Amino Acids Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Region, 2025-2033

Amino Acids Market Size and Share:

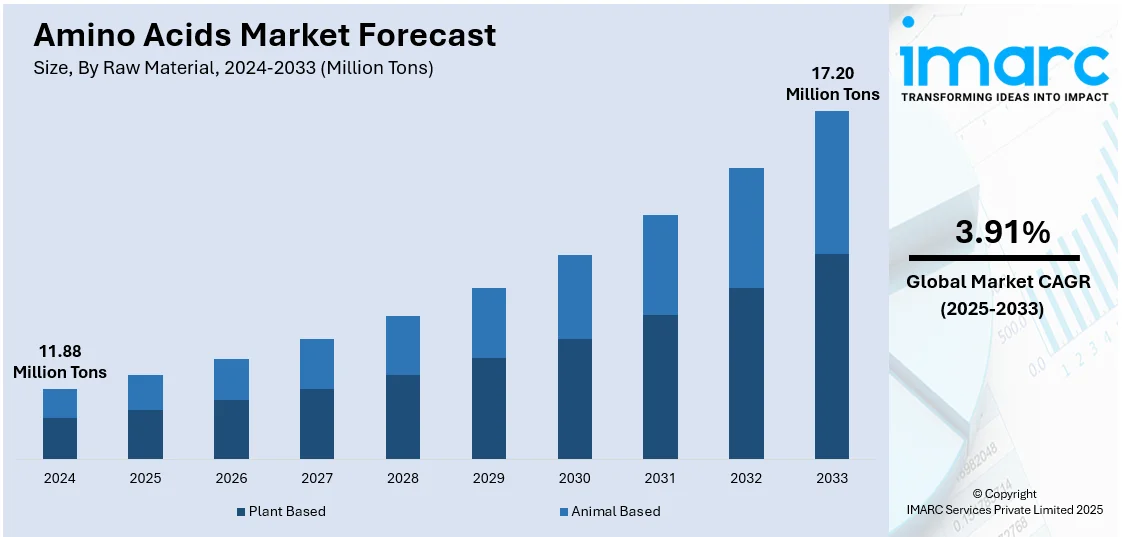

The global amino acids market size was valued at 11.88 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 17.20 Million Tons by 2033, exhibiting a CAGR of 3.91% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 48.8% in 2024. The increasing utilization of amino acids in formulating numerous skincare products, the widespread adoption of plant-based diets, and the expanding use of fermentation techniques, genetic engineering, and enzymatic processes are some of the major factors fueling the amino acids market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 11.88 Million Tons |

| Market Forecast in 2033 | 17.20 Million Tons |

| Market Growth Rate (2025-2033) |

3.91%

|

The market for amino acids is driven by a combination of health, industrial, and technological factors. Rising health consciousness among consumers has boosted the demand for dietary supplements and functional foods enriched with amino acids to support muscle development, metabolism, and overall wellness. The animal feed industry is another major driver, as amino acids enhance feed efficiency and animal growth. The growing use of plant-based diets prompts demand for sustainable amino acids, which exist within plant-based sources. In pharmaceuticals, amino acids are used in drug formulations and therapies, adding to market expansion. Furthermore, advancements in fermentation and biotechnology have improved production efficiency and cost-effectiveness. These diverse applications across sectors are propelling the global growth of the amino acids market, especially in emerging economies.

The amino acids market in the United States is experiencing significant growth, driven by multiple factors. Aaccording to the amino acids market forecast, a primary driver is the increasing demand for dietary supplements and functional foods, as consumers prioritize health and wellness. Amino acids like lysine, glutamine, and arginine are widely used in protein-enriched products for muscle development and recovery, catering to athletes and health-conscious individuals. Additionally, the pharmaceutical sector heavily relies on amino acids in drug formulation, especially in biopharmaceuticals and parenteral nutrition solutions. The animal feed industry is another significant driver, with amino acids such as methionine and threonine playing a crucial role in enhancing livestock health and productivity. Furthermore, advancements in fermentation and synthetic biology have reduced production costs, enabling wider accessibility of amino acid-based products. For instance, in March 2023, Corteva Inc. and Bunge revealed important progress in creating a more nutritious soybean meal designed for the animal feed sector, particularly for poultry, swine, and aquaculture feed. The companies are engaged in a multi-year partnership to create and market soybean varieties that could present a new value stream opportunity for soybean farmers, while providing feed compounders with an alternative to decrease their reliance on synthetic additives, cut expenses, and minimize their carbon footprint. This collaboration exemplifies the biotech and agricultural innovation that is transforming how amino acids are sourced and utilized, especially in livestock nutrition and also rising the key amino acids methionine and lysine proportion in the soybean.

