Aluminum Extrusion Market Size, Share, Trends and Forecast by Product Type, Alloy Type, End-Use Industry, and Region, 2025-2033

Aluminum Extrusion Market Size and Share:

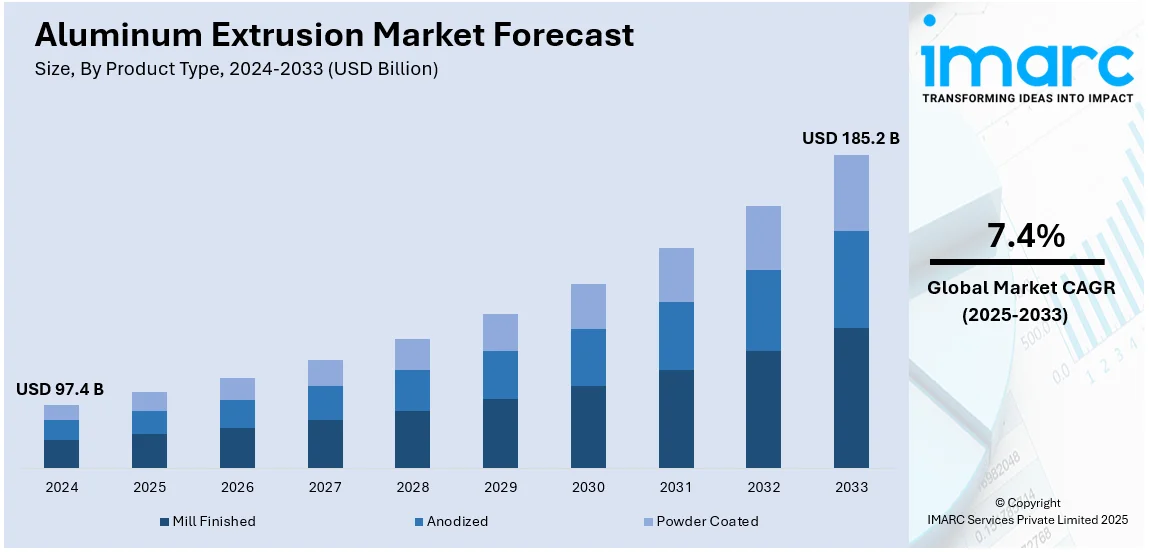

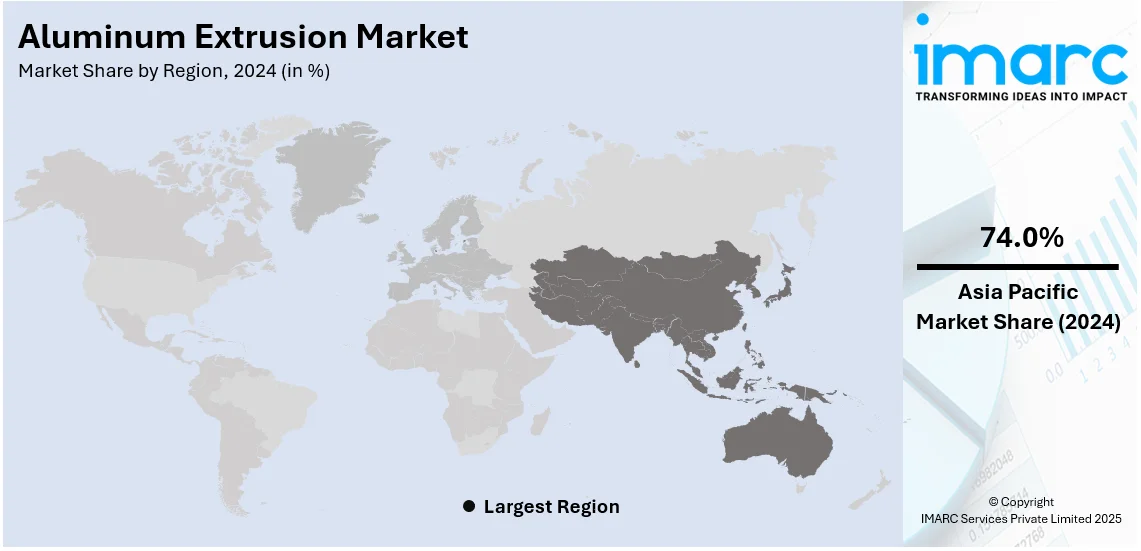

The global aluminum extrusion market size was valued at USD 97.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 185.2 Billion by 2033, exhibiting a CAGR of 7.4% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 74.0% in 2024. The rising focus on sustainable architecture, the availability of raw materials and relatively lower manufacturing costs, and the widespread utilization of aluminum extrusion in the construction and automotive industries are some of the major factors propelling the aluminum extrusion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 97.4 Billion |

