsaicin, a new experimental medication intended to alleviate postoperative pain, had positive Phase 2 clinical trial results published in a peer-reviewed manner. Vocacapsaicin is the first therapy demonstrated to provide effective pain relief for more than seven days, significantly reducing the need for opioids. The company is currently getting ready for Phase 3 trial to advance the development of this intriguing medicine.

- June 2024: GSK acquired Elsie Biotechnologies for over USD 50 Million to accelerate the development of oligonucleotide therapeutics. The acquisition will enable GSK to expand its oligonucleotide pipeline and enhance its R&D capabilities. Oligonucleotides have the potential to address hard-to-treat diseases, and the integration of Elsie's expertise with GSK's capabilities aims to advance drug development for larger patient populations. The acquisition aligns with GSK's commitment to uniting science and technology to deliver innovative medicines.

- May 2024: Novartis confirmed the acquisition of Mariana Oncology, a biotechnology company specializing in radioligand therapies for cancer treatment. The acquisition includes a portfolio of radioligand therapy programs targeting various solid tumor indications. Novartis aims to strengthen its radioligand therapy pipeline and expand its research infrastructure. The upfront payment for the acquisition is USD 1 Billion, with additional payments upon completion of specific milestones. The transaction is pending customary closing conditions.

Analgesics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Prescription, Over-The-Counter (OTC) |

| Drug Classes Covered | Opioids, NSAIDs, Others |

| Route of Administration Covered | Oral, Parenteral, Topical, Transdermal, Rectal |

| Pain Types Covered | Musculoskeletal, Surgical and Trauma, Cancer, Neuropathic, Migraine, Obstetrical, Fibromyalgia, Pain due to Burns, Dental/Facial, Pediatric, Others |

| Applications Covered | Internal, External |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Bayer AG, Novartis International AG, GlaxoSmithKline PLC, Pfizer Inc., Johnson & Johnson Pvt. Ltd., Reckitt Benckiser (RB) Group PLC, Endo Pharmaceuticals PLC, Bristol-Myers Squibb Company, Eli Lilly and Company, Sanofi SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the analgesics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global analgesics market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the analgesics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The analgesics market was valued at USD 56.32 Billion in 2024.

The analgesics market is projected to exhibit a CAGR of 3.71% during 2025-2033, reaching a value of USD 81.06 Billion by 2033.

The market is majorly driven by the rising prevalence of chronic pain conditions, increasing demand for over-the-counter pain relief medications, advancements in drug formulations, growing awareness of pain management, expanding geriatric population, and the rising incidence of injuries and surgeries worldwide, fueling market growth.

North America currently dominates the market, accounting for a share of around 32.8%. The dominance is driven by rising prevalence of chronic pain conditions, an increasing global geriatric population, and significant technological advancements in drug formulations.

Some of the major players in the analgesics market include Bayer AG, Novartis International AG, GlaxoSmithKline PLC, Pfizer Inc., Johnson & Johnson Pvt. Ltd., Reckitt Benckiser (RB) Group PLC, Endo Pharmaceuticals PLC, Bristol-Myers Squibb Company, Eli Lilly and Company, and Sanofi SA, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)