Aluminium Market Size, Share, Trends, and Forecast by Series, Processing Method, End-Use Industry, and Region, 2025-2033

Aluminium Market Size and Share:

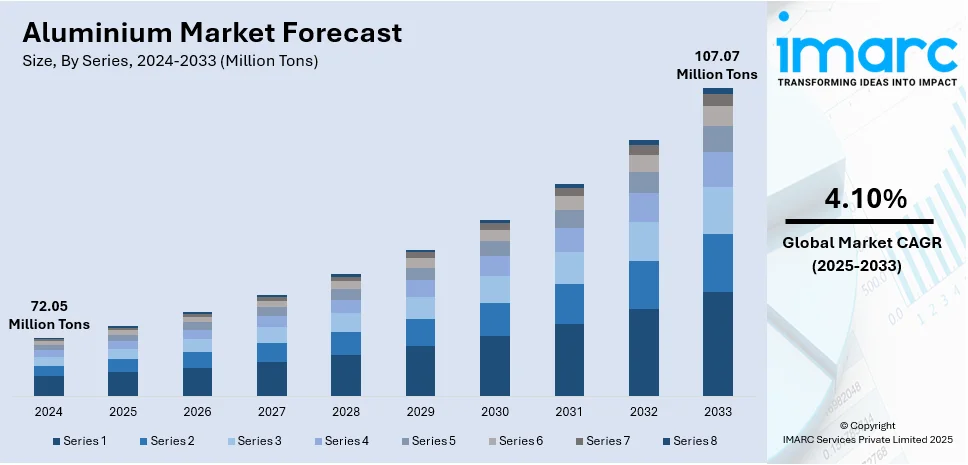

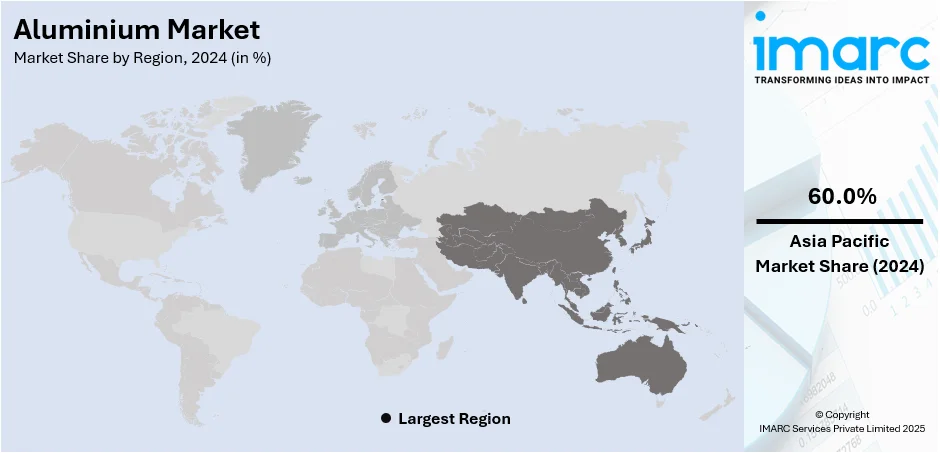

The global aluminium market size reached 72.05 Million Tons in 2024. Looking forward, the market is expected to reach 107.07 Million Tons by 2033, exhibiting a CAGR of 4.10% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 60.0% in 2024. The market is experiencing steady growth, driven by increasing demand across the automotive, construction, packaging, and aerospace industries. Lightweight properties, recyclability, and sustainability benefits are driving its adoption in modern manufacturing. Technological advancements and increasing urbanization further enhance its usage, creating strong global growth prospects. These dynamics significantly influence the overall aluminium market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

72.05 Million Tons |

|

Market Forecast in 2033

|

107.07 Million Tons |

| Market Growth Rate 2025-2033 | 4.10% |

The market is primarily driven by its versatility and growing demand across multiple industries. The automotive industry is also turning to the use of lightweight aluminium elements, which are found to contribute to better fuel consumption and the unrestricted evolution of electric cars. Aluminium finds great usage in the construction industry due to its strength, lack of corrosion and versatility in the design and new infrastructure construction. Increased demand in packaging (particularly in cans and foils) is due to its recyclability and ability to maintain product quality. Developments in aerospace also support growth because of aluminium's strength-weight ratio. Furthermore, the global shift toward sustainability and circular economy practices encourages greater recycling of aluminium, reducing energy consumption and environmental impact. Technological advancements in production and processing further enhance performance and expand applications, collectively propelling market growth.

