Alternators Market Size, Share, Trends and Forecast by Type, Voltage, Rated Power, Application, Speed, Weight, End-Use Sector, Fuel Used, and Region, 2025-2033

Alternators Market Size and Share:

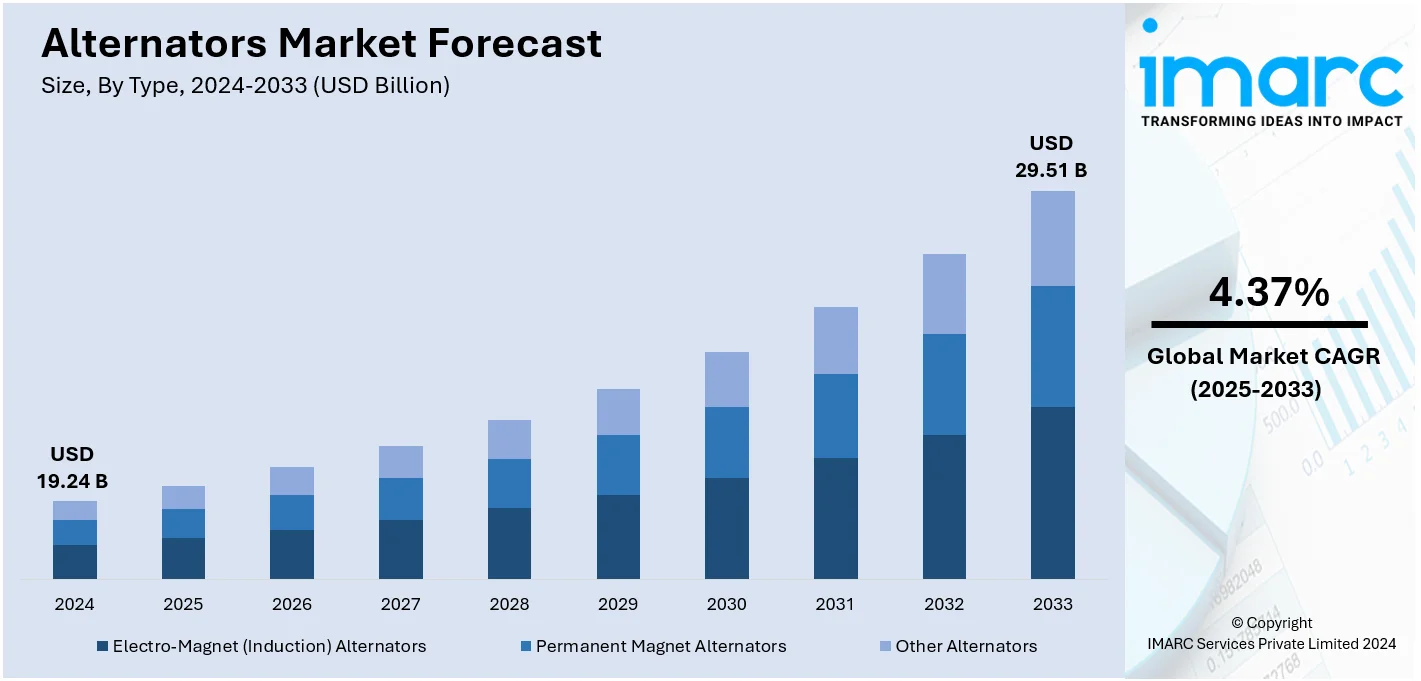

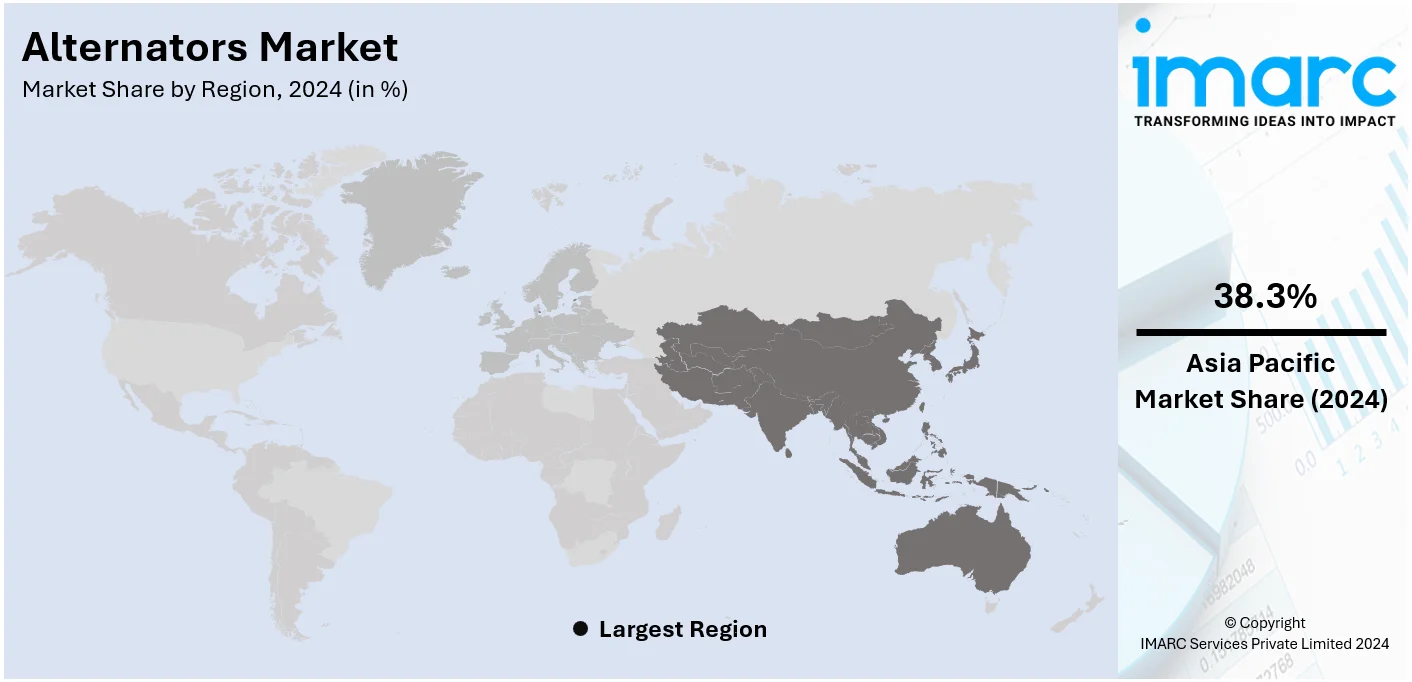

The global alternators market size was valued at USD 19.24 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 29.51 Billion by 2033, exhibiting a CAGR of 4.37% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 38.3% in 2024. The escalating demand for cargo and commercial ships, the growing trend towards the decentralization of power generation, and the rising industrialization are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 19.24 Billion |

|

Market Forecast in 2033

|

USD 29.51 Billion |

| Market Growth Rate (2025-2033) | 4.37% |

The global alternators market is driven by the increasing demand for reliable power solutions across industrial, commercial, and residential sectors. Rapid urbanization, coupled with expanding infrastructure and manufacturing activities, has heightened the need for efficient power generation systems. Technological advancements in alternators, offering improved energy efficiency and durability, further boost adoption. In addition, the growing penetration of renewable energy systems and backup power solutions in emerging markets also supports alternators market growth. Moreover, the rising adoption of electric vehicles and hybrid systems accelerates demand for advanced alternators, making them integral to sustainable and energy-efficient applications globally.

The United States plays a critical role in the global alternators market, mainly influenced by its well-developed automotive segment and resilient industrial base. Elevated need for effective power generation solutions across key sectors, combined with heightening investments in renewable energy infrastructure, bolsters market expansion. For instance, in December 2024, U.S. Department of Agriculture announced significant investment of USD 4.37 billion for clean energy solutions. In addition, the country’s rising focus on technological advancements has resulted in innovations in alternator design, significantly improving both dependability and efficacy. Magnifying infrastructure ventures and the requirement for seamless power in crucial industries sectors, mainly including manufacturing and healthcare, further aid in expansion of alternators market size. Moreover, strong distribution networks and a focus on sustainability solidify the United States' position in the global alternators market.

