Amphibious Vehicle Market Size, Share, Trends and Forecast by Mode of Propulsion, Application, End Use, and Region, 2025-2033

Amphibious Vehicle Market Size and Share:

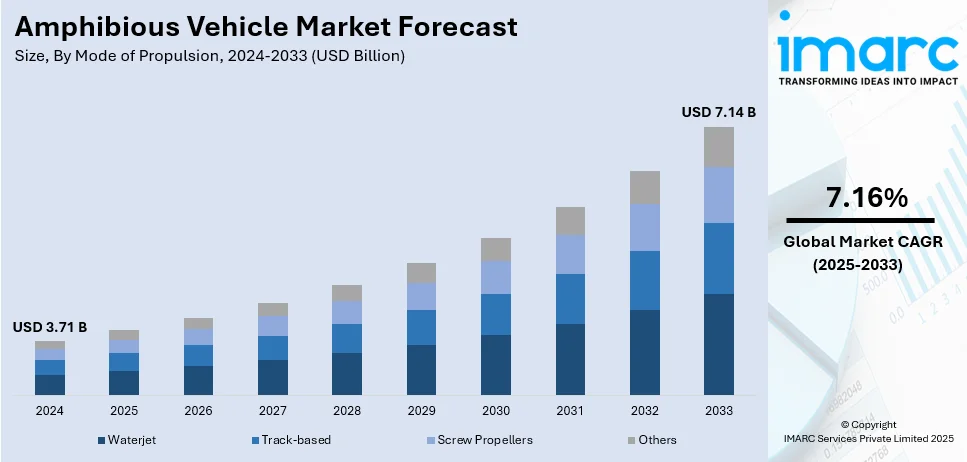

The global amphibious vehicle market size was valued at USD 3.71 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.14 Billion by 2033, exhibiting a CAGR of 7.16% during 2025-2033. North America currently dominates the market, holding a significant market share of over 48.6% in 2024. The market is experiencing steady growth driven by rising geographical conflicts, growing investments in the defense sector by governing agencies of several countries, inflating disposable income levels, and rapid urbanization. These factors are collectively increasing the amphibious vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.71 Billion |

|

Market Forecast in 2033

|

USD 7.14 Billion |

| Market Growth Rate (2025-2033) | 7.16% |

The amphibious vehicle market is driven by several key factors. One of the major drivers include the proliferating demand for multifunctional transport vehicles for the military as well as civilian applications. In the military department, amphibious vehicles are essential in amphibious operations and fostering the demand for specialized equipment. There is an increasing demand for consumer-use products in the leisure market, especially in tourism, tourist activities, and adventure activities. Additionally, infrastructure development in remote areas, where conventional transportation is limited, further promotes the product usage, thereby representing one of the amphibious vehicle market trends. Technological development in vehicle design like better fuel efficiency and land and water mobility are other factors that have a direct impact on the growth of the market. Environmental concerns and the need for multifunctional vehicles in disaster relief operations are adding to the demand.

To get more information on this market, Request Sample

The amphibious vehicle market in the United States is driven by a combination of military, recreational, and infrastructure development needs. The U.S. military’s demand for amphibious vehicles, crucial for amphibious warfare and disaster relief operations, is a significant growth-inducing factor. For instance, in August 2024, the ACV-30, the U.S. Marine Corps' newest amphibious warship, was recently delivered. If necessary, the Marine Corps' strategy for fighting in the Pacific heavily relies on the eight-wheeled combat fighting vehicle. The ACV-30, which Iveco and BAE Systems constructed, can drive up to 250 miles on land after launching from the open ocean and sailing up to 12 nautical miles to land. It can also reach speeds of up to 65 miles per hour on paved highways. Technological advancements, such as enhanced fuel efficiency, durability, and design improvements, are attracting both consumers and military buyers. Additionally, recreational interest in amphibious vehicles for tourism, adventure sports, and off-road activities is rising, fueled by the desire for unique and versatile transportation. The U.S. government’s focus on resilience during natural disasters has further increased demand for these vehicles, thereby contributing to the amphibious vehicle market growth.

