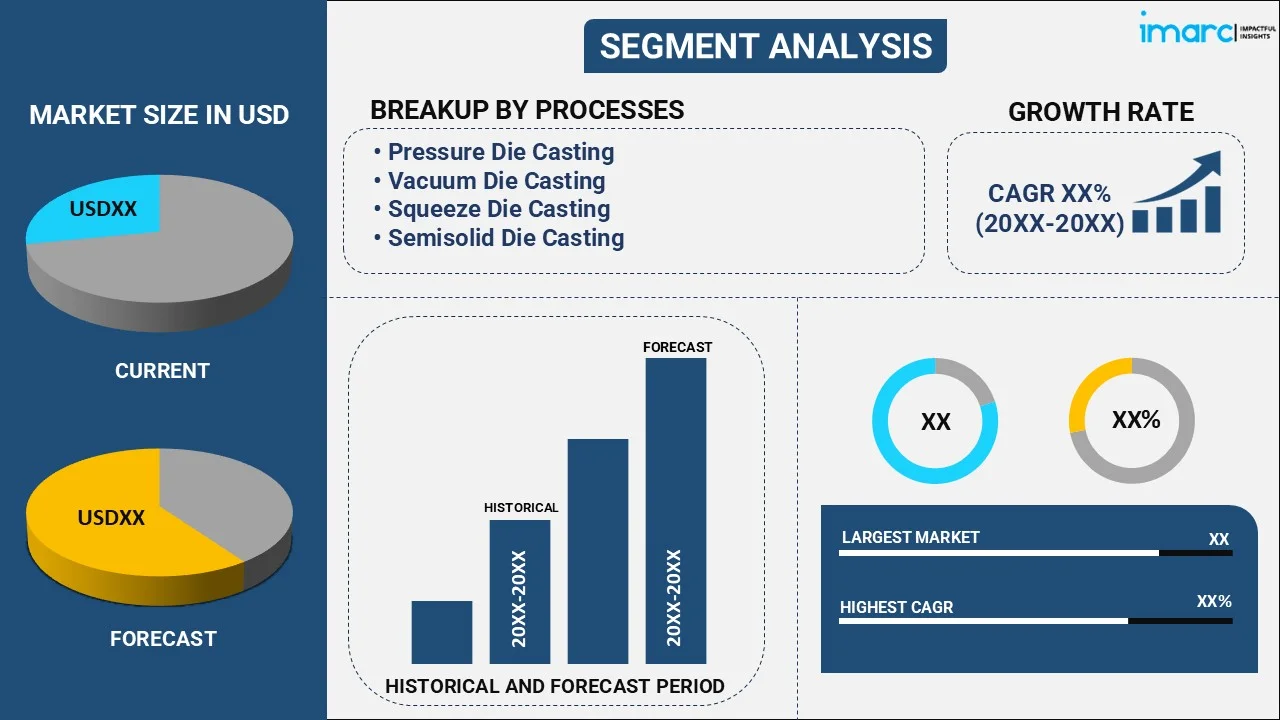

Aluminum Die Casting Market Report by Process (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semisolid Die Casting), Application (Body Parts, Engine Parts, Transmission Parts, and Others), End Use (Transportation, Industrial, Building & Construction, Telecommunication, Consumer Durables, Energy, and Others), and Region 2025-2033

Market Overview:

The global aluminum die casting market size reached USD 29.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 41.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.7% during 2025-2033. The growing emphasis on sustainable manufacturing practices across industries, the widespread adoption of the method in the aerospace sector and rising efforts for reducing fuel consumption and improving energy efficiency are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.2 Billion |

| Market Forecast in 2033 | USD 41.1 Billion |

| Market Growth Rate 2025-2033 | 3.7% |

Aluminum die casting is a metalworking process used to produce detailed and dimensionally accurate parts with high-speed efficiency. The method involves forcing molten aluminum under high pressure into steel molds or dies, which have been designed to create a specific shape. This process can produce complex shapes with excellent surface finish and high structural integrity that would otherwise require multiple machining processes. The components manufactured following the method often feature characteristics such as high strength-to-weight ratio, excellent thermal conductivity, and corrosion resistance. Industries such as automotive, aerospace, consumer electronics, and housing extensively employ aluminum die casting due to its cost-effectiveness and the versatility of end-products. As a precise and reliable manufacturing technique, it significantly enhances product performance while reducing production costs, making it an invaluable process in modern industrial production.