Amino Acids Market Trends:

Rising Health and Wellness Awareness

The increasing consumer awareness about the benefits of amino acids in improving health, fitness, and overall well-being is driving the demand for dietary supplements and functional foods enriched with amino acids. This trend is particularly strong among fitness enthusiasts and aging populations seeking muscle health and recovery solutions. According to the IFIC, 71% of Americans were increasingly seeking to consume more protein in 2024, an increase from 59% in 2022, further fueling the demand for amino acid-enriched dietary supplements and functional foods. Brands and companies are also engaging in campaigns to spread awareness regarding the health benefits of amino acids. For instance, in December 2023, Ajinomoto, a leading global company with specialties in amino acids as its foundation leading to the business of food and wellness, launched an educational campaign “Life is Full of Amino Acid” to educate Thai citizens about the importance of amino acids for human health and their crucial functions in daily life. This initiative is in response to the company's recently adopted vision, Leading in Creation of Our Well-Being along with the slogan of ‘Eat Well, Live Well’. This is expected to fuel the amino acid market forecast over the coming years.

Growth in the Animal Feed Industry

Amino acids are essential in animal nutrition for promoting growth, enhancing feed efficiency, and improving overall livestock health. The American Farrier's Association reported that the pet food market in 2024 was valued at USD 51.7 Billion, with dog and cat food sales comprising a large portion of this market. Much of the food, approximately 9.8 Million Tons, is made from over 600 plant- and animal-based ingredients, many of which include essential amino acids. The expanding livestock and aquaculture industries, particularly in developing regions, are significantly boosting the demand for amino acids in animal feed formulations. According to the American Feed Industry Association, there are 5,800+ animal food manufacturing facilities in the U.S. producing more than 284 million tons of finished feed and pet food each year. This is further driving the amino acid demand in the animal feed industry. For instance, in May 2023, Evonik announced the launch of a new generation of Biolys, a proven source of lysine for livestock feeds, in keeping with the tradition of supplying the market with innovative products and solutions to benefit its customers.

Increasing Demand for Plant-Based Products

The transition to vegetarian and vegan diets is increasing the need for plant-based amino acids. Consumers are progressively looking for plant-derived supplements and food items, fueling expansion in the market for amino acids obtained from plants. Sainsbury's Future of Food Report predicts that by 2025, a quarter of all British people will be vegetarian, further increasing the demand for plant-based amino acids. Furthermore, in October 2023, Redox, in collaboration with CJ Bio, introduced AMIBOOST, a high-quality biostimulant enriched with specialized amino acids to aid in this ongoing struggle. This remarkable product is meticulously designed to bolster crop yield and quality, addressing the needs of various plant types and growth stages. These amino acids act as catalysts for the plant’s secondary metabolism, a vital part of its immune system, enabling plants to thrive even in the face of adversity. This is further influencing the amino acids market insights significantly.

Amino Acids Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global amino acids market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on type, raw material, and application.

Analysis by Type:

- Glutamic Acids

- Lysine

- Methionine

- Threonine

- Phenylalanine

- Tryptophan

- Citrulline

- Glycine

- Glutamine

- Creatine

- Arginine

- Valine

- Leucine

- Iso-Leucine

- Proline

- Serine

- Tyrosine

- Others

Glutamic acid stand as the largest type in 2024, holding around 43.4% of the market. The demand for glutamic acid is driven by its widespread utilization across various industries. For instance, the increasing use of glutamic acid in the form of monosodium glutamate (MSG) in the food and beverage (F&B) industry is positively influencing the market. MSG imparts an umami taste and enhances the savory flavors of various dishes. Additionally, the rising utilization of glutamic acid in preparing various processed foods, snacks, sauces, and condiments is creating a positive amino acids market outlook. Furthermore, the widespread adoption of glutamic acid in the pharmaceutical and biotechnology sectors for the synthesis of various pharmaceutical compounds, amino acid-based drugs, and peptide-based therapies is driving the market. Moreover, its increasing use in drug formulation and therapeutic applications is catalyzing its demand in these industries, thus influencing the amino acids market dynamics.