To get more information on this market, Request Sample

The aluminium market growth in the United States is driven by strong demand across automotive, construction, aerospace, and packaging sectors. Automakers are increasingly adopting aluminium to reduce vehicle weight, improve fuel efficiency, and support electric vehicle growth. In construction, aluminium is valued for its strength, corrosion resistance, and sustainability, making it vital for modern infrastructure. The aerospace industry continues to rely on aluminium’s lightweight yet durable properties for aircraft manufacturing. Additionally, high recycling rates and circular economy initiatives strengthen supply sustainability. Growing demand for eco-friendly packaging solutions further supports market expansion, positioning aluminium as a key material in the US economy. For instance, in July 2025, Aluminz Corporation announced its intention to build the nation’s first aluminium manufacturing facility designed with a zero-landfill approach in Titus County, Texas. The initiative, undertaken in partnership with the Mount Pleasant City Council and the Mount Pleasant Economic Development Corporation (MPEDC), will be located on a 155-acre property secured through a 30-year lease. Upon completion, the plant is projected to generate over 130 long-term employment opportunities for the local community.

Aluminium Market Trends:

Technological advancements

Innovations in aluminium production technologies, such as smelting processes, recycling methods, and alloy development, are supporting the growth of the market. In line with this, improved efficiency in aluminium production lowers production costs, enhancing competitiveness and expanding market reach. Furthermore, advancements in recycling technologies promote sustainable practices, reducing the need for primary aluminium production and lowering environmental impact. According to the International Aluminium Institute (IAI), approximately 75% of the over 1.5 Billion Tonnes of aluminium manufactured in the past is still being used productively today, owing to effective recycling technologies. Besides this, alloy innovations cater to specific industry needs, enhancing the performance characteristics of aluminium for various applications. Moreover, the introduction of surface treatment techniques, such as anodizing, coating, and finishing processes, improve the aesthetics, durability, and functionality of aluminium products. These treatments provide corrosion protection, improve adhesion for paints and coatings, and enable the creation of decorative finishes for architectural applications. Apart from this, new joining technologies, such as friction stir welding, laser welding, and adhesive bonding, benefit in overcoming the challenges associated with welding aluminium. These technologies offer enhanced joint strength, reliability, and efficiency, making them suitable for a wide range of manufacturing applications.

Rising need for effective packaging solutions

The growing use in the packaging sector is driving the aluminium market trends. Aluminium is lightweight, yet strong and durable, providing enhanced protection for packaged goods while minimizing transportation costs. It is impermeable to light, moisture, and gases, ensuring the freshness and integrity of packaged products, particularly sensitive items, such as food and pharmaceuticals, which is contributing to the growth of the market. Apart from this, aluminium packaging is highly versatile, allowing for various shapes, sizes, and closure options to meet the diverse needs of manufacturers and individuals. Moreover, it has aesthetic appeal and can be customized through printing and embossing, enhancing brand visibility. Furthermore, the escalating demand for recyclable packaging materials on account of the rising focus on sustainability and environmental responsibility is bolstering the market growth. As per industry reports, aluminium is recyclable without any loss of quality, making it a preferred choice for eco-conscious individuals and companies aiming to reduce their carbon footprint.

