Alpha Emitter Market Size, Share, Trends and Forecast by Type of Radionuclide, Medical Application, End User, and Region, 2025-2033

Alpha Emitter Market Size and Share:

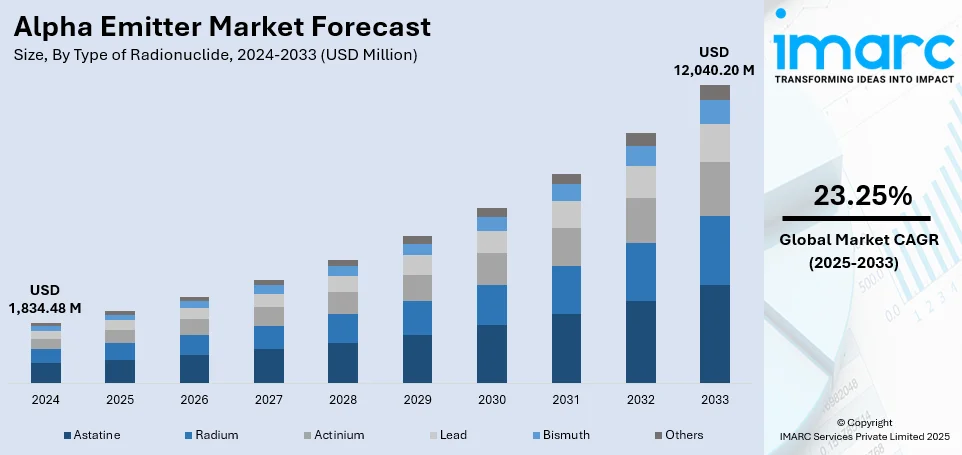

The global alpha emitter market size was valued at USD 1,834.48 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 12,040.20 Million by 2033, exhibiting a CAGR of 23.25% from 2025-2033. North America currently dominates the market, holding a market share of over 43.7% in 2024. Factors such as the increasing focus on targeted cancer treatments, along with the rising number of new nuclear-medicine-based product approvals, are bolstering the alpha emitter market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,834.48 Million |

|

Market Forecast in 2033

|

USD 12,040.20 Million |

| Market Growth Rate (2025-2033) | 23.25% |

The increased prevalence of cancer and the growing need for targeted alpha therapy (TAT) as an enhanced radiation treatment are driving the worldwide alpha emitter market forward. Alpha emitters, such as actinium-225 and radium-223, provide high linear energy transfer (LET) while causing minimum harm to nearby healthy tissues, making them excellent for precision oncology. Advances in nuclear medicine, together with increased government and private sector investment in radiopharmaceutical research, are accelerating industry growth. Furthermore, the growing use of alpha-emitting isotopes in medical imaging and therapeutic applications, together with regulatory approvals for innovative radiopharmaceuticals, is driving the alpha emitter market demand. The market also benefits from technological advances in isotope manufacturing and the increase of clinical trials testing alpha treatments for various malignancies.

To get more information on this market, Request Sample

The alpha emitter market in the United States is quickly developing, driven by rising cancer rates and greater awareness of the benefits of targeted alpha treatment. For example, in 2020, there were 274,364 new cancer cases worldwide, highlighting the growing need for improved therapies. Significant expenditures in R&D have fueled this rise, resulting in advancements in radiopharmaceuticals and alpha-emitting therapeutics. Furthermore, the United States market benefits from a robust healthcare infrastructure and supportive regulatory rules that stimulate the use of cutting-edge therapies. Furthermore, the increasing number of product approvals by regulatory bodies is providing an impetus to the market growth.

Alpha Emitter Market Trends:

Increasing Demand for Targeted Cancer Therapies

The expanding interest in alpha emitters as sources of targeting precisely cancerous cells with lesser destruction to surrounding normal tissue resulting in their diversified applications is impelling the market growth. It has also led to the development of more efficient drugs, mainly because some cancer diseases are unresponsive to drugs with conventional applications, thus giving the patient a better outcome. Cancer cases for NMSC reached a total of 19,976,499 worldwide in 2022 according to the World Cancer Research Fund. For example, in February 2024, the FDA granted a breakthrough device to AlphaMedix, a targeted alpha therapy developed by RadioMedix and Orano Med. This therapy is focused on treating neuroendocrine tumors, which shows advancements in alpha emitter technologies for more effective and targeted cancer treatments.