Analysis by Raw Material:

- Plant Based

- Animal Based

Plant-based leads the market with around 88.4% of market share in 2024. The demand for plant-based raw materials in the market is driven by evolving consumer preferences and sustainability concerns. Additionally, the rising health consciousness among individuals and the growing environmental concerns are catalyzing the demand for sustainable and cruelty-free alternatives to animal-derived products. Apart from this, the environmental impact of traditional animal farming, including land use, greenhouse gas (GHG) emissions, and resource consumption, is promoting eco-friendly options. Furthermore, the increasing adoption of vegetarianism and veganism is driving the demand for plant-based products. Furthermore, continuous innovations in extraction methods, such as fermentation and enzymatic processes, are allowing for the efficient production of amino acids from plant sources. Moreover, the rising utilization of plant-based amino acids across different industry verticals, such as in food and beverages, cosmetics, and pharmaceuticals, is favoring the industry growth.

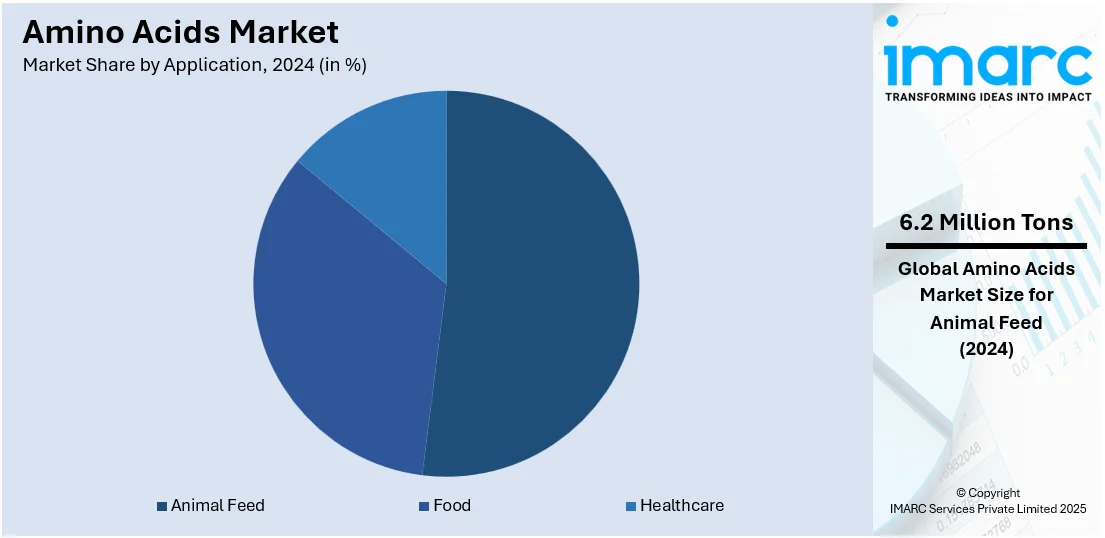

Analysis by Application:

- Animal Feed

- Food

- Healthcare

Animal feed leads the market with around 52.3% of market share in 2024. The amino acids demand in animal feed applications is driven by the escalating demand for high-quality and nutritionally balanced livestock and poultry nutrition. Amino acids are essential nutrients required for proper growth, development, and overall health of animals. Additionally, the rising demand for animal-based products, such as meat, milk, and eggs, is driving the need for efficient and sustainable livestock production. Apart from this, the increasing consumption of supplementation is enabling precise control over protein intake, optimizing animal performance, and reducing the risk of excess nutrient excretion, which is contributing to the amino acids market growth. Amino acid supplementation assists in formulating balanced diets that adhere to regulatory guidelines while ensuring the welfare and health of animals. High-quality amino acid-enriched feed contributes to improved animal health, reduced antibiotic use, and enhanced product quality.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 48.8%. The Asia Pacific amino acids market is expanding rapidly due to health consciousness, disposable incomes, and demand in the food, pharmaceutical, and feed industries. Protein-enriched diets incorporate amino acids in functional foods, beverages, and supplements. They are valued in sports and clinical nutrition and are used extensively in animal feed to improve nutritional outcomes and feed efficiency. Technological improvements in production methods are enhancing availability and cost-effectiveness, further supporting market penetration. The pharmaceutical sector plays a pivotal role in shaping demand, especially with India’s pharmaceutical market for FY 2023–24 valued at USD 50 Billion including USD 23.5 Billion in domestic consumption and USD 26.5 Billion in exports. This strong industry base is contributing to the increased use of amino acids in therapeutic and clinical formulations. Consumer interest in wellness and balanced nutrition continues to shape demand patterns and innovation in product development across the region.