Amphibious Vehicle Market Trends:

Increasing military applications

One of the primary factors driving the market is the increasing demand for advanced military capabilities. For instance, world military expenditure rose for the ninth consecutive year to an all-time high of USD 2,443 Billion. Amphibious vehicles play a crucial role in modern military operations, providing armed forces with the ability to conduct amphibious assaults, river crossings, and beach landings. The military's emphasis on enhancing its expeditionary capabilities, including rapid deployment and maneuverability across diverse terrains, propels the demand for technologically advanced and versatile amphibious vehicles. Nations invest in these vehicles to strengthen their defense capabilities, allowing for swift and effective response in both coastal and inland operations. The integration of advanced communication systems, armor, and amphibious propulsion technologies further contributes to the growth of the market within the military sector.

Disaster response and humanitarian aid

Amphibious vehicles are increasingly recognized for their effectiveness in disaster response and humanitarian aid missions. Disaster occurrences have risen from 100 annually in the 1970s to approximately 400 annually in the last 20 years, according to the Centre for Research on the Epidemiology of Disasters' (CRED) International Disaster Database (EM-DAT). The ability to navigate through diverse terrains, including flooded areas and rough landscapes, makes them valuable assets in delivering assistance during natural disasters such as floods, hurricanes, and earthquakes. These vehicles can reach remote and challenging locations, providing support in rescue operations, transporting supplies, and evacuating affected populations. The versatility of these vehicles in responding to emergencies enhances their appeal to government agencies, non-governmental organizations, and disaster relief organizations, driving the amphibious vehicle market demand in the humanitarian and disaster response sectors.

Rising tourism and recreational activities

The market is also fuelled by the growing interest in adventure tourism and recreational activities. According to UN Tourism, international tourist arrivals reached 89% of pre-pandemic levels in 2023 and 98% in January-September 2024. Amphibious tour vehicles, capable of transitioning seamlessly between land and water, offer unique and thrilling experiences for tourists in coastal regions and cities with water bodies. These vehicles provide guided tours that combine on-land sightseeing with water-based exploration, adding an element of novelty to traditional tourism. The tourism industry's continuous pursuit of innovative and memorable experiences for travelers contributes to the demand for amphibious vehicles in this sector. Additionally, recreational users, such as enthusiasts seeking off-road and amphibious adventures, contribute to the market's growth as they seek vehicles that offer both land and water capabilities for their outdoor activities.

Amphibious Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global amphibious vehicle market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on the mode of propulsion, application, and end use.

Analysis by Mode of Propulsion:

- Waterjet

- Track-based

- Screw Propellers

- Others

Track-based stand as the largest component in 2024, holding around 52.2% of the market. Track-based propulsion is another prevalent mode in the market, particularly in military applications where rugged terrains, mud, and swamps are common. These vehicles have tracks like those on tanks, which ensures that it has a proper grip on the ground to traverse. Track-based propulsion means that even in difficult-to-drive terrains on land the amphibious vehicle is still capable of quick conversion to the water. This mode is rather useful when the vehicle has to move over rough terrains or where regular-wheeled vehicles have certain issues.

Analysis by Application:

- Surveillance and Rescue

- Water Sports

- Water Transportation

- Excavation

- Others

Amphibious vehicles play a crucial role in surveillance and rescue operations. These are equipped with highly developed instruments including sensors, cameras, and communications creating systems for coastline monitoring, search and rescue in flooded or disaster-affected regions, as well as these are used in emergency support. They are constructed for surveillance and search and rescue operations and are used on land and water, thus making them very useful to first responders coast guard, and any disaster management organization.

Conversely, amphibious vehicle use in water sports has become more common, offering enthusiasts exciting and unusual experiences. These recreational vehicles provide guided excursions and adventures that blend land-based exploration with water-based pursuits. These water sports vehicles frequently offer visitors and adventurers a fresh and thrilling way to see lakes, rivers, and coastal regions, which helps the tourism and entertainment sectors flourish.

Moreover, these vehicles serve as efficient means of water transportation in regions with water-rich environments. Such vehicles can easily transform from roads to waterways, making them suitable for areas with minimal development or rough terrains. These types of vehicles are utilized for carrying passengers, goods, and cargo over the river, lake, and coastal lines. Their capability to go to areas where other means of transport cannot go makes them useful in such regions, which cannot be accessed by water or land transport.