Alternators Market Trends:

Industrialization and Infrastructure Development

Industrialization plays a significant role in driving the alternators industry. As emerging economies continue to develop, the need for reliable sources of electricity becomes more pronounced. Alternators are an essential component in standby and portable generators, commonly used in industrial applications for uninterrupted power supply. This is crucial in sectors, including manufacturing, construction, and data centers, where even a short period of power outage can result in significant financial loss and operational disruptions. The global data center market size reached USD 213.6 Billion in 2024. Furthermore, infrastructure projects, such as the construction of airports, highways, and smart cities, also rely on heavy machinery and equipment powered by alternators. Given the scale and growth of industrial activities globally, this is a significant market driver that shows little sign of abating.

Renewable Energy Integration

The push for renewable energy is another strong market driver for alternators. As countries move towards more sustainable energy solutions, alternators find applications in systems, including wind turbines and hydroelectric generators. These renewable energy technologies rely on alternators to convert mechanical energy into electrical energy, which is then fed into the grid or used locally. Around 14% of the world's primary energy now comes from renewable technologies, according to Our World in Data. In confluence with this, the global commitment to reduce carbon emissions and shift away from fossil fuels is likely to provide a substantial market for alternators designed to meet the specific needs of renewable energy generation. These alternators often have to meet high standards of efficiency and reliability, making them a specialized and growing segment within the broader alternators market.

Continuous Technological Advancements

Innovation and technological advancements are propelling the alternators industry to new heights. Improved materials, more efficient design models, and enhanced manufacturing processes are contributing to the production of alternators that are lighter, more efficient, and more reliable. In addition, smart alternators, capable of varying their output based on the electrical load and battery condition, are gaining traction. These advancements not only serve the traditional markets more effectively but also open doors to new applications. For instance, advanced alternators can be used in electric ships, aerospace, and even in off-grid remote power solutions. According to reports, there were 586 battery-powered ships in operation worldwide as of February 2023. As technology continues to evolve, the market scope diversifies, thereby boosting the alternators market size.

Alternators Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global alternators market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on type, voltage, rated power, application, speed, weight, end-use sector, and fuel used.

Analysis by Type:

- Electro-Magnet (Induction) Alternators

- Permanent Magnet Alternators

- Other Alternators

Permanent magnet alternators stand as the largest type in 2024, holding around 44.0% of the market. The market for permanent magnet alternators is experiencing significant growth, driven primarily by their higher efficiency and compact design compared to traditional alternators. One of the main market drivers is the renewable energy sector, especially wind power generation. Permanent magnet alternators are well-suited for variable-speed applications, making them ideal for wind turbines, where they can capture energy more efficiently over a wide range of wind speeds. In addition, their lightweight design benefits the automotive industry, particularly in electric and hybrid vehicles, where reducing overall weight is crucial for maximizing fuel efficiency. The marine sector also shows a growing preference for these alternators due to their ability to withstand harsh environmental conditions, including high humidity and saltwater exposure. Furthermore, their use in decentralized power generation systems, such as microgrids and portable generators, is rising because of their reliable performance and lower maintenance requirements. Overall, the versatility, efficiency, and durability of permanent magnet alternators make them increasingly popular across various industries, driving significant increase in alternators market share.

Analysis by Voltage:

- 220V-440V Alternators

- More than 440V Alternators

- Less than 220V Alternators

220V-440V stand as the largest voltage in 2024, holding around 56.3% of the market. The demand for 220V-440V voltage alternators is particularly strong due to their versatile range of applications, effectively serving both industrial and commercial sectors. One key market driver is the manufacturing industry, where machinery often operates within this voltage range, requiring reliable and efficient power generation. These alternators are also frequently used in medium-sized commercial facilities, including hotels, hospitals, and shopping malls to power HVAC systems, lighting, and other essential utilities. In the construction sector, they are critical for powering a variety of equipment and tools on-site, helping to keep projects on schedule. The agricultural sector, too, relies on these alternators to operate irrigation systems, tractors, and harvesters. Additionally, these alternators are suitable for backup power solutions in residential complexes, ensuring a steady supply of electricity during outages. Their widespread applicability makes them a staple in multiple sectors, thereby driving steady market growth. Moreover, technological advancements aimed at increasing efficiency and durability further bolster their demand, making 220V-440V alternators an enduring segment in the alternators industry.