To get more information on this market, Request Sample

The growing emphasis on sustainable manufacturing practices across industries majorly drives the global market. It aligns with this trend due to its recyclability and energy efficiency. Aluminum is highly recyclable, with a significantly lower energy requirement for recycling compared to primary production. This characteristic makes the process an environmentally friendly choice, contributing to reduced carbon emissions and resource conservation. As companies strive to achieve their sustainability goals and meet regulatory requirements, the demand is expected to increase. Along with this, the widespread adoption in the aerospace sector as it offers several advantages, including weight reduction, corrosion resistance, and high strength-to-weight ratio is significantly supporting the market. Furthermore, the lightweight nature of the method supports sustainability efforts by reducing fuel consumption and improving energy efficiency in applications such as transportation and energy sectors, creating a positive market outlook.

Aluminum Die Casting Market Trends/Drivers:

Growing Demand for Lightweight and High-Strength Components

One of the significant market drivers for aluminum die casting is the increasing demand for lightweight and high-strength components in various industries. Aluminum is known for its exceptional strength-to-weight ratio, making it an ideal material for manufacturing parts that require both durability and lightness. The automotive industry, for instance, has witnessed a rise in the use of the method due to stringent fuel efficiency and emission standards. Additionally, it enables the production of complex shapes and thin-walled structures, which further enhances its appeal in industries such as aerospace, electronics, and consumer goods. These industries are constantly seeking ways to reduce weight while maintaining structural integrity, leading to a growing preference for the process over traditional materials. This demand is rising as industries strive for greater energy efficiency and performance optimization.

Advancements in Die Casting Technologies and Processes

Technological advancements are playing a vital role in driving the market for aluminum die casting. In recent years, significant improvements have been done in die casting technologies and processes, leading to enhanced productivity, cost-effectiveness, and quality control. Advanced simulation tools and software enable manufacturers to optimize the design and production of die cast components, minimizing defects and improving overall efficiency. Moreover, the advent of computer numerical control (CNC) machines and robotics has revolutionized the die casting industry. These technologies allow for precise and automated manufacturing processes, reducing human error and increasing production speed. Additionally, innovations such as vacuum-assisted die casting and squeeze casting have improved the mechanical properties of the process, making them even more attractive for critical applications.

Increasing Infrastructure Development and Urbanization

Infrastructure development and urbanization are driving the demand in sectors, such as construction, telecommunications, and energy. As cities expand and infrastructure projects multiply, there is a need for durable, corrosion-resistant, and aesthetically appealing components. In the construction industry, it find applications in window frames, door handles, lighting fixtures, and HVAC systems. The material's lightweight nature simplifies installation and reduces structural loads. In confluence with this, in the telecommunications sector, the demand for aluminum die castings has escalated with the proliferation of mobile communication towers and equipment that require weatherproof and durable enclosures. Furthermore, the growing emphasis on renewable energy sources, such as wind and solar power, has influenced the demand in the energy sector. Aluminum components are used in the production of wind turbine housings, solar panel frames, and electrical connectors, as they provide excellent corrosion resistance and structural stability in outdoor environments.

Aluminum Die Casting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aluminum die casting market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on process, application and end use.

Breakup by Process:

- Pressure Die Casting

- Vacuum Die Casting

- Squeeze Die Casting

- Semisolid Die Casting

The report has provided a detailed breakup and analysis of the market based on the process. This includes pressure die casting, vacuum die casting, squeeze die casting, and semisolid die casting.

The pressure die casting process in the aluminum die casting industry is driven by the demand for lightweight and high-strength components across industries such as automotive, aerospace, and electronics is a significant driver. Pressure die casting enables the production of complex shapes and thin-walled structures with exceptional precision, making it ideal for manufacturing lightweight aluminum components that meet stringent performance requirements. Apart from this, advancements in die casting technologies and processes have further propelled the market. Advanced simulation tools, automation, and improved quality control systems have increased productivity, efficiency, and cost-effectiveness, driving the adoption of pressure die casting.