Furthermore, they find applications in excavation projects, particularly in marshy or aquatic environments. Equipped with specialized tools and attachments, these vehicles can perform tasks such as dredging, land reclamation, and environmental restoration in areas where conventional land-based heavy equipment may face limitations. Amphibious excavation vehicles are essential in projects involving waterlogged soils or bodies of water, providing a versatile solution for construction and environmental engineering applications.

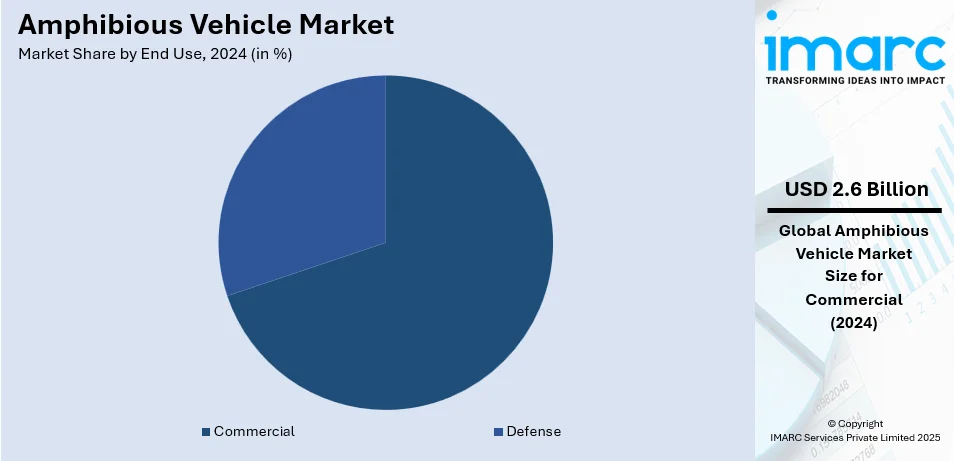

Analysis by End Use:

- Defense

- Commercial

Commercial leads the market with around 69.5% of market share in 2024. The commercial sector represents a significant end user of these vehicles, encompassing a range of applications. In commercial use, they serve purposes such as transportation in water-rich regions, disaster response, tourism, and recreational activities. These are used in transporting passengers, publicly and privately owned vehicles, goods, and products over water, mainly in regions with inadequate infrastructures. Moreover, these are developed specifically for leisure and enhance the demand in the tourism and recreational sectors, providing new and extreme opportunities for tourists and passionate people.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 48.6%. North America stands as a dominant force in the market, leading in both market share and technological advancements. The region's strong position is attributed to robust investments in defense capabilities, with amphibious vehicles playing a crucial role in military operations and border security. Additionally, the commercial sector in North America embraces these vehicles for various applications, including disaster response, tourism, and recreational activities. The presence of key manufacturers, ongoing research and development initiatives, and a significant defense budget contribute to North America's leadership in the market. For instance, in April 2024, BAE Systems obtained a $79 million contract from the U.S. Marine Corps to build and deliver production representative test vehicles (PRTVs) for the Amphibious Combat Vehicle Recovery (ACV-R) variant later this year. The ACV family of vehicles (FOVs) will get direct field assistance, maintenance, and recovery from the ACV-R.

Key Regional Takeaways:

United States Amphibious Vehicle Market Analysis

In 2024, the United States accounted for the largest market share of over 83.40% in North America. The adoption of amphibious vehicles is seeing significant growth due to the increasing demand for efficient transportation solutions within the cargo industry. According to U.S. Department of Transportation, in 2023, the U.S. transportation system moved a daily average of about 55.5 Million tons of freight valued at more than USD 51.2 Billion. This surge in adoption can be attributed to the booming production and infrastructure expansion in regions where there is a substantial need to move goods efficiently across both land and water. The versatility of amphibious vehicles allows them to operate seamlessly in areas where traditional transport may face barriers, such as rivers, lakes, and other bodies of water. As the cargo industry expands, driven by industrial growth and a need for enhanced logistics, these vehicles are becoming indispensable for ensuring smooth and effective transport operations in both urban and rural settings. This trend is further supported by advancements in vehicle technology, enabling amphibious vehicles to handle heavier loads and operate in more challenging environments, contributing to the growing reliance on these vehicles for logistical support.