Key Regional Takeaways:

North America Amino Acids Market Analysis

The North American amino acids market is driven by several key factors. The increasing demand from the animal feed industry, particularly in the U.S. and Canada, is significant, as amino acids are essential for enhancing feed quality and animal health. The growing awareness of health and wellness among consumers has led to a surge in the use of amino acids in nutraceuticals and dietary supplements. Additionally, advancements in biotechnology and fermentation processes have improved production efficiency, making amino acids more accessible for various applications. The food and beverage industry also contributes to amino acids market growth by incorporating amino acids to enhance flavor and nutritional value. Furthermore, the pharmaceutical sector's increasing utilization of amino acids in drug formulation supports market expansion.

United States Amino Acids Market Analysis

In 2024, the United States accounted for over xx75.80 of the amino acids market in North America. The United States amino acids market is witnessing sustained growth driven by rising demand from the food, dietary supplements, and pharmaceutical industries. Consumer preference for protein-rich and functional foods contributes significantly to the uptake of amino acids in nutraceutical formulations and health beverages. Additionally, the growing emphasis on preventive healthcare and wellness is increasing the integration of amino acids in medical nutrition and sports nutrition products. The U.S. pharmaceutical industry, expected to surpass USD 1 Trillion by 2030 with a CAGR of 5.48% as per Yellow Bus ABA, is further contributing to the increased use of amino acids in drug formulations and clinical nutrition. Technological advancements in fermentation processes and bio-based production methods are enhancing the scalability and cost-efficiency of amino acid manufacturing. The expanding applications in animal nutrition, particularly in feed formulations, are also propelling market demand. Additionally, the rising adoption of amino acids in cosmetic formulations for their conditioning and anti-aging properties is adding to the momentum. Continuous innovation in product formulations and increasing awareness about the benefits of amino acids in cellular metabolism and muscle recovery are supporting broader market penetration.

Europe Amino Acids Market Analysis

Europe’s amino acids market is progressing steadily due to growing consumer inclination toward health-centric diets and functional nutrition. Rising awareness about amino acids’ role in metabolic health, muscle development, and immune function is encouraging their use across a range of dietary and therapeutic applications. The region’s strong demand for plant-based and clean-label products is prompting greater adoption of naturally derived amino acids in food and beverage innovations. Additionally, the pharmaceutical sector is increasingly incorporating amino acids in clinical nutrition and drug formulations, particularly for aging populations. Sustainable sourcing and bio-based production techniques are gaining traction, aligning with regional environmental goals. In line with these trends, Circular Bio-based Europe allocated €213 million to advance the region’s circular bio-based economy, further promoting the development of sustainable practices in amino acid production. In animal nutrition, amino acids continue to be integral in feed optimization to enhance livestock productivity and nutritional efficiency.

Latin America Amino Acids Market Analysis

Latin America’s amino acids market is developing steadily, supported by growing usage in food enrichment, nutritional supplements, and feed applications. Consumer awareness around the health benefits of amino acids in muscle maintenance and metabolic support is fostering demand across health and wellness products. Their incorporation in fortified foods and dietary formulations is increasing in response to changing lifestyle and nutritional trends. Notably, the region’s wellness sector is gaining momentum, with Brazil alone accounting for a USD 96 Billion wellness economy, according to the Global Wellness Institute. This underscores the rising consumer inclination toward health-oriented products, including amino acid-enriched offerings. The animal feed sector is also witnessing greater uptake of amino acids to improve feed quality and livestock health.

Middle East and Africa Amino Acids Market Analysis

The amino acids market in the Middle East and Africa is gradually growing, driven by rising interest in nutrition-based health solutions and functional food products. Increasing urbanization and evolving dietary habits are boosting the demand for protein-enhancing ingredients across food and supplement categories. This urban shift is influencing consumer lifestyles and dietary preferences, leading to greater demand for health-oriented, amino acid-enriched products. Amino acids are gaining popularity in animal nutrition for improved feed performance and livestock health, with growing interest in wellness- and vitality-focused nutrition, supported by technological advancements.

Competitive Landscape:

The global amino acids market is highly competitive, driven by rising demand from the food, pharmaceutical, and animal feed sectors. Key players include Evonik Industries AG, Ajinomoto Co., Inc., Kyowa Hakko Bio Co., Ltd., and Amino GmbH, who dominate through innovation and strategic partnerships. Asia-Pacific leads in production and consumption, with China and Japan as major contributors. Market competition intensifies due to technological advancements and increasing R&D investments. Companies focus on expanding product portfolios and enhancing sustainability to gain market share. The trend toward plant-based and fermented amino acids also shapes competitive strategies. Overall, the market is fragmented but consolidating as players pursue mergers and acquisitions to strengthen their global presence and meet evolving consumer demands.