Analysis by Rated Power:

- <1kW

- 1 kW-5 kW

- 5 kW-50 kW

- <50KW-500 kW

- 500KW-1500 kW

- 1500KW-5000 kW

- >5000KW

1500KW-5000kW leads the market with around 51.1% of market share in 2024. The market for alternators with rated power between 1500kW and 5000kW is seeing significant growth, largely driven by their applications in heavy industries and large-scale energy projects. The utility sector, where these high-capacity alternators are often integrated into power plants for grid electricity generation, is positively influencing the market. In addition, the mining industry also heavily relies on these alternators to operate machinery that performs resource extraction, conveying, and processing. Another key driver is the growth in data centers, which require substantial and reliable power supplies to maintain uptime and data integrity; these alternators fulfill the need for robust backup systems. Large maritime vessels, such as cargo ships and specialized naval crafts, often use alternators in this power range for their onboard electrical systems. Moreover, the increasing demand for reliable, high-capacity power solutions in sectors, such as utilities, mining, and maritime applications is fostering steady growth in the market for alternators with a rated power between 1500kW and 5000kW.

Analysis by Application:

- Industrial Applications

- Automotive and Transportation

- Power Generation

- Standby Power

- Others

Industrial applications lead the market with around 35.3% of market share in 2024. The industrial sector serves as a significant market driver for the alternators industry, given the critical need for consistent and reliable power in manufacturing, processing, and operations. Various types of machinery, from conveyor belts to CNC machines, rely on electrical power generated by alternators. Additionally, the demand is especially high in industries, including petrochemicals, textiles, and metallurgy, where continuous power supply is essential for maintaining production levels and ensuring safety. The expansion of industrial zones and manufacturing hubs, particularly in emerging economies, is contributing to increased demand for high-quality, efficient alternators. Additionally, the growing emphasis on automation and Industry 4.0 technologies is escalating the need for alternators capable of supporting complex, automated systems. Furthermore, as industries adopt more energy-efficient practices, the push for alternators that offer higher efficiency and lower maintenance costs is intensifying.

Analysis by Speed:

- Low Speed Alternators

- Medium Speed Alternators

- High Speed Alternators

- Ultra High-Speed Alternators

High speed alternators lead the market with around 60.2% of market share in 2024. The market for high speed alternators is experiencing robust growth, fueled by their advantages of compact design and higher efficiency. One significant market driver is the aerospace industry, where high-speed alternators are employed to minimize weight while maintaining a reliable electrical power supply for onboard systems. Similarly, high-performance automotive applications, including electric and hybrid vehicles, are increasingly adopting high-speed alternators to optimize fuel efficiency and overall performance. In the medical sector, these alternators are utilized in critical equipment, such as MRI machines, where high-speed, high-efficiency operation is essential. The renewable energy sector, particularly in wind and hydroelectric power generation, also benefits from high speed alternators, as they can adapt to fluctuating power generation conditions more rapidly. Another driving factor is the push for miniaturization in various industrial applications, where space is at a premium, but performance cannot be compromised. High-speed alternators meet this need, offering a compact yet powerful solution.

Analysis by Weight:

- Low Weight Alternators

- Medium Weight Alternators

- High Weight Alternators

Low weight alternators lead the market with around 44.9% of market share in 2024. The demand for low weight alternators is on the rise, driven by sectors that prioritize weight reduction without compromising on power output. One significant market driver is the automotive industry, particularly in the context of electric and hybrid vehicles, where every reduction in weight contributes to improved fuel efficiency and range. These low-weight alternators are also increasingly used in aerospace applications, where weight is a critical factor affecting fuel consumption and overall performance. Portable generators, often used for outdoor recreational activities or emergency situations, benefit from lighter alternators to enhance portability and ease of use. In confluence with this, the marine industry is another sector where reducing weight is crucial, as it directly impacts the buoyancy and fuel efficiency of vessels. Furthermore, the trend toward miniaturization in industrial machinery and equipment has made low-weight alternators more appealing. Their lighter weight, without a sacrifice in efficiency or reliability, makes them ideal for a range of applications, thus fueling growth in this specific market segment.