Asia Pacific Amphibious Vehicle Market Analysis

The growing adoption of amphibious vehicles is also driven by the increasing need for transportation solutions in regions with vast coastal areas. For instance, India has a coastline of 7517 km with 13 Major Ports and about 200 minor ports along the coastline and island. These areas, rich in waterways and prone to waterway traffic, require versatile vehicles capable of navigating both land and water. The proximity to the coast creates opportunities for using amphibious vehicles to bridge transportation gaps and enhance connectivity in regions where traditional infrastructure is limited or inadequate. In regions with extensive coastal areas, the ability to seamlessly transition between land and water not only improves access but also reduces transportation bottlenecks, especially for passengers and goods. As the demand for such transportation systems continues to rise, these vehicles are increasingly becoming a preferred option for coastal connectivity.

Europe Amphibious Vehicle Market Analysis

In European regions where tourism is a significant contributor to the economy, the adoption of amphibious vehicles is seeing a steady rise. For instance, international arrivals to Europe in July and August show year-on-year growth of +12%, just above the global average (+11%). As tourism continues to grow, there is a growing demand for unique and engaging experiences that offer access to both land and water landscapes. Amphibious vehicles provide a distinctive way to explore regions that offer both coastal and inland attractions. These vehicles allow tourists to visit remote areas, cruise along scenic shorelines, and even explore off-road terrains, enhancing the overall travel experience. The increasing demand for these experiences, coupled with the development of tourist destinations, is encouraging tourism operators to invest in amphibious vehicles as an innovative solution to meet evolving customer expectations, drive tourism traffic, and cater to eco-tourism markets.

Latin America Amphibious Vehicle Market Analysis

The growing adoption of amphibious vehicles in the defense sector is driven by the increasing need for versatile and adaptable transportation solutions. For instance, military spending in Central America and the Caribbean in 2023 was 54 % higher than in 2014. In Latin America, there is a rising demand for military and defense operations to ensure effective maneuverability across challenging terrains that include water bodies, marshlands, and dense forests. Amphibious vehicles provide the flexibility required to navigate land and water, offering strategic advantages in operations where traditional vehicles might be hindered by environmental conditions. As defense budgets increase and the need for enhanced mobility and versatility rises, amphibious vehicles are becoming a crucial tool in the region’s defense operations, enabling improved troop deployment and logistical support.

Middle East and Africa Amphibious Vehicle Market Analysis

In the Middle East and Africa, the growing construction sector is contributing to the adoption of amphibious vehicles for transporting materials in challenging environments. According to reports, Saudi Arabia is witnessing rapid growth in its construction sector, with over 5,200 projects underway, valued at USD 819 Billion. As construction projects expand, especially in areas with limited road access or rough terrain, the ability to use amphibious vehicles becomes increasingly vital for transporting equipment and supplies across both land and water. These vehicles provide the versatility to navigate around obstacles like rivers, marshes, or desert terrain, which are common in many construction sites in the region. With the demand for faster, more efficient construction processes, amphibious vehicles are being incorporated into the supply chain, facilitating smoother operations, and reducing delays in material delivery, ultimately supporting the region’s construction growth.

Competitive Landscape:

The amphibious vehicle market is highly competitive, with key players leading the charge in both military and recreational segments. Companies focus on innovation, offering high-performance vehicles with advanced capabilities for land and water operations. Several firms emphasize environmentally friendly designs and fuel efficiency to meet growing sustainability demands. Strategic partnerships and mergers are common, as companies seek to expand product offerings and access new markets. Additionally, emerging players in the recreational and tourism sectors are driving market diversification, while established manufacturers continue to dominate through military contracts and government partnerships.

The report has also analysed the competitive landscape of the amphibious vehicle market with some of the key players being:

- BAE Systems

- EIK Engineering Sdn Bhd

- General Dynamics European Land Systems

- Griffon Hoverwork

- Hitachi Construction Machinery (Europe) NV

- Remu

- Rheinmetall AG

- Ultratrex Machinery Sdn. Bhd

- Wetland Equipment

- Wilco Manufacturing, L.L.C.