| Market Forecast in 2033 | USD 185.2 Billion |

| Market Growth Rate (2025-2033) | 7.4% |

The market growth is primarily driven by rising demand from industries such as automotive, construction, and aerospace, where lightweight and durable materials are prioritized. Rapid urbanization rates and infrastructure development have heightened the use of aluminum extrusions in windows, doors, and structural frameworks. According to industry reports, 57.5% of the total global population lives in urban areas in 2024. In addition, technological advancements in extrusion processes have improved efficiency and enabled the production of complex profiles, catering to diverse applications. Government initiatives encouraging the use of lightweight materials for energy conservation further contribute to global aluminum extrusion market growth.

The United States is emerging as a key regional market for aluminum extrusion, driven by growing demand in sectors such as automotive, construction, and aerospace, where lightweight and strong materials are essential. The shift toward electric vehicles and fuel-efficient transportation has increased the use of aluminum extrusions in vehicle components to reduce weight and improve energy efficiency. As per a report published by the IMARC Group, the United States electric vehicles market size reached USD 44.5 Billion in 2024 and is forecasted to reach USD 386.5 Billion by 2033, exhibiting a CAGR of 27.5% during 2025-2033. Besides this, the recyclability and energy-efficient properties of aluminum align with sustainability goals, encouraging widespread adoption.

Aluminum Extrusion Market Trends:

Increasing demand in the automotive and transportation sector

As environmental concerns push the automotive industry toward more sustainable practices, there is an increasing need for lightweight, energy-efficient materials. By using aluminum components, manufacturers can significantly reduce vehicle weight, thereby improving fuel efficiency and lowering greenhouse gas emissions. As the transportation sector is one of the largest consumers of energy, this transformation has a profound ripple effect. In addition, the high resistance of aluminum to corrosion makes it ideal for external automobile parts exposed to the elements, as well as for use in marine and aerospace applications. Electric vehicles (EVs) also contribute to this demand. As the transition from internal combustion engine vehicles to EVs increases, the need for lightweight materials, such as extruded aluminum, is increasing, particularly for battery enclosures and structural components. According to the IEA, global electric vehicle (EV) sales reached approximately 17 Million in 2024, accounting for more than one in five cars sold worldwide. Besides this, the ongoing investment in public transport infrastructures, including metros, trams, and high-speed trains globally, further contributes to the overall aluminum extrusion market demand.

Expanding construction industry

The aesthetic appeal, corrosion resistance, and high strength-to-weight ratio of aluminum make it a sought-after material for modern architectural designs. Green construction or sustainable building practices are propelling the need for durable and eco-friendly materials. According to industry reports, the global buildings construction market size reached USD 6.8 Trillion in 2024. Moreover, aluminum is recyclable and using it in construction often contributes to LEED (Leadership in Energy and Environmental Design) certification points. Furthermore, the construction industry is experiencing rapid growth in developing countries, partly due to urbanization and growing populations. This uptick in construction activities leads to a higher demand for aluminum extrusion products. According to the aluminum extrusion market forecast, advancements in extrusion technology allow for increasingly complex and aesthetically pleasing designs, further boosting the appeal of aluminum in construction applications.

Technological advancements in manufacturing processes

Advancements in manufacturing technologies, such as direct extrusion, indirect extrusion, and hydrostatic extrusion, are offering higher flexibility and opening new avenues for building more complex shapes and forms with aluminum, creating a favorable aluminum extrusion market outlook. Moreover, Industry 4.0 initiatives are incorporating smart manufacturing practices that include real-time monitoring, predictive maintenance, and data analytics, thus ensuring optimal production levels and quality control. As per industry reports, the global smart manufacturing market size reached USD 358.3 Billion in 2024. These advancements have reduced operational costs and increased output capabilities, allowing manufacturers to offer more competitive pricing and diverse product portfolios. As a result, industries that may have previously overlooked aluminum extrusion due to cost or complexity are now more inclined to consider it as a viable option, thereby expanding the market demand.

Aluminum Extrusion Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aluminum extrusion market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, alloy type, and end-use industry.