Increasing demand for recycled aluminium

The growing demand for recycled aluminium due to the rising awareness about the environmental impact of traditional production methods is positively influencing the market. According to the International Aluminium Institute (IAI), recycling aluminium takes approximately 95% less energy than manufacturing from ore, eliminating emissions, including greenhouse gases. In addition, recycling aluminium requires less energy and produces fewer greenhouse gas (GHG) emissions as compared to primary production, making it an eco-sustainable alternative. Globally, recycling 1 Ton of aluminium reduces greenhouse gas emissions by an average of more than 16 tons, according to the International Aluminium Institute (IAI). Besides this, aluminium is a valuable resource with finite reserves of bauxite ore. Recycling aluminium reduces the need for extracting and processing new raw materials, conserving natural resources while extending the lifespan of existing aluminium reserves. Moreover, recycling aluminium consumes only a fraction of the energy required for primary production. It saves energy as compared to producing aluminium from raw materials. This energy efficiency assists in attracting industries seeking to reduce their carbon footprint and operating costs. Apart from this, it offers comparable quality and performance to primary aluminium, making it suitable for a wide range of applications across industries, such as automotive, construction, packaging, and consumer goods.

Aluminium Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aluminium market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on series, processing method, and end-use industry.

Analysis by Series:

- Series 1

- Series 2

- Series 3

- Series 4

- Series 5

- Series 6

- Series 7

- Series 8

Series 3 aluminium alloys hold the largest share in the market due to their exceptional balance of strength, corrosion resistance, and workability. Composed primarily of aluminium and manganese, this series offers superior resistance to environmental factors, making it ideal for construction, roofing, siding, and marine applications. Its excellent weldability and formability allow manufacturers to use it in diverse industries without compromising durability. Additionally, Series 3 alloys are cost-effective compared to other higher-strength grades, which makes them highly preferred in large-scale projects. Their recyclability further enhances appeal in regions prioritizing sustainable materials. With versatility, affordability, and eco-friendly properties, Series 3 remains the most widely adopted segment in the global aluminium market.

Analysis by Processing Method:

- Flat Rolled

- Castings

- Extrusions

- Forgings

- Pigments and Powder

- Rod and Bar

Extrusions hold the largest share in the market because of their versatility, lightweight nature, and ability to be shaped into complex profiles. According to the aluminium market forecast, this process allows manufacturers to produce components with high strength-to-weight ratios, making extrusions essential in automotive, aerospace, and construction industries. In building applications, aluminium extrusions are widely used for windows, doors, facades, and structural frameworks due to their durability and corrosion resistance. The growing shift toward electric vehicles also fuels demand, as extruded aluminium parts help reduce overall vehicle weight and improve efficiency. Additionally, extrusions are highly recyclable, supporting sustainability initiatives. Their adaptability, cost-effectiveness, and broad usage across multiple sectors make them the dominant product form in the aluminium market.

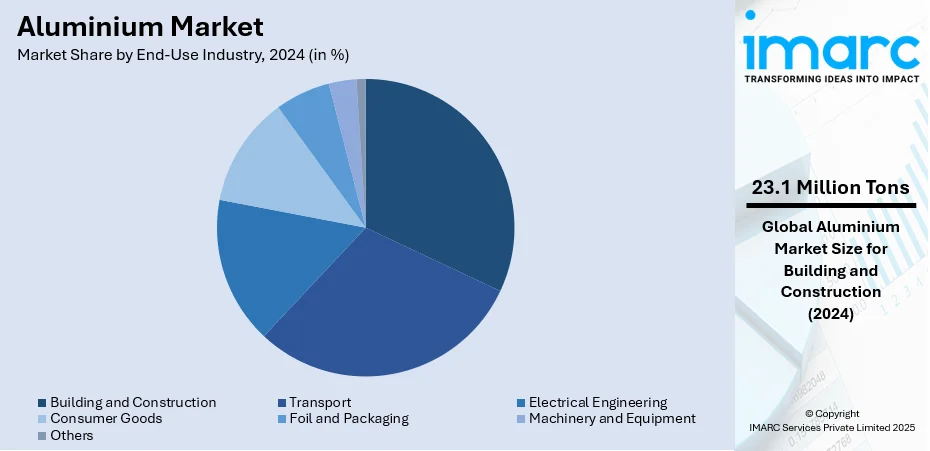

Analysis by End-Use Industry:

- Transport

- Building and Construction

- Electrical Engineering

- Consumer Goods

- Foil and Packaging

- Machinery and Equipment

- Others

Building and construction leads the market with 32.0% of market share in 2024 due to the material’s unique combination of strength, durability, and lightweight properties. Aluminium is widely used in windows, doors, roofing, cladding, and curtain walls, offering both structural reliability and modern design flexibility. Its corrosion resistance makes it highly suitable for long-lasting infrastructure, particularly in urban environments and coastal regions. Additionally, aluminium’s recyclability aligns with green building practices and sustainability regulations, further driving its adoption and creating a positive impact on the aluminium market outlook. Rapid urbanization, rising demand for energy-efficient buildings, and expanding infrastructure projects globally are accelerating its usage. The versatility, cost-effectiveness, and eco-friendly attributes of aluminium ensure that building and construction remain the leading end use segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 60.0%. The aluminium market demand in the Asia Pacific is expanding due to a surge in industrial diversification and green infrastructure investment. Rapid urban expansion and large-scale public works projects, such as metro systems, ports, and clean-energy installations, are driving strong demand for aluminium’s lightweight strength and long-lasting corrosion resistance. Governments across the region are prioritizing energy transition strategies and emissions standards, propelling growth in secondary aluminium recycling and low-carbon smelting techniques. Moreover, rising vehicle production is boosting reliance on aluminium for lightweight structural components. For instance, the total number of passenger vehicles, three-wheelers, two-wheelers, and quadricycles manufactured in India reached 24,76,915 units in March 2025, as per the India Brand Equity Foundation (IBEF). Demand is further supported by the booming packaging sector, where consumer-facing brands are shifting toward recyclable and premium aluminium cans and containers to meet evolving environmental expectations. Trade policies and industrial localization efforts are also reshaping the supply chain, as countries aim to cultivate domestic capacity in aluminium refining and fabrication.

Key Regional Takeaways:

North America Aluminium Market Analysis

The aluminium market in North America is driven by strong demand across key industries such as automotive, construction, aerospace, and packaging. Within the automotive industry, aluminium is being adopted at a growing pace to lower overall vehicle weight, improve fuel economy, and facilitate the accelerating transition toward electric mobility. Construction projects rely on aluminium for its durability, corrosion resistance, and modern design applications in facades, roofing, and infrastructure. The aerospace industry benefits from aluminium’s high strength-to-weight ratio, making it vital for aircraft production. Rising demand for sustainable and recyclable materials also boosts aluminium adoption, as recycling reduces energy consumption and supports circular economy goals. Additionally, technological advancements in extrusion and rolling processes further expand its applications, fueling steady market growth in the region.

United States Aluminium Market Analysis

In 2024, the United States accounted for 85.70% of the aluminium market in North America. The United States aluminium market is primarily driven by industrial innovation, sustainability transitions, and evolving regulatory trends. In sectors such as automotive and aerospace, manufacturers are increasingly turning to lightweight aluminium alloys to enhance energy efficiency and performance. Moreover, expanding construction and infrastructure projects are driving aluminium usage in cladding, framing, and structural applications due to the metal’s durability, corrosion resistance, and design versatility. According to the United States Census Bureau, construction expenditure in the country from January to May 2025 reached USD 841.5 Billion. Additionally, growth in renewable energy systems, particularly solar installations and wind turbine structures, is creating further opportunities for aluminium in high-strength, long-life roles. According to the Solar Energy Industries Association (SEIA), solar energy installations accounted for more than 69% of new renewable energy installations in the United States in Q1 2025. Other than this, demand is also being shaped by an expanding recycling ecosystem. Secondary aluminium production, which requires substantially less energy than primary smelting, is growing rapidly alongside circular-economy efforts and greenhouse gas reduction goals. Domestic policy and trade measures, including import tariffs and incentives for onshore production, are also influencing market dynamics and encouraging reshoring of capacity. Furthermore, emerging technologies, such as high-performance alloys, 3D-printable aluminium, and additive manufacturing, are introducing novel applications across industrial and consumer goods, supporting sustained industry expansion.