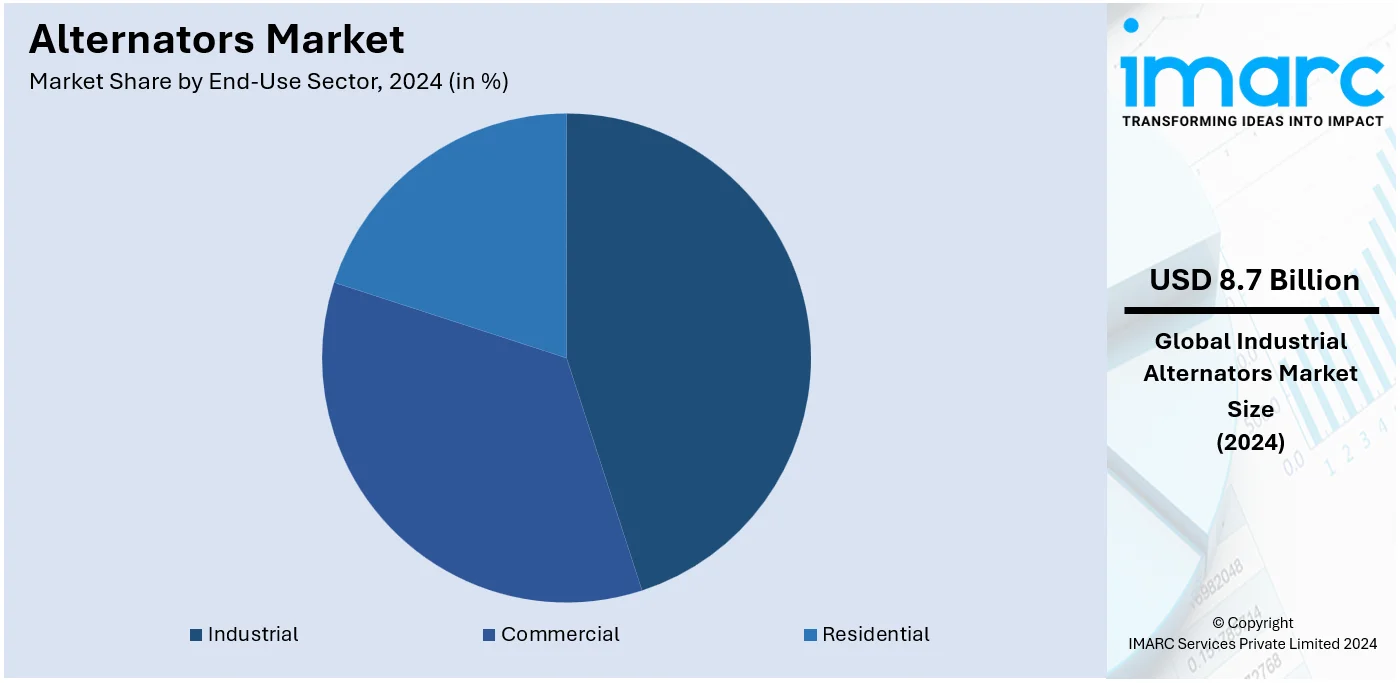

Analysis by End-Use Sector:

- Industrial

- Commercial

- Residential

Industrial leads the market with around 45.2% of market share in 2024. The industrial end-use sector is a major market driver for the alternators industry due to its vast and varied demand for reliable and efficient power generation. In manufacturing plants, a continuous power supply is critical for running machinery and automated systems, making alternators a key component. The growth of heavy industries, such as steel, cement, and chemicals, which require high-power alternators for their energy-intensive processes, also contributes to market expansion. Moreover, sectors including oil and gas have specific needs for explosion-proof and ruggedized alternators suitable for challenging operational conditions. Furthermore, the ongoing trend towards industrial automation and the adoption of Internet of Things (IoT) technologies further heightens the demand for highly efficient and smart alternators capable of adapting to complex electrical loads. As industrial activities continue to grow, especially in emerging economies undergoing rapid industrialization, the need for advanced, durable, and efficient alternators is projected to increase, thereby driving significant growth in this market segment.