Expanding Production Capacity of Alpha Emitters

There is a growing need for larger-scale production as more applications for alpha emitters emerge in cancer treatment. Expanding manufacturing infrastructure is critical to ensure a steady supply of these isotopes, thereby meeting the increasing clinical and research demands. For instance, in January 2024, Orano Med began building a new site in Onnaing, France, dedicated to producing lead-212 radioligand therapies. This facility will enhance large-scale manufacturing capabilities. Therefore, supporting the alpha emitter market outlook.

Advancements in Manufacturing Technology

The alpha emitter sector is undergoing a revolution due to the development of more scalable and efficient manufacturing technologies, such as cyclotron-based production techniques. The market as a whole is improved by these developments as they lower prices, increase isotope purity, and make alpha particles for medical purposes more widely available and dependable. For example, Actinium Pharmaceuticals started a strategic project in March 2024 with the goal of manufacturing Actinium-225 using its in-house cyclotron-based technology. This advancement attempts to provide a scalable, economical technique with excellent radiochemical purity in order to meet the increasing need for alpha emitters in targeted cancer treatments.

Alpha Emitter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global alpha emitter market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type of radionuclide, medical application, and end user.

Analysis by Type of Radionuclide:

- Astatine

- Radium

- Actinium

- Lead

- Bismuth

- Others

Radium dominates the market with 54.5% shares in 2024. Radium, an alpha emitter, is commonly used in treating metastatic bone cancer. Its targeted approach delivers high-energy alpha particles to cancer cells, minimizing damage to healthy tissues. For example, Xofigo is a well-known treatment utilizing radium-223 for effective cancer management. The growing prevalence of bone metastases, particularly in prostate and breast cancer patients, is driving demand for radium-based therapies. Additionally, increased FDA approvals and ongoing research into expanding radium-223 applications beyond bone cancer are strengthening its market position. Pharmaceutical companies are also investing in optimizing radium formulations for improved efficacy and patient convenience. Moreover, strategic collaborations between healthcare providers and nuclear medicine manufacturers are enhancing accessibility to radium-based treatments, further fueling market growth. With continuous advancements in radiopharmaceutical development, radium’s dominance in the alpha emitter market is expected to persist in the coming years.

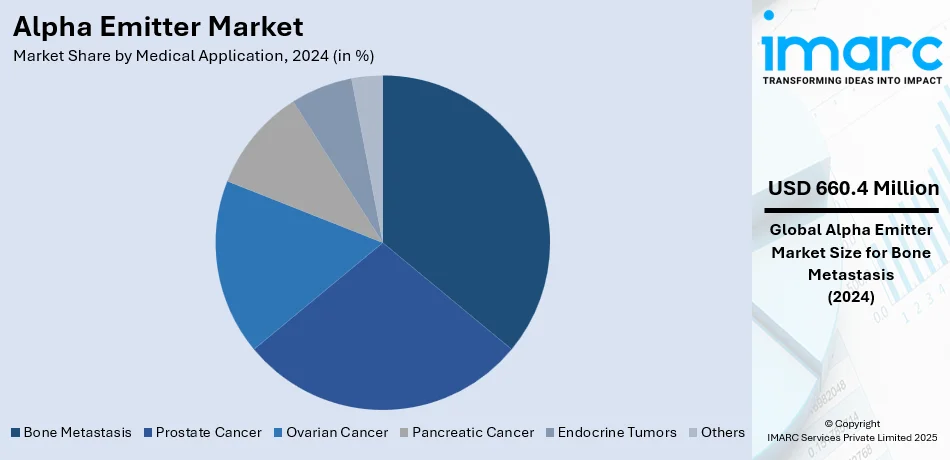

Analysis by Medical Application:

- Prostate Cancer

- Bone Metastasis

- Ovarian Cancer

- Pancreatic Cancer

- Endocrine Tumors

- Others

With 36.0% market shares, bone metastasis dominates the alpha emitter industry, owing to the rising frequency of metastatic malignancies, notably prostate, breast, and lung cancer. Alpha-emitting radiopharmaceuticals, such as radium-223 (Xofigo), are commonly used to treat bone metastases because of their ability to precisely target cancer cells while causing minimal damage to adjacent tissues. The increasing need for less invasive, tailored therapy is driving market expansion. Furthermore, advances in nuclear medicine and increased FDA approvals of alpha-emitting medicines are broadening their clinical uses. Growing expenditures in R&D, together with increased patient knowledge and access to radiopharmaceuticals, are projected to maintain bone metastasis applications' dominance in the alpha emitter industry.

Analysis by End User:

- Hospitals

- Medical Research Institutions

- Others

The global alpha emitter market is growing in hospitals due to rising cancer cases and the increasing adoption of targeted alpha therapy (TAT). Hospitals are incorporating alpha-emitting radiopharmaceuticals such as radium-223 and actinium-225 to enhance cancer treatment, leading to better patient outcomes and fewer side effects.

More investment in medical research institutions spurring alpha emitter application in advanced oncology and other therapeutic areas is driving also the growth of this market. Growing government and private funding support clinical trials, innovations in radiopharmaceuticals, and improved isotope production that accelerates new alpha-based treatments for diseases.

Other end users, including specialty clinics and nuclear medicine centers, contribute to market expansion by offering outpatient alpha therapy solutions. Growing collaborations between pharmaceutical companies and healthcare providers, along with improved regulatory frameworks, are further facilitating the widespread adoption of alpha emitters across diverse healthcare settings.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

As per the alpha emitter analysis report, North America leads the market with 43.7% shares due to strong investments in cancer therapies and advanced medical technologies. Apart from this, the region's focus on targeted alpha therapies for cancer treatment drives demand for alpha emitters like Actinium-225. For example, Actinium Pharmaceuticals in the U.S. is developing innovative alpha therapies for difficult-to-treat cancers. Furthermore, strong healthcare infrastructure and increasing research initiatives continue to propel market growth in North America, thereby ensuring the region remains a prominent player in the market. Additionally, the presence of key pharmaceutical companies, favorable regulatory policies, and increasing clinical trials for novel alpha-emitting radiopharmaceuticals further solidify North America’s dominance in this rapidly expanding market.

Key Regional Takeaways:

United States Alpha Emitter Market Analysis

The U.S. alpha emitter market is expanding due to the rising incidence of chronic diseases and the increasing need for advanced treatment solutions. According to the U.S. Department of Health and Human Services, approximately 129 million Americans suffer from at least one major chronic condition, including heart disease, cancer, diabetes, obesity, or hypertension. This significant health burden fuels the need for more effective treatments, particularly in the field of cancer care. Alpha-emitting isotopes like actinium-225 and radium-223 are gaining attention for their potential in targeted cancer therapies, offering precision treatment options. The U.S. government’s investments in cancer research and a favorable regulatory framework for radiopharmaceuticals further accelerate market growth. Additionally, the demand for diagnostic tools incorporating alpha emitters is on the rise, particularly in personalized medicine to identify and target cancerous tissues. The presence of key industry players and continuous innovation in radiopharmaceuticals strengthens the market’s potential. With a growing aging population and rising cancer cases, along with increased funding from both public and private sectors, the U.S. alpha emitter market is poised for substantial growth in the coming years.