On the other hand, vacuum die casting eliminates gas porosity and reduces the formation of shrinkage defects, resulting in superior surface finish and dimensional accuracy. This makes it a preferred choice for manufacturing critical and visually appealing aluminum components. Additionally, the increasing adoption of aluminum in various applications due to its excellent properties, such as high strength-to-weight ratio and corrosion resistance, has contributed to the market growth of vacuum die casting. Furthermore, advancements in vacuum die casting technology, including improved vacuum systems and control mechanisms, have enhanced productivity and process reliability, further driving its adoption.

Breakup by Application:

- Body Parts

- Engine Parts

- Transmission Parts

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes body parts, engine parts, transmission parts, and others.

The automotive industry's shift towards lightweight design and improved fuel efficiency has driven the demand for aluminum transmission parts. Aluminum's high strength-to-weight ratio makes it an ideal material for manufacturing transmission components that require both durability and weight reduction. Additionally, aluminum die casting offers design flexibility, allowing for complex geometries and integration of multiple features, which is advantageous for transmission parts. In addition, the growing adoption of electric vehicles (EVs) has further propelled the demand for aluminum transmission components. Moreover, advancements in die casting technologies and processes have improved the quality and cost-effectiveness of aluminum transmission parts, contributing to market growth.

On the contrary, aluminum's exceptional strength-to-weight ratio makes it an ideal choice for manufacturing engine components, enabling vehicles to achieve improved fuel efficiency and performance. Along with this, the rising focus on emission regulations and environmental sustainability has pushed manufacturers to explore lightweight materials to reduce carbon emissions and improve overall engine efficiency. The product offers the necessary strength and durability while providing weight reduction benefits. Furthermore, advancements in die casting technologies and processes have enhanced the production efficiency and quality control of aluminum engine parts, making them more attractive to manufacturers.

Breakup by End Use:

- Transportation

- Industrial

- Building & Construction

- Telecommunication

- Consumer Durables

- Energy

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes transportation, industrial, building & construction, telecommunication, consumer durables, energy, and others.

The market drivers for industrial end use in the aluminum die casting industry are influenced by the sector's demand for durable and high-quality components. Aluminum die castings offer excellent mechanical properties, such as strength, durability, and corrosion resistance, making them suitable for various industrial applications. Industries such as machinery, equipment manufacturing, and industrial automation rely on them for components, such as housings, brackets, and structural parts. Moreover, the growing emphasis on sustainability and environmental consciousness has led to increased usage in the industrial sector.

On the other hand, the construction sector's increasing focus on energy efficiency and sustainable building practices has driven the demand for aluminum die castings. Aluminum's excellent thermal conductivity and corrosion resistance make it a preferred choice for components such as window frames, door handles, and structural elements in buildings. These components contribute to energy savings, durability, and aesthetics in construction projects. Furthermore, the demand for lightweight materials in the building and construction industry has propelled the market.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

The aluminum die casting industry in the Asia Pacific region is driven by the rapid industrialization and economic growth in countries such as China, India, and Japan. These countries have witnessed significant infrastructure development, automotive production, and industrial expansion, all of which require aluminum components produced through die-casting processes. Along with this, the growing consumer electronics and electrical industries in Asia Pacific have contributed to the market. With a large consumer base and increasing disposable incomes, the demand for electronic devices and appliances has raised. Moreover, the Asia Pacific region is home to a vast number of die casting companies, both large-scale manufacturers and smaller enterprises. This robust manufacturing ecosystem, coupled with advancements in die casting technologies and processes, has further influenced the market.

On the contrary, Asia Pacific is estimated to expand further in this domain due to the strong presence of the automotive industry in the region. North America is home to several leading automotive manufacturers, and the demand for lightweight, high-performance vehicles has fueled the adoption of aluminum die castings. In addition, the increasing focus on sustainable manufacturing practices and stringent environmental regulations has contributed to the market.