Analysis by Fuel Used:

- Fossil fuel

- Natural

Natural fuel leads the market with around 41.7% of market share in 2024. The use of natural fuel, including natural gas and biofuels serves as a significant market driver in the alternators industry. As the global focus shifts toward cleaner and more sustainable energy solutions, natural-fuel-powered generators featuring alternators are increasingly adopted for both standby and prime power applications. These generators are particularly popular in sectors that require eco-friendly options, such as healthcare, data centers, and public utilities. In remote locations where renewable energy infrastructure is challenging to implement, natural fuel generators with efficient alternators offer a more environmentally responsible alternative to traditional diesel generators. Additionally, the growing interest in cogeneration or combined heat and power (CHP) systems, which make use of natural fuels for highly efficient electricity and heat production, also contributes to the demand for high-performance alternators. Regulatory pressures to reduce carbon emissions and the volatile prices of conventional fuels are further driving businesses and industries to adopt natural fuel alternatives, boosting the market for compatible, efficient, and robust alternators.

Regional Analysis:

- Asia-Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 38.3%. The alternator market in the Asia-Pacific (APAC) region is driven by rapid industrialization, urbanization, and the increasing demand for electricity. The automotive industry, particularly in China, South Korea, India, and Japan, plays a significant role, with electric vehicle (EV) adoption on the rise. According to industry reports, China leads with an EV penetration of 27.1%, while South Korea has achieved 10.3%. In contrast, countries like Indonesia, Vietnam, Malaysia, the Philippines, and Thailand have EV penetration ranging from 0.1% to 2.5%, indicating slower adoption in these markets. Additionally, the expansion of the construction and mining sectors creates a demand for reliable power generation solutions, particularly in off-grid areas. The region’s increasing focus on renewable energy projects, such as wind and solar farms, also drives the need for high-performance alternators. Governments across APAC are supporting green technologies and emissions reduction, providing a favorable environment for the market’s growth. Overall, the region's evolving energy needs and automotive trends ensure continued expansion of the alternator market.

Key Regional Takeaways:

United States Alternators Market Analysis

In 2024, United States accounted for the 86.00% of the market share in North America. The alternator market in the United States is experiencing growth driven by several factors, including increasing demand for electric vehicles (EVs), advancements in manufacturing technologies, and a focus on renewable energy. The U.S. Energy Information Administration reports that the combined share of battery electric vehicles, plug-in hybrid electric vehicles, and in total new light-duty vehicle (LDV) sales increased from 17.8% in Q1 2024 to 18.7% in Q2 2024 . This upward trend in EV adoption is fueling the demand for high-performance alternators, as these vehicles require efficient power generation solutions. Additionally, the shift towards fuel-efficient and environmentally friendly technologies in the automotive sector further contributes to market growth. The increasing adoption of renewable energy, such as wind and solar power, also drives the demand for alternators in energy systems. Moreover, strong investments in infrastructure, industrial activities, and the construction sector further support the market, as these industries require reliable backup power solutions. As a result, the U.S. alternator market is set for continued expansion, driven by technological advancements and the ongoing shift toward cleaner, more sustainable energy solutions.

North America Alternators Market Analysis

The North America market for alternators is experiencing steady growth, driven by the expansion of renewable energy projects, such as wind and solar farms, where alternators are essential components for electrical generation. In addition, the robust manufacturing industry in the region demands reliable and efficient alternators for powering various types of machinery. The construction sector, which is witnessing a growth in both residential and commercial building projects, requires alternators for on-site power generation. For instance, as per industry reports, Canada's construction segment is anticipated to reach around CAD 222.11 Billion by the year 2024, exhibiting growth by 3.9%. Apart from this, the growing emphasis on disaster preparedness and grid stability, which has led to increased investment in backup and emergency power solutions, including portable and standby generators equipped with alternators. The automotive sector, particularly the electric vehicle (EV) and hybrid markets, also contributes to the demand for highly efficient and lightweight alternators. As technology advancements continue to improve the efficiency and reliability of alternators, the North American market is poised for sustained growth, driven by a blend of traditional and emerging applications.