Analysis by Product Type:

- Mill Finished

- Anodized

- Powder Coated

Mill finished stands as the largest component holding 57.6% of the market share in 2024. Mill finished extrusions are aluminum profiles that have gone through the extrusion process and are in a form that is ready to be utilized or further processed. These profiles have not been anodized, painted, or otherwise coated and have a fairly smooth surface with some manufacturing lines visible. Moreover, some of the main reasons for the dominance of mill-finished products are their versatility and adaptability. Since they have not undergone additional finishing treatments, they can be easily customized by the end-user for a variety of applications, be it in construction, automotive, or electrical engineering. This flexibility is particularly advantageous for industries that require specific, custom solutions. Skipping the additional treatment processes reduces production time and minimizes costs, making mill-finished products more affordable. Furthermore, the properties of mill-finished aluminum, such as corrosion resistance and high strength-to-weight ratio, are often sufficient for numerous applications, negating the need for further surface treatments.

Analysis by Alloy Type:

- 1000 Series Aluminum Alloy

- 2000 Series Aluminum Alloy

- 3000 Series Aluminum Alloy

- 5000 Series Aluminum Alloy

- 6000 Series Aluminum Alloy

- 7000 Series Aluminum Alloy

6000 series aluminum alloy represents the leading market segment holding 49.7% in 2024. 6000 series aluminum alloy is primarily composed of aluminum, magnesium, and silicon. It is renowned for its versatility, combining multiple beneficial attributes, including high strength, excellent corrosion resistance, and superior machinability. The 6000 series is particularly indispensable in sectors such as automotive and construction, where there is an increasing demand for materials that are both lightweight and strong. In the automotive industry, the alloys are integral to the development of parts that are durable yet light enough to enhance fuel efficiency and reduce greenhouse gas emissions. Furthermore, the construction industry values the 6000 series for its excellent formability, making it a go-to-choice for structural components such as window and door frames, curtain walls, and roofing systems. Its corrosion-resistant qualities and the ease with which it can be anodized add to its durability and aesthetic versatility, making it suitable for both indoor and outdoor applications.

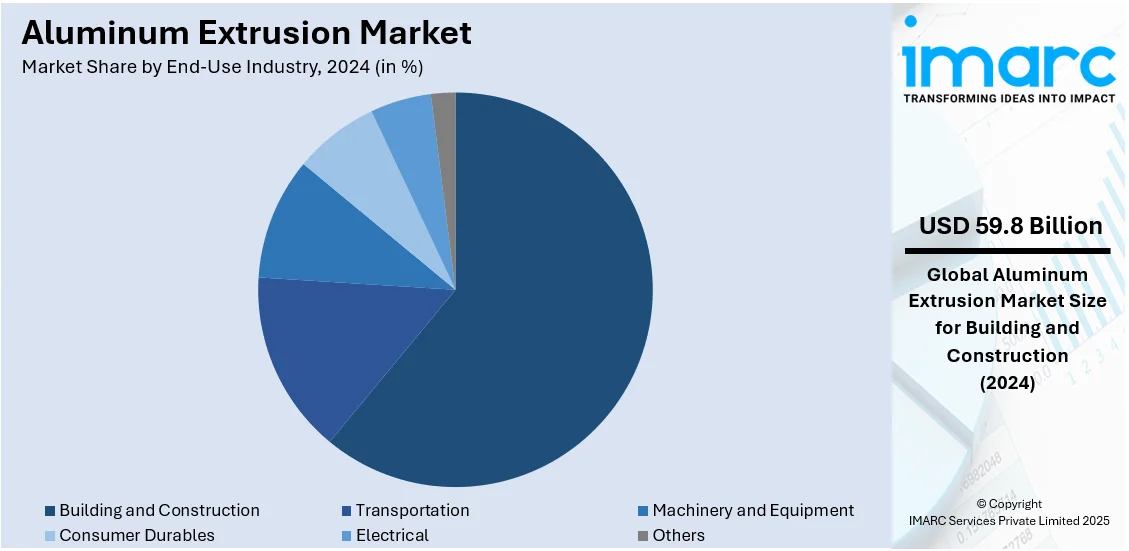

Analysis by End-Use Industry:

- Building and Construction

- Transportation

- Machinery and Equipment

- Consumer Durables

- Electrical

- Others

Building and construction exhibits a clear dominance in the market holding 61.4% of market share in 2024. The construction industry values aluminum extrusions for their versatility and aesthetic appeal. Advancements in extrusion technology have allowed for increasingly intricate and complex designs, thereby expanding architectural possibilities. This is particularly vital in an era where sustainable yet aesthetically pleasing construction is becoming the norm. Moreover, aluminum is recycle-friendly, which is in line with green building campaigns, also contributing toward LEED certification points. Rapid urbanization and related economic activities, particularly in developing economies, have also increased construction activities. Durable and cost-effective materials are more in demand because of the rising rate of construction activity, and aluminum extrusions fit perfectly. Furthermore, as buildings are designed to become increasingly complex with incorporated systems for improved energy efficiency, the flexibility of aluminum extrusions, where designs can be easily varied to suit different applications, makes this material even more attractive to builders and architects.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest region holding 74.0% of market share. The automotive industry in the Asia Pacific region is experiencing an upward growth trajectory, with countries such as Japan and South Korea being notable automotive powerhouses and China emerging as the largest auto market globally. The emphasis on lightweight and fuel-efficient vehicles to meet increasingly stringent environmental regulations further propels the need for aluminum extrusion products. Moreover, the Asia Pacific region is a hub for manufacturing and technology, sectors that also make extensive use of aluminum extrusions. Whether it is in consumer electronics, machinery, or even aerospace, the diversity of applications adds to the consumption of extruded aluminum in the region. As per the aluminum extrusion market forecast, several governments in the region are actively investing in infrastructure development, further propelling demand for aluminum across various sectors, including transportation and public utilities. Furthermore, rapid industrialization, expanding construction, and favorable economic conditions in the Asia Pacific region further solidify its dominant position in the global aluminum extrusion market, ensuring sustained growth.

Key Regional Takeaways:

United States Aluminum Extrusion Market Analysis

In 2024, the United States accounts for over 83.70% of the aluminum extrusion market in North America. This growth has resulted from the massive demand for light, high-strength aluminum extrusions across industries. The automotive industry is highly adopting aluminum extrusions due to fuel-efficient, robust, and green vehicles, in compliance with stricter regulations imposed on the production of greenhouse gas-emitting vehicles. Moreover, the construction machinery market, which has grown to USD 43.53 Billion in 2023, also indicates the increased demand for strong and durable products, propelling demand for materials such as aluminum to be used as a cost-effective material in construction machinery and other infrastructure-related uses. Aluminum profiles are also vastly employed in the building construction industry due to their excellent corrosion resistance and aesthetic value with cost-effectiveness. Additionally, the increased demand for electrical components, which include renewable energy solutions such as solar panels and wind turbines, is driving the aluminum extrusion market. The demand for modern, energy-efficient systems by the infrastructure sector is driving the use of aluminum extrusions in transportation and utility applications. Furthermore, technological advancements in extrusion processes are fueling growth as they enable greater product customization and precision. The emphasis on sustainability and recycling practices is also reinforcing the leading position of aluminum in U.S. manufacturing.

Asia Pacific Aluminum Extrusion Market Analysis

The Asia Pacific aluminum extrusion market is booming, driven by industrialization and urbanization of the region. World Bank states that East Asia and Pacific is the most rapidly urbanizing region globally with an average annual rate of 3%. High-scale urban development within China, India, and Japan is fueling the demand for aluminum extrusions, particularly in building and infrastructure work. A major market driver also arises from the acceptance of aluminum extrusions by automotive industries to address efficiency in fueling and reduce greenhouse gas emissions. The renewable energy sector, along with growth in solar and wind energy systems, is gaining momentum and expanding the demand for aluminum extrusions in energy efficiency technologies. Government policies encouraging energy efficiency and sustainable practices further support the growth of the market. Additionally, the increasing manufacturing capacity in China is further solidifying the region's position as a global leader in aluminum extrusion production and export.

Europe Aluminum Extrusion Market Analysis

The aluminum extrusion market in Europe is rapidly expanding. Increased usage of lightweight and low-energy products and materials by diversified industries, primarily automotive industries seeking to make vehicles lighter for improvement of fuel efficiency, along with stricter environmental laws, is the prime force behind the aluminum extrusion industry's rapid development. New registrations for electric cars in Europe, estimated by the International Energy Agency (IEA), are almost 3.2 Million as of 2023, almost 20% higher compared to figures in 2022. Demand for aluminum extrusions consequently increases since most electric vehicles require enclosures for batteries, body frames, and other structural components. The market demand is also considerably boosted by the construction industry. Aluminum extrusions are majorly required in large quantities for the production of window and door frames and roofing. Furthermore, the solar and wind sector, particularly the renewable energy sector, greatly requires aluminum for manufacturing various components of turbine and solar panel frames. Advanced technological development in the extrusion processes improves product customization and accuracy, while the growing concerns about sustainability and recycling further emphasize the increasing use of aluminum as a preferred material in Europe.