- Wilson Marsh Equipment, Inc

Latest News and Developments:

- January 2025: RICTOR has unveiled the world's first amphibious passenger flying motorcycle, the Skyrider X1, at the 2025 CES in Las Vegas. Equipped with automatic route planning and a takeoff/landing system, this innovative vehicle integrates air, land, and sea mobility solutions. The launch showcases RICTOR's commitment to smart, eco-friendly transportation in the evolving eVTOL sector. The Skyrider X1 captivated global audiences, solidifying RICTOR's position as a leader in the mobility industry.

- December 2024: MilDef has secured a SEK 80 Million contract to supply rugged switches for BAE Systems Hägglunds' new amphibious BvS10 tracked vehicle. The vehicle, designed for rapid terrain navigation and amphibious operations, will be delivered to an additional European nation. Deliveries are expected from 2025 to 2029. This collaboration strengthens defense systems in Sweden and Europe.

- December 2024: China officially named its new Type 076 amphibious catapult carrier "Sichuan" during a launch ceremony in Shanghai. The carrier was floated out from Hudong drydock on December 29 and moved to the fitting-out basin for further construction. The "Sichuan" is part of China's ongoing naval expansion, joining various other military vessels in the region. The ship’s hull number and final details were also revealed during the event.

- December 2024: ST Engineering has partnered with Kazakhstan Paramount Engineering (KPE) to develop an 8×8 amphibious armoured vehicle for the Kazakhstan military, based on ST Engineering's Terrex platform. The agreement includes engineering support and local production by KPE in Kazakhstan. This deal marks ST Engineering’s entry into Central Asia and a key international land platform contract. The specific Terrex design used in the vehicle was not disclosed.

- February 2024: H2O Amphibious Inc. is set to launch its next-generation amphibious cars, following the success of its Panther Amphibious Cars introduced in 2013. The new model features comprehensive upgrades, with every component reimagined to honor past designs while setting a new standard for amphibious vehicles. This innovation continues the company's legacy of seamless land-to-water transition.

Amphibious Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Propulsions Covered | Waterjet, Track-based, Screw Propellers, Others |

| Applications Covered | Surveillance and Rescue, Water Sports, Water Transportation, Excavation, Others |

| End Uses Covered | Defense, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BAE Systems, EIK Engineering Sdn Bhd, General Dynamics European Land Systems, Griffon Hoverwork, Hitachi Construction Machinery (Europe) NV, Remu, Rheinmetall AG, Ultratrex Machinery Sdn. Bhd, Wetland Equipment, Wilco Manufacturing, L.L.C., Wilson Marsh Equipment, Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the amphibious vehicle market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global amphibious vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the amphibious vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The amphibious vehicle market was valued at USD 3.71 Billion in 2024.

IMARC estimates the amphibious vehicle market to reach USD 7.14 Billion by 2033, exhibiting a CAGR of 7.16% during 2025-2033.

Key factors driving the amphibious vehicle market include increasing demand from military applications for amphibious warfare and disaster relief, rising interest in recreational vehicles for tourism and adventure, technological advancements in design and fuel efficiency, infrastructure development in remote areas, and a growing need for versatile, eco-friendly transportation solutions.

North America leads the amphibious vehicle market, holding a significant share of 48.6%. This dominance can be attributed to the strong demand for versatile vehicles in both recreational and commercial sectors. The region benefits from advanced technology, significant investments in research and development, and a robust manufacturing base. Additionally, North America's large defense and military sector has driven innovation and production of amphibious vehicles for various applications, including search and rescue, tourism, and military operations, further creating a positive amphibious vehicle market outlook.

Some of the major players in the amphibious vehicle market include BAE Systems, EIK Engineering Sdn Bhd, General Dynamics European Land Systems, Griffon Hoverwork, Hitachi Construction Machinery (Europe) NV, Remu, Rheinmetall AG, Ultratrex Machinery Sdn. Bhd, Wetland Equipment, Wilco Manufacturing, L.L.C., Wilson Marsh Equipment, Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)