Europe Alternators Market Analysis

In Europe, the alternator market is primarily fueled by the region's focus on sustainable energy solutions, technological progress, and the growing transition to electric vehicles (EVs). According to the International Energy Agency (IEA), in 2023, Europe saw approximately 3.2 million new electric car registrations, reflecting a 20% rise from the 2022 figures. In the European Union, sales amounted to 2.4 Million, reflecting similar growth. This surge in EV adoption, alongside Europe’s aggressive environmental policies and emissions reduction targets, has significantly boosted the demand for high-performance alternators, essential for electric and hybrid vehicles. Furthermore, Europe’s strong focus on renewable energy solutions, such as wind and solar power, contributes to the market growth, as alternators play a key role in power generation. Industrial sectors, including manufacturing, mining, and construction, continue to support the demand for alternators as companies seek reliable backup power systems. In addition, the ongoing investments in smart grid technologies, infrastructure, and green initiatives across the region create a favorable market environment. These factors, combined with Europe’s continued commitment to carbon neutrality and sustainable energy, position the alternator market for further expansion in the coming years.

Latin America Alternators Market Analysis

The alternator market in Latin America is driven by the growing automotive industry, increasing demand for renewable energy solutions, and expanding infrastructure projects. According to data from the National Association of Sustainable Mobility of Colombia (Andemos) reported to DW, a total of 118,191 hybrid and electric vehicles were registered in 2021, more than double the 57,078 units registered in 2020. This surge in EV adoption is contributing to the rising demand for alternators in the region. Additionally, infrastructure development and renewable energy projects, particularly in wind and solar power, further boost the need for high-performance alternators across various sectors.

Middle East and Africa Alternators Market Analysis

The alternator market in the Middle East and Africa is primarily driven by expanding infrastructure, particularly in the construction, mining, and oil & gas sectors. According to the Energy Information Administration (EIA), In 2023, Saudi Arabia represented approximately 40% of the Middle East’s oil usage, ranking as the fifth-largest global consumer of liquid fuels. Saudi Arabia's total liquid fuel consumption grew by 2% annually, climbing from 3.6 million b/d in 2022 to 3.7 million b/d in 2023. This growing energy demand in sectors like oil and gas drives the need for reliable power generation solutions, including alternators.

Competitive Landscape:

The global alternators market is represented by vigorous competition among major players actively emphasizing on dependability, effectiveness, and advancements. Key companies are leading the market with a wide range of product portfolio and innovative technologies to address the evolving needs of major sectors, such as power generation, automotive, and industrial. In addition, competitive differentiation is attained through heavy research and development investments targeted at improving sustainability, energy efficiency, and product performance. Moreover, emerging firms are currently utilizing regional insights and cost-efficient production to achieve major market share. The market also is also witnessing tactical acquisition, partnerships, and mergers as prevalent strategies to proliferate distribution networks and solidify market foothold. Furthermore, heightening requirement for personalized solutions facilitates competition, bolstering advancements across the alternators segment globally. For instance, in November 2024, STAMFORD | AvK presented the adaptable STAMFORD S series alternators, including the S7 and S9 models, capable of delivering both high and low voltage outputs. Featuring the CoreCooling airflow system with excellent effectiveness, this range offers superior thermal management. The dedicated S series alternators are engineered for higher power density and seamless integration, supported by flexible feet for easy adaptability.

The report provides a comprehensive analysis of the competitive landscape in the alternators market with detailed profiles of all major companies, including:

- Cummins Inc. (Stamford-Avk)

- Mecc Alte SpA

- Leroy-Somer, Inc.

- Valeo Service SAS

- DENSO Europe BV

- Hyundai Electric & Energy Systems Co., Ltd.

Latest News and Developments:

- October 2024: Revatek has launched the Altion and Altion Max alternator regulators, designed to enhance the charging and management of high-power battery systems. The Altion integrates years of R&D, offering advanced microprocessor architecture, universal compatibility, and user-friendly features, making it a highly versatile solution for lithium and lead-acid power systems.