Latin America Aluminum Extrusion Market Analysis

Rising demand for lightweight, corrosion-resistant materials for construction, automotive, and renewable energy is fueling the Latin American aluminum extrusion market. With urbanization levels reaching nearly 80%, there is an urgent need for tough, energy-efficient materials in the construction of modern infrastructure and houses. This change in the automobile industry, wherein aluminum is becoming the preference for fuel-efficient vehicles, further drives market growth. Also, the renewable energy sector, specifically the solar energy segment, is fueling demand for aluminum extrusions in the frame of solar panels. Policies in favor of sustainability and infrastructure are also boosting market expansion.

Middle East and Africa Aluminum Extrusion Market Analysis

The Middle East and Africa aluminum extrusion market is driven by a boom in the construction and infrastructural development of countries such as the UAE and Saudi Arabia, where the steel market had a valuation of USD 8.7 Billion in 2024. Building facades, windows, and roofing sections are major sectors where extruded aluminum is significantly used, providing lightweight and tough properties while increasing energy efficiency. The automotive sector has also witnessed market growth as companies transition to using aluminum for lightening their vehicle to increase fuel efficiency. Moreover, an expanding renewable energy sector, such as solar, is raising demand for aluminum extrusions in the solar panel infrastructure and associated frameworks.

Competitive Landscape:

Key players in the aluminum extrusion market are driving growth through strategic acts such as increased capacity, more advanced technologies for extrusion purposes, and eco-friendly initiatives in the manufacturing system. Companies are advancing their extrusion methods with complex technologies to produce precisely designed profiles intended for various purposes in industries such as automotive, aerospace, and construction. Recent emphasis on sustainability has increased the use of more environmentally sensitive manufacturing processes, using recycled aluminum products. Collaborations and partnerships with end-use industries also enhance product customization and expand market reach. Major players are also establishing new production facilities and upgrading the existing ones to cater to the increased demand for lightweight, durable, and energy-efficient aluminum solutions globally.

The report provides a comprehensive analysis of the competitive landscape in the aluminum extrusion market with detailed profiles of all major companies.

Latest News and Developments:

- June 2024: LoadLok has introduced the IsoLok 3073 Alu RS Track, an advanced aluminum extrusion track system designed to improve payload capacity and production efficiency for refrigerated trailers.

- February 2024: Atomic13, founded by Eric Donsky, aims to scale the Shear Assisted Processing and Extrusion (ShAPE) technology developed by PNNL to recycle aluminum scrap into low-carbon extruded parts, initially targeting the building industry. The technology, which transforms aluminum scrap into high-quality materials, helps meet energy-efficient standards such as LEED and supports circularity in the aluminum market by reducing reliance on primary aluminum.

- January 2024: Superior Extrusion Incorporated has completed the installation of a new aluminum extrusion press and expanded its facilities in Gwinn, MI. The project includes acquiring 25 acres of land and constructing a 138,000 sq ft building to house the new 9-inch, 3,000-ton press. This expansion enhances the company's capacity and capabilities, positioning it for future growth and securing its long-term sustainability.

- January 2024: Jindal Aluminium, India’s largest aluminum extrusion company, has launched a new fabrication division. Powered by tools developed in-house, the new segment is another value-added offering after the company’s launch of an environment-friendly powder coating unit.

Aluminum Extrusion Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment: Assessment:

|

| Product Types Covered | Mill Finished, Anodized, Powder Coated |

| Alloy Types Covered | 1000 Series Aluminum Alloy, 2000 Series Aluminum Alloy, 3000 Series Aluminum Alloy, 5000 Series Aluminum Alloy, 6000 Series Aluminum Alloys, 7000 Series Aluminum Alloy |

| End-Use Industries Covered | Building and Construction, Transportation, Machinery and Equipment, Consumer Durables, Electrical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aluminum extrusion market from 2019-2033.

- The aluminum extrusion market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aluminum extrusion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aluminum extrusion market was valued at USD 97.4 Billion in 2024.

The aluminum extrusion market is projected to exhibit a CAGR of 7.4% during 2025-2033, reaching a value of USD 185.2 Billion by 2033.

The market is driven by the increasing demand for lightweight and durable materials in automotive and aerospace industries, rapid urbanization and infrastructure development accelerating construction applications. Advancements in extrusion technology enabling complex profile designs, growing emphasis on sustainability and recyclability of aluminum, further fuels market growth.

Asia Pacific currently dominates the aluminum extrusion market, accounting for a share of 74.0% in 2024. The dominance is fueled by the region's robust industrial growth, rapid urbanization, and high demand from the construction, automotive, and electronics sectors, particularly in China and India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)