Competitive Landscape:

The global aluminum die casting market is experiencing significant growth due to the growing focus on sustainability, aiming to reduce environmental footprint. Companies are investing in advanced technologies to improve energy efficiency and recycle waste products, further impacting the market. Along with this, the widespread adoption of automation, robotics, and digital technologies such as IoT and AI for predictive maintenance and process optimization is also positively influencing the market. In addition, the diversification of product offerings, such as creating castings for a wide range of industries, such as automotive, aerospace, construction, and electronics is significantly supporting the market. Apart from this, Companies are engaging in strategic partnerships and M&As to strengthen their market position, expand their product portfolio, and enhance their technological capabilities. Furthermore, the rising investments in new materials and processes to improve the performance and durability of castings is contributing to the market.

The report has provided a comprehensive analysis of the competitive landscape in the global aluminum die casting market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alcast Technologies Ltd.

- Alcoa Corporation

- Bodine Aluminum Inc.

- Consolidated Metco Inc.

- Dynacast Deutschland GmbH

- GF Casting Solutions

- Gibbs Die Casting Corporation

- Martinrea Honsel Germany GmbH

- Rheinmetall Automotive AG

- Ryobi Die Casting Dalian Co., Ltd.

- Shiloh Industries Inc.

- Walbro LLC

Recent Developments:

- In September 2022, Alcoa Corporation announced about the research and use of alloys, further solidifying its position as a provider of sophisticated aluminium alloys. A210 ExtruStrongTM, a new high-strength 6000 series alloy that offers advantages in a variety of extruded applications, including transportation, building, industrial, and consumer items, is one of the company's creations.

- In March 2021, Linamar Corporation announced reached an agreement with GF Casting Solutions (GF) to purchase their 50% stake in their Mills River, North Carolina-based joint venture, GF Linamar LLC.

- In July 2023, The German and Dutch militaries contracted Rheinmetall in a €1.9 billion deal for up to 3,058 Caracal airmobile platforms, specifically designed for special operations. This purchase, financed by a German special fund, marks bilateral cooperation between the nations and expands Rheinmetall's portfolio into the lightweight 4x4 segment.

Aluminum Die Casting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Processes Covered | Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semisolid Die Casting |

| Applications Covered | Body Parts, Engine Parts, Transmission Parts, Others |

| End Uses Covered | Transportation, Industrial, Building & Construction, Telecommunication, Consumer Durables, Energy, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alcast Technologies Ltd., Alcoa Corporation, Bodine Aluminum Inc., Consolidated Metco Inc., Dynacast Deutschland GmbH, GF Casting Solutions, Gibbs Die Casting Corporation, Martinrea Honsel Germany GmbH, Rheinmetall Automotive AG, Ryobi Die Casting Dalian Co., Ltd., Shiloh Industries Inc., Walbro LLC etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aluminum die casting market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aluminum die casting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aluminum die casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global aluminum die casting market was valued at USD 29.2 Billion in 2024.

We expect the global aluminum die casting market to exhibit a CAGR of 3.7% during 2025-2033.

The rising demand for aluminum die casting across various industries, such as automotive, transportation, electrical and electronics, etc., as aluminum possesses high corrosion resistance, durability, stiffness, etc., is primarily driving the global aluminum die casting market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for aluminum die casting.

Based on the process, the global aluminum die casting market has been segmented into pressure die casting, vacuum die casting, squeeze die casting, and semisolid die casting. Currently, pressure die casting holds the majority of the total market share.

Based on the end use, the global aluminum die casting market can be divided into transportation, industrial, building & construction, telecommunication, consumer durables, energy, and others. Among these, transportation exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global aluminum die casting market include Alcast Technologies Ltd., Alcoa Corporation, Bodine Aluminum Inc., Consolidated Metco Inc., Dynacast Deutschland GmbH, GF Casting Solutions, Gibbs Die Casting Corporation, Martinrea Honsel Germany GmbH, Rheinmetall Automotive AG, Ryobi Die Casting Dalian Co., Ltd., Shiloh Industries Inc., Walbro LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)