- June 2024: EcoFlow has launched its 800W Alternator Charger in Australia, enabling fast charging of EcoFlow devices by harnessing vehicle alternator energy. In addition to charging, it functions as a jump starter and battery maintainer. The device can recharge a DELTA 2 in 1.3 hours while driving and allows pass-through charging for appliances, offering a more efficient alternative to traditional generators.

- bARCO Marine has launched the ARCO Zeus alternators (A275L and A225S), designed for high power output in marine, RV, military, and commercial applications. These alternators feature advanced cooling technology, running 8-20% cooler than competitors, and include innovations like heat-shedding coatings, exterior rectifiers, and dual cooling fans for enhanced performance.

- May 2024: EAV and DENSO have partnered to develop a super-efficient connected actively cooled eCargo bike named EAV2Cool. The EAV2Cool features a 1.4m³ rear compartment that can be maintained at a temperature of between 2°C - 5°C for 10 hours in 30°C heat.

- August 2023: TCPL GES, a subsidiary of Tata Cummins Private Limited, signed an MoU with the Government of Jharkhand to set up a manufacturing plant for low-to-zero-emission technologies. The plant will produce fuel-agnostic powertrain solutions, including Hydrogen Internal Combustion Engines, Battery Electric Vehicle Systems, Fuel Cell Electric Vehicle Systems, and Fuel Delivery Systems.

Alternators Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electro-Magnet (Induction) Alternators, Permanent Magnet Alternators, Other Alternators |

| Voltages Covered | 220V-440V Alternators, More than 440V Alternators, Less than 220V Alternators |

| Rated Powers Covered | <1kW, 1 KW-5 KW, 5 KW-50 KW, <50KW-500 KW, 500KW-1500 KW, 1500KW-5000 KW, >5000KW |

| Applications Covered | Industrial Application, Automotive and Transportation, Power Generation, Standby Power, Others |

| Speeds Covered | Low Speed Alternators, Medium Speed Alternators, High Speed Alternators, Ultra High-Speed Alternators |

| Weights Covered | Low Weight Alternators, Medium Weight Alternators, High Weight Alternators |

| End-Use Sectors Covered | Industrial, Commercial, Residential |

| Fuels Used Covered | Fossil Fuel, Natural |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Cummins Inc. (Stamford-Avk), Mecc Alte SpA, Leroy-Somer, Inc., Valeo Service SAS, DENSO Europe BV, Hyundai Electric & Energy Systems Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the alternators market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global alternators market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the alternators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An alternator is an essential electrical device that converts mechanical energy into alternating current (AC) electricity. Widely used in automotive, industrial, and power generation sectors, alternators are critical for supplying reliable power to various systems, ensuring operational efficiency and continuity across diverse applications.

The alternators market was valued at USD 19.24 Billion in 2024.

IMARC estimates the global alternators market to exhibit a CAGR of 4.37% during 2025-2033.

The global alternators market is driven by increasing demand for reliable power solutions across industries, growth in automotive and industrial sectors, advancements in alternator technology for enhanced efficiency, and rising adoption of renewable energy systems. Expanding infrastructure projects and robust energy requirements further contribute to market growth.

According to the report, permanent magnet alternators represented the largest segment by type, driven by their efficiency and reliability in diverse applications.

220V-440V alternators lead the market by voltage, driven by wide applicability in industrial and commercial setups.

1500 kW-5000kW leads the market by rated power, driven by the need for high-capacity power generation.

Industrial applications lead the market by application, driven by demand for reliable power in manufacturing and processing.

High speed alternators lead the market by speed, driven by efficiency and compact design.

Low weight alternators lead the market by weight, driven by portability and ease of installation.

Industrial leads the market by end-use sector, driven by extensive use in manufacturing and energy sectors.

Natural fuel leads the market by fuel, driven by the efficiency and availability of natural fuel sources.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Alternators market include Cummins Inc. (Stamford-Avk), Mecc Alte SpA, Leroy-Somer, Inc., Valeo Service SAS, DENSO Europe BV, Hyundai Electric & Energy Systems Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)