Europe Alpha Emitter Market Analysis

The European alpha emitter market is expanding due to the rising incidence of cancer and the increasing demand for targeted treatment options. According to the analysis, the European Union's population on January 1, 2023, was predicted to be 448.8 million, with more than one-fifth (21.3%) aged 65 and more. This aging demographic, combined with rising cancer incidence, is greatly increasing the demand for effective cancer therapies. Alpha-emitting isotopes such as actinium-225, radium-223, and thorium-227 are gaining popularity for their capacity to administer precise, focused therapy, offering patients more effective treatment alternatives. Europe's favorable regulatory environment, with organizations such as the European Medicines Agency (EMA) favoring the approval of novel medicines, is boosting alpha emitter market growth. Furthermore, cooperation among academic institutions, pharmaceutical firms, and healthcare providers are increasing the use of alpha emitters. Europe’s strong focus on research and development in radiopharmaceuticals is enabling continued advancements in cancer care, further boosting the market. The region's well-established healthcare system, along with increasing public and private sector funding, supports the expansion of alpha emitter usage. As these factors converge, Europe is projected to experience steady market expansion, especially in the field of cancer treatment, in the coming years.

Asia Pacific Alpha Emitter Market Analysis

The Asia Pacific (APAC) alpha emitter market is driven by rising cancer incidence, particularly ovarian cancer, which poses a significant burden in the region. According to reports, while developed countries face a higher risk of ovarian cancer, less developed nations, including China and India, report the highest number of diagnoses, with over 30,000 and 25,000 cases annually, respectively. India also has Asia’s highest ovarian cancer mortality rate. This growing disease burden fuels demand for targeted alpha therapy (TAT), particularly for metastatic cancers. Increasing investments in nuclear medicine, advancements in isotope production such as actinium 225 and radium 223, and expanding healthcare infrastructure in China, Japan, and India support market growth. Governments and private entities are enhancing radiopharmaceutical supply chains and regulatory frameworks. Additionally, medical tourism in India and Thailand boosts demand for innovative cancer treatments. Strengthening research collaborations and rising government funding further accelerate the adoption of alpha emitting therapies in APAC.

Latin America Alpha Emitter Market Analysis

In Latin America, the alpha emitter market is gaining momentum due to the increasing prevalence of chronic diseases and a rising demand for advanced healthcare solutions. In Brazil, for instance, approximately 928,000 deaths are attributed to chronic diseases annually, according to reports. The increasing health burden is fueling demand for more effective treatment solutions, including radiopharmaceuticals that utilize alpha emitters. The adoption of precision medicine and advancements in cancer treatments are further boosting market potential. With government initiatives and international partnerships facilitating the development of radiopharmaceuticals, the alpha emitter market in Latin America is poised for growth.

Middle East and Africa Alpha Emitter Market Analysis

The Middle East and Africa (MEA) alpha emitter market is driven by increasing adoption of targeted radionuclide therapies and expanding nuclear medicine infrastructure. Government initiatives to enhance oncology treatment and investments in healthcare facilities further support growth. According to PMC, Arab countries reported 463,675 new cancer cases, accounting for 2.4% of global incidence, highlighting the urgent need for advanced treatment options. Strategic collaborations between international radiopharmaceutical firms and regional providers improve accessibility. Growing awareness and clinical trials evaluating alpha-emitting radiopharmaceuticals fuel innovation.

Competitive Landscape:

The global alpha emitter market is highly competitive, with key players focusing on product innovation, strategic partnerships, and geographic expansion to strengthen their market position. Major companies focus on advancing targeted alpha therapy (TAT) for cancer treatment. The market is driven by increasing investments in nuclear medicine and rising clinical research on radiopharmaceuticals. Regulatory approvals and government support for isotope production further shape the competitive landscape. Additionally, partnerships between pharmaceutical firms and research institutions are accelerating R&D efforts. Companies are also expanding their production capabilities to meet growing demand, especially in North America and Europe. However, stringent regulatory frameworks, limited isotope availability, and high production costs pose challenges.

The report provides a comprehensive analysis of the competitive landscape in the alpha emitter market with detailed profiles of all major companies, including:

- Actinium Pharmaceuticals, Inc.

- Alpha Tau Medical Ltd.

- Bayer Corporation

- BWXT Medical Ltd

- Fusion Pharma

- IBA Radiopharma Solutions

- NorthStar Medical Radioisotopes, LLC

- Orano Group

- RadioMedix, Inc.