The report provides a comprehensive analysis of the competitive landscape in the amino acids market with detailed profiles of all major companies, including:

- AjinomotoCo., Inc.

- Kyowa Hakko Bio. Co. Ltd.

- Amino GmbH

- Bill Barr & Company

- Iris Biotech GmbH

- Taiwan Amino Acids Co. Ltd.

- BI Nutraceuticals

- Sichuan Tongsheng Amino acid Co., Ltd

- Wacker Chemie AG

- CJ CheilJedang Corp.

- Donboo Amino Acid Co., Ltd.

- Evonik Industries AG

- Archer-Daniels-Midland Company

Latest News and Developments:

- January 2025: Cizzle Brands launched Spoken Nutrition, a premium NSF Certified for Sport nutraceutical brand targeting athletes. Backed by experts and MLB team orders, the product line included Sleep Builder, Greens, Aminos + ATP, Creatine, Fish Oil + D, MAG 3, Pro Resolving Mediators, Vitamin D3 + K1/K2, Daily Packs, Grass Fed Whey, and Beef Protein.

- September 2024: Agape ATP Corporation launched its enhanced wellness supplement, ATP2, featuring 76 essential minerals, 20 amino acids, and advanced enzymes. The product aims to address aging, metabolism, and chronic disease, promoting energy, vitality, and overall health.

- September 2024: Arla Foods Ingredients launched the "Go High in Protein" campaign to inspire dairy manufacturers. The campaign highlighted the Nutrilac® ProteinBoost range, showcasing new high-protein dairy recipes like spoonable and drinking yogurts.

- July 2024: The Coconut Collab launched Protein Yog, a plant-based, dairy-free yogurt providing 10 grams of protein per serving. Made from soy and almond, it is low in sugar and rich in essential amino acids.

- May 2024: VetSynova launched its new "AA: Amino Acids" pet supplement. The supplement is designed to strengthen muscles in dogs and cats.

- April 2024: TRI-K Industries launched TRICare™ CG, an amino acid-based multifunctional ingredient that enhances product preservation while respecting the skin and scalp microbiome. It reportedly addresses skin redness and targets acne and dandruff-causing organisms.

Amino Acids Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Glutamic Acids, Lysine, Methionine, Threonine, Phenylalanine, Tryptophan, Citrulline, Glycine, Glutamine, Creatine, Arginine, Valine, Leucine, Iso-Leucine, Proline, Serine, Tyrosine, Others |

| Raw Materials Covered | Plant Based, Animal Based |

| Applications Covered | Animal Feed, Food, Healthcare |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AjinomotoCo., Inc., Kyowa Hakko Bio. Co. Ltd., Amino GmbH, Bill Barr & Company, Iris Biotech GmbH, Taiwan Amino Acids Co. Ltd., BI Nutraceuticals, Sichuan Tongsheng Amino acid Co., Ltd, Wacker Chemie AG , CJ CheilJedang Corp., Donboo Amino Acid Co., Ltd., Evonik Industries AG, Archer-Daniels-Midland Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the amino acids market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global amino acids market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the amino acids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The amino acids market was valued at 11.88 Million Tons in 2024.

The amino acids market is projected to exhibit a CAGR of 3.91% during 2025-2033, reaching a value of 17.20 Million Tons by 2033.

Key factors driving the amino acids market include rising demand for dietary supplements, increased use in animal feed for better nutrition, growing health awareness, and expanding applications in pharmaceuticals and cosmetics. Additionally, advancements in fermentation technology and the shift toward plant-based and sustainable production methods are fueling market growth.

Asia Pacific currently dominates the amino acids market due to rising health consciousness, expanding pharmaceutical and livestock sectors, and advancements in biotechnology, enhancing production efficiency.

Some of the major players in the amino acids market include AjinomotoCo., Inc., Kyowa Hakko Bio. Co. Ltd., Amino GmbH, Bill Barr & Company, Iris Biotech GmbH, Taiwan Amino Acids Co. Ltd., BI Nutraceuticals, Sichuan Tongsheng Amino acid Co., Ltd, Wacker Chemie AG, CJ CheilJedang Corp., Donboo Amino Acid Co., Ltd., Evonik Industries AG, Archer-Daniels-Midland Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)