Europe Aluminium Market Analysis

The growth of the Europe aluminium market is largely fueled by a strong focus on decarbonization and industrial autonomy. As countries aim to reduce reliance on imported raw materials, investment is flowing into domestic aluminium production and refining capabilities, with a focus on renewable-powered smelting operations. Green manufacturing practices are also becoming a competitive differentiator, encouraging companies to adopt low-emission technologies and prioritize sustainable sourcing across supply chains. Moreover, manufacturers are increasingly adopting lightweight aluminium alloys in the automotive sector to reduce overall vehicle weight and lower carbon emissions, supporting Europe’s shift toward electric transportation. According to the European Environment Agency (EEA), 22.7% of newly registered cars and 7.7% of newly registered vans were electric vehicles (EVs) in 2023. Overall, there were 2.4 Million new EV registrations in 2023, recording a notable increase in comparison to 2022 at 2 Million and highlighting Europe’s increasing transition toward EVs. Additionally, the defense and electronics sectors are adopting specialized aluminium grades for components that require thermal conductivity, strength, and corrosion resistance. Research collaboration between universities, public institutions, and private industry is also fostering breakthroughs in alloy development and sustainable production methods. Other than this, digitalization across manufacturing is enhancing process efficiency and waste reduction, enabling aluminium producers to improve output while lowering environmental impact.

Latin America Aluminium Market Analysis

The Latin America aluminium market is experiencing robust growth due to rising demand from emerging sectors such as renewable energy, electric mobility, and consumer electronics. Governments and private investors are increasing support for solar and wind energy projects, where aluminium is widely used in mounting systems, turbine components, and cabling infrastructure. For instance, solar and wind power accounted for 21% of Brazil’s renewable energy capacity in 2023, recording a substantial growth in comparison to 2022 at 17% and 2016 at 5.8%, as per industry reports. Besides this, regional emphasis on economic diversification is encouraging local processing and value-added production, reducing reliance on raw material exports. As digital infrastructure expands, the use of aluminium in data center construction, power grids, and telecommunications is also increasing, supporting overall market growth in the region.

Middle East and Africa Aluminium Market Analysis

The Middle East and Africa aluminium market is significantly influenced by economic transformation, resource abundance, and infrastructure growth. For instance, Saudi Arabia currently has infrastructure projects totaling USD 1.8 Trillion either planned or already underway, according to the Saudi British Joint Business Council. In the Gulf region, nations such as the UAE, Saudi Arabia, Qatar, and Oman are investing heavily in domestic aluminium production projects and efficient smelting capacity, leveraging abundant low-cost energy to establish global competitiveness in primary output. Moreover, numerous governments are investing in industrial zones and special economic areas that promote downstream aluminium manufacturing for sectors such as packaging, electronics, and transportation. The rise of sustainable construction practices is also increasing demand for aluminium in green building materials due to its recyclability and thermal efficiency, further facilitating overall industry expansion.

Competitive Landscape:

Key players are investing in research and development (R&D) activities to develop new alloys and enhance manufacturing processes. This helps them stay competitive by offering innovative products with improved performance characteristics and makes the aluminium market price cost-effective. In line with this, companies are expanding their production capacities to meet aluminium market demand, particularly in regions experiencing rapid industrialization and infrastructure development. They are investing in new smelting facilities, extrusion plants, and rolling mills to increase output and serve diverse markets. Furthermore, major manufacturers are adopting sustainable practices, such as energy-efficient smelting technologies, recycling initiatives, and reducing carbon emissions, to minimize their environmental footprint and meet regulatory requirements.