- Telix Pharmaceuticals Limited

- TerraPower LLC

Latest News and Developments:

- July 2024: Clarity Pharmaceuticals has secured a supply agreement with TerraPower for Ac-225, an alpha-emitting isotope, for its 225Ac-bisPSMA program. Dr. Alan Taylor, Executive Chairperson, highlighted the potential of their dual-targeted PSMA product in advanced prostate cancer treatment. The collaboration addresses Ac-225's manufacturing challenges, including purity and scalability, and avoids reliance on Russian sources with harmful Ac-227 contamination. This agreement strengthens Clarity's supply chain for alpha-emitting isotopes, supporting the program's development and future commercialization.

- June 2024: The Norwegian Radiation and Nuclear Safety Authority (DSA) had authorized Thor Medical to establish a pilot production plant for the alpha-emitting medical isotope Th-228 at Herøya, Norway. This authorization covered manufacturing, import/export, and commercial trade of radioisotopes, supporting Thor Medical’s efforts to supply Th-228 for precision cancer treatments. The pilot plant produced samples for customer acceptance by late 2024, with full commissioning completed by the end of Q3. Thor Medical had planned to scale production commercially by the end of 2025 to meet clinical trial needs.

- March 2024: Actinium Pharmaceuticals has launched a strategic initiative to manufacture Actinium-225 (Ac-225), a potent alpha-particle emitter used in targeted radiotherapies for cancer. Ac-225 is highly effective in killing cancer cells by inducing double-strand breaks in DNA, with no known resistance or repair mechanisms. The company’s proprietary cyclotron-based production method, supported by 5 U.S. and 49 international patents, offers a high-purity, cost-effective alternative to the traditional Thorium-229 generator method, with the potential for higher yields at commercial scale.

- June 2023: Artbio, a Norwegian start-up, focuses on developing α-emitting radiopharmaceuticals for cancer treatment. The company’s drug candidates use the isotope 212Pb, which targets cancer cells with high precision due to its short half-life of 10.6 hours. CEO Emanuele Ostuni notes that α-particles deliver greater DNA damage to tumors compared to β-particles, with less risk to healthy tissue. This advantage, along with faster patient recovery, supports more frequent doses.

Alpha Emitter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Radionuclides Covered | Astatine, Radium, Actinium, Lead, Bismuth, Others |

| Medical Applications Covered | Prostate Cancer, Bone Metastasis, Ovarian Cancer, Pancreatic Cancer, Endocrine Tumors, Others |

| End Users Covered | Hospitals, Medical Research Institutions, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Actinium Pharmaceuticals, Inc., Alpha Tau Medical Ltd., Bayer Corporation, BWXT Medical Ltd, Fusion Pharma, IBA Radiopharma Solutions, NorthStar Medical Radioisotopes, LLC, Orano Group, RadioMedix, Inc., Telix Pharmaceuticals Limited, TerraPower LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the alpha emitter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global alpha emitter market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the alpha emitter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alpha emitter market was valued at USD 1,834.48 Million in 2024.

IMARC Group estimates the market to reach USD 12,040.20 Million by 2033, exhibiting a CAGR of 23.25% from 2025-2033.

The market is driven by rising cancer prevalence, increasing adoption of targeted alpha therapy (TAT), advancements in radiopharmaceuticals, growing government funding for nuclear medicine research, and strategic collaborations between pharmaceutical companies and research institutions to enhance alpha emitter production and therapeutic applications.

North America currently dominates the market due to strong healthcare infrastructure, high investment in nuclear medicine research, regulatory support for radiopharmaceuticals, and the presence of key industry players. The region benefits from increasing clinical trials and FDA approvals for targeted alpha therapies, further driving market growth.

Some of the major players in the alpha emitter market include Actinium Pharmaceuticals, Inc., Alpha Tau Medical Ltd., Bayer Corporation, BWXT Medical Ltd, Fusion Pharma, IBA Radiopharma Solutions, NorthStar Medical Radioisotopes, LLC, Orano Group, RadioMedix, Inc., Telix Pharmaceuticals Limited, TerraPower LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)