The report provides a comprehensive analysis of the competitive landscape in the aluminium market with detailed profiles of all major companies, including:

- Alcoa Corporation

- Aluminium Bahrain BSC

- Century Aluminium Company

- China Hongqiao Group Limited

- East Hope Group

- Emirates Global Aluminium PJSC

- Kaiser Aluminium

- Norsk Hydro ASA

- Novelis Inc. (Hindalco Industries Limited)

- Rio Tinto Ltd.

- Vedanta limited

Latest News and Developments:

- July 2025: The Union Minister of India officially launched the Aluminium Vision Document during the International Conference on Sustainable and Responsible Mining through Best Mine Closure Practices. The Vision Document presents a strategy plan for doubling the country's aluminum recycling rate, increasing aluminum manufacturing sixfold by 2047, boosting the use of environmentally friendly technologies, and improving raw material availability through specific institutional and legislative changes.

- June 2025: The VELUX Group and Novelis Inc. signed a multi-year commercial agreement for the supply of aluminium with a high recycled percentage. With this partnership, VELUX roof windows and accessories will be manufactured using flat-rolled aluminium from Novelis that has over 70% recycled content in order to further minimize carbon emissions.

- April 2025: AMG Metals & Materials and Rio Tinto inked a Memorandum of Understanding (MoU) to collaboratively evaluate the viability of establishing a renewable energy-powered integrated low-carbon aluminum production plant in India. As part of this agreement, the companies will examine the possibility of developing a primary aluminum smelter capable of manufacturing up to 1 Million tonnes per year (Mtpa) and alumina production capacity of up to 2 Mtpa.

- March 2025: Novelis Inc., a renowned manufacturer of flat-rolled aluminium goods, officially introduced the first-ever aluminium coil in history, manufactured exclusively from 100% recycled automobile scrap. This innovation, which was engineered and manufactured for the European vehicle market, is a major milestone toward the goal of increased sustainability and circularity in the automotive sector.

- January 2025: The Albanese Labor Government announced a funding of USD 2 Billion for the Australian aluminium sector in an effort to guarantee higher-paying positions for Australian workers throughout the area. As part of this investment, Australian aluminium smelters that transition to renewable energy sources before 2036 will receive targeted assistance through a new Green Aluminium Production Credit.

Aluminium Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Series Covered | Series 1, Series 2, Series 3, Series, 4, Series 5, Series 6, Series 7, Series 8 |

| Processing Methods Covered | Flat Rolled, Castings, Extrusions, Forgings, Pigments and Powder, Rod and Bar |

| End Use Industries Covered | Transport, Building and Construction, Electrical Engineering, Consumer Goods, Foil and Packaging, Machinery and Equipment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alcoa Corporation, Aluminium Bahrain BSC, Century Aluminium Company, China Hongqiao Group Limited, East Hope Group, Emirates Global Aluminium PJSC, Kaiser Aluminium, Norsk Hydro ASA, Novelis Inc. (Hindalco Industries Limited), Rio Tinto Ltd., Vedanta limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aluminium market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global aluminium market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aluminium industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aluminium market reached 72.05 Million Tons in 2024.

The aluminium market is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching 107.07 Million Tons by 2033.

The aluminium market is driven by rising demand in transportation for lightweight, fuel-efficient vehicles, increasing product use in construction for sustainable and durable infrastructure, and strong recycling potential supporting circular economy goals. Additionally, growing applications in packaging, electronics, and renewable energy sectors further expand aluminium market globally.

Asia Pacific currently dominates the aluminium market due to rapid urbanization, booming construction activities, rising automotive and aerospace production, expanding packaging demand, and strong government support for sustainable, lightweight, and recyclable materials.

Some of the major players in the aluminium market include Alcoa Corporation, Aluminium Bahrain BSC, Century Aluminium Company, China Hongqiao Group Limited, East Hope Group, Emirates Global Aluminium PJSC, Kaiser Aluminium, Norsk Hydro ASA, Novelis Inc. (Hindalco Industries Limited), Rio Tinto Ltd., Vedanta limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)